Cash flow projection for small businesses

To run a successful business, good cash flow management is crucial. Cash flow projection can help with that.

Written by Kari Brummond—Content Writer, Accountant, IRS Enrolled Agent. Read Kari's full bio

Table of contents (H2)

- What is a cash flow forecast?

- Benefits of a cash flow forecast

- Cash flow forecasting periods

- How to forecast your cash flow

- Cash flow forecasting with spreadsheets or software

- An example of cash flow forecasting

- Cash flow forecasts help you manage your business finances

- FAQs on cash flow forecasting

Key takeaways (H2)

- Cash flow forecasting helps you estimate how much cash you'll have at a point in future.

- Cash flow forecasts can help you budget, decide if your growth plans or purchases are feasible, and fix financial early.

- Analyze how different expenses or scenarios may affect future cash flows.

- Accounting software and tools like cash flow calculators and templates can make the forecasting process easier.

What is a cash flow forecast? (H2)

A cash flow projection (also known as a cash flow forecast) is a way to predict cash inflows and outflows to see how much money your business will have at a point in the future. It provides a glimpse into your business's future financial health to help you plan your spending.

A cash flow projection is different from a cash flow statement. While a statement looks back to past cash flows, a projection looks forward.

What goes into a cash flow forecast (h3)

It shows starting cash, estimates for incoming and outgoing cash, and projected cash at the end of the period.

The more comprehensive and inclusive your forecast is, the better.

- The forecast should include all the cash coming into your business – both from sales and other sources like loans, grants, tax refunds, or owner contributions.

- Outgoing cash should include expenses, loan payments, owner draws (money the owner takes out of the business that isn’t wages), and cash that's going out of your business for any other reason.

There are two recognized methods for developing a cash flow forecast:

- the direct method – in which you’d gather financial information above and build it up piece by piece

- the indirect method, in which you use financial statements to build your forecasts.

There’s more detail on these and the differences between them in the steps to creating a forecast below.

The more accurate your estimates are, the more accurate your forecast will be. Learn more about cash flow forecasts from the US Treasury.

Benefits of a cash flow forecast (H2)

Cash flow forecasting has many operational and financial benefits for your business. For example, it helps you:

- Spot cash shortages and gives you time to deal with them – such as by delaying spending or securing a business loan

- Judge whether you can afford your growth plans – for example, forecasts can show if there’s enough money for new tools or a new hire

- Identify quickly if expenses are climbing or income is slumping

- Reveal fixable cash flow problems like slow-paying customers, impractical payment terms, or over-reliance on high-cost finance

- Check you’ll have enough cash to pay yourself!

Learn more from WA BizFar about how cash flow forecasts can help you make business decisions.

Types of cash flow forecasting periods (H2)

A cash flow dashboard shows how cash balances will rise and fall in response to expected transactions.

Cash flow analysis is based on the period of time involved – here are the usual periods over which you might forecast your cash flow.

Short-term forecasts (h3)

Short-term projections focus on the immediate availability of cash. How much cash do you have over the next month, week, or even just today? Use short-term forecasts when you're worried about overdrawing your bank account, want to increase inventory immediately, or need money for an urgent expense.

Medium-term forecasts (h3)

Want to make sure you can cover your bills during the off season? Deciding whether you can afford a new business purchase this year? That's where medium-term cash flow analysis comes in. These reports look at cash flow over a 3- to 12-month period, and they can help you make decisions and budget for upcoming expenses.

Long-term forecasts (h3)

Long-term forecasts focus on cash flow over the next 1 to 5 years. These reports guide your long-term goals and help you make decisions about taking out loans, expanding your business, or preparing for economic challenges like raising labor or supply costs, or sales downturns.

Mixed-period forecasts (h3)

A mixed-period report helps you set goals and budget. A forecast with mixed time frames lets you test different scenarios – for example, to:

- See how short-term expenditures affect long-term cash flows

- Check how improving short-term cash flow makes it possible to invest in growth over the long term

Learn more about financial management, including cash flow budgeting strategies, with the FDIC's small business resources.

