Pay bills on time using Xero accounts payable software

Automate bill entry and simplify your payments with Xero accounts payable software - helping save you time and giving you a clearer view of your UK business's cash flow.

All your bills, in one place

Automate bill entry, streamline approvals and never miss a due date, helping save you time and giving you a clearer view of your cash flow.

Capture bills effortlessly

Xero has smarter tools to automate bill entry for fast, accurate, paperless processing.

Take control of your bills

Assign roles, flag duplicates, and track due dates to help reduce errors, stay organised, and on top of payments.

Simplify payments

Pay multiple bills at once and automate reconciliation ensuring records are always up-to-date.

92% of customers agree Xero helps their business run more efficiently

*Source: survey conducted by Xero of 858 small businesses in the UK using Xero, May 2024

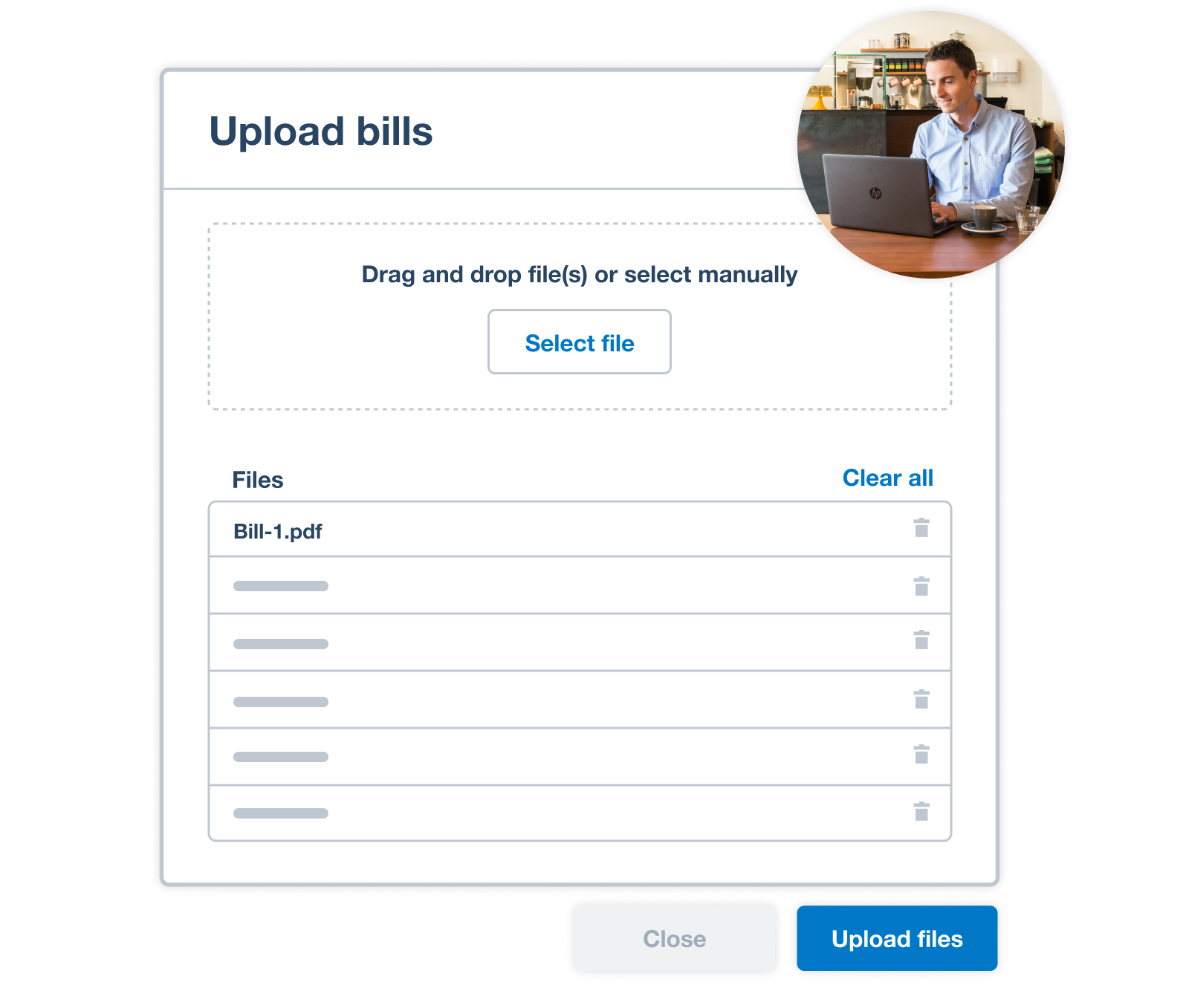

Capture bills effortlessly, your way

Help save time and reduce the risk of manual errors using Xero accounts payable software for your UK small business.

