New Xero research reveals over half of Australians fear making a mistake on their tax return

73% of Australians report feeling worried or stressed at EOFY, with small business owners echoing this sentiment

Melbourne, 29 May 2025 — Xero, the global small business platform, has released new research¹ revealing many Australians are heading into this end of financial year (EOFY) period concerned and confused about key tax rules. The ‘Xero Tax Confidence Index’ survey of more than 1,000 Australians found that more than half (54%) are worried about making a mistake on their return, while around one in five report feeling anxious (20%) or stressed (18%) at the prospect of completing their return.

Tax time stress impacting individuals and small businesses alike

Nearly three quarters (73%) of Australians are worried or anxious about tax time in general, with owing money to the Australian Taxation Office (ATO) (33%), following tax rules correctly (28%), and being audited by the ATO (22%) among the most common concerns.

The tax time pressure is even greater for Australia’s 2.6 million small business owners. Separate Xero research² revealed the majority of the more than 1,000 surveyed small business leaders said they find tax time to be stressful (71%) or overwhelming (83%), with navigating tax compliance cited as the top source of overwhelm for a third of respondents.

Angad Soin, Managing Director ANZ and Global Chief Strategy Officer at Xero, said: “Tax time can be daunting for all taxpayers — individuals and small businesses alike. Our research shows that one in five Australians have avoided asking questions at tax time because they were worried it might seem silly or obvious. Similar research shows 33% of business leaders find tax prep overwhelming. When it comes to tax and getting it right, there’s no such thing as a silly question.

“At Xero, we wanted to identify universal challenges and knowledge gaps for all Australians as we approach EOFY, with the aim of providing simple and easy-to-use information to reduce confusion and anxiety at this time of year. Getting the right support in place is key to building confidence around tax time. That’s why we built our EOFY hub to help small business owners. Finding a trusted advisor who can answer any questions and guide you through the process is invaluable, as is using tools to capture your data throughout the year for tracking expenses and allocating them to the right categories.”

Tax deduction rules a common source of confusion

While 58% of Australians said they made purchases in the previous financial year with the intention of claiming them as personal tax deductions, more than half (51%) also admitted they were confused about deduction rules — particularly those relating to car, transport and travel expenses (21%) or working from home costs (21%).

Almost one in five said they had previously tried to claim a deduction they weren’t sure was actually eligible, and half of those who made a specific tax deduction purchase last year found it didn’t go positively, for reasons including they didn’t get the return they expected (17%), discovering their purchase was ineligible to claim (21%), or they had to amend their return due to incorrect deduction claims (7%).

Australians use trusted sources, but myths remain

Despite the confusion, most Australians rely on trusted sources for tax guidance, including the official ATO website (51%) or a tax agent or accountant (40%). By contrast, only seven per cent have consulted AI tools like ChatGPT, and even fewer (5%) use social media influencers.