How to forecast your cash flow (H2)

To forecast cash flow, you estimate the size and timing of upcoming transactions and show what they do to your cash position. You can do this using a spreadsheet or software – here’s a cash flow projection template to simplify the process.

1. Set clear forecasting goals (H3)

Figure out what you want to learn from your forecast. Do you want to know whether you have enough money for payroll or another immediate expense? Or do you need a new piece of equipment or to remodel your commercial space in the next couple of years? Your goal determines the type of information you want to see and the time period you need to look at.

2. Choose your forecasting time frame (H3)

Choose a time frame that lines up with your goals. Urgent questions require a short-term forecast, but if you're thinking about the future, you need a medium, long, or mixed-term report.

3. Choose a forecasting method(H3)

There are two cash flow forecasting methods: direct and indirect. The choice between them comes down to how far into the future you’re forecasting, how you want to create your forecast (manually or with software – see below), and how accurate your past cash transactions are to your projected future transactions.

- The direct method is described above – it's when you note all your expected incoming and outgoing cash to predict how much cash you'll have on hand at a certain point in the future.

- The indirect method is the same concept, but it uses income (profit and loss) statements and the balance sheet to create the forecast. Generally, you don't need special cash flow forecasting software to do this – these capabilities are built into most bookkeeping software.

You start an indirect cash flow forecast with the cash on hand noted on your balance sheet. Then, use the income and expenses from your profit and loss reports over a certain period to make predictions about the future.

4. Collect data for your forecast (H3)

To do a direct cash flow forecast, make a list of all of your upcoming cash inflows and outflows.

- Create sales flows (cash inflows) based on past sales reports for the same period. Adjust them if you think sales will be higher or lower than previous periods. If you invoice clients, make a list of the outstanding invoices (accounts receivable) and the dates they're likely to get paid. Remember to account for future income that hasn't been invoiced yet.

- For outflows, look at your bills (accounts payable) and upcoming loan payments, but also include any unusual expenses that may be coming up, like repairs, incidentals, or staff bonuses.

To gather the numbers, use old sales reports, invoices, bank statements or accounting records. A cash flow calculator like this one can help you estimate how much cash you'll have after accounting for your inflows and outflows over a certain period.

Cash flow forecasting with spreadsheets or software (H2)

You can forecast cash flow manually with a spreadsheet or automatically using software – the right option depends on the size of your business, how many cash transactions you make, the time period, and how much time you have. A spreadsheet takes longer but it gives you more control over which expenses to enter.

