Take the hassle out of 1099 filing

Xero helps you prepare and file 1099s. Securely collect W-9s then create and review 1099 reports for easier filing.

Collect W-9s and manage contractor info

Securely request W-9s from vendors, track W-9 completion status, and efficiently manage your 1099 contacts in one place. Collect information throughout the year to make 1099 prep even faster.

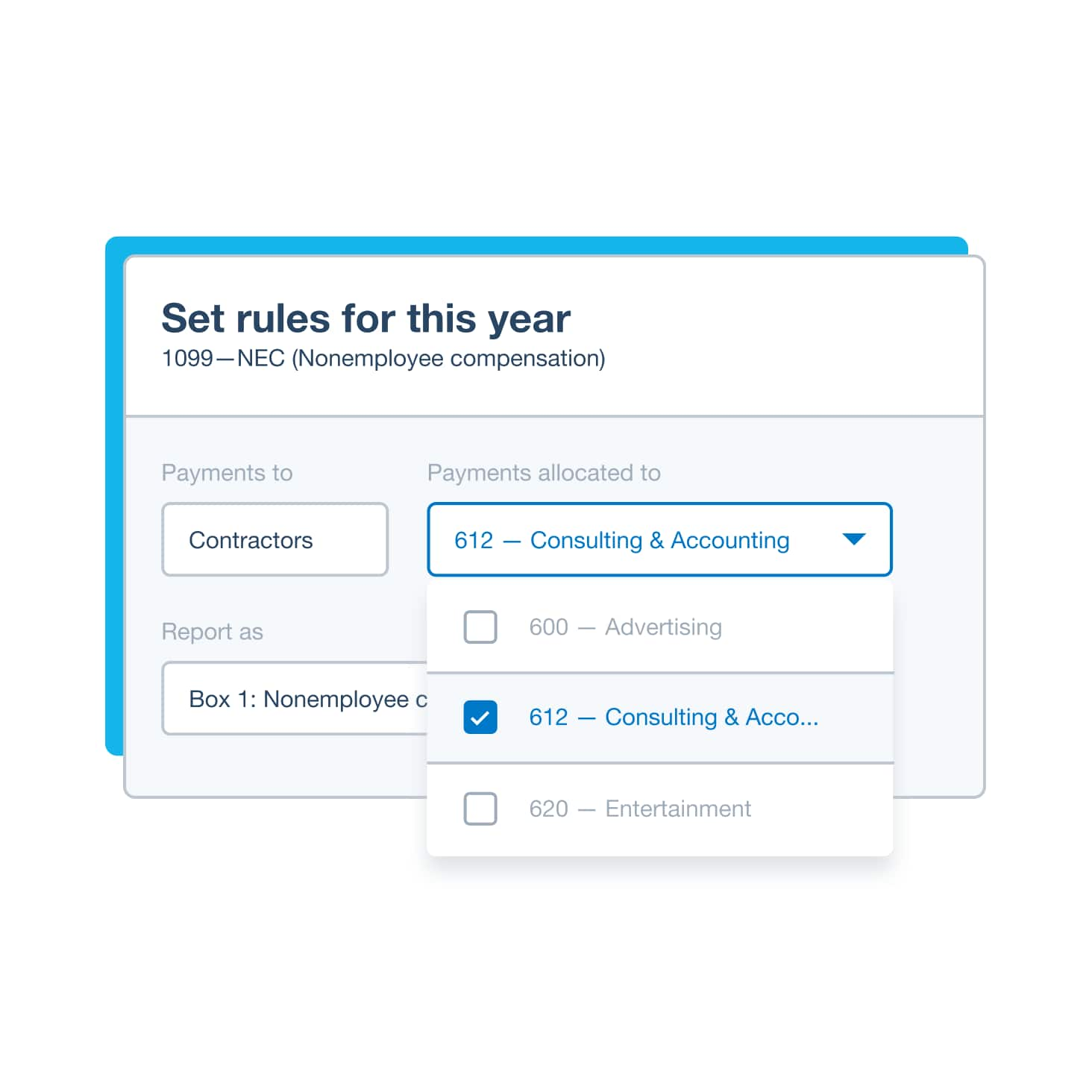

Prepare 1099 reports

Create, view and manage 1099 reports. Set up rules to report payments for 1099-NEC and 1099-MISC forms. View transactions that match your rules, and see a summary of contacts and payments in reports.

