Proforma Invoice: Definition, How It Works, & When To Use It

Proforma invoices help you secure payment commitments and streamline international trade. Learn how to use them effectively.

Written by Jotika Teli—Certified Public Accountant with 24 years of experience. Read Jotika's full bio

Published Wednesday 26 November 2025

Table of contents

Key takeaways

• Utilize pro forma invoices after price agreement but before sale completion to help customers secure funding, arrange payment terms, and provide required documentation for importing goods worth NZ$1000 or more.

• Create pro forma invoices using your standard invoice template but clearly label them as "Pro Forma Invoice" and avoid recording them in accounts receivable or as income since they represent preliminary agreements, not completed sales.

• Recognize that pro forma invoices have no tax implications and cannot be used for GST reporting or compliance, as you only have GST liability when you issue the final sales invoice.

• Apply pro forma invoices strategically for international shipments, complex procurement processes, and situations where customers need definitive pricing documentation beyond standard quotes for internal approvals or customs clearance.

What is a pro forma invoice?

A pro forma invoice is a preliminary billing document sent before a sale is finalised. It outlines products, services, and pricing without requesting immediate payment.

Key characteristics of pro forma invoices:

- Not a payment request: No invoice number or due date required

- Not recorded as income: Doesn't appear in accounts receivable

- Preliminary agreement: Confirms transaction details before finalising the sale

3 common reasons for issuing a pro forma invoice

Pro forma invoices serve three main business purposes:

Pro forma invoices serve three main business purposes:

- help buyers secure funding or arrange payment terms before purchase

- provide required documentation for importing goods, including calculating duties and facilitating border clearance, especially for items worth NZ$1000 or more

- give large organisations more definitive pricing than standard quotes for procurement processes

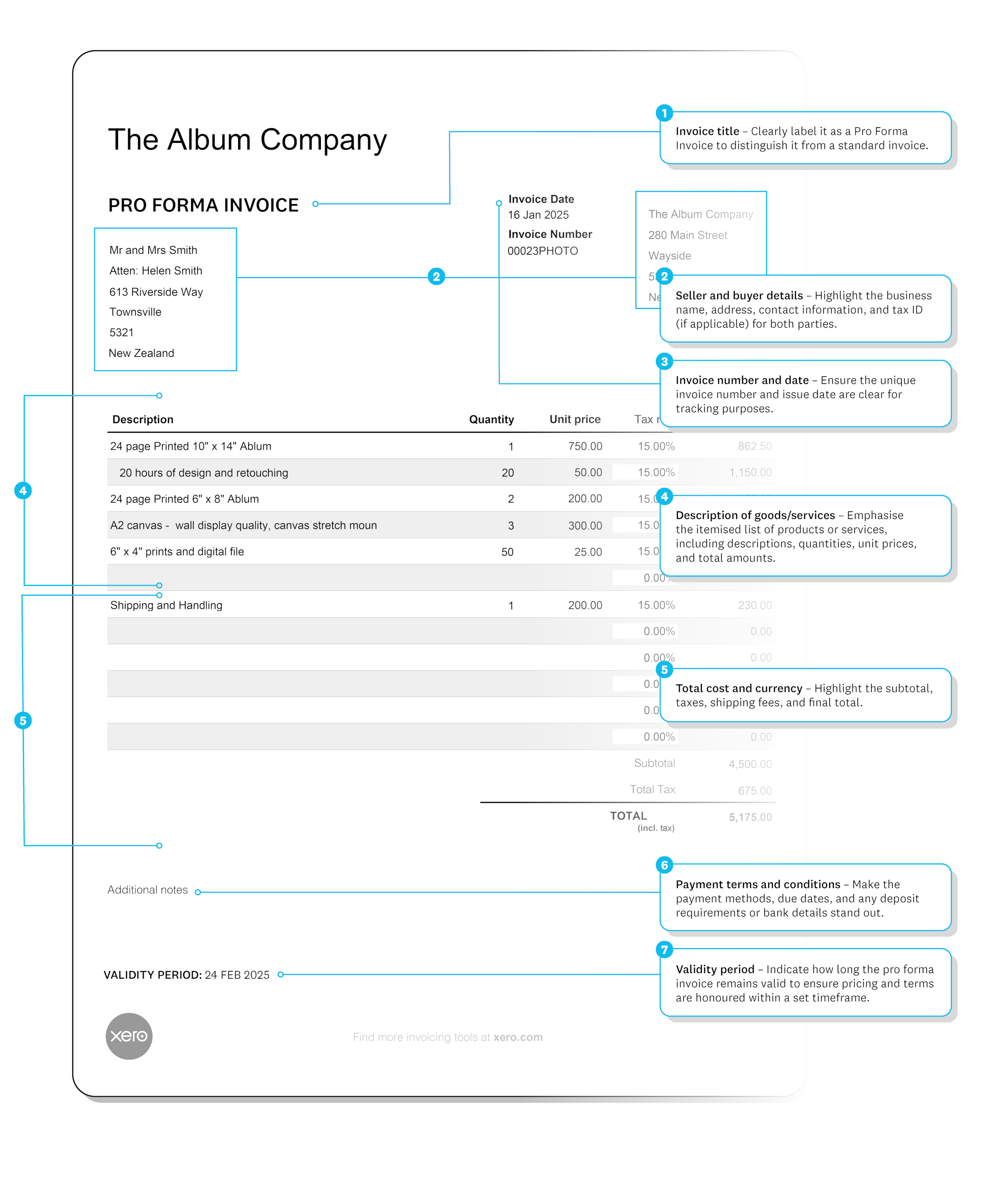

What should a pro forma invoice look like?

