Profit margin: What it means and how to improve yours

Profit margin shows how much money your business keeps from each sale. Learn what it is and how to calculate it.

Written by Jotika Teli—Certified Public Accountant with 24 years of experience. Read Jotika's full bio

Published Tuesday 18 November 2025

Table of contents

Key takeaways

• Calculate your profit margin using the formula (Profit ÷ Revenue) × 100 to measure how efficiently your business converts sales into profit, and track all three types—gross, operating, and net—to get a complete picture of your financial health.

• Compare your profit margins against industry benchmarks and your own historical performance to identify whether your margins are competitive and spot trends that indicate improving or declining financial health.

• Improve your profit margins by focusing on three core strategies: controlling operational costs through expense reviews, increasing efficiency via staff training and streamlined operations, and optimising pricing with dynamic pricing or premium packages.

• Use profit margin analysis to make strategic business decisions about pricing, resource allocation, and investment priorities by directing efforts toward your highest-margin products and services.

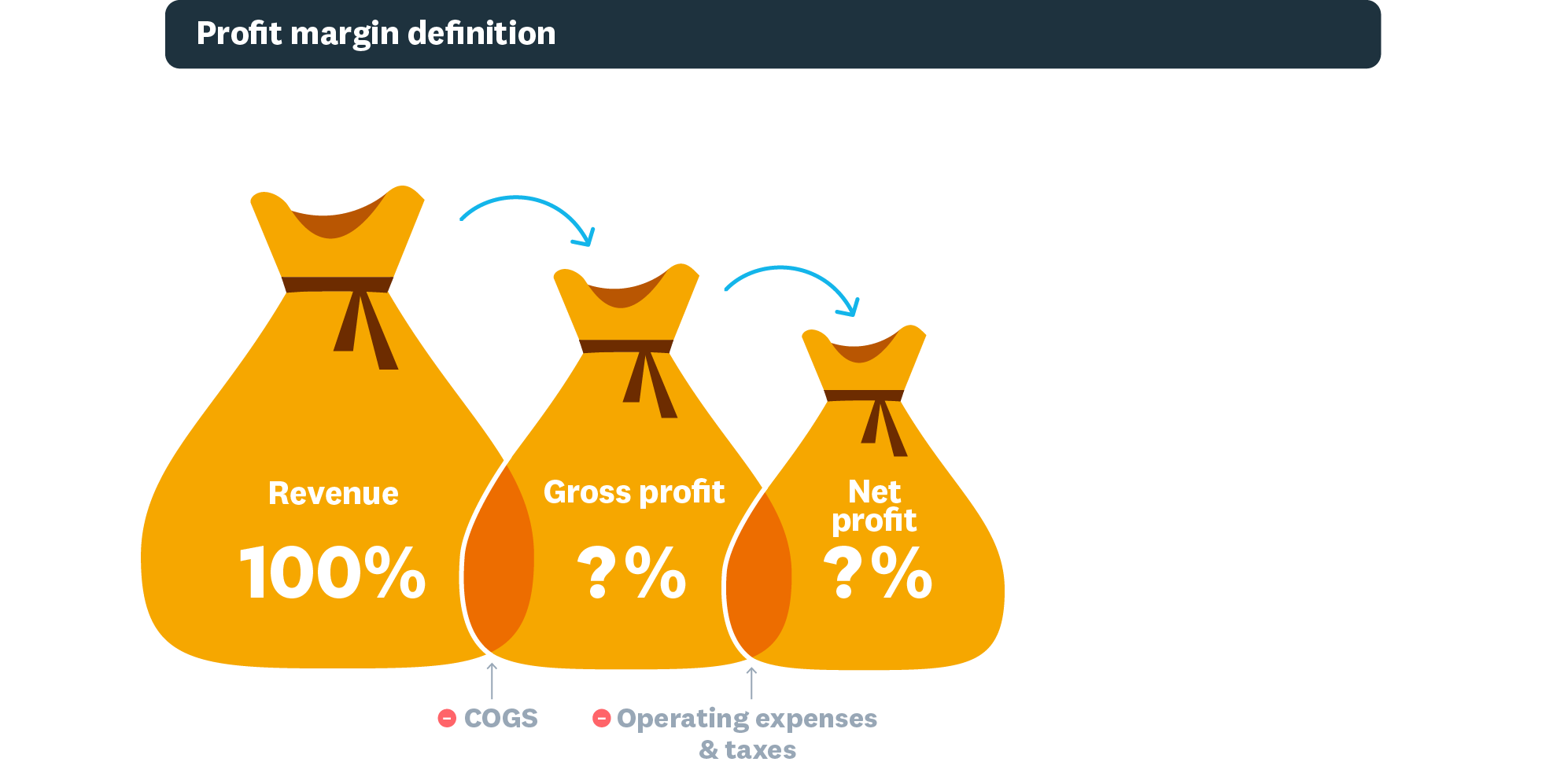

What is a profit margin?

