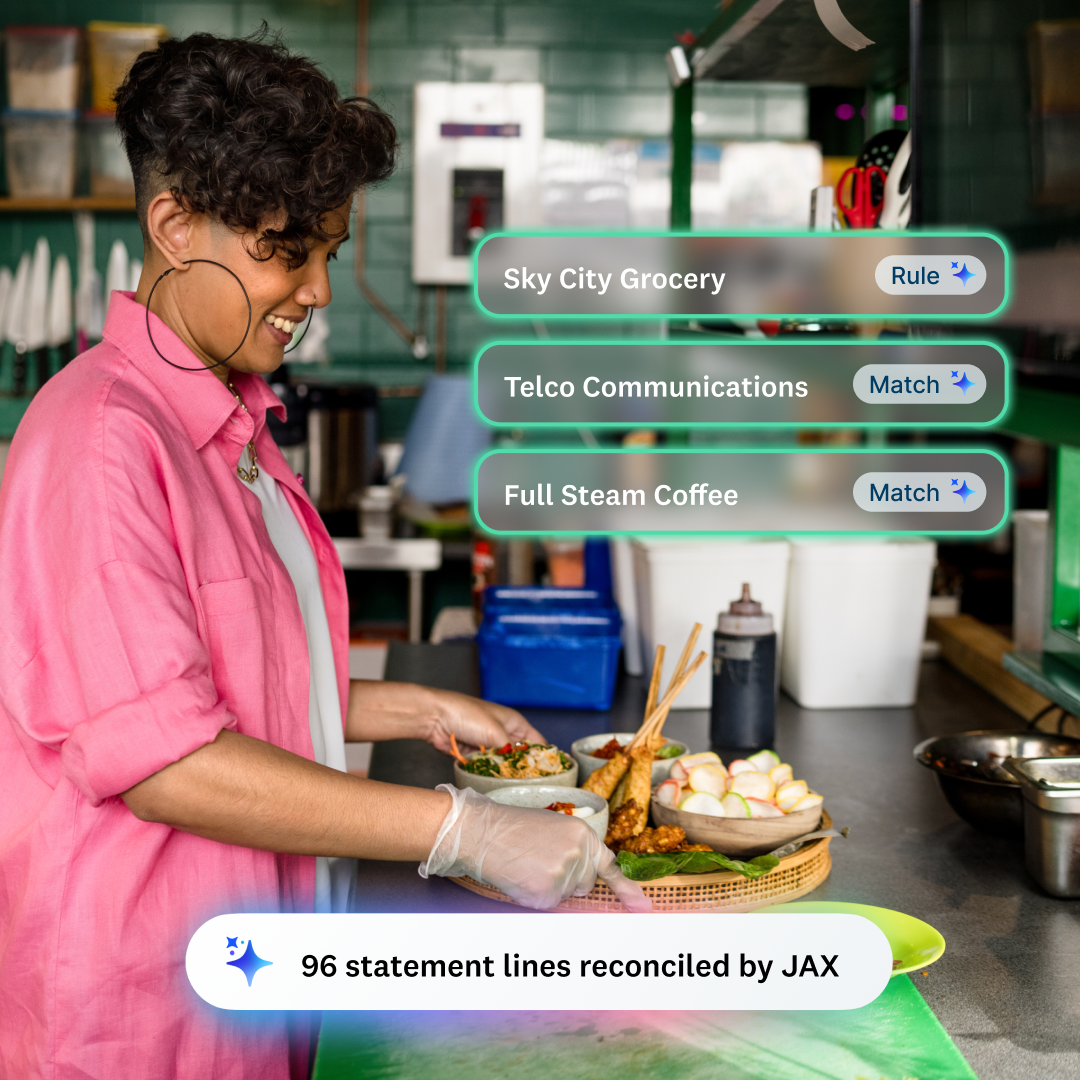

Automatic bank reconciliation powered by JAX (in beta)

JAX, your new AI financial superagent, works alongside you to automatically reconcile bank transactions where there's high confidence, giving you a reliable, up-to-date view of your finances sooner.

Full visibility and total control

See everything JAX reconciles, make changes and turn automation on/off so you’re in control.

Free up time for high-value advisory

Let JAX handle routine reconciliations, freeing you up for the work that requires your expertise.

Get a clear view of your cash flow, faster

JAX immediately reconciles transactions, helping keep your accounts up-to-date.

Smart automation you can trust

JAX learns from your actions to become an even smarter partner to you over time.

