Make CIS scheme deductions and submit returns

Use Xero accounting software to manage CIS scheme deductions, submit returns and simplify compliance.

Automate CIS calculations

Xero automatically calculates the right amount of CIS deductions on your invoices from your mobile, and bills and invoices from your desktop, the moment you create them. You can get back to business.

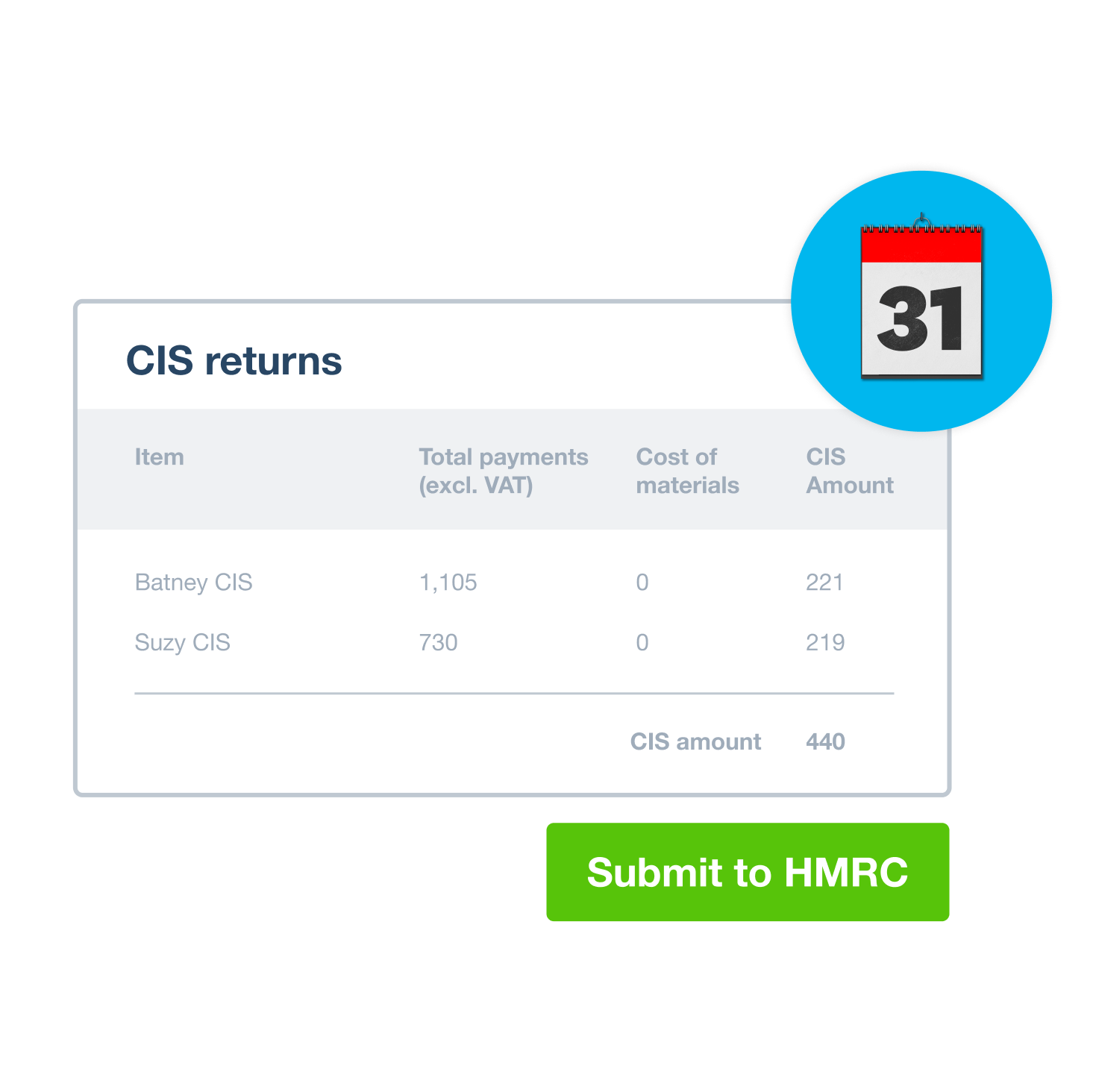

File monthly CIS returns

Submit CIS scheme returns with a click in Xero’s CIS accounting software. File your monthly return directly from Xero to HMRC. All the data is taken from one convenient, accurate and secure source.