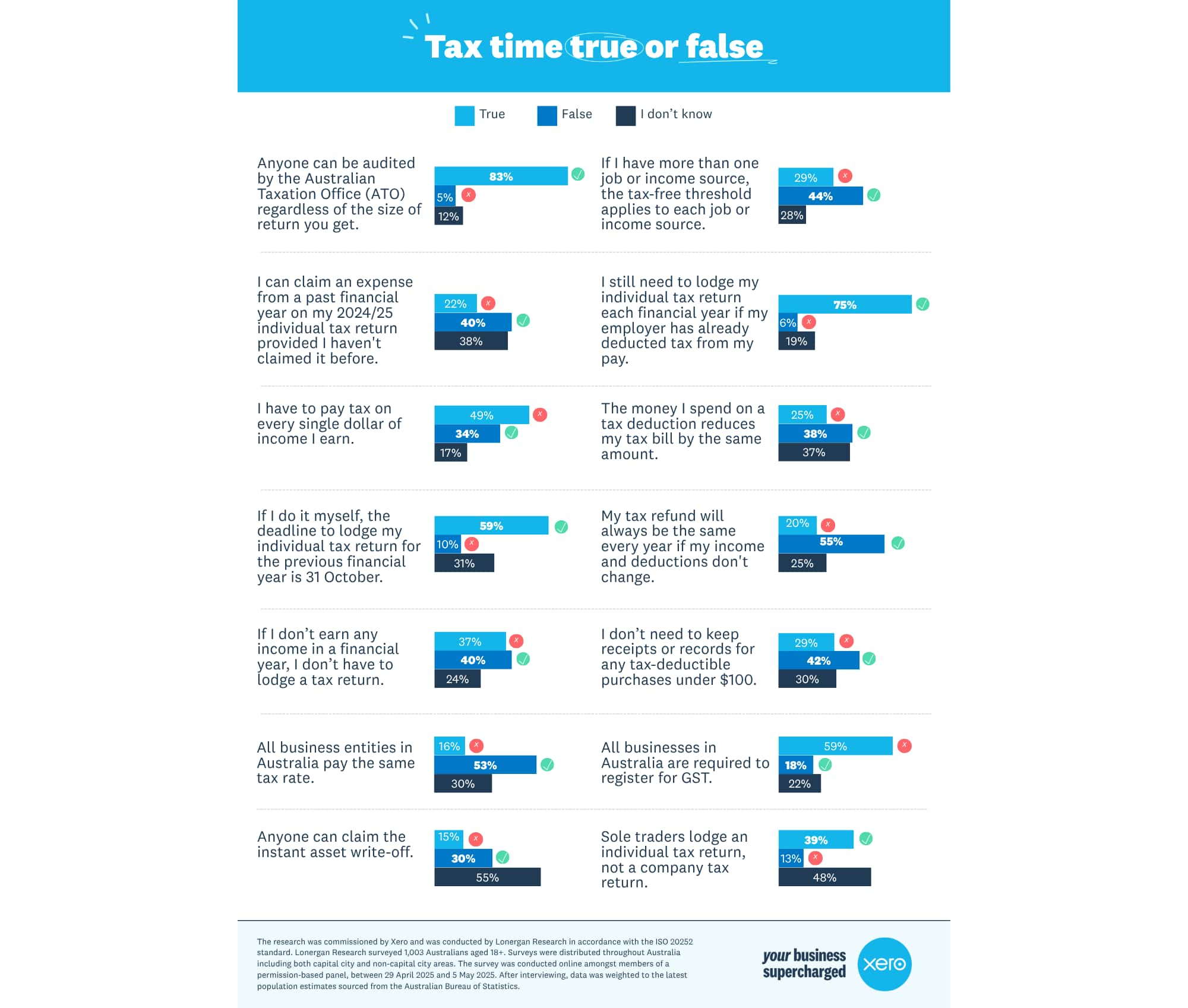

To test Australia’s knowledge of common tax scenarios, respondents answered ‘true’. ‘false’ or ‘I don’t know’ to several statements relating to income tax. The research showed the majority (at least half) of Australians answered incorrectly or were unsure of the correct answer to the following statements:

- The money I spend on a tax deduction reduces my tax bill by the same amount.”

- “If I have more than one job or income source, the tax-free threshold applies to each job or income source.”

- “I can claim an expense from a past financial year on my 2024/25 individual tax return, provided I haven't claimed it before.

If Australians have any questions this tax time - no matter how silly they think they are - they should speak to their accountant or tax practitioner. Small businesses can find more information and practical tips on preparing for EOFY at Xero’s EOFY Resource Hub.

ENDS

Media Contact

Xero Australia | Jess Brophy | Director of Communications, ANZ | +61 431 268 549 | jess.brophy@xero.com

About Xero

Xero is a global small business platform that helps customers supercharge their business by bringing together the most important small business tools, including accounting, payroll and payments — on one platform. Xero’s powerful platform helps customers automate routine tasks, get timely insights, and connects them with their data, their apps, and their accountant or bookkeeper so they can focus on what really matters. Trusted by millions of small businesses and accountants and bookkeepers globally, Xero makes life better for people in small business, their advisors, and communities around the world. For further information, please visit xero.com.

About the research

¹ The ‘Xero Tax Confidence Index’ research was commissioned by Xero and conducted by Lonergan Research. Lonergan Research surveyed a nationally representative population of 1,003 Australians aged 18+. After interviewing, data was weighted to the latest population estimates sourced from the Australian Bureau of Statistics. The survey was conducted online amongst members of an independent and permission-based panel, between 29 April 2025 and 5 May 2025.

² Small business research was commissioned by Xero and conducted by YouGov. Total sample size was 1,077 Australian adults, with 80% from NSW, VIC and QLD, who are small business owners and decision makers in businesses with fewer than 20 employees. Fieldwork was undertaken between 10th - 19th May 2024. The survey was carried out online.

Disclaimer

This media release includes and is in parts based on assumptions or estimates. It contains general information only and should not be taken as taxation, financial, investment or legal advice. Xero recommends that readers always obtain specific and detailed professional advice about any business decision. The insights in this release were created from the data that was available as at the date it was extracted. Data used was anonymised and aggregated to ensure individuals and businesses can not be identified.

Related media and inquiries

For all media inquiries, please contact the Xero media team.

- Media release

Xero now offers Tap to Pay on iPhone for Australian small businesses with a Stripe account to accept contactless payments

An easy, secure and private way to accept contactless payments with an iPhone and the Xero Accounting iOS app

- Media release

Xero reveals new tagline: 'Your business supercharged'

Brand promise reflects a deeper commitment to customer success and growth

- Media release

Xero and Sumday partner to support climate reporting demands with free carbon accounting tools

Small businesses can easily track their carbon footprint with 12 months free access

Get one month free

Sign up to any Xero plan, and we will give you the first month free.