Accumulated depreciation: Definition, how to calculate it and the impact it has on your small business

Learn if accumulated depreciation is an asset, how to calculate it, and what it means for your balance sheet.

Written by Jotika Teli—Certified Public Accountant with 24 years of experience. Read Jotika's full bio

Published Wednesday 26 November 2025

Table of contents

Key takeaways

• Calculate accumulated depreciation using the straight-line method by subtracting salvage value from asset cost, dividing by useful life, then multiplying by years owned to track total depreciation over time.

• Record accumulated depreciation as a contra asset account with a credit balance on your balance sheet to show realistic asset values while reducing taxable income through annual depreciation expenses.

• Apply the book value formula (asset cost minus accumulated depreciation) to determine current asset worth for financial reporting, replacement planning, and loan applications.

• Utilize depreciation as a non-cash expense that improves cash flow indirectly by lowering your tax bill while providing accurate financial statements for investors and lenders.

What is accumulated depreciation?

Accumulated depreciation is the total amount an asset has decreased in value since you bought it and is a key factor in determining an asset's carrying amount, which is calculated after deducting any accumulated depreciation and impairment losses. It shows the cumulative wear, tear, and aging of your business assets over time.

This tracking shows the current value of your assets on your financial statements. The calculation is simple: book value = asset cost – accumulated depreciation This book value represents what your asset is realistically worth today.

Here are some examples:

- Office furniture costs $5,000 and depreciates by $1,000 each year. After three years, it has depreciated by $3,000, leaving a book value of $2,000.

- Machinery costs $25,000 and depreciates by $2,500 each year. After six years, it has depreciated by $15,000, leaving a book value of $10,000.

- Office furniture cost $5000, with $1000 depreciation each year. After 3 years it has depreciated by $3000, leaving a book value today of $2000.

- Machinery cost $25,000, with $2500 depreciation each year. After 6 years it has depreciated by $15,000, leaving a book value today of $10,000.

Depreciation vs accumulated depreciation

Depreciation is the annual expense showing how much an asset loses value each year.

Accumulated depreciation is the running total of all depreciation expenses for that asset since you bought it.

The key difference:

- Depreciation: Annual expense (appears on income statement)

- Accumulated depreciation: Cumulative total (appears on balance sheet)

Is accumulated depreciation an asset or a liability?

Accumulated depreciation is neither an asset nor a liability – it's classified as a contra asset account.

Here's why it's not a liability:

- Accumulated depreciation isn't a debt to repay

- It simply tracks how much value your asset has lost over time

Contra asset accounts work differently from regular assets:

- Reduce asset totals with negative values

- Show realistic asset values rather than original purchase prices

- Appear alongside assets on the balance sheet but subtract from their value

While you record the contra asset alongside your other assets, it always has a negative value, showing how accumulated depreciation reduces an asset's value from its original cost. This gives a more realistic estimate of an asset's book value.

Why understanding accumulated depreciation matters for a business

- Track asset values over time to plan replacements, upgrades and maintenance

- Reduce your taxable income with depreciation expenses, which can lower your tax bill and keep more cash in your business. Eligible Australian businesses may be able to use temporary tax depreciation incentives to claim immediate or accelerated deductions for certain assets

- Show lenders and investors the value of your assets to improve your chances of getting finance

How does accumulated depreciation affect financial statements?