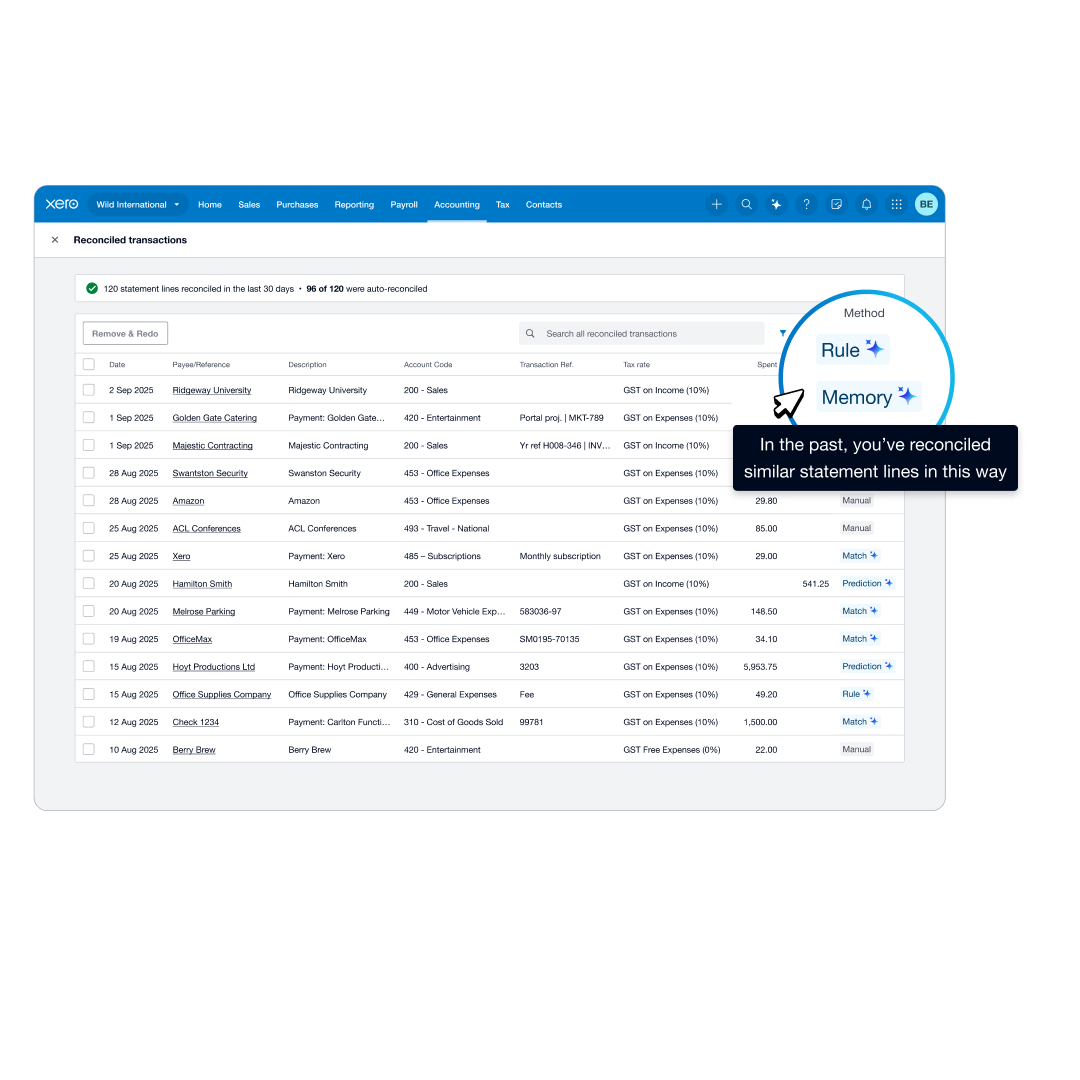

Full visibility and total control

You're in control. The new ‘Reconciled page’ gives you complete oversight and control over automation.

- See bank and accounting details in a single view for a fast, at-a-glance review of JAX’s work.

- Turn the automation on or off at any time for each bank account.