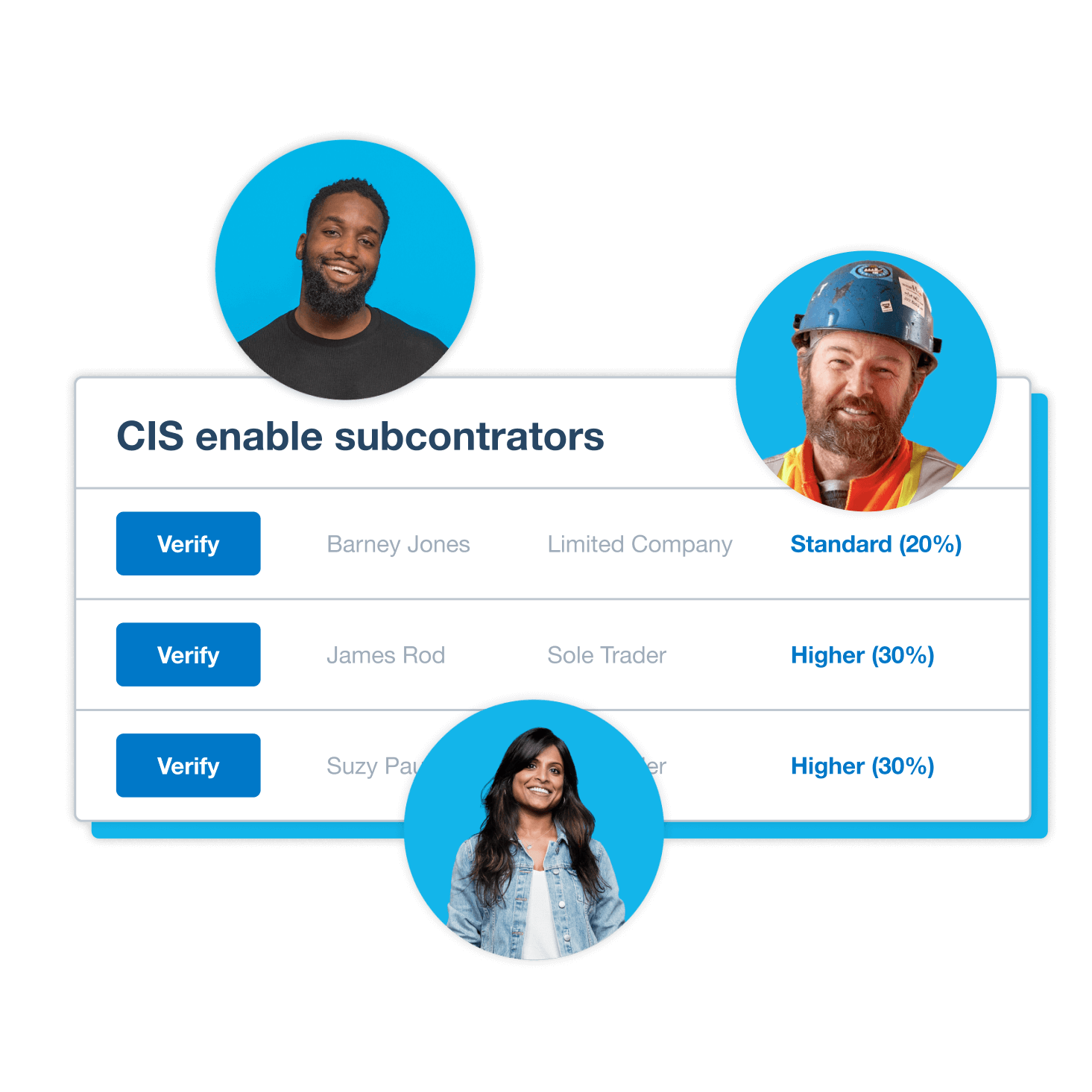

Verify subcontractors

Use the advanced functionality of the CIS add-on to check and verify your subcontractors online. Add or import them as contacts, then confirm their SVN and their CIS scheme deduction rate with HMRC.

