Gross profit margin formula: How to calculate and improve yours

Learn the gross profit margin formula to set prices, cut costs, and grow profit.

Written by Lena Hanna—Trusted CPA Guidance on Accounting and Tax. Read Lena's full bio

Published Wednesday 26 November 2025

Table of contents

Key takeaways

• Calculate gross profit margin using the formula (Gross Profit ÷ Revenue) × 100, where gross profit equals revenue minus cost of goods sold, to measure what percentage of sales revenue remains after covering direct costs.

• Avoid common calculation errors by including all direct costs in COGS, matching revenue and costs to the same time period, excluding operating expenses from COGS, and using precise figures before converting to percentages.

• Benchmark your gross profit margin against industry standards, aiming for 50-70% for most small businesses while recognising that acceptable margins vary significantly by industry and business model.

• Improve your gross profit margin by strategically adjusting prices based on market conditions and value delivered, reducing cost of goods sold through supplier negotiations, and streamlining operations to eliminate waste and inefficiencies.

What is gross profit margin?

Gross profit margin measures the percentage of sales revenue left after paying for direct costs of goods or services sold.

Why gross profit margin matters:

- Cash flow visibility: Shows how much revenue you retain to cover operating expenses

- Efficiency measurement: Reveals how well you control production and service delivery costs

- Business health indicator: Identifies profitable areas and potential problem spots

- Growth planning: Higher margins provide more resources for expansion and investment

Low gross profit margins limit your ability to cover essential expenses like rent and utilities, reducing your chances of achieving net profitability.

Gross profit margin vs gross profit

Gross profit vs gross profit margin differs in how the information is presented:

- Gross profit: Dollar amount remaining after subtracting direct costs (e.g., $50,000)

- Gross profit margin: Percentage of revenue retained after direct costs (e.g., 60%)

Gross margin is simply another term for gross profit margin – both refer to the same percentage-based profitability measure.

How to calculate gross profit margin

Gross profit margin (calculation)

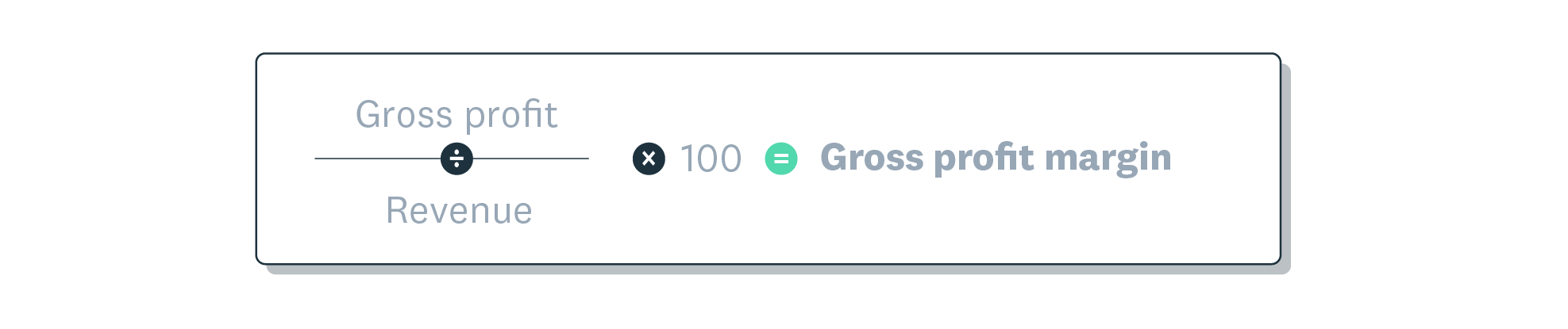

Gross profit margin formula:

Gross Profit Margin = (Gross Profit ÷ Revenue) × 100

Where:

- Gross Profit = Revenue - Cost of Goods Sold (COGS)

- Revenue = Total sales income

- Result = Percentage showing profit efficiency

Gross profit margin formula explained

Step-by-step calculation process:

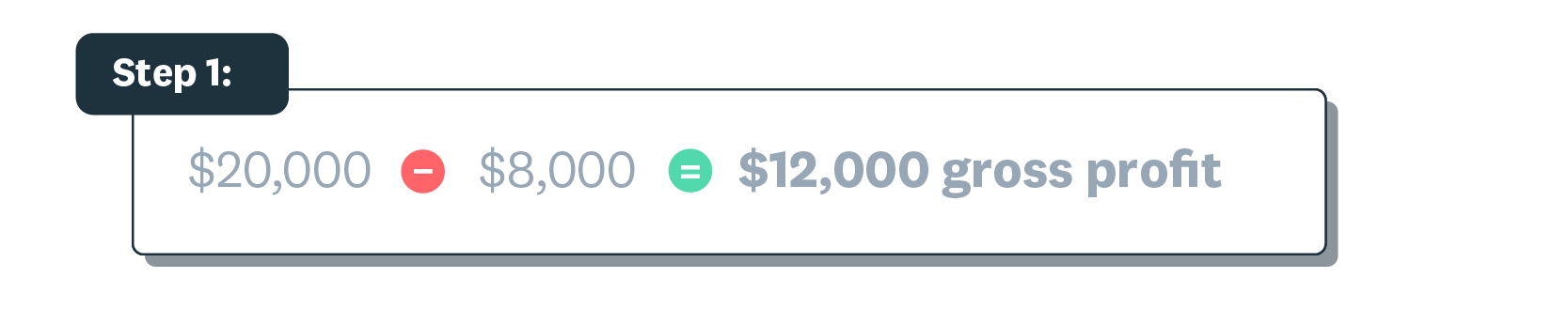

Step 1: Calculate your gross profit

- Take your total revenue (sales income)

- Subtract your cost of goods sold (COGS)

- Result = Gross profit in dollars

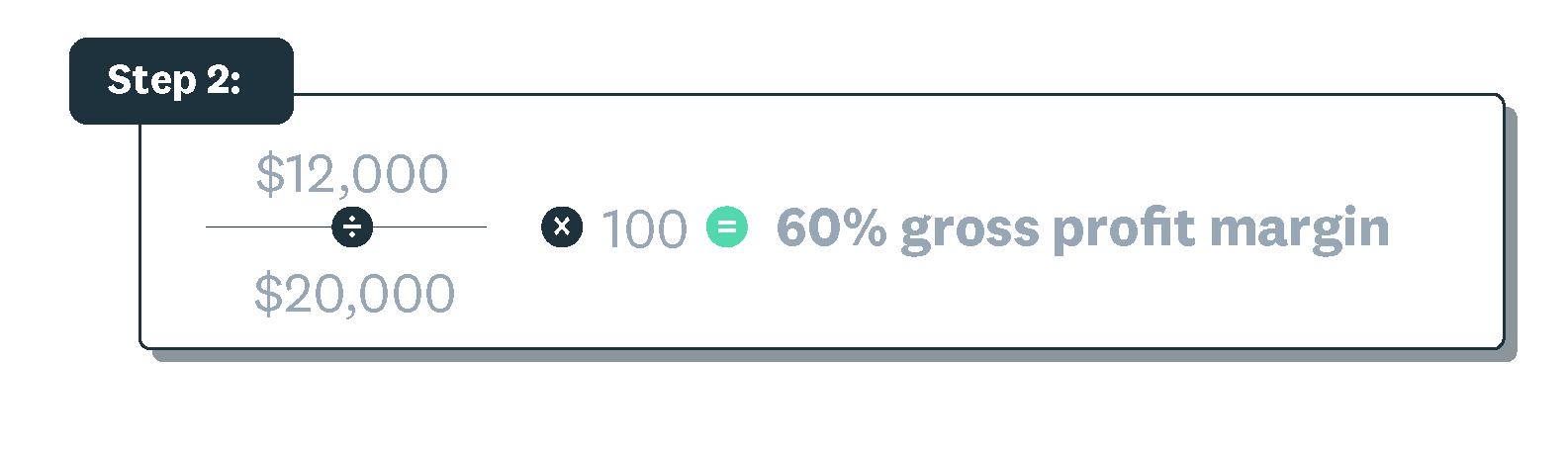

Step 2: Calculate your gross profit margin

- Divide gross profit by total revenue

- Multiply by 100 to get percentage

- Result = Your gross profit margin percentage

Gross profit margin example calculation

For example, if your business makes $20,000 by cleaning offices and it costs $8,000 to provide those services, your gross profit is $12,000.

Your gross profit margin is 60%.