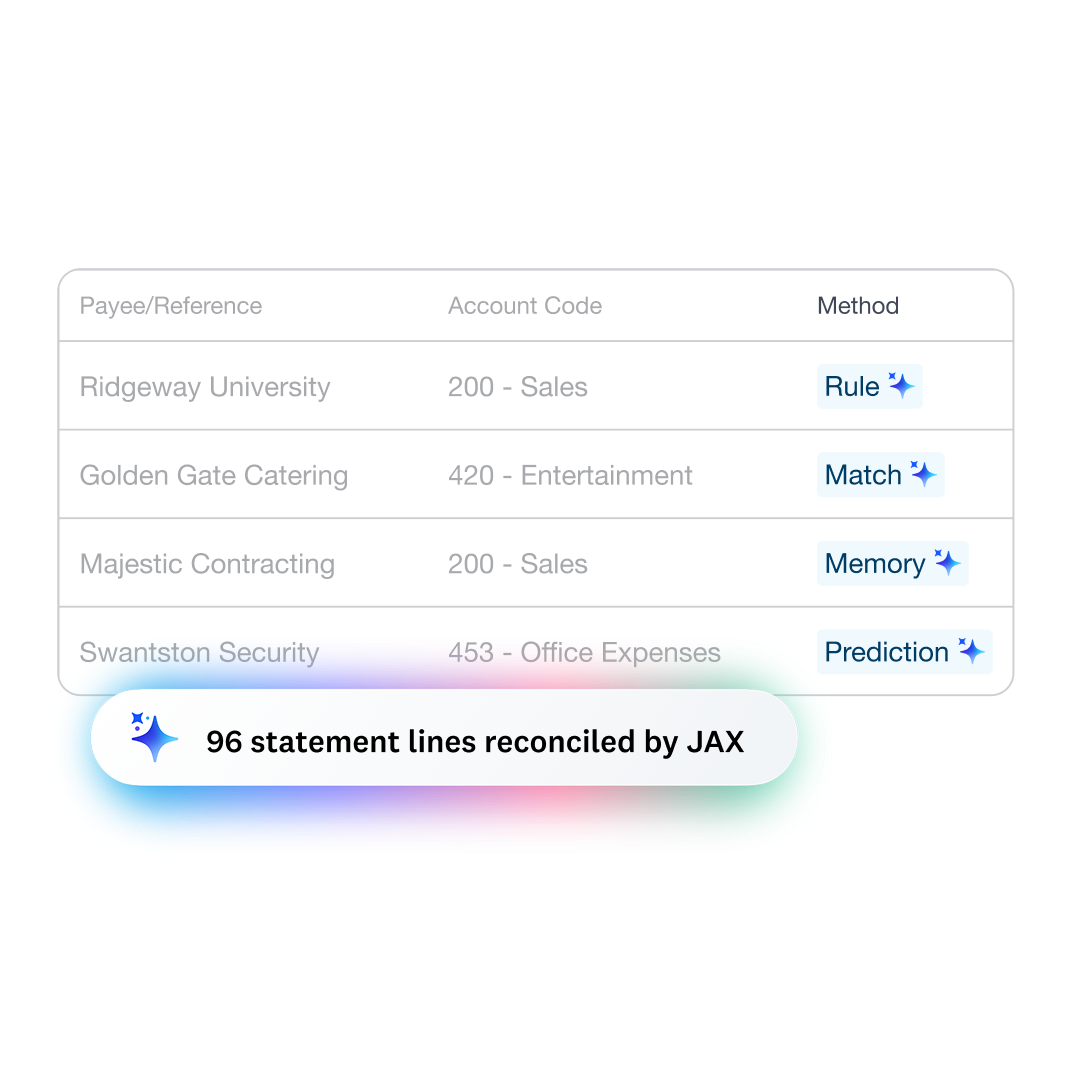

- The new ‘Method’ column makes it clear what's been auto-reconciled and what needs your attention.

- Each transaction shows why it was reconciled, giving you total oversight.

- Instantly fix any error. The ‘Remove and redo’ function sends a transaction back in a single step.

I can view them and pretty easily identify which have been auto-reconciled and check those. And that ‘reconciled’ page makes it really easy. It lets me get on with other parts of my job.

Anthony Bishop, Bookkeeper at Suncity Legal Services

Free up time for high-value advisory

Confidently offload your routine reconciliation to JAX and focus your effort where it matters most.

- JAX makes bank reconciliation easier by doing your manual, repetitive work for you.

- Helps win back valuable time to focus on the critical work that only you can do.

It saves probably about four hours a week which is pretty big... I went away last week and came back yesterday and only have a few transactions to reconcile which was amazing. The accuracy is through the roof.

Anthony Bishop, Bookkeeper at Suncity Legal Services

Get a clearer view of your finances, faster

Reduce your manual backlog and get a more timely, accurate snapshot of your business finances.

- JAX gets to work, reconciling transactions that it’s confident about, the moment they arrive.

- By keeping your accounts more current, you can move from reactive reporting to proactive financial decision-making.

I would say I'm usually spending seven hours a week. I'll be able to get through them in less than 30 minutes on a given day now – definitely a third of the time I'd usually be spending.

Rob Morrison, Bread + Butter

Smart automation you can trust

JAX’s intelligence goes beyond simple matches, learning to reconcile transactions by using your history, existing documents, and patterns across Xero, becoming an even smarter partner to you over time.

- JAX will automatically categorise and match your bank transactions when it's highly confident.

- The more you use and guide JAX, the smarter it becomes, adapting to your business and automating more of your manual work over time.

Learn how AI is powering auto reconciliation

Read more about how our AI models work to automate & support accounting workflows and adapt to your business.

The philosophy behind Xero’s use of AI

Wherever we use AI in our products we’re committed to looking after your data and keeping you in control.

