Current Ratio: Formula, Example and How to Use It

Learn how the current ratio checks short term health, helps you spot risks, and manage cash with confidence.

Written by Jotika Teli—Certified Public Accountant with 24 years of experience. Read Jotika's full bio

Published Monday 22 December 2025

Table of contents

Key takeaways

- Calculate your current ratio monthly by dividing current assets by current liabilities to monitor your business's ability to pay short-term debts and identify financial trends over time.

- Maintain a current ratio above 1.0 to ensure you can cover short-term obligations, with an ideal range of 1.5-2.0 providing a healthy financial buffer without tying up excessive cash.

- Use your current ratio strategically to guide business decisions: invest in growth opportunities when your ratio is high (above 2.0) and focus on improving cash flow when it's low (below 1.0).

- Combine current ratio analysis with other financial metrics like quick ratio and cash flow forecasts to get a complete picture of your liquidity, as the current ratio alone provides only a snapshot view.

Current ratio definition

Current ratio is a financial metric that measures your business's ability to pay short-term debts with current assets. This liquidity ratio shows whether you can cover bills and loan repayments due within the next year. You might also see it called the working capital ratio.

Current ratio gives you a wider view of how easily you can pay your short-term bills than other ratios. Unlike the quick ratio, it includes all current assets – even those that take longer to convert to cash, like inventory.

Current ratio formula

Current ratio calculation requires two key numbers from your balance sheet:

- Current assets: Cash, accounts receivable, inventory, and other assets you expect to convert into cash within one year

- Current liabilities: Bills, short-term loans, and other debts you must pay within one year

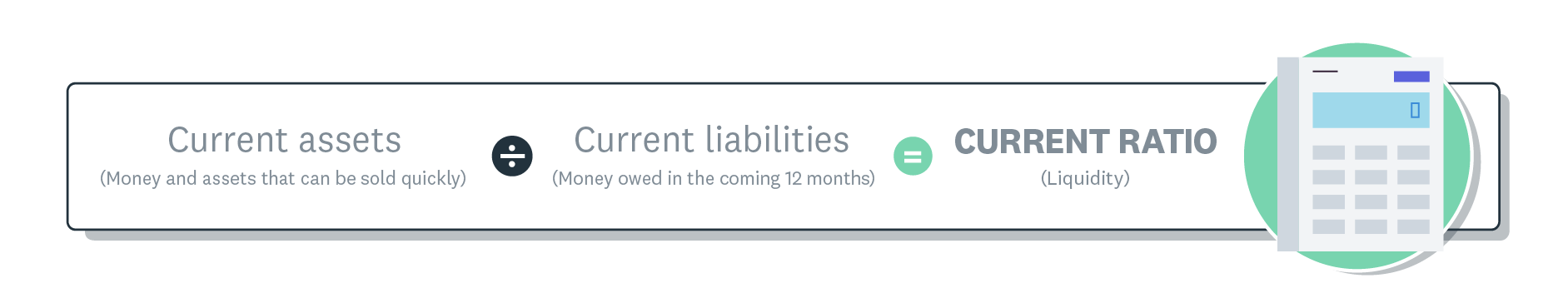

Here's what the current ratio formula looks like:

Current ratio liquidity formula.

Example of a current ratio calculation

Example scenario: A small construction business needs to assess its ability to cover upcoming loan repayments and material costs.

Given information:

- Current assets: $250,000

- Current liabilities: $175,000

Calculation: $250,000 ÷ $175,000 = 1.43

Result interpretation: The current ratio of 1.43 means the business can cover its short-term debts. For every $1 of liabilities, the company has $1.43 in assets available.

This surplus provides strategic options:

- Invest in business growth opportunities

- Maintain cash reserves for periods when assets may be lower

How to interpret your current ratio

The ideal range for your current ratio is 1.5-2.0, which indicates a healthy financial buffer.

Current ratio benchmarks:

- 1.0 or higher: Indicates healthy liquidity and ability to cover short-term debts

- Consistently very high (above 2.5): May signal excess cash that could be invested in growth

- Below 1.0: Can be workable for a time if you are growing and investing, but you should plan to lift your ratio over the longer term

Key principle: Avoid maintaining a ratio permanently below 1.0, as this indicates potential cash flow challenges.

