Cash Flow Forecast: Steps & Tips For Small Businesses

Learn how a cash flow forecast helps your small business plan, pay bills on time, and grow with confidence.

Written by Kari Brummond—Content Writer, Accountant, IRS Enrolled Agent. Read Kari's full bio

Published Friday 5 December 2025

Table of contents

Key takeaways

• Create monthly cash flow projections that forecast 3-12 months ahead using a rolling forecast method, where you update predictions monthly, remove the completed period, and add a new month to maintain continuous visibility into your financial future.

• Identify potential cash shortages weeks or months in advance by listing all expected cash inflows and outflows with specific dates, then calculating your running cash balance to spot gaps before they become critical problems.

• Use conservative estimates for income and account for seasonal fluctuations in your business when building forecasts, as underestimating sales creates a financial buffer while overestimating can lead to dangerous cash shortfalls.

• Leverage accounting software or spreadsheet templates to automate cash flow projections rather than starting from scratch, as these tools can generate forecasts quickly using your existing financial data and save significant time.

What is a cash flow projection?

Cash flow projection is a financial planning method that predicts your business's future cash position by estimating incoming and outgoing money. This forecasting technique helps you see how much cash you'll have at specific future dates. It provides crucial insights into your business's financial health and enables strategic spending decisions.

A cash flow projection is different from a cash flow statement. A statement focuses on past cash flows, a projection aims to predict the future.

Why is a cash flow projection important?

Cash flow projection helps you avoid cash shortages and ensures you can pay both business expenses and yourself on time. This becomes critical when costs are rising and profit margins shrink. Effective cash flow forecasting prevents the stress of scrambling for funds when bills come due.

Benefits of a cash flow projection

Regular cash flow projection transforms how you manage business finances by providing early warning systems for potential problems. Key benefits include:

- Early shortage detection: Identify cash gaps weeks or months ahead

- Strategic planning time: Develop contingency plans before problems hit

- Growth assessment: Evaluate whether you can afford new investments or hires

- Owner payment security: Ensure consistent income for yourself

- Problem identification: Spot fixable issues like slow-paying customers or poor payment terms

What are the key components of a cash flow projection?

Cash flow projections display five essential financial elements:

- Starting balance: Current cash in your business accounts

- Cash inflows: Expected money coming in from sales, loans, or asset sales

- Cash outflows: Projected expenses and payments going out

- Net cash flow: Whether your cash position improved or declined

- Closing balance: Predicted cash amount at the end of the period

Who is responsible for doing a cash flow projection?

A cash flow dashboard shows how cash balances will rise and fall in response to expected transactions.

Lots of small business owners do their own cash flow projections. They can use a spreadsheet or accounting software to do it. But plenty of others rely on a bookkeeper or accountant. They're able to do them quite quickly because they really know their way around small business cash flow.

How to do a cash flow projection

Creating a cash flow projection involves estimating when money will flow in and out of your business, then calculating your resulting cash position over time. This process shows exactly when you'll have cash surpluses or shortages. You can build projections using spreadsheets or specialised software.

Doing a cash flow projection spreadsheet

Follow these steps to create your spreadsheet forecast:

- Step 1: Choose your forecasting period and record your current cash balance

- Step 2: List all expected cash inflows with specific dates (sales receipts, grants, tax refunds, loans)

- Step 3: List all expected cash outflows with dates (regular expenses, annual fees, taxes, repairs)

- Step 4: Calculate your running cash balance by adding inflows and subtracting outflows

- Step 5: Review the results to identify potential cash shortages or surpluses

Doing a cash flow projection with software

A cash flow dashboard shows how cash balances will rise and fall in response to expected transactions.