- Automate bill entry by uploading files directly to Xero or forwarding bills from your email. Xero's AI extracts the key details to create draft bills ready for approval

- Use Hubdoc to photograph and upload your bills into Xero for paperless record-keeping

Take control of your bills

Assign roles and permissions to control who can create and approve bills, improving security and accuracy.

- Detect and flag duplicate bills automatically to minimise fraud and payment errors

- Organise bills by status, add planned payment dates so your bills get paid on time, and set up repeating bills so you don't have to create them manually each time

- Maintain strong relationships with your suppliers and never miss a payment

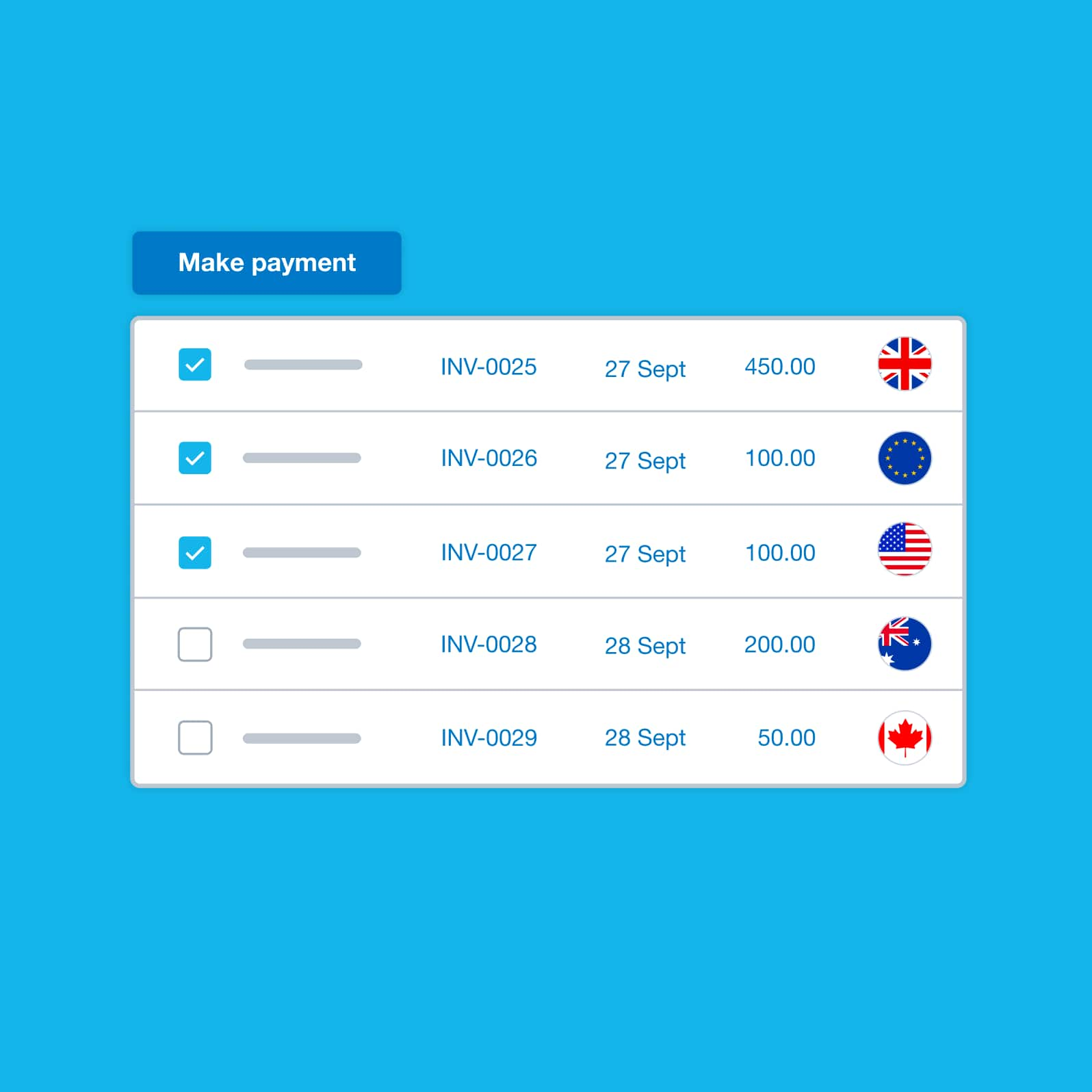

Simplify payments

Help save time by combining seamless, secure bill payments and your accounting, all in one place.

