What is working capital and how do you calculate it?

Working capital is the cash and liquid assets of your business. Good working capital management keeps your cash flow steady and helps your business grow.

What is working capital?

Working capital is the difference between a business’s current assets and liabilities over a 12-month period. The surplus or deficit is measured in dollars.

Current assets and liabilities

- Current assets are any assets you can liquidate within a year, like cash, funds in bank accounts, accounts receivable, inventory, prepaid expenses, short-term investments, and tax refunds. More about current assets

- Current liabilities are any outgoings or loans your business must pay within a year, such as accounts payable, loan or credit interest and payments, deferred revenue, and accrued expenses like wages and bank fees. More about current liabilities

The importance of working capital in business

Working capital helps you understand the operational viability of your business, its ability to withstand market and seasonal fluctuations, and its potential for growth.

Lenders and investors use a business’s working capital to assess a business’s financial stability.

Positive vs negative working capital

If current assets exceed current liabilities, the business has positive working capital, meaning it can pay its bills and debts, and could reinvest any surplus into the business.

But if current liabilities exceed current assets, the business has negative working capital, which indicates the business may struggle to meet its debts without borrowing or raising funds. The business could be in financial trouble if this continues.

When current assets and current liabilities are close to equal, working capital is neutral. This is fine if sales are good (the business consistently converts inventory into cash), but it leaves little buffer for reinvestment or unforeseen expenses.

While low working capital prevents a business from reinvesting to improve itself, really high working capital isn’t great in the long run, as it suggests the business isn’t innovating enough.

How to calculate working capital

To calculate working capital, you’ll need to project current assets and current liabilities for the next 12 months.

If you use accounting software, it’s easy to pull this information from balance sheets and financial reports. Here's how Xero financial reports can help you.

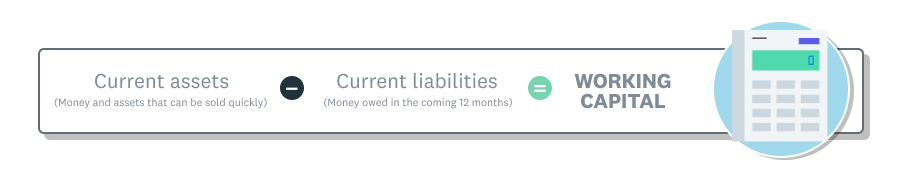

The working capital formula

A working capital formula example

The owner of a retail florist business needs to measure their working capital.

First, they add up their current assets across the next 12 months. The total comes to $100,000.

They then total their current liabilities across the next 12 months, which come to $75,000.

Using this information, they calculate their working capital is $25,000 ($100,000 – $75,000).

Working capital vs working capital ratio

While working capital is the difference between a business’s current assets and liabilities, the working capital ratio (also known as the current ratio) measure is the relationship between them – a different calculation for a different purpose. Here’s more about the working capital ratio.

Working capital examples in different businesses

The different operating cycles, cash flow patterns, and asset and liability structures between industries mean that a "good" working capital figure differs too. Here’s some more detail on the types of working capital in different businesses.

Working capital in construction and manufacturing

Construction projects and manufacturing businesses often have irregular cash flow due to long project timelines and payment schedules. Working capital funds upfront material, subcontractor, and labor costs that the business often can’t recover until a project is finished.

For example, a small business manufacturer of building materials wants to know how the business will hold up in an uncertain market.

- They add up their current assets: cash ($100,000) + accounts receivable ($200,000) + inventory ($300,000) = $600,000.

- They add up their current liabilities: accounts payable ($150,000) + short-term loans ($100,000) + accrued expenses ($50,000) = $300,000.

- Applying the working capital formula, they subtract their current liabilities from their current assets: $600,000 – $300,000 = $300,000. The business therefore has $300,000 in positive working capital, so that it has enough assets to cover its liabilities for now.

Working capital in service businesses

Businesses providing services, like consultancies or agencies, don’t hold inventory so they typically need less working capital than product-based industries. They may have higher accounts receivable (because they invoice clients) and will still need enough working capital to cover payroll, office expenses, and project costs.

Working capital in retail

Retail and wholesale businesses, and hospitality businesses like food service businesses, often hold lots of inventory and rely on their revenue, so they often need plenty of working capital to buy inventory in advance to meet customer demand in peak seasons. Retail businesses therefore need to balance their stock and sales to keep their working capital healthy.