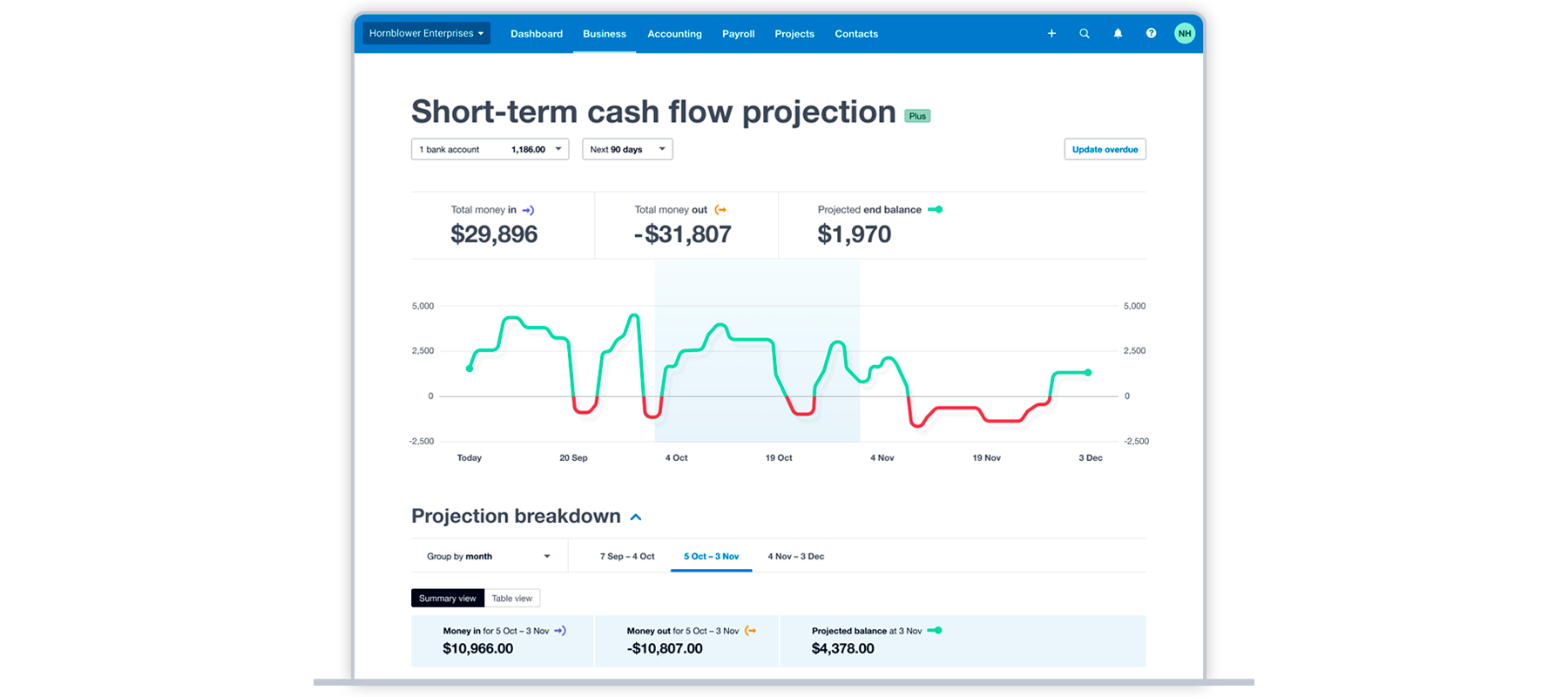

Businesses can also generate a cash flow projection using accounting software. Xero, for example, is designed to track business incomings and outgoings, which means it can create a projection with a few clicks.

Accounting software can also integrate with other apps to provide clear, long-term projections. Popular forecasting apps include Spotlight, Fathom and Calxa.

Alternative methods of cash flow projections

There are other ways to generate cash flow projections from your balance sheet and income statement. These typically provide longer term cash flow guidance rather than day–to–day or week–to–week projections. You need some accounting knowledge to prepare one of these projections, so ask an adviser if you want to know more.

Example of a cash flow projection

The finance manager of Tiny Construction wants to assess whether the business' cash flow will support the purchase of a new piece of equipment in the next month. The equipment will cost $20,000.

Based on current bank balances and reconciliations, Tiny Construction has a starting balance of $45,000. Outstanding invoices and sales forecasts estimate that incoming payments from sales within the next 30 days will be $90,000. There are no other incoming payments for the month.

The "money out" part of the cash flow projection will look like this:

With incoming sales receipts of $90,000 and outgoings of $65,000, the company would have added $25,000 in net cash flow for the period. Adding that to the $45,000 of existing cash will mean the business has $70,000 left in its bank account at the end of the month. This would become their starting balance the following month.

However, if they purchase the equipment with surplus cash, their starting balance for the next month would reduce to $50,000. This example shows how businesses can use cash flow projections to make investment decisions and estimate whether they would be able to afford it or would have to consider financing it.