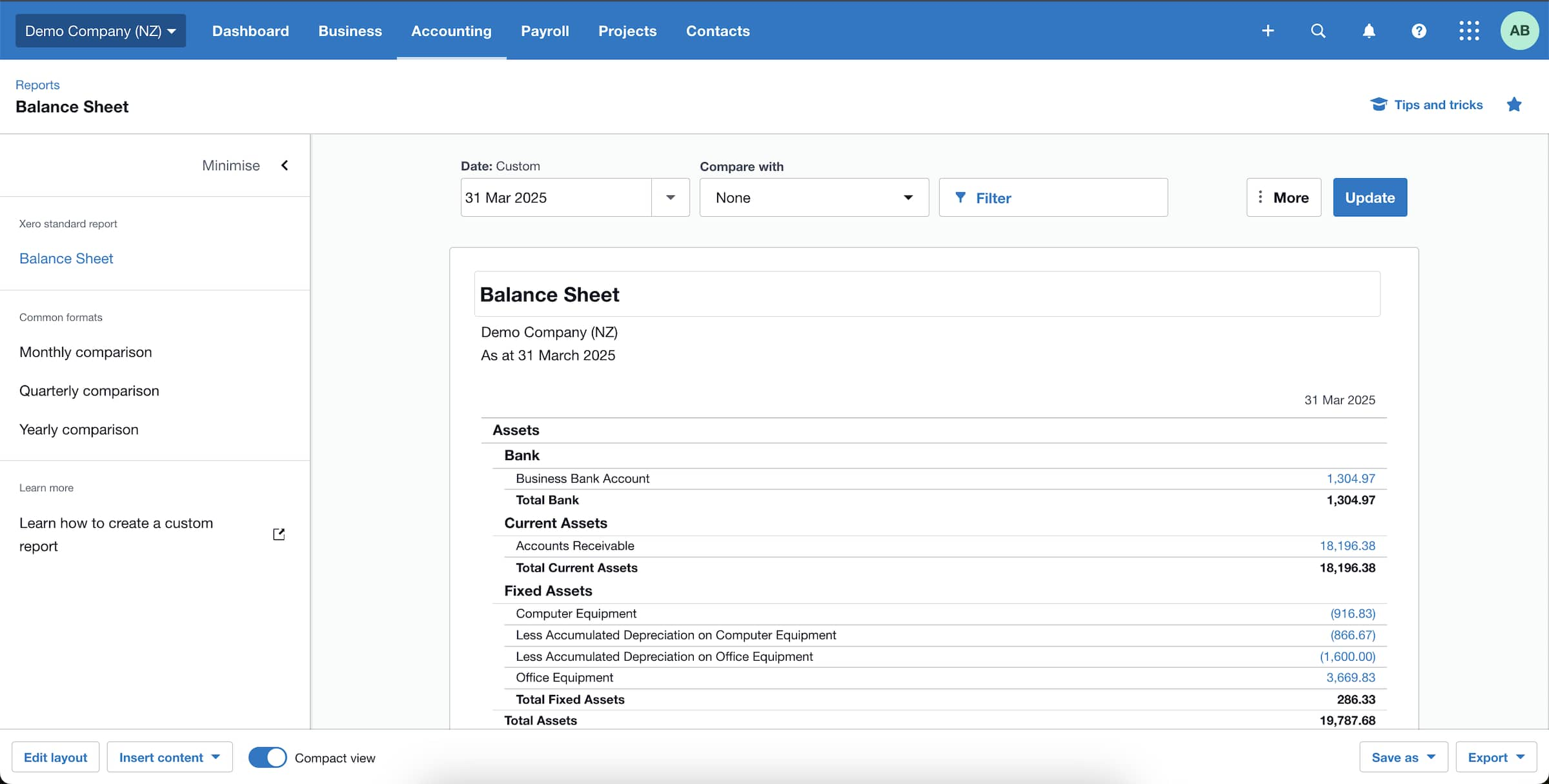

Accumulated depreciation on the balance sheet

Accumulated depreciation reduces an asset's book value on the balance sheet.

Although a balance sheet lists the asset's original cost, accumulated depreciation adjusts this value downwards to reflect the asset's current worth.

Accumulated depreciation on the income statement

You record depreciation as an expense, which reduces your taxable income. As a non-cash expense, it lowers your profits without affecting cash flow.

Accumulated depreciation on the cash flow statement

You add depreciation back to net income on the cash flow statement because it doesn't affect cash flow.

This adjustment reflects that depreciation is an accounting expense, not a cash outflow.

Learn more about how depreciation is treated by your local tax authority

How to calculate accumulated depreciation

Straight line depreciation spreads an asset's cost evenly across its useful life – making it the simplest method for small businesses to calculate accumulated depreciation.

