Margin of Safety Formula: How to Calculate and Use It

Discover the margin of safety formula to protect profit, set sales targets, and plan for slow periods.

Written by Shaun Quarton—Accounting & Finance Content Writer and Growth Marketer. Read Shaun's full bio

Published Friday 30 January 2026

Table of contents

Key takeaways

- Calculate your margin of safety by subtracting your break-even sales from current sales, then dividing by current sales to get the percentage buffer before your business starts losing money.

- Aim for a margin of safety of 20% or higher to maintain financial resilience, as this provides adequate protection against unexpected sales drops or cost increases.

- Use your margin of safety to guide key business decisions like pricing strategy, cost management, and performance targets by understanding how close you are to your break-even point.

- Track your margin of safety regularly (monthly or quarterly) alongside other metrics like cash flow and profit margins to get a complete picture of your business's financial health and risk level.

What is the margin of safety?

Margin of safety is the percentage by which your current sales exceed your break-even point. It measures how much your sales can drop before your business starts losing money.

This financial buffer protects your business against:

- Demand drops: Seasonal slowdowns or market changes

- Cost increases: Rising supplier prices or unexpected expenses, such as the recent trend where health insurance premiums increased by around 19% in a single year.

- Economic uncertainty: Recession or industry disruption, which includes factors like rising unemployment, amplifying risks for business sectors.

What is the margin of safety formula?

The margin of safety formula calculates the percentage buffer between your current performance and break-even point:

Formula: (Current sales - Break-even sales) ÷ Current sales = Margin of safety

Key components:

- Current sales: Your total revenue over a specific period

- Break-even sales: Revenue needed to cover all costs with zero profit or loss

Here's a quick margin of safety example.

Let's say a business has current sales of $50,000 and needs $30,000 in sales to break even.

Margin of safety = ($50,000 – $30,000) / $50,000 = 0.4 (40%)

This means the business's sales could drop by 40% before it hits its break-even point. If sales fall by more than 40%, the business moves into a loss-making position.

The importance of the margin of safety for your small business

Margin of safety indicates your business's financial resilience and guides risk management decisions.

High margin of safety (above 20%):

- Low risk: Business can absorb market fluctuations

- Operational flexibility: Room for strategic investments

- Stress protection: Buffer against unexpected costs

Low margin of safety (below 10%):

- High risk: Vulnerable to small revenue drops

- Limited flexibility: Operating close to break-even

- Immediate action needed: Focus on cost control or sales growth

Your margin of safety also supports smarter financial decisions across your business by showing how close you are to break-even.

How to calculate margin of safety

Here is how to work out the margin of safety calculation.

1. Find your current sales

First, work out your current sales, whether they are actual or forecast.

Finding your current sales requires accessing actual figures or creating forecasts based on available data.

For actual sales:Check your existing systems for revenue totals over your chosen period (monthly, quarterly, or yearly).

For sales forecasting, use these methods:

- Historical analysis: Review past sales patterns in your point-of-sale (POS) system, e-commerce platform or accounting software

- Market research: Analyse industry trends and competitor performance data

- Expert consultation: Gather insights from your sales team or industry specialists

- Statistical forecasting: Apply quantitative methods to historical data for predictions

The best approach for you depends on your business type and the data available to you. For example, a craft business uses a POS system to track monthly sales. Last month, sales were $5,000. This figure is used in future steps of the margin of safety calculation.

2: Calculate your break-even sales revenue point

Break-even sales revenue shows the exact dollar amount needed to cover all business costs with zero profit.

Formula: Fixed costs ÷ ((Sales price - Variable cost) ÷ Sales price) = Break-even sales

Cost components:

- Fixed costs: Expenses that don't change with sales volume; includes rent, salaries, insurance, software subscriptions

- Variable costs: Expenses that increase with each sale; includes raw materials, shipping, sales commissions, payment processing fees

Here's more info on variable costs and how they differ from fixed costs. Your accountant can also help you distinguish between them.