How do you analyse a cash flow projection?

Analyse your projection by examining three key measures:

- Closing balance: Review your predicted cash reserves at each period's end. One useful metric is the current ratio (current assets vs. current liabilities); according to guidance for small businesses, a ratio below 1:1 may indicate a shortage of funds and needs attention.

- Net cash flow: Check whether cash increased or decreased during each period

- Forecast accuracy: Compare predictions to actual results and identify estimation errors

Improve future forecasts by understanding what you over or underestimated. This analysis reveals business patterns that make your next projection more reliable.

How often should you do cash flow projections?

Most businesses should update their cash flow projections monthly and forecast 3–12 months ahead. To identify potential liquidity risks, experts suggest developing a forecast on at least a twelve month “rolling” basis. Shorter-term forecasts (1–3 months) provide high accuracy for immediate planning. Longer-term projections (6–12 months) help with strategic decisions but become less precise over time.

Update your projections using this rolling forecast method:

- Monthly refresh: Review and update your forecast at month-end

- Remove completed period: Drop the month that just finished

- Add new period: Extend the forecast by one additional month

- Adjust existing forecasts: Update remaining months based on new information

Cash flow forecast templates and tools

You don't need to start from scratch. There are tools available to make forecasting easier.

Cash flow forecast template

A spreadsheet is a simple way to get started. You can build your own or download a free cash flow projection template to begin. Spreadsheets give you full control, but you'll need to enter all the data manually.

Cash flow forecasting software

For a more automated approach, accounting software like Xero can help. Because it's already connected to your bank accounts and holds your bills and invoices, it can generate a short-term cash flow projection in just a few clicks. This saves time and can help you spot cash shortfalls before they occur.

Tips for accurate cash flow forecasting

Your forecast will be more accurate if you use up-to-date, reliable information. Use these tips to make your projections more reliable.

- Review past performance: Look at your financial history to understand your business's natural cycles. This helps you make more realistic predictions.

- Be conservative with income: It's often better to underestimate your sales than to overestimate them. This creates a buffer in case things don't go as planned.

- Account for seasonality: If your business has busy and quiet periods, make sure your forecast reflects this. Don't assume every month will be the same.

- Update your forecast regularly: A forecast isn't a one-time task. Review and update it monthly to keep it relevant and accurate.

- Talk to your advisor: An accountant or bookkeeper can help you create and analyse your forecast, offering valuable insights you might have missed.

Take control of your business finances with Xero

Cash flow control determines whether your small business thrives or struggles to survive. Effective cash flow projections help you anticipate shortages, plan for growth opportunities, and maintain the financial stability needed to pay bills and yourself consistently.

Cash flow forecasting gives you a clearer view of your financial future, helping you make smarter, more confident decisions. By understanding when money is likely to come in and go out, you can plan for expenses, invest in growth, and stay on track to meet your goals. It's a powerful way to move from reacting to financial events to managing them with confidence.

Get one month free to get started today.

FAQs on cash flow forecasting

Here are some common questions small business owners have about cash flow forecasting.

What is the formula for forecasting cash flow?

A simple formula is: starting cash + projected cash inflows – projected cash outflows = ending cash. You repeat this calculation for each period in your forecast.

What are the different techniques for cash flow forecasting?

The two main methods are the direct method and the indirect method. The direct method, which we've covered here, involves tracking cash inflows and outflows. The indirect method starts with net income and adjusts for non-cash items, which is more complex and often used for formal financial statements.

How far ahead should I forecast my cash flow?

It's a good idea to have a rolling 12-month forecast that you update monthly. For day-to-day management, a shorter 30–90 day forecast can provide more detailed, actionable insights.

What's the difference between cash flow forecasting and budgeting?

A cash flow forecast predicts the actual cash moving in and out of your bank account. A budget is a plan for your income and expenses over a period, which often includes non-cash items like depreciation. A forecast shows if you'll have the cash to meet your budget.

Disclaimer

Xero does not provide accounting, tax, business or legal advice. This guide has been provided for information purposes only. You should consult your own professional advisors for advice directly relating to your business or before taking action in relation to any of the content provided.

Get one month free

Purchase any Xero plan, and we will give you the first month free.