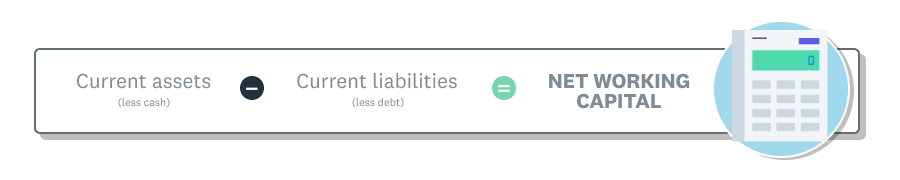

What is net working capital?

The term ‘net working capital’ is often used interchangeably with working capital, but there are differences.

- Net working capital (also called operating working capital) excludes cash (an asset) and debt (liabilities) from the calculation. This means you’re looking only at the efficiency of the business’s daily operations.

- Net working capital is often used for longer-term financial assessments and by businesses that are expanding. It’s especially useful in industries like retail, manufacturing, and distribution, where margins are small and your profitability depends on keeping costs down by operating efficiently.

The net working capital formula

Let’s look again at the florist. Suppose their current assets include a cash amount of $20,000, and their current liabilities include loan debts of $10,000. The new formula for their net working capital is $80,000 ($100,000 – $20,000) – $65,000 ($75,000 – $10,000) = $15,000.

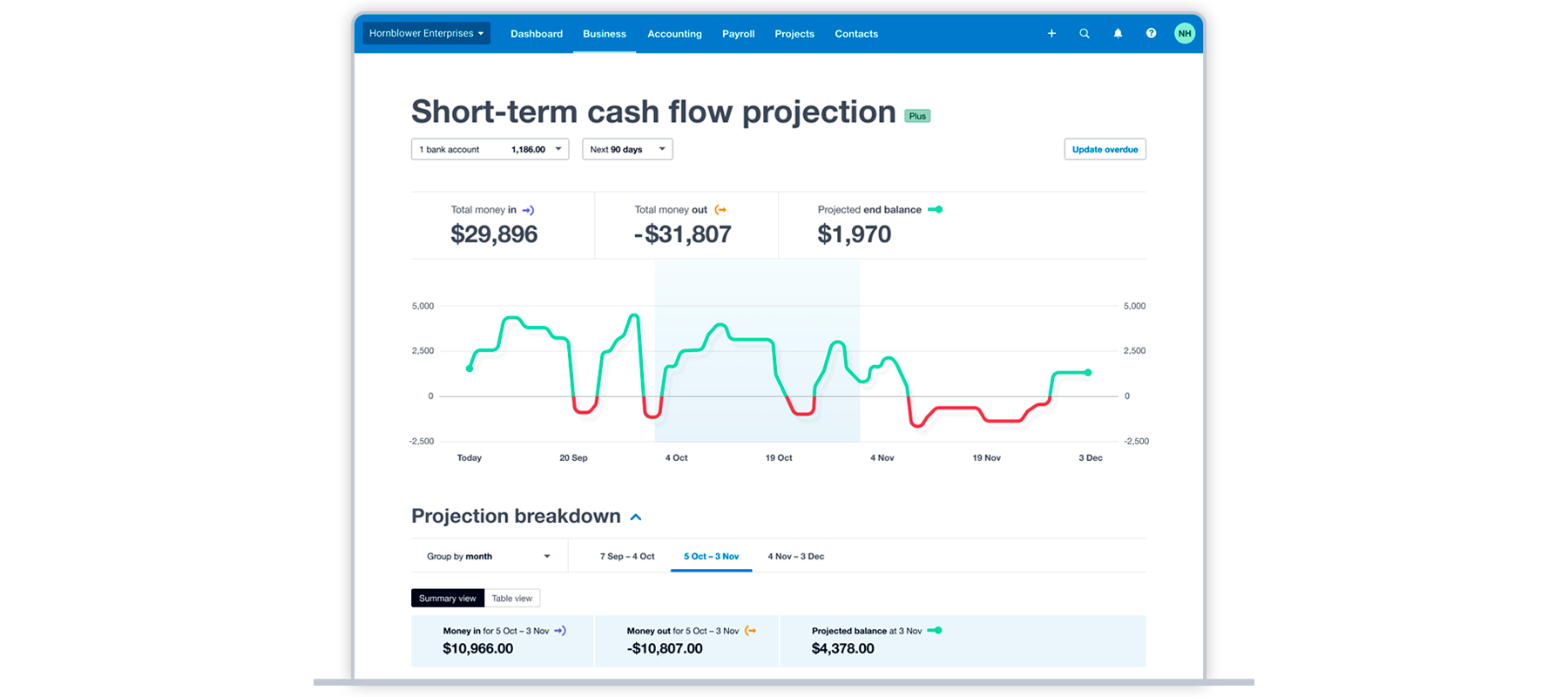

Working capital vs cash flow: what’s the difference?

