NOPAT: How to Calculate Net Operating Profit After Tax

Discover how NOPAT shows core operating profit, so you can compare companies and plan smarter growth.

Written by Kari Brummond—Content Writer, Accountant, IRS Enrolled Agent. Read Kari's full bio

Published Friday 30 January 2026

Table of contents

Key takeaways

- Calculate NOPAT using the formula: operating profit × (1 - tax rate) to measure your core business performance without the influence of debt financing or non-operating income.

- Use NOPAT to make fair comparisons between businesses regardless of their debt levels, as it reveals true operational performance by excluding interest expenses that can distort profitability analysis.

- Apply NOPAT calculations to support better investment decisions by combining it with Economic Value Added (EVA) analysis, which helps determine if your invested capital is generating strong returns.

- Track your effective tax rate by dividing income tax paid by operating profit from previous years, then adjust for potential tax bracket changes as your business grows.

What is NOPAT?

Net Operating Profit After Tax (NOPAT) is a financial metric that measures how much profit your business earns from core operations after paying taxes but before interest expenses. This calculation excludes non-operating income and focuses solely on your main business activities.

NOPAT provides clear insight into operational performance by:

- Excluding non-operating income: Removes gains from investments or side activities

- Ignoring interest expenses: Eliminates debt-related costs from loans or credit cards

- Focusing on core operations: Shows true business performance from main activities

- Supporting investment analysis: Helps calculate returns on business investments

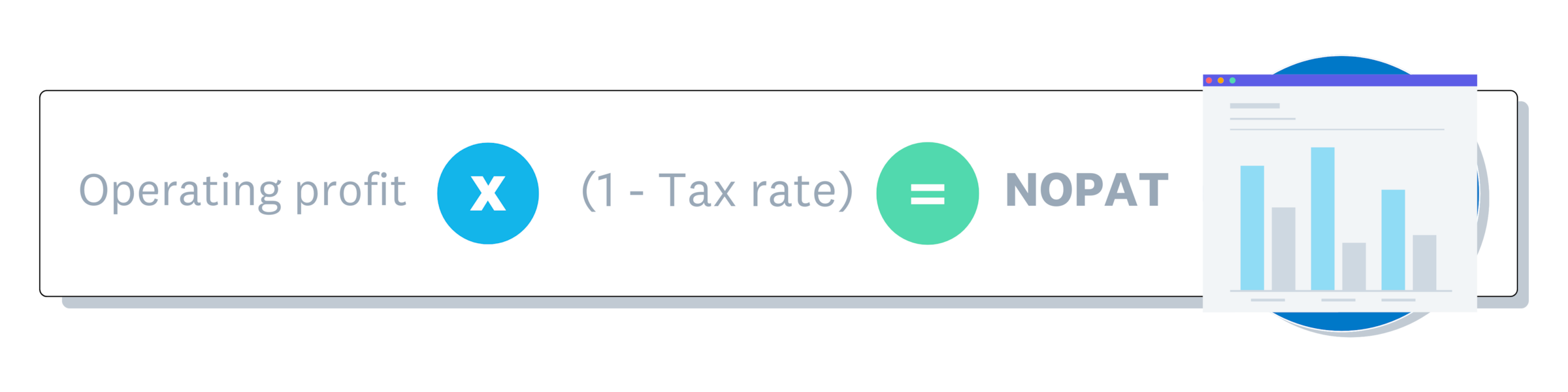

NOPAT formula explained

Let's break down the NOPAT formula:

NOPAT = operating profit × (1 - tax rate)

NOPAT calculation process:

- Start with operating profit: Earnings after all expenses (including depreciation) but before taxes and interest

- Calculate tax retention rate: 1 minus your effective tax rate

- Apply the formula: Operating profit × (1 - tax rate) = NOPAT

Example: 20% tax rate means you keep 80% of operating profit for NOPAT calculation.

Operating profit is often confused with EBIT (earnings before interest and tax). EBIT includes all income sources, while operating profit only includes operating income (money earned from your main line of business).

How to calculate NOPAT

To nail down the formula, let's see how it relates to a net operating profit after tax example.

1. Determine operating profit

First, determine your operating profit. This is your earnings before tax and interest (EBIT), without any non-operating income. Calculate this number by subtracting operating expenses from gross profit (revenue minus cost of goods sold).

2. Find the tax rate

Calculate your effective tax rate:

- Gather last year's data: Operating profit and income tax paid

- Apply the formula: Income tax ÷ operating profit = effective tax rate

- Example calculation: $20,000 tax ÷ $100,000 operating profit = 20% tax rate

- Adjust for growth: Factor in higher earnings that may increase your tax bracket. In New Zealand, Inland Revenue’s tax rates for businesses show that most companies pay income tax at 28%.

Check Tax rates for businesses to estimate current rates for your business size.

3. Apply the formula

Use your numbers to apply the NOPAT formula. To illustrate, let's use these sample numbers:

- Operating profit: $50,000

- Tax rate: 25%

$37,500 = $50,000 * (1-.25)

That means after tax (but not including interest), your business's operations earn $37,500 per year.

NOPAT vs EBIT

While they sound similar, NOPAT and EBIT (earnings before interest and tax) measure different things. The key difference is tax.

