What are liabilities?

Liabilities (definition)

Liabilities are what a business owes. It could be money, goods, or services. They are the opposite of assets, which are what a business owns.

Businesses regularly owe money, goods, or services to another entity. Examples of liabilities are bank loans, overdrafts, outstanding credit card balances, money owed to suppliers, interest payable, rent, wages and taxes owed, and pre-sold goods and services. In all cases, the business is indebted and that debt is recorded as a liability. Liabilities are usually split into current and non-current.

The liabilities of a plumber might include:

- a loan for a vehicle

- unpaid invoices for business supplies

- wages owed

- GST owed

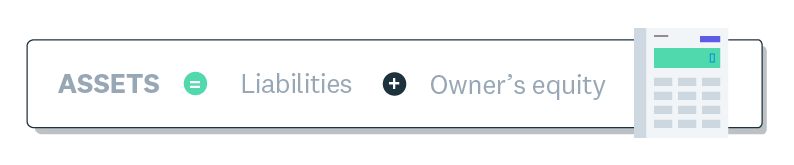

Liabilities decrease a business’s value and equity. They are on one side of the accounting equation, together with owner’s equity, and should equal the assets on the other side on the balance sheet. Keeping liabilities low helps preserve the book value of the business.

The accounting equation

See related terms

Handy resources

Advisor directory

You can search for experts in our advisor directory

Xero Small Business Guides

Discover resources to help you do better business

Financial reporting

Keep track of your performance with accounting reports

Disclaimer

This glossary is for small business owners. The definitions are written with their requirements in mind. More detailed definitions can be found in accounting textbooks or from an accounting professional. Xero does not provide accounting, tax, business or legal advice.