FAQs about automatic bank reconciliation

Auto bank reconciliation in Xero is powered by JAX – Your AI financial super agent – to automatically categorise and match your bank transactions. JAX only automatically reconciles a transaction if there’s high confidence in the suggestion. If JAX doesn’t have enough confidence to reconcile the suggestion, it still suggests a match or categorisation, but leaves the bank statement line for you to review and reconcile manually. When new statement lines arrive, JAX aims to reconcile using one of four methods: ‘Rule’, ‘Match’, ‘Memory’ and ‘Prediction’. ‘Rule’ shows you when one of your bank rules has been applied. ‘Match’ signifies when a bank transaction matches to an existing Xero document. ‘Memory’ tells you when JAX has made a decision based on how you’ve reconciled similar transactions in the past. And ‘Prediction’ tells you that JAX has made a suggestion based on how other Xero users have reconciled similar transactions.

Learn more in Xero CentralAuto bank reconciliation in Xero is powered by JAX – Your AI financial super agent – to automatically categorise and match your bank transactions. JAX only automatically reconciles a transaction if there’s high confidence in the suggestion. If JAX doesn’t have enough confidence to reconcile the suggestion, it still suggests a match or categorisation, but leaves the bank statement line for you to review and reconcile manually. When new statement lines arrive, JAX aims to reconcile using one of four methods: ‘Rule’, ‘Match’, ‘Memory’ and ‘Prediction’. ‘Rule’ shows you when one of your bank rules has been applied. ‘Match’ signifies when a bank transaction matches to an existing Xero document. ‘Memory’ tells you when JAX has made a decision based on how you’ve reconciled similar transactions in the past. And ‘Prediction’ tells you that JAX has made a suggestion based on how other Xero users have reconciled similar transactions.

Learn more in Xero CentralAutomatic bank reconciliation is a feature subscribers and advisors can turn on or off for each bank account in your organisation. If you have Xero’s Grow plan and above, you can go to the bank account page and turn on the automation.

Learn more in Xero CentralAutomatic bank reconciliation is a feature subscribers and advisors can turn on or off for each bank account in your organisation. If you have Xero’s Grow plan and above, you can go to the bank account page and turn on the automation.

Learn more in Xero CentralXero already helps you categorise and match bank statement lines by offering suggestions that come from analysing your bank rules and patterns from your organisation and others. Our new and improved AI models will provide more accurate suggestions and automatically reconcile high confidence suggestions on your behalf. With greater accuracy and more automation, JAX will help you spend less time on manual bookkeeping and have a more up-to-date view of your business finances.

Xero already helps you categorise and match bank statement lines by offering suggestions that come from analysing your bank rules and patterns from your organisation and others. Our new and improved AI models will provide more accurate suggestions and automatically reconcile high confidence suggestions on your behalf. With greater accuracy and more automation, JAX will help you spend less time on manual bookkeeping and have a more up-to-date view of your business finances.

Auto bank reconciliation will be included in Xero’s Grow plan and above. However, we reserve the right to change the terms and conditions of using JAX, including the pricing.

Auto bank reconciliation will be included in Xero’s Grow plan and above. However, we reserve the right to change the terms and conditions of using JAX, including the pricing.

Auto bank reconciliation is a feature powered by Xero’s AI financial superagent, JAX (Just Ask Xero). As with all of our JAX-powered features, Xero is committed to keeping your data secure and delivering the best AI experiences for our customers. We take our responsibilities for protecting your data seriously.

Read more about our responsible data use commitmentsAuto bank reconciliation is a feature powered by Xero’s AI financial superagent, JAX (Just Ask Xero). As with all of our JAX-powered features, Xero is committed to keeping your data secure and delivering the best AI experiences for our customers. We take our responsibilities for protecting your data seriously.

Read more about our responsible data use commitmentsXero is committed to innovation and responsible data use. We may use data we collect about your use of our products, including automatic bank reconciliation, to help us improve and deliver great products. More information about how we use information about you is set out in our privacy notice. We don't use customer data to train our automatic bank reconciliation models unless it is anonymised or we have permission to do so, nor do we allow any third parties we work with to use your customer data for their own purposes. More information about how we use your customer data can be found in our data processing addendum and terms of use.

Read our Terms of UseRead more about our data processing termsXero is committed to innovation and responsible data use. We may use data we collect about your use of our products, including automatic bank reconciliation, to help us improve and deliver great products. More information about how we use information about you is set out in our privacy notice. We don't use customer data to train our automatic bank reconciliation models unless it is anonymised or we have permission to do so, nor do we allow any third parties we work with to use your customer data for their own purposes. More information about how we use your customer data can be found in our data processing addendum and terms of use.

Read our Terms of UseRead more about our data processing terms

Get one month free

Purchase any Xero plan, and we will give you the first month free.