Margin of safety: what it is and how to calculate yours

Learn how margin of safety helps you protect profit and plan smarter, plus how to calculate it.

Written by Shaun Quarton—Accounting & Finance Content Writer and Growth Marketer. Read Shaun's full bio

Published Monday 26 January 2026

Table of contents

Key takeaways

- Calculate your margin of safety using the formula (Current sales - Break-even sales) ÷ Current sales to determine what percentage your sales can drop before reaching break-even, with 20% or higher generally considered a healthy buffer.

- Monitor your margin of safety monthly or quarterly to stay on top of your financial health and react quickly to changes in sales or costs that could affect your business risk.

- Use your margin of safety to guide critical business decisions including setting realistic sales targets, adjusting pricing strategies, controlling costs, and evaluating new product launches based on their impact on your financial buffer.

- Combine margin of safety calculations with cost-volume-profit analysis and other financial metrics to get a complete view of your business risk and profit potential rather than relying on this single measure alone.

What is the margin of safety?

Margin of safety is the percentage your sales can drop before your business reaches break-even. It measures your financial buffer against revenue declines or cost increases.

The wider your margin of safety, the lower your business risk.

Why margin of safety matters for your small business

Margin of safety protects your business from financial risk by showing how much sales can drop before you make a loss.

External shocks like supplier price increases push up your break-even point, a risk that is magnified if you rely on one supplier that provides 30 per cent or more of your total product requirements. This reduces your margin of safety and exposes your business to further risks.

Benefits of knowing your margin of safety

Knowing your margin of safety gives you a clear advantage when making business decisions. It provides a buffer that helps you operate with more confidence.

- Protects against forecasting errors. Sales forecasts are never perfect. Your margin of safety gives you a cushion if your projections are too optimistic.

- Reduces financial risk. It shows you exactly how much sales can dip before you start losing money, helping you avoid cash flow problems.

- Supports confident decisions. When you know your financial buffer, you can make choices about pricing, costs, and growth with less stress.

- Improves long-term stability. Consistently monitoring your margin of safety helps you build a more resilient business that can weather economic ups and downs.

What is the margin of safety formula?

The margin of safety formula calculates the percentage buffer between your current sales and break-even point:

(Current sales - break-even sales) / current sales = Margin of safety

The formula requires two key figures:

- Current sales: Your total revenue over a specific period

- Break-even sales: The minimum revenue needed to cover all costs

Here's a quick margin of safety example.

Let's say a business has current sales of $50,000 and needs $30,000 in sales to break even.

Margin of safety = ($50,000 – $30,000) / $50,000 = 0.4 (40%)

This means your sales could drop by 40% before you hit your break-even point. Any further drop in sales would result in a loss.

The margin of safety calculation is set out in more detail below.

How to calculate margin of safety

Use these three steps to work out your margin of safety and see your business's financial buffer.

1. Find your current sales

Step 1 determines your current sales using either actual figures or forecasts.

Current sales figures are available through your existing sales tools.

Sales forecasting requires analysis and estimation. Four common methods include:

- Historical data: Analyse your financial reports for past sales trends and seasonal patterns. You might find these in your point of sale (POS) system, ecommerce platform, or accounting software like Xero.

- Market research: Study your target market, industry trends, and competitor performance.

- Qualitative forecasting: Ask your sales team or industry experts for their insights.

- Quantitative forecasting: Use statistical methods to analyse your historical and market data to predict future sales more accurately.

The best approach for you depends on your business type and the data available to you. For example, a craft business uses a point of sale (POS) system to track monthly sales. Last month, sales were $5,000. This figure is used in future steps of the margin of safety calculation.

2: Calculate your break-even sales revenue point

Step 2 calculates your break-even sales revenue using this formula:

Fixed costs ÷ ((Sales price – Variable cost) ÷ Sales price) = Break-even sales

In the formula:

- Fixed costs are expenses that stay the same, regardless of sales volume, such as salaries and rent. For some businesses, salary expenses can significantly exceed the industry benchmark of 20 to 25 per cent, making them a critical fixed cost to manage.