Monitoring best practices:

- Measure consistently: Calculate your current ratio at the same time each month for accurate trend analysis

- Track patterns: Look for long-term trends rather than focusing on single-month variations

- Use comprehensive analysis: Combine current ratio with other profitability ratios and cash flow forecasts for complete financial assessment

Current ratio vs quick ratio and other liquidity ratios

Comparison of different liquidity ratios:

- Current ratio: Includes all current assets (most comprehensive view)

- Quick ratio: Excludes inventory and includes only assets convertible within 90 days (more conservative)

- Cash ratio: Uses only cash and cash equivalents (most stringent measure)

Each ratio shows something slightly different about how easily you can pay your bills over different time periods. Learn more about these metrics in our guide to liquidity ratios.

Current ratio in relation to working capital and cash flow

Current ratio connects to other key financial metrics that measure your business's spending power and financial health:

Related financial measures:

- Working capital: Current assets minus current liabilities (shows money available after covering short-term debts)

- Cash flow: Net money moving in and out of your business (measures overall cash availability)

- Free cash flow: Operating cash flow minus capital expenditure (indicates profitability after essential investments)

What are the limitations of using the current ratio?

The current ratio is only a snapshot. It shows just one point-in-time view of your financial position.

The ratio treats all current assets equally, despite varying liquidity speeds:

- Cash: Available immediately

- Inventory: May take months to convert to cash through sales

Additional limitations of using the current ratio:

- Timing mismatches: Assumes all liabilities are due simultaneously, ignoring actual payment schedules

- Daily fluctuations: It does not show day-to-day changes in your cash flow

- Seasonal variations: It can give a misleading view for businesses with strong seasonal patterns, so compare it with results from the same season each year

Using current ratio to make better business decisions

Your current ratio does more than show where you are today; it helps you decide what to do next. When you understand your number, you can plan how to use your cash and assets to reach your goals:

- A high ratio (above 2.0) suggests you have strong financial footing. This could be the right time to invest in growth, such as buying new equipment, hiring another team member, or paying down long-term debt.

- A low ratio (below 1.0) is a signal to be cautious with cash. You might focus on getting invoices paid faster, negotiating longer payment terms with your suppliers, or holding off on large, non-essential purchases.

Tracking your current ratio helps you spot opportunities and address challenges before they become problems, giving you more control over your business's future.

Monitor your finances in real-time with Xero

Xero makes it easy for you to track your current ratio by automating the calculations and giving you clear financial insights. Key benefits include:

- Instant visibility: View cash flow and current ratio at a glance

- Automated tracking: Monitor financial performance indicators over time

- Smart forecasting: Create projections using built-in reporting features

- Better decisions: Access real-time data for informed financial planning

FAQs on current ratio

Here are some common questions small business owners ask about the current ratio.

What is considered a good current ratio?

A current ratio between 1.5 and 2.0 is often considered healthy for many businesses, as it shows you can comfortably cover your short-term bills. However, the ideal ratio can vary depending on your industry.

Is a current ratio of 1.0 acceptable for small businesses?

A ratio of 1.0 means your current assets exactly match your current liabilities. While it's acceptable, it leaves no room for unexpected expenses. It's a good idea to aim for a ratio above 1.0 to create a financial buffer.

What does a current ratio of 2.5 mean for my business?

A ratio of 2.5 means you have $2.50 in current assets for every $1.00 of current liabilities. This indicates strong financial health, but it could also mean you have idle cash or excess inventory that could be invested back into the business for growth.

How often should I calculate my current ratio?

Aim to calculate your current ratio every month. It helps you track trends over time and understand how your business decisions are affecting your liquidity.

Can a current ratio be too high?

Yes. A consistently high ratio might suggest that you're not using your assets efficiently. You could have too much cash sitting in the bank or slow-moving inventory, which could be better used to grow your business.

Disclaimer

Xero does not provide accounting, tax, business or legal advice. This guide has been provided for information purposes only. You should consult your own professional advisors for advice directly relating to your business or before taking action in relation to any of the content provided.

Get one month free

Purchase any Xero plan, and we will give you the first month free.