Profit margin is the percentage of revenue remaining after all business expenses are paid. This metric tells you how much profit your business generates for every dollar of sales.

A strong profit margin means you’re in good financial health. It shows you earn enough to cover your costs and make a profit. Use your profit margin to spot what’s working well and where you could cut costs.

Profit margins vs net profit

Net profit vs profit margin – here’s the key difference:

- Net profit: The actual dollar amount left after paying all expenses

- Profit margin: The percentage of revenue that becomes profit

For example, if you earn $100,000 revenue and have $20,000 net profit, your profit margin is 20%. The margin percentage helps you compare performance across different time periods and against competitors.

How profit margins work

Think of profit margin as a measure of your efficiency. It shows how well you turn revenue into profit you keep.

When you sell a product or service, the money you receive is revenue. But you had to spend money to make that sale. Profit margin tells you what percentage of the revenue is left after you've paid your expenses. A higher margin means you're keeping more of each dollar you make.

Types of profit margins

Three types of profit margins measure different aspects of your profitability:

Gross profit margin shows revenue remaining after paying for goods or services sold (cost of goods sold). You can use this margin to set your pricing strategies and compare your performance over time.

Operating profit margin reveals profit after paying production costs like wages and materials, but before taxes and interest. This margin shows how profitable your core business operations are. Investors and lenders look at this margin to see how viable your business is.

Net profit margin measures income left after paying all costs, taxes, and expenses. In New Zealand, the standard company tax rate is 28 percent, so you need to include this in your final calculation.

Here's more info about net profit margin

Why do profit margins matter?

Profit margins reveal your financial health by showing how efficiently you turn sales into profit.

Use profit margins to make key business decisions:

- Pricing strategy: Set prices that ensure healthy margins

- Cost control: Identify where expenses are eating into profits

- Resource allocation: Direct investment toward high-margin activities

- Funding applications: Banks and investors evaluate margins when making lending decisions

What is a good profit margin?

A good profit margin depends on your industry and business model. There’s no universal 'good' percentage.

Industry examples:

- Low-end retail: High sales volume, low margins (2-6%)

- Luxury retail: Lower volume, high margins (50%+)

Margin hierarchy: Your gross profit margin is always higher than your operating margin, which is higher than your net margin. Focus on your operating and net margins for the clearest picture of your business health.

Benefits of high profit margins for growth

High profit margins typically mean a business:

- Is financially healthy, making it easier to attract investment

- Has room to reinvest in its own growth

- Has more space to innovate – for example, by changing pricing strategies to find a competitive edge

Look closely at your performance to find trends and opportunities. Benchmark yourself against your competitors to see if you’re in a strong position.

Do high profit margins guarantee growth?

While healthy margins support growth, they don’t always increase as your business grows. If your costs rise quickly, your margins may shrink. Focus on sustainable growth and keep your profit margins in mind when making business decisions.

Factors affecting profit margins

Profit margins can change due to market conditions or your business strategy. For example, retail and hospitality often have higher overheads, so their profit margins are usually lower than those in business consulting. For example, challenges in the retail sector can impact property values, with the Reserve Bank of New Zealand noting the capital value of Auckland prime retail property declined 16% over 2022.

Economic fluctuations can greatly affect profit margins, as inflation and high interest rates increase a business's costs. This is particularly relevant for businesses with debt, as research from the Reserve Bank of New Zealand shows that around 80% of bank lending to businesses is on a floating rate or reprices within three months.

If you have borrowed to fund your business, higher interest rates can reduce your profit margins. For example, the Reserve Bank of New Zealand reports that effective interest rates on business lending have increased by 4 percentage points since mid-2021.

Your location affects the rent and taxes your business pays. Costs like these will need to be taken into account when assessing profit margins and pricing strategies.

How to calculate profit margins

Profit margin formula: (Profit ÷ Revenue) × 100 = profit margin %

This universal formula applies to all profit margin types. The percentage format lets you easily compare performance across different time periods, business sizes, and competitors.