- Variable costs change with sales volume, such as raw materials and sales commission.

Here's more info on variable costs and how they differ from fixed costs. Your accountant can also help you distinguish between them.

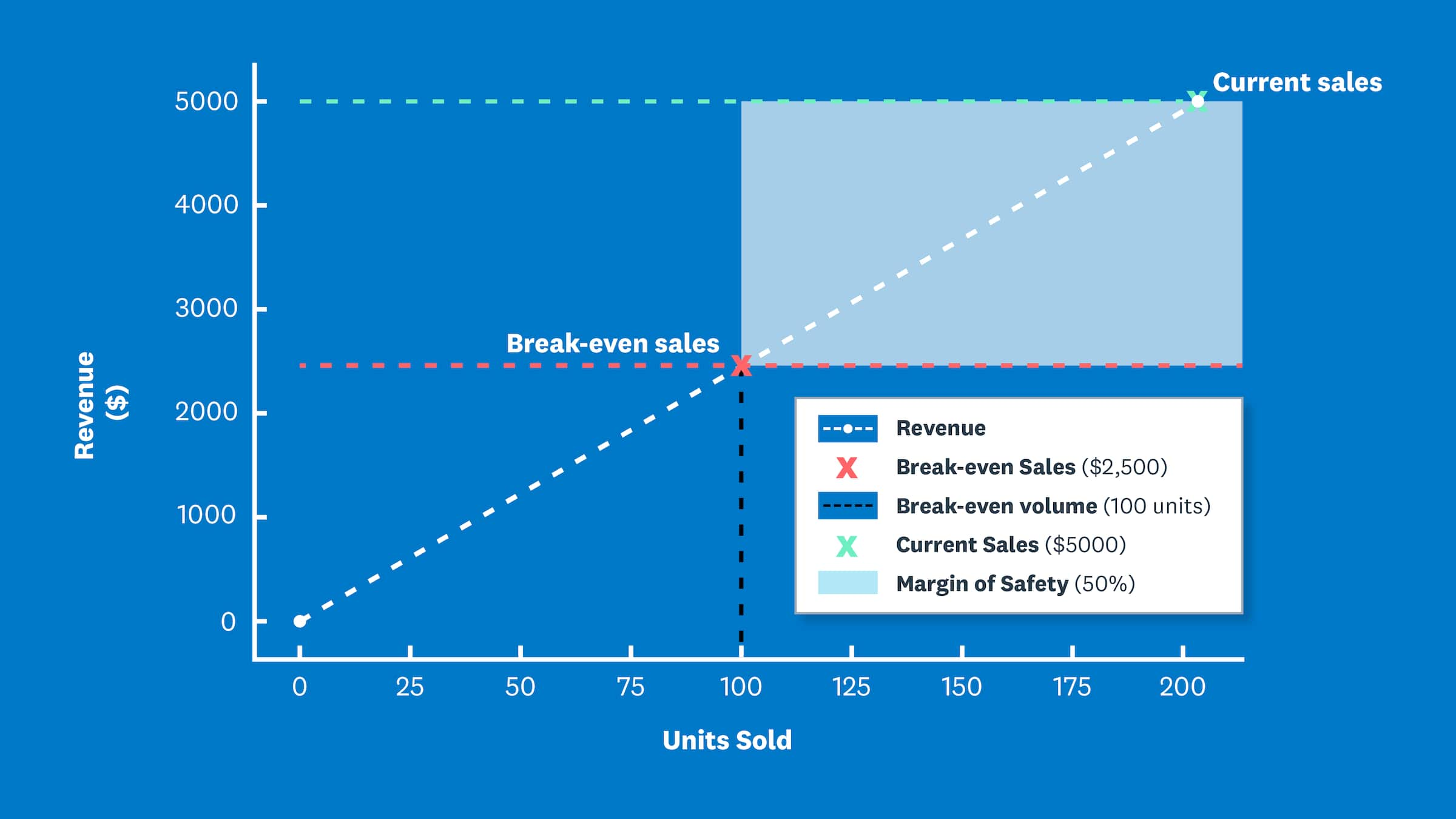

To demonstrate, a craft business has:

- Fixed costs of $2,000

- Variable costs of $5 per unit

- A sales price of $25 per unit

Therefore:

2,000 ÷ ((25 – 5) ÷ 25) = Break-even sales revenue = 2,000 ÷ (20 ÷ 25) = 2,000 ÷ 0.8 = $2,500

So with a sales price of $25, you need revenue of $2,500 (100 sales units) to break even.

Learn more about your break-even point.

3: Apply the margin of safety formula

Finally, apply the margin of safety formula:

(Current sales – Break-even sales) ÷ Current sales = Margin of safety

The result is your margin of safety ratio – the percentage by which sales can fall before your business starts operating at a loss.

Let's apply the formula to the craft business example, where current sales are $5,000 and the break-even point for sales revenue is $2,500:

($5,000 – $2,500) ÷ $5,000 = Margin of safety = 2,500 ÷ 5,000 = 0.5 = 50%

The craft business has a 50% margin of safety, meaning sales could fall by half before they reach the break-even point.

How the margin of safety supports your business decisions

Margin of safety guides key business decisions across four areas:

- Performance targets: Set achievable sales goals based on your break-even point

- Pricing strategy: Adjust prices when your margin shrinks to ensure adequate cost coverage

- Cost control: Reduce expenses when low margins signal financial risk

- Product launches: Evaluate how new offerings affect your safety buffer before launch

Other metrics work with the margin of safety in your accounting analysis

Margin of safety works best when combined with other financial metrics for comprehensive business analysis.

Margin of safety and CVP analysis

Cost-volume-profit (CVP) analysis models how changes in costs, sales volume, and pricing affect profitability. It's a forward-looking tool that complements margin of safety calculations, though research shows 80% of organisations still use traditional costing methods that can negatively impact business management.

Margin of safety shows your current financial buffer. CVP analysis projects how business changes will affect future profitability.

Together, these tools provide a complete view of business risk and profit potential.

Learn more about decision-making.

Simplify your margin of safety calculations

Manual margin of safety calculations are time-consuming and error-prone. Traditional methods require:

- Tracking down financial figures across multiple sources

- Updating spreadsheets manually

- Piecing together reports from different systems

Xero automates margin of safety calculations by giving you up-to-date financial data in one place. You can make decisions faster with clear reports and current numbers. Try Xero for free today.

FAQs on margin of safety

Here are answers to some common questions about margin of safety.

What is a good margin of safety percentage?

While it varies by industry, a margin of safety of 20% or more is generally considered healthy, as this buffer helps absorb unexpected costs like shrinkage of stock, which can represent a significant percentage of the cost of goods sold. A higher percentage means your business has a stronger buffer against unexpected changes.

How often should I calculate my margin of safety?

It's a good practice to calculate your margin of safety monthly or quarterly. This helps you stay on top of your financial health and react quickly to any changes in sales or costs.

What does it mean if my margin of safety is negative?

A negative margin of safety means your business is operating below its break-even point and is currently making a loss. You can use this as a prompt to review your pricing, sales volume, and costs quickly, similar to how one company's risk profile remained outside its stated appetite for 30 consecutive months.

How does margin of safety compare to other financial ratios?

Margin of safety focuses specifically on the risk related to your break-even point. Other ratios, like profitability ratios, measure how efficiently you turn revenue into profit. Using them together gives you a more complete picture of your business's financial health.

Disclaimer

Xero does not provide accounting, tax, business or legal advice. This guide has been provided for information purposes only. You should consult your own professional advisors for advice directly relating to your business or before taking action in relation to any of the content provided.

Start using Xero for free

Access Xero features for 30 days, then decide which plan best suits your business.