To demonstrate, let's say a craft business has:

- Fixed costs of $2,000

- Variable costs of $5 per unit

- A sales price of $25 per unit

Therefore:

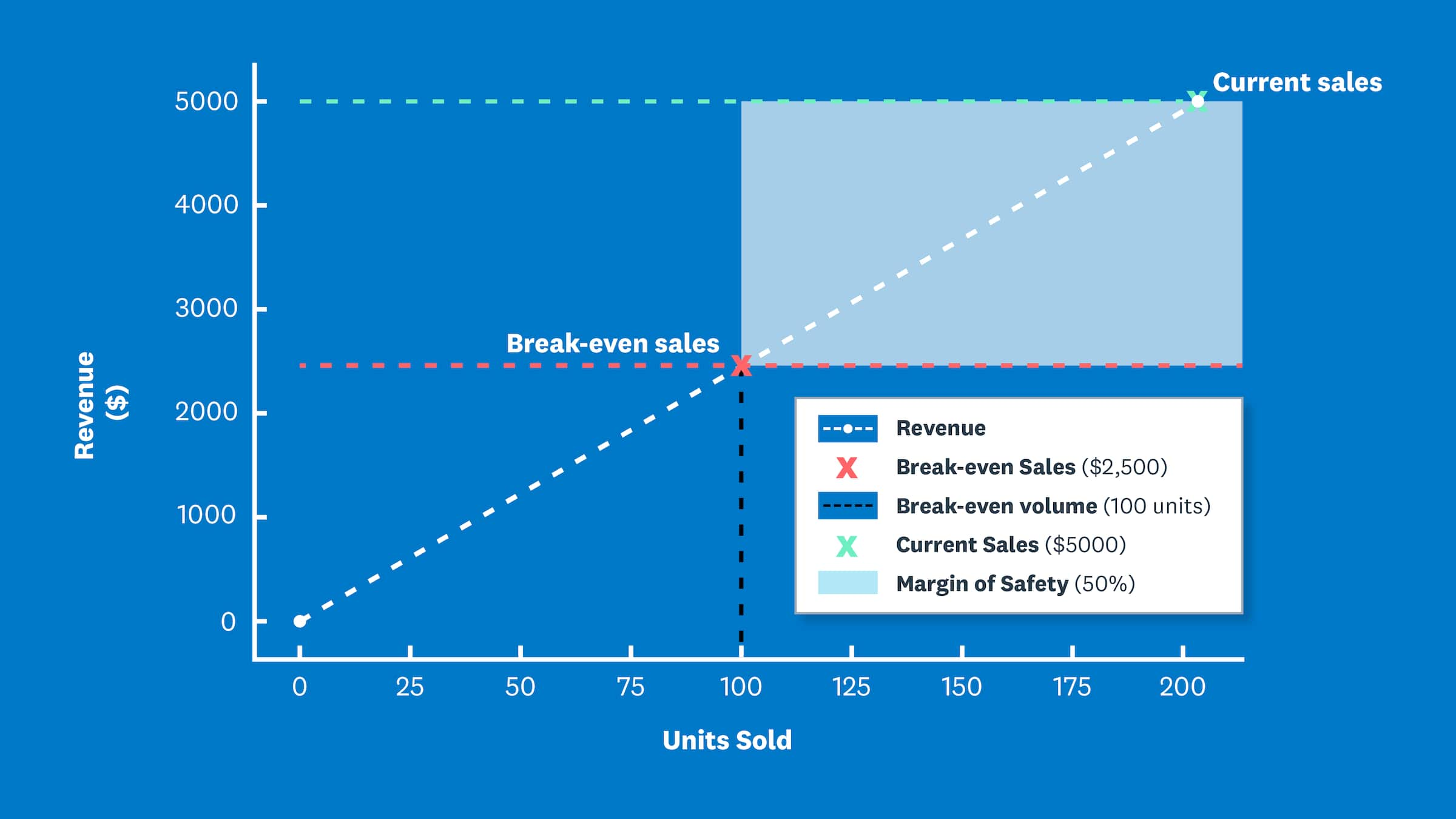

2,000 ÷ ((25 – 5) ÷ 25) = Break-even sales revenue = 2,000 ÷ (20 ÷ 25) = 2,000 ÷ 0.8 = $2,500

So with a sales price of $25, you need revenue of $2,500 (100 sales units) to break even.