- Pay multiple bills at once with just a few clicks or schedule GBP payments for later.

- Send money 180+ countries including Europe (EUR), America (USD) and Australia (AUD) at competitive rates and avoid hidden fees.

- Delegate payment preparation with confidence while maintaining control through final review and authorisation.

- Reduce the risk of fraud with multi-factor authentication and if enabled by your bank, verify supplier details with 'Confirmation of Payee.'

Accounting software for your UK small business

Run your business accounting online with Xero. Easy-to-use accounting software, designed for your small business.

- Everything in one place

- Connect to your bank

- Collaborate in real time

- Customise to suit your needs

Plans to suit your business

All pricing plans cover the accounting essentials, with room to grow.

Simple

A new plan with features designed for sole traders and landlords, supporting MTD for Income Tax

Simple

Usually £7

Now £0.70

GBP per month

Save £37.80 over 6 months

- Send quotes and 10 invoices†

- MTD for Income Tax Ready

- Reconcile bank transactions

- Capture bills and receipts with Hubdoc

- Short-term cash flow and business snapshot

- Automate CIS calculations and reports

Xero is fantastic. The last software we had was so expensive and hard to use

Colleen from Evansdale Cheese

Benefits of accounts payable software for small businesses

Accounts payable software simplifies managing business finances. Automated tools and improved workflows help save time and reduce errors.

Effortless bill capture

Automate bill entry by uploading files, forwarding bills from email, or use Hubdoc to snap and go.

Enhanced control

Assign user roles, flag duplicates, and organise bills by status to streamline your workflow.

Simplify payments

Pay multiple bills at once, track your payment status and automate reconciliation in Xero.

FAQs on paying bills

Setting up online bill payments is free and takes approx. 1-2 minutes. Allow data sharing permissions with our trusted payments partner, Crezco, to enable open banking services, and connect your bank account to get started. Then, if eligible you can also submit your business details for verification by Crezco to enable international payments.

See how to set up online bill paymentsSetting up online bill payments is free and takes approx. 1-2 minutes. Allow data sharing permissions with our trusted payments partner, Crezco, to enable open banking services, and connect your bank account to get started. Then, if eligible you can also submit your business details for verification by Crezco to enable international payments.

See how to set up online bill paymentsSure, you can make copies of old bills in Xero to send as new bills. And you can set up repeating bills for specific suppliers – for as long as you need. Just add or amend the details as necessary.

See how to repeat and replicate billsSure, you can make copies of old bills in Xero to send as new bills. And you can set up repeating bills for specific suppliers – for as long as you need. Just add or amend the details as necessary.

See how to repeat and replicate billsAssign billable expenses to your suppliers when you enter a bill, a spend money transaction, or an invoice with Xero billing software. Choose the customer you want to assign the cost to, and get paid what you’re owed.

See how to add billable expensesAssign billable expenses to your suppliers when you enter a bill, a spend money transaction, or an invoice with Xero billing software. Choose the customer you want to assign the cost to, and get paid what you’re owed.

See how to add billable expensesOf course. Xero account payables software shows you all bills, credit notes, and overpayments owed with the Aged Payables Detail report. For an up-to-date view, run the report after entering purchases and reconciling your bank transactions.

See how to run the aged payables detail reportOf course. Xero account payables software shows you all bills, credit notes, and overpayments owed with the Aged Payables Detail report. For an up-to-date view, run the report after entering purchases and reconciling your bank transactions.

See how to run the aged payables detail reportWhen it comes to paying bills, software like Xero lets you easily track and manage all your bills. Xero puts all the information at your fingertips and helps you pay suppliers at the right time.

When it comes to paying bills, software like Xero lets you easily track and manage all your bills. Xero puts all the information at your fingertips and helps you pay suppliers at the right time.

Start using Xero for free

Access Xero features for 30 days, then decide which plan best suits your business.

See how to manage bills efficiently

A video about bills! It’s better than it sounds.