What is Working Capital? Meaning, Formula and Why It Matters

Learn how to calculate working capital and use it to plan cash, pay bills, and grow.

Written by Jotika Teli—Certified Public Accountant with 24 years of experience. Read Jotika's full bio

Published Monday 22 December 2025

Table of contents

Key takeaways

- Calculate working capital by subtracting current liabilities from current assets to determine if your business can cover day-to-day operations and short-term debts within the next 12 months.

- Monitor your working capital ratio regularly, aiming for 1.2 to 2.0 for most small businesses, with service businesses needing lower ratios (1.2-1.5) and manufacturing requiring higher ratios (1.8-2.5).

- Improve your working capital position by accelerating invoicing, negotiating better supplier payment terms, optimising inventory levels, and controlling unnecessary expenses.

- Utilise accounting software to automate invoicing, track expenses in real-time, and forecast cash flow to maintain better control over your working capital management.

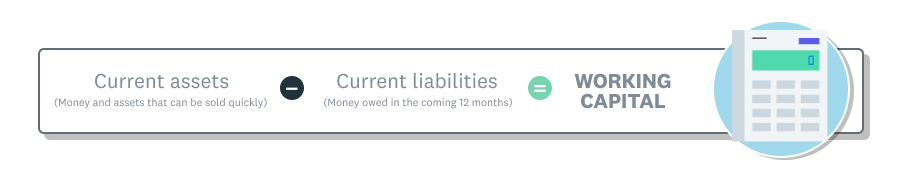

Components of the working capital formula

The working capital formula has two main parts: current assets and current liabilities. Understanding what goes into each will help you calculate your working capital accurately.

Current assets

Current assets are anything your business owns that you can convert into cash within 12 months. Think of them as your short-term resources.

- Cash and funds in bank accounts

- Accounts receivable (money owed to you by customers)

- Inventory (stock, raw materials, and finished goods)

- Short-term investments

- Prepaid expenses (like rent or insurance paid in advance)

Current liabilities

Current liabilities are any debts or payments your business needs to make within the next 12 months. These are your short-term financial obligations.

- Accounts payable (money you owe to suppliers)

- Short-term loan payments and interest

- Accrued expenses (like wages, taxes, and bank fees)

- Deferred revenue (payments received for work you haven't done yet)

The importance of working capital in business

Working capital reveals your business's ability to survive and grow. It shows whether you can pay bills during slow periods, handle unexpected expenses, and invest in new opportunities.

Lenders and investors use working capital to evaluate your financial stability before approving loans or investments.

Positive vs negative working capital

If current assets exceed current liabilities, the business has positive working capital, meaning it can pay its bills and debts, and could reinvest any surplus into the business.

But if current liabilities exceed current assets, the business has negative working capital, which indicates the business may struggle to meet its debts without borrowing or raising funds. The business could be in financial trouble if this continues.

When current assets and current liabilities are close to equal, working capital is neutral. This is fine if sales are good (the business consistently converts inventory into cash), but it leaves little buffer for reinvestment or unforeseen expenses.

While low working capital can limit reinvestment, very high working capital may mean you are holding more cash than you need instead of investing in innovation or growth.

How to calculate working capital

Calculate working capital by following these steps:

- Gather your financial data: Use your balance sheet or accounting software to find current assets and liabilities

- Apply the formula: Subtract current liabilities from current assets

- Interpret the result: Positive numbers indicate healthy cash flow, negative numbers signal potential problems

The working capital formula

A working capital formula example

The owner of a retail florist business needs to measure their working capital.

First, they add up their current assets across the next 12 months. The total comes to $100,000.

They then total their current liabilities across the next 12 months, which come to $75,000.

Using this information, they calculate their working capital is $25,000 ($100,000 – $75,000).

Working capital vs working capital ratio

Working capital shows the dollar amount available for operations (assets minus liabilities).

Working capital ratio shows the relationship between assets and liabilities (assets divided by liabilities).

Use working capital to understand cash availability. Use the ratio to compare financial health across time periods or against other businesses. Here's more about the working capital ratio.

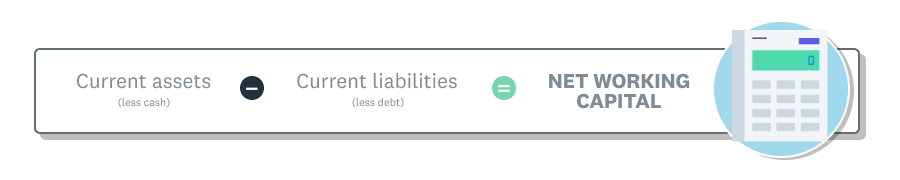

What is net working capital?

The term 'net working capital' is often used interchangeably with working capital, but there are differences.

- Net working capital (also called operating working capital) excludes cash (an asset) and debt (liabilities) from the calculation. This means you're looking only at the efficiency of the business's daily operations.