Learn more about your break-even point.

3: Apply the margin of safety formula

Finally, apply the margin of safety formula:

(Current sales – Break-even sales) ÷ Current sales = Margin of safety

The result is your margin of safety ratio – the percentage by which sales can fall before your business starts operating at a loss.

Let's apply the formula to the craft business example, where current sales are $5,000 and the break-even point for sales revenue is $2,500:

($5,000 – $2,500) ÷ $5,000 = Margin of safety = 2,500 ÷ 5,000 = 0.5 = 50%

The craft business has a 50% margin of safety, meaning sales could fall by half before they reach the break-even point.

What is a good margin of safety percentage?

A good margin of safety gives you a comfortable buffer against unexpected sales drops or cost increases. While there's no single magic number, many businesses aim for a margin of safety of 20% or more, with some sources suggesting a high margin of safety of 25% or more indicates a good position.

A higher percentage generally means your business is in a healthier, more resilient position. But what's considered 'good' can change depending on your industry, business model, and how established you are. A new business might operate with a lower margin, while a more mature one might aim for a wider buffer.

Tracking this percentage over time matters more than hitting a single number. If your margin grows, your position is getting stronger. If it falls, review your pricing, costs or sales strategy.

How the margin of safety supports your business decisions

Margin of safety guides critical business decisions by revealing financial risk levels and improvement opportunities.

Key decision areas:

- Performance targets: Set sales goals above break-even to maintain profitability buffer

- Pricing strategy: Increase prices when margin shrinks to improve contribution per sale

- Cost management: Reduce expenses when margin falls below 10%, a level considered very low (10th percentile) performance by some benchmarks, to restore the financial buffer

- Product launches: Calculate impact of new offerings on overall margin before committing resources

Other metrics to use with margin of safety

Margin of safety works best when combined with complementary financial metrics for comprehensive business analysis.

Effective metric combinations:

- Cash flow analysis: Reveals timing of revenue and expenses

- Profit margins: Shows how efficiently sales turn into profit

- Break-even analysis: Identifies minimum performance requirements

- Cost-volume-profit (CVP) analysis: Models how cost, volume and price changes affect profitability

Margin of safety and CVP analysis

The margin of safety is an output of cost-volume-profit (CVP) analysis. Margin of safety shows the financial buffer you have today. CVP looks ahead by modelling different scenarios for your costs, sales volume and prices so you can see how they affect profit. It also shows how changing any one of these factors, up or down, affects your profit.

Used together, CVP analysis and margin of safety guide your planning by giving you a clearer view of both profitability and risk.

Learn more about decision-making.

Improve your margin of safety calculations with better financial data

Manual margin of safety calculations take time you could spend growing your business. Tracking sales data, updating spreadsheets and pulling reports together can take hours each month.

Xero streamlines this process by:

- Centralising financial data: All sales and cost information in one platform

- Automating calculations: Real-time margin of safety updates as data changes

- Generating reports: Instant access to break-even analysis and profitability metrics

- Helping you decide quickly: Clear dashboards for confident financial planning

Get one month free to simplify your financial analysis and focus more time on business growth.

FAQs on margin of safety

Here are answers to some common questions about margin of safety.

Can your margin of safety be negative?

Yes, if your current sales fall below your break-even point, your margin of safety will be negative. This means your business is operating at a loss, and it's a clear signal to take action to either increase sales or reduce costs.

How often should you calculate margin of safety?

It's a good practice to calculate your margin of safety regularly, such as monthly or quarterly. This helps you monitor your business's financial health and react quickly to any changes in sales or costs. If your sales or costs change often, you may want to check it more frequently.

What's the difference between margin of safety and profit margin?

Margin of safety tells you how much your sales can drop before you start making a loss, so it is a measure of risk. Profit margin, on the other hand, shows what percentage of revenue is profit, so it is a measure of profitability. Both metrics matter, but they focus on different parts of your business performance.

Disclaimer

Xero does not provide accounting, tax, business or legal advice. This guide has been provided for information purposes only. You should consult your own professional advisors for advice directly relating to your business or before taking action in relation to any of the content provided.

Get one month free

Purchase any Xero plan, and we will give you the first month free.