Avoid common calculation mistakes

Common calculation mistakes to avoid:

- Incomplete COGS: Include all direct costs like materials, labour, and production expenses

- Wrong timeframe: Match your revenue and COGS to the same period

- Mixed expenses: Don't include operating expenses (rent, marketing) in COGS calculations

- Rounding errors: Use precise figures before converting to percentages

Accurate cost of goods sold (COGS) calculation is critical – even small errors can significantly affect your margin analysis and business decisions.

What is a good gross profit margin?

What constitutes a good gross profit margin varies by industry and business model:

General benchmarks:

- 50-70%: Good margin range for most small businesses

- Above 70%: Excellent margin indicating strong pricing power

- Below 50%: May indicate pricing or cost control challenges

Your margin must be sufficient to cover operating expenses, taxes, and provide reasonable profit after all direct costs are paid.

Factors affecting your margins

Several factors affect what is considered a good gross profit margin.

Benchmarking your gross profit margin

Benchmark your business against competitors to see how your performance compares.

Compare your gross profit margin with similar-sized businesses in your industry, market or region for the best insight.

Industry benchmarks for gross profit margin

Industry benchmark examples:

Higher margin industries (55%+):

- Jewellery and luxury goods

- Cosmetics and personal care

- Software and digital services

- Professional services

Lower margin industries (below 45%):

- Electronics retail

- Alcoholic beverages

- Grocery and food retail

- Manufacturing with high material costs

These differences reflect the unique costs and competition in each industry.

Your accountant or bookkeeper can help you find gross profit margin benchmarks for small to medium-sized businesses (SMBs) in your industry and clarify what your business should aim for.

When to reassess your gross profit margin

Evaluating and monitoring your gross profit margins is especially useful in a changing market, such as when your costs rise. Reviewing your margins during financial performance analysis can help you identify opportunities for growth.

Your gross profit margin needs to cover the cost of goods sold (COGS), as well as other costs such as operating expenses and taxes. Your accountant can help you determine the right gross profit margin for your business.

Xero accounting software makes it easy for you to track your business performance using financial reports.

Analysing gross profit margin for business insights

Analysing your gross profit margin shows you which parts of your business are most profitable and where you can improve.

Set competitive prices to increase sales. Manage your costs to boost your profit margin.

Interpreting gross profit margin trends

Monitor your gross margin trends over time to reveal patterns in your business's performance, such as which products generate the most revenue and how your costs change throughout the year.

Factors affecting gross profit margin

External factors can affect your gross profit margin:

- Changes in demand – this affects the prices you can charge. If demand falls, for example, you might have to lower prices to entice customers

- Rising supplier (input) costs – when costs rise (such as for materials and labour), your profit margins will narrow

When customers' daily costs rise, they may adjust their spending, which can influence your revenue.

How to improve gross profit margin

Improving your gross profit margin requires strategic focus on pricing and cost management:

Adjust your prices

Strategic pricing adjustments:

- Market-based pricing: Monitor competitor prices and adjust strategically

- Value-added pricing: Enhance products/services to justify premium pricing

- Regular price reviews: Assess pricing quarterly to reflect cost changes

- Customer communication: Explain price increases by highlighting added value

Raising your prices can improve your margins if customers see the value.

Reduce your cost of goods sold

Keep your costs low to protect your gross profit margin. Build strong relationships with suppliers to access bulk discounts and better rates.

Streamline your operations

Reduce waste and automate your processes, such as by using accounting software, to cut costs and boost profit margins. Effective inventory management can also help you minimise excess stock and reduce storage costs.

Use Xero to track your gross profit margin

Xero accounting software helps you track your gross profit margin and other key financial metrics, giving you more time to focus on growing your business.

FAQs on gross profit margin

Below are answers to common questions about gross profit margin.

What's the difference between markup and margin?

While both measure profitability, they use different calculations. Margin is your profit as a percentage of your revenue. Markup is your profit as a percentage of your cost. A 50% markup is not the same as a 50% margin, so make sure you use the right calculation when setting prices.

Can a gross profit margin be negative?

Yes, a negative gross profit margin means your cost of goods sold is higher than your revenue. If this happens, review your pricing and costs to improve your profitability.

How often should I calculate my gross profit margin?

It's a good idea to review your gross profit margin every month. This helps you spot trends and make quick decisions about your pricing or costs. Accounting software can automate this calculation, so you can track it easily.

Disclaimer

Xero does not provide accounting, tax, business or legal advice. This guide has been provided for information purposes only. You should consult your own professional advisors for advice directly relating to your business or before taking action in relation to any of the content provided.