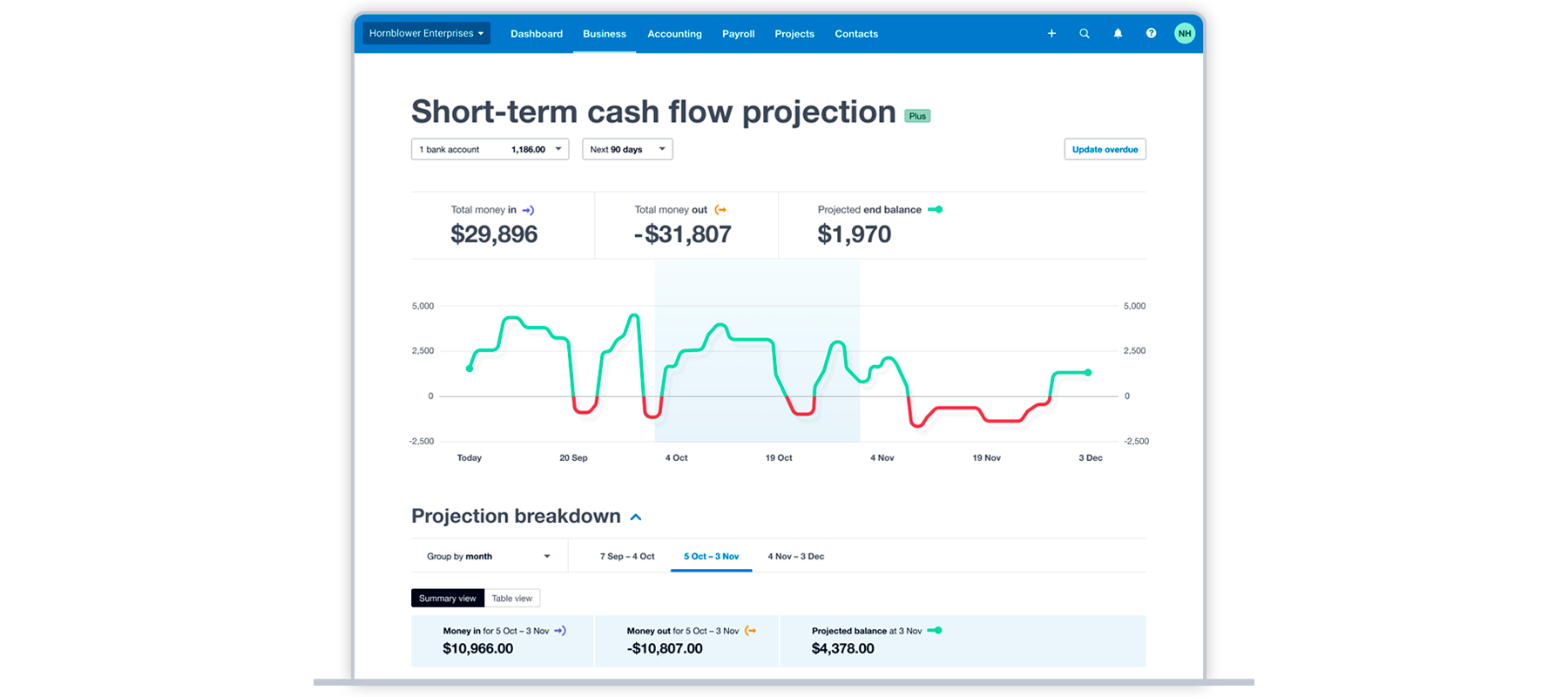

Software helps you create a projection with a few taps on your computer. The process is fast and scalable. Auto-generated forecasts are limited to past performance, but if your business is changing, you can manually adjust for additional cash inflows or outflows to create a more realistic forecast than you can with historical data alone.

How to do a cash flow projection with a spreadsheet (H3)

Follow these tips for completing a cash flow projection with a spreadsheet:

- Choose a forecast period and note how much cash you have at the beginning of that period.

- List and date all your expected cash income for the forecast period, including sales receipts and things like grants, tax refunds, or incoming financing that will impact your accounts.

- List and date your outflows, too. Besides familiar business costs, capture less regular items like annual fees or taxes that might come due, or repairs you need to make during the period.

- Take your starting balance and run through the forecasting period, adding incoming amounts and subtracting outgoing amounts. This will show how much cash you’ll have at a given point in time.

Forecasting cash flow with software (H3)

Accounting software like Xero makes it easy to generate a cash flow projection as it’s designed to track business incomings and outgoings, which means it can create a projection with a few clicks.

Other ways to carry out your cash flow forecasting (H3)

You can also generate cash flow projections from your balance sheet and income statement. These typically provide longer-term cash flow guidance rather than day-to-day or week-to-week projections.

But you’ll need accounting knowledge, so ask an accountant if you want to know more. You can find one in Xero’s advisor directory.

An example of cash flow forecasting(H2)

The finance manager of Tiny Construction wants to assess whether the business’s cash flow is enough to buy a new piece of equipment in the next month. The equipment costs $20,000.

Based on its current bank balances and bank reconciliations, Tiny Construction has a starting balance of $45,000. Outstanding invoices and sales forecasts estimate that incoming payments from sales in the next 30 days will be $90,000. There are no other incoming payments for the month.