EBIT shows you a company's profitability before considering interest and tax expenses. NOPAT takes it a step further by subtracting taxes. This gives you a clearer picture of how well a company's core operations perform after its tax obligations are met, but still without the influence of how the business is financed.

Why is NOPAT important?

NOPAT importance centres on providing unbiased operational insights. This metric eliminates financing structure bias, allowing fair comparisons between businesses regardless of debt levels or geographic location.

Reveals true business performance

NOPAT reveals a clearer picture of your business's overall performance:

- Operational focus: Shows true business performance without debt influence

- Tax-adjusted reality: Accounts for actual tax burden while excluding financing costs

- Complex business evaluation: Particularly valuable for businesses with multiple investors or intricate financial structures

- Strategic decision-making: Identifies improvement areas and guides long-term growth planning

Helps to standardise comparisons

NOPAT makes it easier to compare companies in different regions and markets. If a business is in debt, its net profit may be low and its cash flow may be strained. NOPAT lets you focus on the health of its core operations. It also helps you compare how the tax rates in different areas affect the company's bottom line.

Consider this business comparison example:

Company A: $100,000 net profitCompany B: $80,000 net profit (appears weaker)Company B NOPAT: $120,000 (excluding interest payments)

NOPAT reveals Company B's superior operational performance, showing its potential value after debt restructuring.

Similarly, let's say you're comparing businesses in different tax jurisdictions. NOPAT shows you exactly how the tax liabilities in each of these areas affect profits.

Improved decision-making

NOPAT also supports better decisions because it shows how well money invested in the business is performing. It can highlight operational problems that create large losses, such as cases where destroyed stock equalled 11.6% of the cost of goods sold. It does this by helping you calculate Economic Value Added (EVA).

EVA puts interest back into the equation, but it also takes shareholder equity into account. To determine EVA, start with NOPAT and then subtract total invested capital times the cost of the capital.

EVA calculation example:

- NOPAT: $50,000

- Total capital: $200,000 ($100,000 loans + $100,000 cash investment)

- Average capital cost: 3%

- Capital cost: $200,000 × 3% = $6,000

- EVA result: $50,000 - $6,000 = $44,000

This $44,000 EVA shows that your $200,000 investment is generating strong annual returns. EVA becomes critical for businesses with multiple shareholders, guiding future investment and loan decisions.

You can see more EVA calculation examples in this guide.

NOPAT vs net income

NOPAT and net income differ in scope and focus:

- Net income: Includes all business income, expenses, taxes, and financing costs

- NOPAT: Excludes interest expenses and non-operating activities, focusing solely on core operations after tax

Net income is the bottom line, as it accounts for operational expenses, interest, depreciation, amortisation, and taxes. It also includes all of the income and expenses the business earns from side activities or investments. NOPAT excludes interest and any income or expenses that are not related to the business's core operations.

Bakery NOPAT calculation:

- Net income: $100,000

- Remove non-operating income: -$12,000 (parking lot rent)

- Add back interest expense: +$8,000 (loan interest)

- NOPAT result: $80,000

This shows the bakery's true operational performance without financing costs or side income.

NOPAT focuses on how well your day-to-day operations make a profit, while net income includes every income and expense item. However, if a business doesn't have any debt or other income streams, then its NOPAT and net income are the same.

Operating profit vs NOPAT

Both operating profit and NOPAT show how much a business earns from its core operations before interest expenses. You can track these using key performance indicators such as staff productivity results. But operating profit doesn't include taxes, while NOPAT does. Neither of these numbers include income or expenses that aren't related to the main operations.

To calculate operating profit, add the tax back into NOPAT. Say the NOPAT is $80,000 and the business's tax liability is $16,000. That means that the operating profit is $96,000.

Track your financial performance with Xero

Streamline NOPAT analysis by automating data collection and calculations.

Xero tracks your income and expenses automatically, and generates the financial reports you need for accurate NOPAT calculations. Get one month free.

FAQs on NOPAT

Here are some common questions about Net Operating Profit After Tax.

Is NOPAT the same as EBIT?

No, they aren't the same. NOPAT is calculated after taxes, while EBIT is calculated before interest and taxes. NOPAT shows your operational profit after tax. EBIT does not include this tax effect.

How do you convert EBIT to NOPAT?

You can find NOPAT if you know your EBIT and tax rate. The formula is NOPAT = EBIT × (1 - tax rate). This adjusts your earnings to account for the tax you will pay.

When should I use NOPAT instead of net income?

Use NOPAT when you want to measure how well a business's core operations are performing, without the results being affected by how much debt it has. Net income is your final profit after everything, including interest on debt, has been subtracted.

What's a good NOPAT for a small business?

Rather than aiming for a single “good” NOPAT number, focus on the overall trend. Instead, focus on the trend. A consistently positive and growing NOPAT shows that your core business is becoming more profitable over time. It's also helpful to compare your NOPAT to other businesses in your industry, as financial metrics can vary widely from the industry benchmark.

Disclaimer

Xero does not provide accounting, tax, business or legal advice. This guide has been provided for information purposes only. You should consult your own professional advisors for advice directly relating to your business or before taking action in relation to any of the content provided.

Get one month free

Purchase any Xero plan, and we will give you the first month free.