While working capital shows you how much money is left after you’ve covered your upcoming costs, cash flow shows how your money moves in and out of your business, and therefore the cash you have on hand.

Here’s an example from Xero’s short-term cash flow projection. Here, we see figures for the total money in and out for the next 90 days. It doesn’t include liquid assets or show the whole picture of the business’s health and adaptability.

How to manage your working capital

Managing working capital is important for a small business’s bottom line.

Manage your inventory

- Keep your inventory at an optimal level – that is, where you’re neither tying up cash in unsold goods, nor understocked to the point where you’re vulnerable to sudden changes in supply or demand.

- Find ways to turn over inventory faster, such as by offering promotions or discounts on slow-moving stock.

- Think about using inventory management software to track your stock in real time, forecast demand, and automate reordering. Check out Xero's inventory management guide for more advice and learn more about Xero's inventory management features.

Control your expenses

- Identify where you can reduce costs without affecting quality or operations.

- Cut non-essential expenses and focus spending on things that help your business grow.

- Use lean business practices to streamline processes and reduce waste. Learn more about tracking business expenses.

Monitor your cash flow

Anticipate shortages or surpluses so you can plan for them by regularly checking your cash inflows and outflows.

Here’s more info about projecting cash flow. Set aside some of your profits as a ‘rainy day’ fund for lean periods.

Check out Xero's cash flow guide for more advice.

Invest in software tools to streamline your operations

Accounting software like Xero can help you run your business smoothly which in turn can benefit your working capital.

Automate invoicing and payments

Accounting software like Xero can automatically generate and send invoices, track payment status, and automatically follow up on overdue accounts.

Automating these tasks will improve your cash flow by reducing payment delays and preventing many manual errors.

Manage customer payments

Accounting software monitors and manages customer payments to save you admin time. You can also make it easy for customers to pay you by sending them automatic reminders and giving them plenty of ways to pay you, improving your cash flow.

Track your business expenses

Accounting software tracks your expenses for you, giving you real-time insights into your cash flow and helping you control your costs.

Manage your finances from anywhere

Cloud-based accounting software lets you access your financial data anytime and from anywhere with an internet connection. This flexibility lets you respond to cash flow issues as they arise.

All of these features give you more control over the situation and status of your business, improving working capital so you can confidently grow from a stable base.

FAQs about working capital

What is a good working capital ratio for small businesses?

As a general rule, a good working capital ratio for a small business is between 1.2 and 2.0. A ratio below 1.0 would indicate you don’t have enough assets to cover your debts.

This differs between industries – a service business won’t need as high a ratio as a retailer with plenty of inventory to manage.

How can I improve working capital ratio?

Here are things you can start doing today to improve your working capital ratio:

- Speed up invoicing. Send invoices immediately to reduce the turnaround time of payments. Find out how Xero accounting software makes invoicing easy.

- Negotiate better payment terms. Ask your suppliers for longer payment terms to slow your cash outflows.

- Offer early payment discounts. Encourage customers to pay sooner.

- Control your overheads. Find ways to cut non-essential spending to boost your assets.

What happens if my working capital ratio is too low?

A low working capital ratio means your business may not be able to cover its short-term debts – which could make the business insolvent if it continues.

What is a working capital loan?

If efforts to improve working capital ratio haven’t worked, as a last resort you may be able to apply for a working capital loan, which is a loan to fund the day-to-day operations of a business at risk. Before taking on new debt it’s always a good idea to seek advice from a financial advisor.

Is working capital the same as liquidity?

Not quite – your liquidity shows you how easily your business can cover its upcoming costs, while your working capital shows how much money is left after covering those upcoming costs.

Improve your working capital with Xero

Xero accounting software helps you manage your working capital through tracking your assets and liabilities and streamlining invoicing and payments.

With Xero you can:

- Automate your invoicing and payments

- Track your inventory easily

- Get real-time insights into your finances

- Track your expenses more easily

- Forecast your cash flow

Disclaimer

Xero does not provide accounting, tax, business or legal advice. This guide has been provided for information purposes only. You should consult your own professional advisors for advice directly relating to your business or before taking action in relation to any of the content provided.

Start using Xero for free

Access Xero features for 30 days, then decide which plan best suits your business.