So the “money in” part of the cash flow projection looks like this:

The “money out” part of the cash flow projection looks like this:

With incoming sales receipts of $90,000 and outgoings of $65,000, the company would have added $25,000 in net cash flow for the period. Adding that to the $45,000 of existing cash means the business will have $70,000 left in its bank account at the end of the month. This would become their starting balance the following month.

But if they buy the equipment with surplus cash, their starting balance for the next month would reduce to $50,000. This example shows how businesses can use cash flow projections to make investment decisions and estimate whether they would be able to afford it or would have to consider financing it.

Cash flow forecasts help you manage your business finances (H2)

Cash is king. A cash flow projection helps you improve your cash flow planning and take control of your business’s finances.

To reduce the time you spend collecting and updating cash flow data, you can automate the process with accounting software like Xero. If you’re not ready for software, you can start by downloading a free cash flow projection template

FAQs on cash flow forecasting (H2)

How do you analyze a cash flow projection? (H3)

Once you’ve prepared a cash flow projection, analyze it by checking:

- The closing balance – the money you expect to have in reserve at the end of each period

- Net cash flow – the amount by which your cash reserves went up or down during the period

- Accuracy – projection compared with what actually happens

If your projection was off, find out what you overestimated or underestimated. Doing this will help make your next projection more accurate, and who knows – you might learn something new about your business.

How often should I make cash flow projections? (H3)

Large businesses should consider doing cash flow projections monthly, while small businesses may only need to do them quarterly or even annually. Consider doing a cash flow projection anytime you need to make a decision that's reliant on your cash flow in the future - for instance, can I buy more inventory next month? Can I invest in a new company vehicle this year? When will I have enough cash to buy new equipment?

What’s the best way to handle irregular or unpredictable income in cash flow forecasting? (H3)

You must include irregular transactions and allow for unpredictable income if you want your forecasts to be accurate. To be on the safe side, use low estimates for incoming cash and high estimates for outgoing cash.

Then, update your projections with the actual numbers in real-time. That way, you can check the accuracy of your projections and adjust future reports as needed. If you run a 12- month projection with a column for each month, say, you might refresh it at the end of each month. Drop the last month off, add another month to the end, and check all the projections in between to see if anything needs updating.

Also, think about doing scenario analysis to see how different events may affect your cash reserves. Just use your imagination to assess different scenarios. For instance, how would an unexpected repair, a natural disaster, or losing a key employee affect your cash flow?

Xero’s bank reconciliation tools can help you make sure your end-of-period figures include unexpected transactions.

Here’s more about connecting your bank to Xero for fast bank reconciliation

How do I incorporate seasonal trends and market fluctuations into a cash flow forecast? (H3)

Historical data can help you identify seasonal changes in your cash flow, like when you can expect recurring income or expenses. But your data has to be right – if you generate a projection for this month based on last month, it won't work if last month was the busy season and this month is the slow season. So use time periods that correlate with your seasonal highs and lows, and you might need to adjust your forecasts based on seasonal patterns or changing industry trends.

This whole process gets even easier when you connect your bank feed to Xero. The software automatically imports your transactions. Then, you can easily generate a report based on info from the relevant historical time frame.

How can I forecast cash flow during periods of rapid growth or expansion? (H3)

If your business is changing rapidly, factor in revenue growth but also consider how that increases costs like payroll and inventory purchases. To keep your forecasts accurate, use short-term or rolling forecasts.

Rolling forecasts are continuously updated as time goes along. For instance, on a 12-month forecast, you add a new month every time one drops off. Traditional projections, in contrast, are static - they look at a set period of time, and as time passes, the forecast gets shorter. For example, on month 3 of a 12-month static forecast, you only see the remaining 9 months.

Update your reports based on actual cash flows, then modify future forecasts based on the accuracy of your previous estimates.

Disclaimer

Xero does not provide accounting, tax, business or legal advice. This guide has been provided for information purposes only. You should consult your own professional advisors for advice directly relating to your business or before taking action in relation to any of the content provided.

Start using Xero for free

Access Xero features for 30 days, then decide which plan best suits your business.