The straight line depreciation calculation

Formula: Annual depreciation expense = (cost of asset − salvage value) / useful life

Key terms explained:

- Cost of asset:Original purchase price

- Salvage value: Estimated resale or scrap value when the asset is no longer useful

- Useful life: Expected years the asset will function before becoming obsolete. To maintain accuracy, Australian Accounting Standards require that an asset's useful life and its residual value be reviewed at least annually.

Each factor changes the annual depreciation expense.

For example, an asset with a short useful life spreads depreciation over fewer years, resulting in a higher annual depreciation expense.

If an asset holds its value well and has a relatively high salvage value, it will depreciate less each year, leading to a lower annual depreciation expense.

Calculate straight line depreciation

Now, calculate accumulated depreciation using the straight line depreciation method. For example, if your asset costs $1,000, has a useful life of five years, and a salvage value of $100.

Step 1: Calculate the annual depreciation expense

Using the formula above, this example gives you:

($1000 – $100) ÷ 5 = $180 per year

Step 2: Track accumulated depreciation each year

Create a depreciation schedule to track how accumulated depreciation increases each year by the depreciation expense. In this example:

- Year 1: 1 x $180 = $180

- Year 2: 2 x $180 = $360

- Year 3: 3 x $180 = $540

- Year 4: 4 x $180 = $720

- Year 5: 5 x $180 = $900

Step 3: Calculate the asset's book value at a point in time

Use the formula:

Book value = initial cost – accumulated depreciation

In our example, after 3 years, the asset's book value is:

$1000 – $540 = $460

Other depreciation methods

While the straight-line method is popular for its simplicity, other methods might suit your business better, especially for assets that lose value faster in their early years. Accounting standards require you to use a depreciation method that is not based on revenue generated by the asset.

Declining balance method

This method applies a constant depreciation rate to the asset's book value each year. It results in higher depreciation expenses in the early years and lower expenses later on. It's useful for assets that are more productive when they're new.

Double-declining balance method

A more accelerated version of the declining balance method, this approach doubles the straight-line depreciation rate. It significantly speeds up depreciation in the first few years, which can be beneficial for technology or equipment that quickly becomes outdated.

Simplify your accounting with Xero

Managing depreciation, adjusting entries, and calculating accumulated depreciation quickly gets complicated – especially as your business grows.

Xero simplifies these tasks by streamlining your accounting processes and helping you manage and track your assets. For instance, you can create detailed depreciation schedules that give you a clear view of fixed asset values in Xero and improve the accuracy of your financial reporting.

Learn how Xero supports your business

FAQs on accumulated depreciation

Find answers to common questions about accumulated depreciation below.

How does accumulated depreciation affect cash flow?

Accumulated depreciation doesn’t directly affect cash flow because it’s a non-cash expense – no money actually leaves your business.

However, it improves your cash position indirectly:

- Depreciation expenses reduce your taxable income

- Lower taxable income means lower tax bills

- Lower taxes mean more cash stays in your business

What happens to an asset's accumulated depreciation when you sell it?

An asset's accumulated depreciation is removed from the balance sheet when you sell it. According to accounting standards, depreciation stops at the earlier of the date the asset is classified as held for sale or the date it is derecognised from the books.

The asset's book value at the time of disposal (asset cost – accumulated depreciation) is compared with the sale price to determine a net gain or loss.

Do I record accumulated depreciation as a debit or a credit?

Record accumulated depreciation as a credit on the balance sheet because it's classed as a contra asset – an account type that reduces the value of an asset.

Since assets typically have debit balances on the balance sheet, accumulated depreciation is credited against the depreciating asset to reflect its falling value over time. This lowers the asset's book value without affecting cash flow.

Is accumulated depreciation a current liability?

No – accumulated depreciation is not a current liability. It’s recorded on the balance sheet as a contra asset – an account type that reduces the value of an asset.

Current liabilities are short-term debts due within 12 months, whereas accumulated depreciation lowers the book value of an asset over time – it isn’t an amount owed that you have to repay.

Learn more about current and non-current liabilities.

Disclaimer

Xero does not provide accounting, tax, business or legal advice. This guide has been provided for information purposes only. You should consult your own professional advisors for advice directly relating to your business or before taking action in relation to any of the content provided.

Start using Xero for free

Access Xero features for 30 days, then decide which plan best suits your business.