A pro forma invoice format mirrors a standard invoice but with key differences.

Required elements:

- Clear "Pro Forma Invoice" labelling

- Buyer and seller details

- Product or service descriptions and pricing

- Sale terms and conditions

- Reference number (not an official invoice number)

Additional requirements for imports:

- Product weights and measurements

- Country of origin information

How is a pro forma invoice different from other invoices (and quotes)?

Pro forma invoices differ from other business documents in timing and purpose.

vs Sales invoice:

- Pro forma: Sent before sale completion, no payment due

- Sales invoice: Sent after sale finalisation, payment required

vs Commercial invoice:

- Pro forma: Preliminary document for planning and approvals

- Commercial invoice: Final document for completed international sales, includes tariff details

vs Quote:

- Pro forma: Used after price agreement for administrative purposes

- Quote: Used during price negotiation and deal-making

A pro forma invoice isn't a tax invoice

Pro forma invoices have no tax implications because they represent preliminary agreements, not completed sales. As of 1 April 2023, official sales must be recorded with documents now known as taxable supply information, a requirement that pro forma invoices do not meet.

Tax considerations:

Tax considerations:

- you do not have GST liability until you issue the final sales invoice

- you can include projected tax amounts for planning purposes

- you cannot use pro forma invoices for tax reporting or compliance

When to send a pro forma invoice

Send pro forma invoices after price agreement but before sale completion.

Typical timing:

- After quote acceptance: Both parties have agreed to terms

- Before final processing: Sale, shipping, and final invoicing haven't occurred

- When requested: Customers need documentation for internal processes

Common customer needs:

- Import duty calculations, which may use a simplified entry for commercial imports with a value of less than $1000.

- Internal procurement approvals

- Financing arrangements

- Customs documentation

Important: Always confirm final approval before processing the actual sale or issuing the final sales invoice.

How to create a pro forma invoice

Creating a pro forma invoice involves adapting your standard invoice process with key modifications.

Creation steps:

- Add clear labelling: Mark document as "Pro Forma Invoice"

- Avoid accounting entries: Don't record in accounts receivable or income

Accounting software considerations:

- Check provider guidance: Ensure proper pro forma invoice handling

- Prevent accidental sales recording: Avoid triggering income recognition in accrual accounting

- Maintain separate tracking: Keep pro forma invoices distinct from actual sales invoices

Streamline your invoicing process with Xero

Pro forma invoices are just one part of efficient business documentation. When used correctly, they help you secure deals, satisfy customer requirements, and maintain professional standards.

Effective invoicing practices save you time and make your admin easier. Using the right tools, from pro forma invoices to final billing and payment tracking, helps you keep your cash flow healthy and your customers happy.

See how Xero invoicing can make your billing easier – get one month free.

FAQs on pro forma invoices

Here are answers to some common questions about pro forma invoices.

Is a pro forma invoice legally binding?

No. A pro forma invoice is not a legally binding document. It’s created before you deliver products or services as a good-faith agreement.

Do I need to cancel a pro forma invoice if the sale doesn’t go ahead?

No. Because a pro forma invoice isn’t an official accounting document, you don’t need to cancel or edit it if the sale falls through.

Can I turn a pro forma invoice into a commercial invoice?

No. Although they contain similar information, a commercial invoice includes additional legal terms and details required for international sales, so a pro forma invoice can’t be converted into one.

Why might a customer ask for a pro forma invoice?

Some customers—particularly importers—may request a pro forma invoice to help with their internal processes or customs requirements. Providing one can help you do business with them.

Should I pay a pro forma invoice?

No. You should wait to pay until you receive an official sales invoice, as a pro forma invoice isn’t binding and prices may still change.

What are the advantages of using pro forma invoices?

Pro forma invoices can:

- help you and your customer agree on the details before a sale

- provide information needed to get goods through customs

- allow changes to products, services or costs without affecting your business accounts

Related content

What is an invoice?

Get the lowdown on invoices.

How to send an invoice

Find out when and how to send an invoice.

How to make an invoice

Let’s walk through the process of making an invoice.

Disclaimer

Xero does not provide accounting, tax, business or legal advice. This guide has been provided for information purposes only. You should consult your own professional advisors for advice directly relating to your business or before taking action in relation to any of the content provided.

Get one month free

Purchase any Xero plan, and we will give you the first month free.