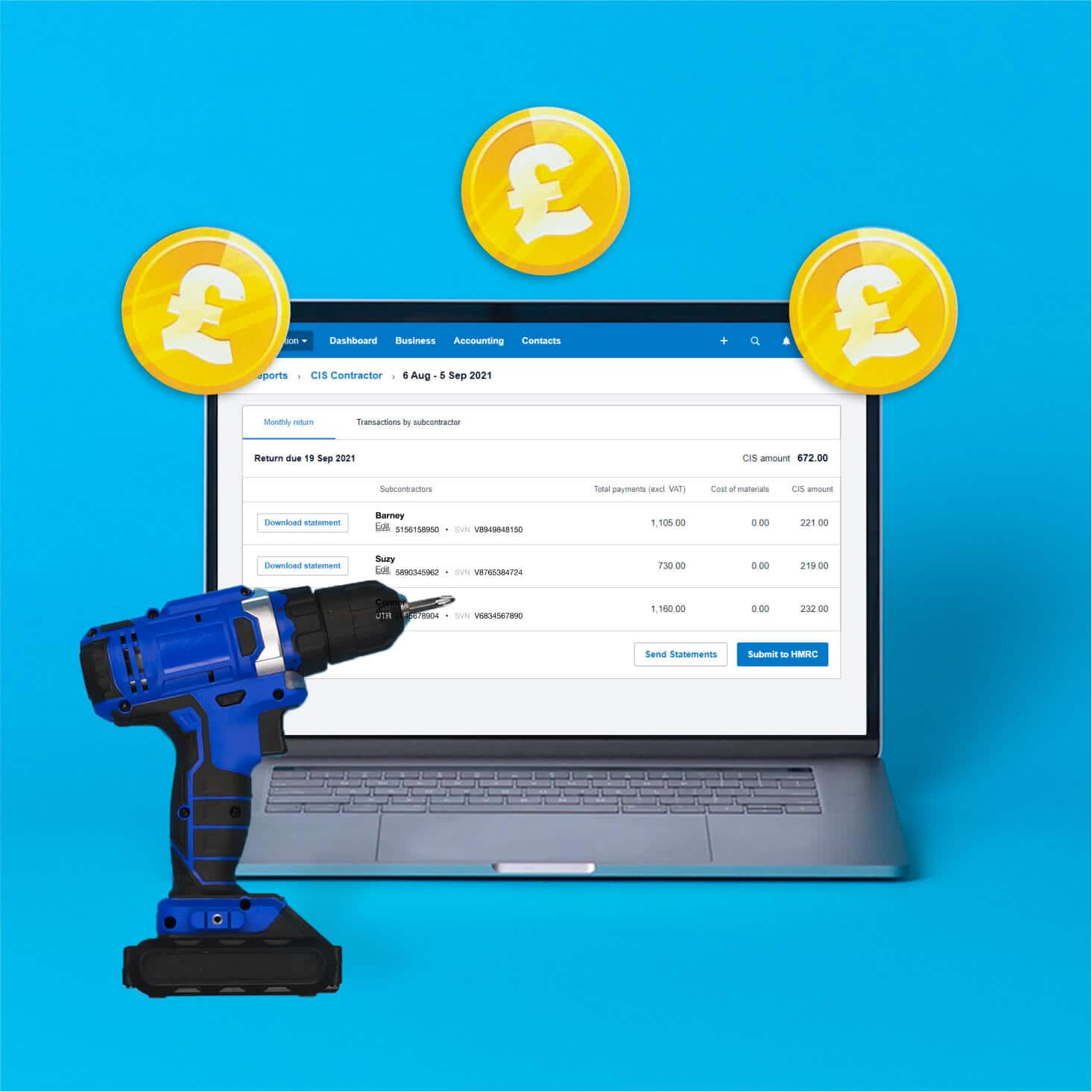

Send statements directly

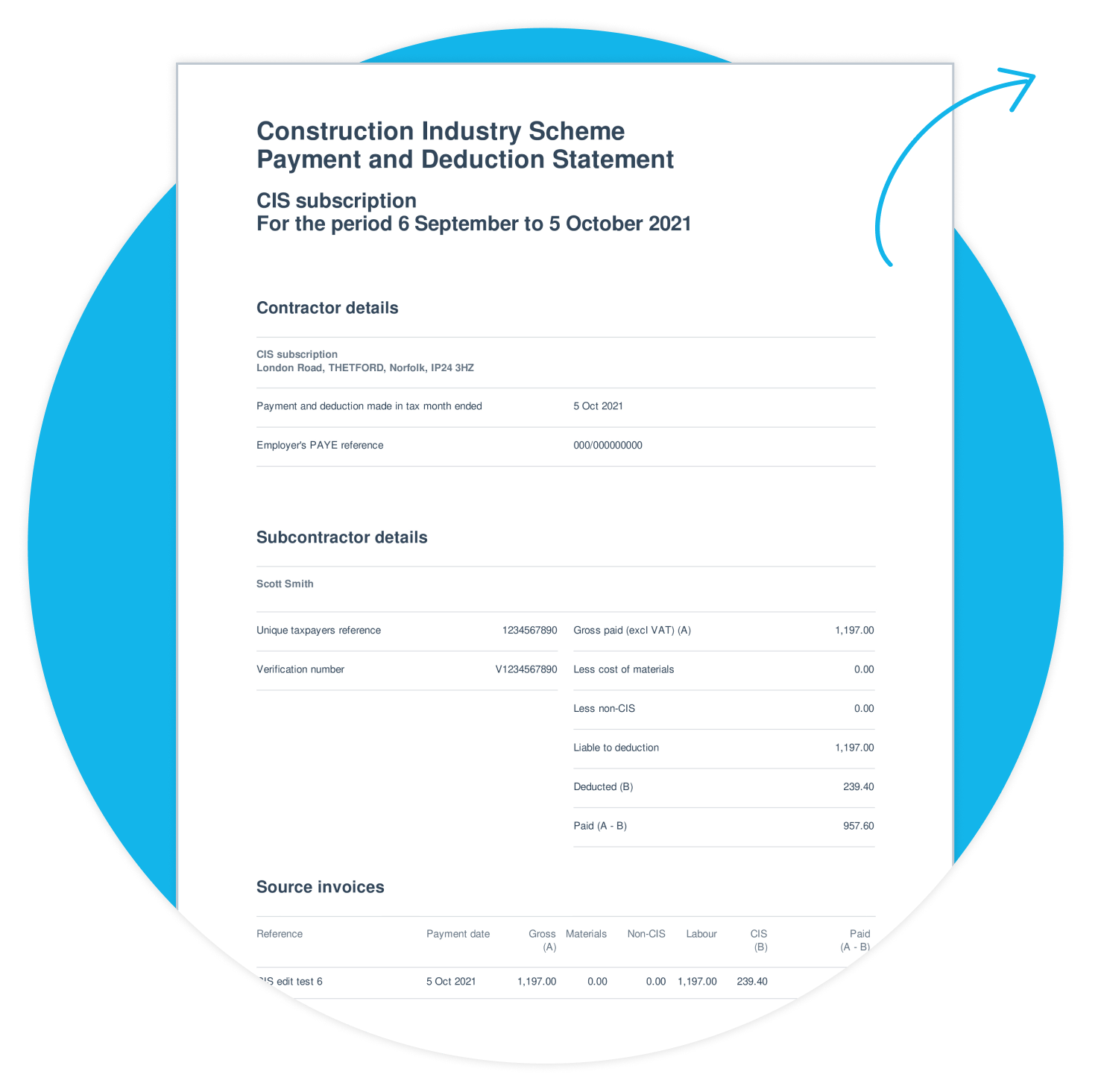

Email construction industry scheme payment and deduction statements to subcontractors directly from the CIS accounting software in Xero. Send statements to your subcontractors in bulk to save time.

More about submitting CIS returns

The Construction Industry Scheme (CIS) requires tax to be deducted at source when payments are made by a contractor or subcontractor.

Learn more about the Construction Industry Scheme (CIS)The Construction Industry Scheme (CIS) requires tax to be deducted at source when payments are made by a contractor or subcontractor.

Learn more about the Construction Industry Scheme (CIS)When you enable CIS as a subcontractor, Xero uses CIS account codes to calculate and apply deductions to your transactions. You then create invoices as usual. Check what deductions have been made by contractors on your behalf in the Suffered CIS report.

Find out about the Construction Industry Scheme in XeroWhen you enable CIS as a subcontractor, Xero uses CIS account codes to calculate and apply deductions to your transactions. You then create invoices as usual. Check what deductions have been made by contractors on your behalf in the Suffered CIS report.

