What is liquidity?

Liquidity (definition)

Liquidity measures a business’s ability to pay all its bills and make loan repayments in the coming months. It is commonly expressed as a ratio.

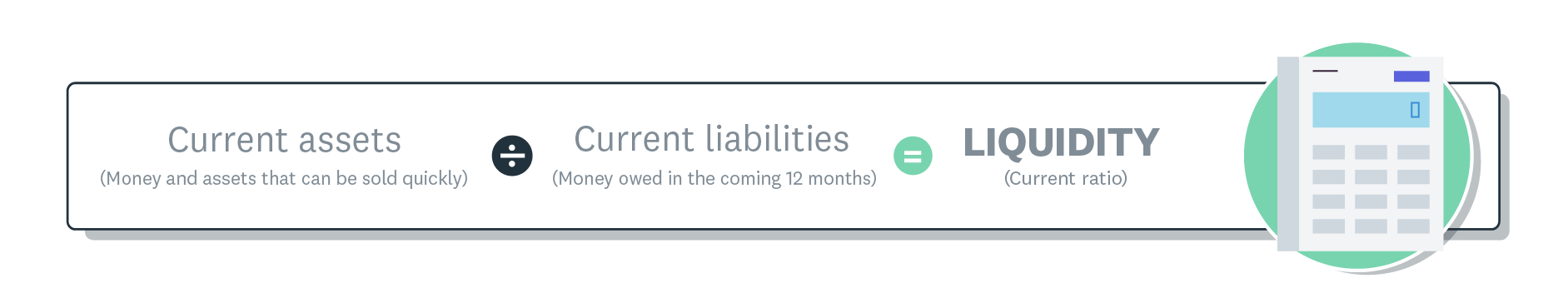

Liquidity compares current liabilities (which are amounts owed within the coming 12 months) against current assets. Current assets include cash the business has, inventory, plus payments due to come in such as receivables, and any assets that could be sold quickly.

Current ratio liquidity formula.

What liquidity means for the business

A ratio of 1.0 or more shows the business can cover its costs and is generally in good shape. A ratio of less than 1.0 is not so positive but isn’t necessarily a bad thing. A business that’s investing in growth will have bigger bills and may find their current ratio drops below 1.0. However, most businesses will want to avoid having a ratio that is permanently stuck at less than 1.0.

The liquidity ratio will change depending on where a business is in its billing cycle, so it’s a good idea to measure it at the same time every month. That way you’re comparing like for like and can see if liquidity is trending up or down over the long term.

Other liquidity ratios

Although the current ratio is the most common way for small businesses to measure liquidity, there are two other ratios:

- Quick ratio (or acid test ratio): It only uses assets that can be changed into cash within three months. Cash, cash equivalents, short-term investments and receivables divided by current liabilities (debts due to be paid within three months). Or alternatively, current assets minus inventory and prepaid expenses divided by current liabilities (debts due to be paid within three months).

- Cash ratio: Cash and cash equivalents divided by current liabilities.

Learn more in our guide on liquidity ratios.

How liquidity differs from workin.g capital, free cash flow, and cash flow

Liquidity is a measure of spending power, similar to cash flow, free cash flow, and working capital. Each of these terms has its own complexities, but here’s roughly how they compare:

- Cash flow refers to the general availability of cash

- Liquidity shows how easily a business can cover upcoming costs (expressed as a ratio)

- Working capital shows how much money will be left after covering those upcoming costs

- Free cash flow is the amount of cash left after making capital investments

See related terms

Handy resources

Advisor directory

You can search for experts in our advisor directory

Xero Small Business Guides

Discover resources to help you do better business

Online accounting with Xero

Automate your accounting in the cloud

Disclaimer

This glossary is for small business owners. The definitions are written with their requirements in mind. More detailed definitions can be found in accounting textbooks or from an accounting professional. Xero does not provide accounting, tax, business or legal advice.