- Net working capital is often used for longer-term financial assessments and by businesses that are expanding. It's especially useful in industries like retail, manufacturing, and distribution, where margins are small and your profitability depends on keeping costs down by operating efficiently.

The net working capital formula

Let's look again at the florist. Suppose their current assets include a cash amount of $20,000, and their current liabilities include loan debts of $10,000. The new formula for their net working capital is $80,000 ($100,000 – $20,000) – $65,000 ($75,000 – $10,000) = $15,000.

Working capital examples in different businesses

Working capital needs vary significantly by industry because businesses have different cash flow patterns and operational requirements.

Service businesses typically need less working capital than retailers or manufacturers. Understanding your industry's patterns helps you set realistic targets and identify potential problems.

Working capital in construction and manufacturing

Construction projects and manufacturing businesses often have irregular cash flow due to long project timelines and payment schedules. Working capital funds upfront material, subcontractor, and labour costs that the business often can't recover until a project is finished.

For example, the owner of a small manufacturing business that makes building materials wants to know how their business will hold up in an uncertain market.

- They add up their current assets: cash ($100,000) + accounts receivable ($200,000) + inventory ($300,000) = $600,000.

- They add up their current liabilities: accounts payable ($150,000) + short-term loans ($100,000) + accrued expenses ($50,000) = $300,000.

- Applying the working capital formula, they subtract their current liabilities from their current assets: $600,000 – $300,000 = $300,000. The business has $300,000 in positive working capital, which means it has enough assets to cover its short-term liabilities.

Working capital in service businesses

Businesses providing services, like consultancies or agencies, don't hold inventory so they typically need less working capital than product-based industries. They may have higher accounts receivable (because they invoice clients) and will still need enough working capital to cover payroll, office expenses, and project costs.

Working capital in retail

Retail and wholesale businesses, and hospitality businesses like food service businesses, often hold lots of inventory and rely on their revenue. According to the Reserve Bank of New Zealand, borrowing for working capital remains high in these sectors to manage exposure to weak consumer spending and buy inventory to meet customer demand in peak seasons.

Working capital vs cash flow: what's the difference?

While working capital shows you how much money is left after you've covered your upcoming costs, cash flow shows how your money moves in and out of your business, and therefore the cash you have on hand.