Find out about the Construction Industry Scheme in XeroXero can help take care of your CIS scheme obligations to HMRC and subcontractors. Use Xero to deduct the right CIS amount from subcontrator payments, download or bulk email statements to subcontractors, and export or file CIS returns direct to HMRC.

Find out about the Construction Industry Scheme in XeroXero can help take care of your CIS scheme obligations to HMRC and subcontractors. Use Xero to deduct the right CIS amount from subcontrator payments, download or bulk email statements to subcontractors, and export or file CIS returns direct to HMRC.

Find out about the Construction Industry Scheme in XeroSet up CIS for your organization in Xero and you can access the CIS account codes for use in transactions. Use Xero’s accounting software to generate invoices, bills, reports, payment and deduction statements, and returns showing CIS deductions.

See how to set up CIS in XeroSet up CIS for your organization in Xero and you can access the CIS account codes for use in transactions. Use Xero’s accounting software to generate invoices, bills, reports, payment and deduction statements, and returns showing CIS deductions.

See how to set up CIS in XeroSubscribe to the CIS contractor add-on to file monthly CIS returns direct to HMRC. Check details of transactions in your report before you submit it. Verify subcontractors with HMRC and bulk email payment and deduction statements to subcontractors.

See how to file a monthly CIS return from XeroSubscribe to the CIS contractor add-on to file monthly CIS returns direct to HMRC. Check details of transactions in your report before you submit it. Verify subcontractors with HMRC and bulk email payment and deduction statements to subcontractors.

See how to file a monthly CIS return from XeroXero’s Ignite, Grow, Comprehensive and Ultimate plans let you calculate CIS deductions, run reports and export returns. Contractors can add the CIS add-on to their subscription to file CIS returns from Xero, verify subcontractors, and bulk email statements to them.

See the UK pricing plansXero’s Ignite, Grow, Comprehensive and Ultimate plans let you calculate CIS deductions, run reports and export returns. Contractors can add the CIS add-on to their subscription to file CIS returns from Xero, verify subcontractors, and bulk email statements to them.

See the UK pricing plans

Start using Xero for free

Access Xero features for 30 days, then decide which plan best suits your business.