Gross profit margin calculation

Let's say your business makes $20,000 by cleaning offices. It costs you $8,000 to provide those services, so your gross profit is $12,000.

Therefore:

$12,000 / $20,000 x 100 = 60% gross profit margin

You can use the gross profit margin calculator to work this out.

Net profit margin calculation

You also pay $4,000 in taxes, so your net profit is $8,000.

Therefore:

$8,000 / $20,000 x 100 = 40% net profit margin

Try our net profit margin calculator.

Operating profit margin calculation

You spend another $3,000 on operating expenses, so your operating profit is $5,000.

Therefore:

$5,000 / $20,000 x 100 = 25% operating profit margin

How to increase your profit margins

Three strategies boost profit margins: cost control, operational efficiency, and pricing optimisation.

Focus your improvement efforts on these core areas for maximum impact on profitability.

Control your costs

Reduce your operational expenses by reviewing subscriptions, removing items you no longer need, and managing labour costs.

Make your operations more efficient

Increase your operational efficiency by delivering great customer service, encouraging your team to innovate, and investing in staff training so everyone performs at their best.

Adjust your pricing

A strong pricing strategy that fits your industry and customers helps you maximise your revenue and boost your margins. Consider:

- Dynamic pricing where you adjust prices to fit demand and seasonal changes

- Premium packages and bundles can increase revenue.

Learn from high-profit-margin businesses

Some industries tend to have higher profit margins. You can increase your margins by building a strong value proposition, running your operations efficiently, and building customer loyalty.

Industries with high profit margins

Luxury goods, software, and technology businesses often have high profit margins. Online businesses can also achieve higher net profit margins than bricks-and-mortar stores.

Tips for maintaining high profit margins

Even if you are not in a high-profit sector or cannot change your business model, you can still raise your profit margins by following these practices used by high-profit businesses.

- Communicate a strong value proposition to your customers: Customers are more likely to trust a brand if they understand why they should buy from you instead of your competitor.

- Run an efficient operation: Streamlining your operations by efficiently utilising your resources and reducing unnecessary costs improves productivity and boosts profit margins.

- Nurture loyal customers: A strong product, excellent customer relations, and clever marketing entices customers to return. Having a reliable client base can create a steadier revenue stream helping to maintain strong profit margins.

Analyse your profit margins for better business decisions

Profit margin analysis drives better business decisions:

Pricing decisions: Identify which products or services generate the highest margins. Use this data to adjust prices and focus on profitable offerings.

Budget planning: Allocate resources toward high-margin activities that deliver better returns on investment.

Investment strategy: Direct growth investments toward your most profitable business areas.

What profit margin trends reveal

Profit margin trends are patterns in a company's profit margins over time. They can indicate a business's financial health and operational efficiency.

For instance, a steady increase in profit margins suggests a business's financial health is improving, while an ongoing decline indicates the opposite.

There is no single number that is a 'good' profit margin. Comparing your profit margin trends with your competitors can give you valuable insights into your performance in the market.

Track your margins with the right tools

You can track your profit margins easily with accounting software. This gives you a real-time view of your financial health, so you can spot trends and make smarter decisions quickly.

With the right tools, you can automate calculations, generate reports quickly, and see where your money is going. This helps you focus on running your business, not just your books. Start a free trial of Xero to see how it works for you.

Frequently asked questions about profit margins

Heading: "FAQs on profit margins" Introduction: "Find answers to common questions about profit margins below."

What does a 5% profit margin mean for my business?

A 5% profit margin means that for every dollar of revenue you earn, you keep five cents as profit after all expenses are paid.

How do I know if my profit margin is too low?

A good way to tell is by comparing your margin to your industry's average and your own past performance. If you're consistently below those benchmarks, it might be time to review your pricing or costs.

What's the difference between profit margin and markup?

Profit margin is your profit as a percentage of your revenue (selling price). Markup is your profit as a percentage of your cost. These are two different ways to look at your profitability.

Do profit margins vary by season?

Yes, for many businesses they do. Seasonal changes in customer demand, supply costs, or operating expenses can all affect your profit margins throughout the year.

Should I focus on gross or net profit margin?

It's best to track both. Gross profit margin shows how profitable your products or services are on their own. Net profit margin gives you the bigger picture of your overall financial health after every expense is included.

Disclaimer

Xero does not provide accounting, tax, business or legal advice. This guide has been provided for information purposes only. You should consult your own professional advisors for advice directly relating to your business or before taking action in relation to any of the content provided.