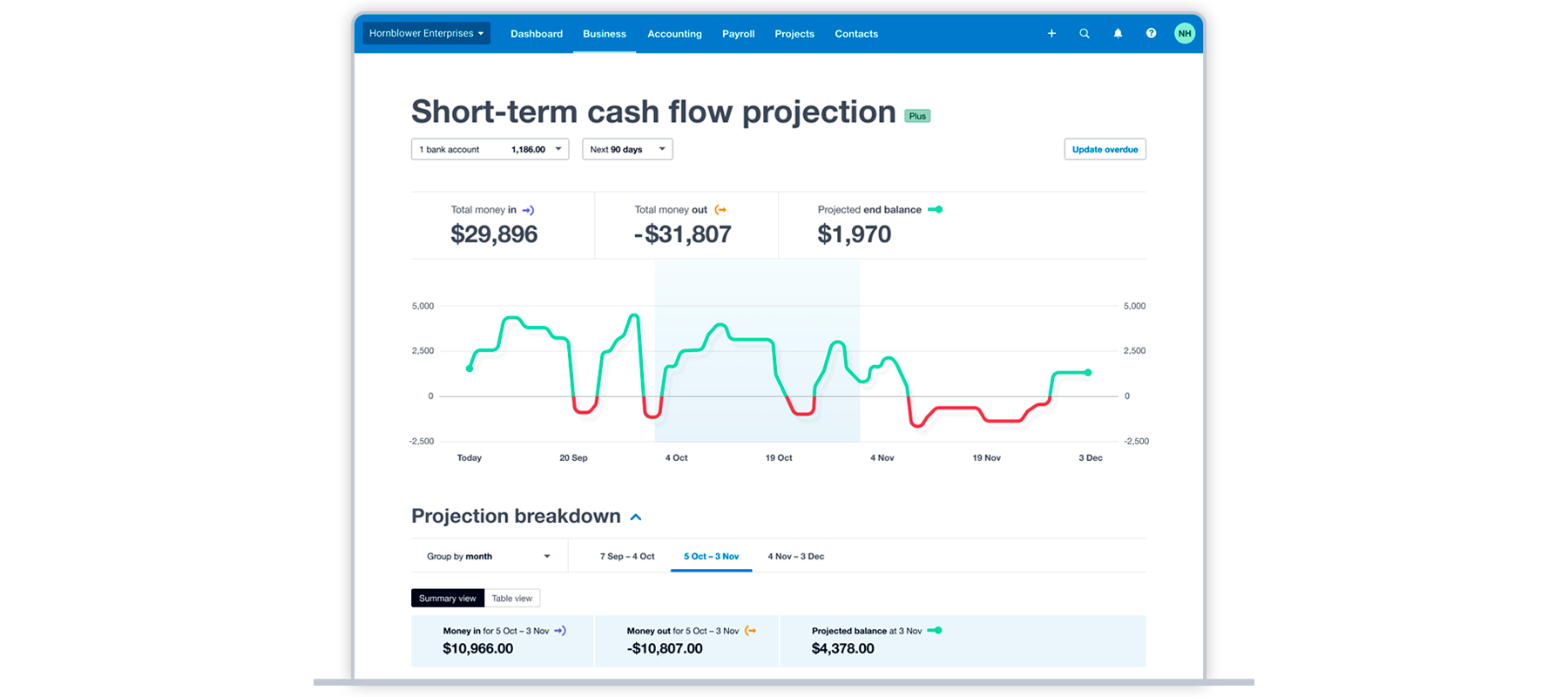

Here's an example from Xero's short-term cash flow projection. Here, you can see the total money in and out for the next 90 days. It doesn't include liquid assets or show the whole picture of the business's health and adaptability.

How to manage your working capital

Effective working capital management directly improves your profitability and reduces financial stress. It ensures you can pay bills on time, avoid expensive emergency loans, and seize growth opportunities when they arise.

Manage your inventory

Optimise inventory levels to balance cash flow and customer demand:

- Avoid overstocking: Excess inventory ties up cash that could fund operations

- Prevent stockouts: Insufficient inventory leads to lost sales and disappointed customers

- Monitor turnover rates: Track which products sell quickly and adjust ordering accordingly

Check out Xero's inventory management guide for more advice.

Control your expenses

To keep your expenses under control:

- Identify where you can reduce costs without affecting quality or operations

- Cut non-essential expenses and focus spending on things that help your business grow

- Use lean business practices to streamline processes and reduce waste

Monitor your cash flow

Anticipate shortages or surpluses so you can plan for them by regularly checking your cash inflows and outflows.

Set aside some of your profits as a 'rainy day' fund for lean periods.

Invest in software tools to streamline your operations

Accounting software directly improves your working capital management by automating time-consuming tasks and providing real-time financial insights.

Accounting software helps you maintain healthy working capital in multiple ways:

- Faster customer payments: Automated invoicing and payment reminders reduce the time between completed work and received payment, directly increasing your current assets.

- Manage customer payments: Accounting software monitors and manages customer payments to save you admin time. You can also make it easy for customers to pay you by sending them automatic reminders and giving them plenty of ways to pay you, improving your cash flow.

- Track your business expenses: Accounting software tracks your expenses for you, giving you real-time insights into your cash flow and helping you control your costs.

- Manage your finances from anywhere: Cloud-based accounting software lets you access your financial data anytime and from anywhere with an internet connection. This flexibility lets you respond to cash flow issues as they arise.

These features give you more control over your finances and help you improve working capital so you can grow with confidence.

Improve your working capital with Xero

Xero accounting software helps you manage your working capital through tracking your assets and liabilities and streamlining invoicing and payments.

With Xero you can:

- Automate your invoicing and payments

- Track your inventory easily

- Get real-time insights into your finances

- Track your expenses more easily

- Forecast your cash flow

Ready to see how Xero can help your business? Get one month free today.

FAQs on working capital

Here are common questions amll business owners might have about working capital.

What is a good working capital ratio for small businesses?

A healthy working capital ratio ranges from 1.2 to 2.0 for most small businesses. This means you have $1.20 to $2.00 in current assets for every $1.00 in current liabilities.

Industry variations:

- Service businesses: 1.2 to 1.5 (lower inventory needs)

- Retail businesses: 1.5 to 2.0 (higher inventory requirements)

- Manufacturing: 1.8 to 2.5 (complex supply chains and longer production cycles)

How can I improve working capital ratio?

Improve your working capital ratio immediately with these proven strategies:

- Accelerate invoicing: Send invoices immediately after completing work to reduce payment delays

- Negotiate supplier terms: Request 30-60 day payment windows to improve cash flow timing

- Incentivise early payments: Offer 2-3% discounts for payments within 10 days

- Reduce unnecessary expenses: Cut non-essential costs to increase available assets

What happens if my working capital ratio is too low?

A low working capital ratio means you may struggle to cover short-term debts. It’s a signal to review your cash flow, costs, and funding options so you can improve your position early.

What is a working capital loan?

If other steps do not improve your working capital, you may be able to apply for a working capital loan. This type of loan helps you fund day-to-day operations while you work on a longer term solution. Before taking on new debt it's always a good idea to seek advice from a financial advisor.

Explore your options for funding your working capital.

Is working capital the same as liquidity?

Not quite. Your liquidity shows you how easily your business can cover its upcoming costs, while your working capital shows how much money is left after covering those upcoming costs.

Disclaimer

Xero does not provide accounting, tax, business or legal advice. This guide has been provided for information purposes only. You should consult your own professional advisors for advice directly relating to your business or before taking action in relation to any of the content provided.

Get one month free

Purchase any Xero plan, and we will give you the first month free.