Review and fine tune reports

Double check that you have all necessary vendor details such as Tax ID number. Review transactions included and excluded from the report. Transactions below the $600 payment threshold are excluded.*

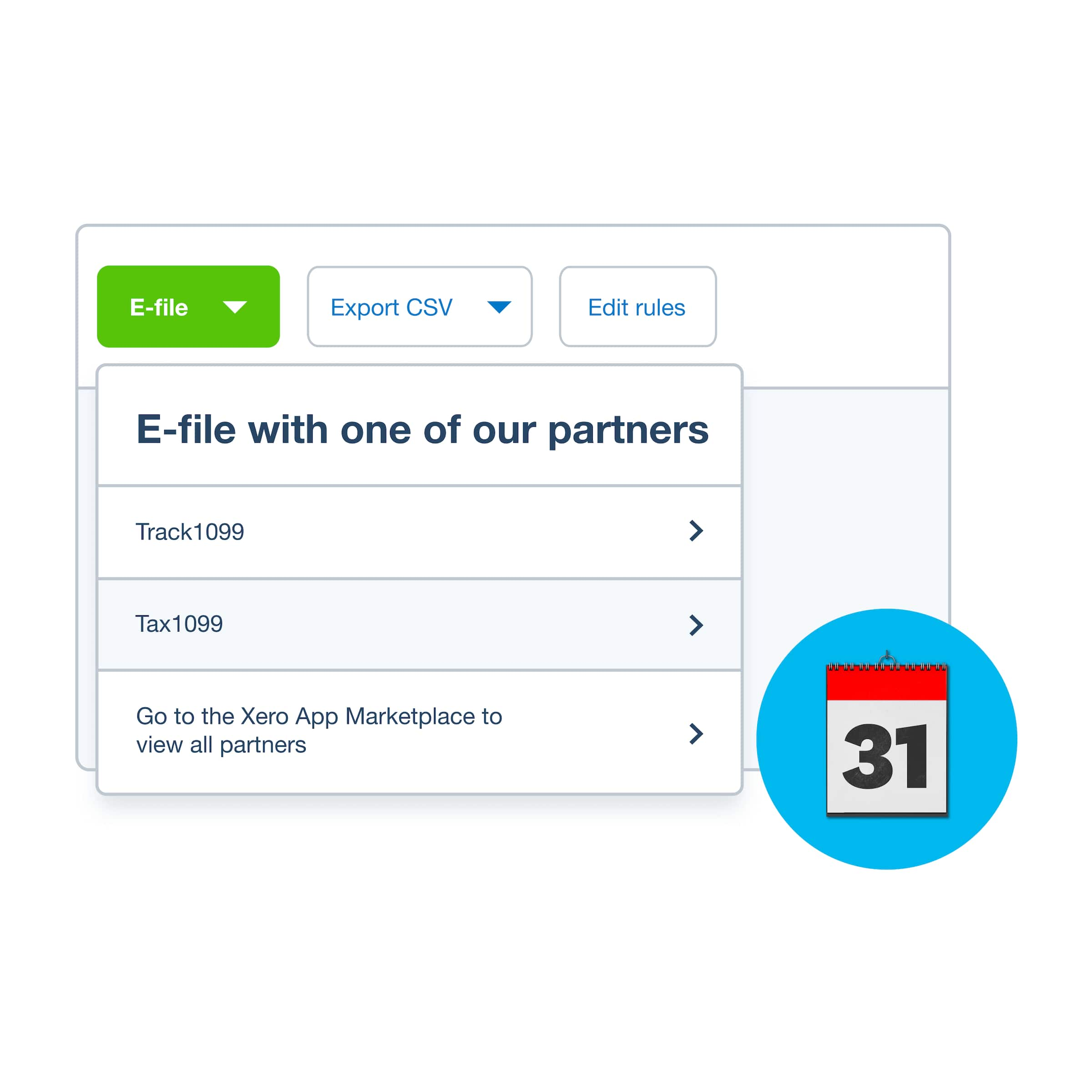

Complete and file 1099 forms

Use the friendly due-date reminders so forms are filed before IRS deadlines. Prepare and file 1099s through one of the 1099 apps that connects to Xero, or export your reports as CSV files.

More about filing 1099s

Xero excludes transactions under the $600 payment threshold and credit card transactions. You can also manually exclude other transactions such as payments by debit card or third-party processors. You can still see excluded transactions in the 1099 report.

Xero excludes transactions under the $600 payment threshold and credit card transactions. You can also manually exclude other transactions such as payments by debit card or third-party processors. You can still see excluded transactions in the 1099 report.

1099-NEC is an IRS form for reporting payments made to non-employees such as independent contractors who’ve provided a service during the tax year. Find out more in the Xero guide to 1099-NECs.

Learn more about the 1099-NEC form1099-NEC is an IRS form for reporting payments made to non-employees such as independent contractors who’ve provided a service during the tax year. Find out more in the Xero guide to 1099-NECs.

Learn more about the 1099-NEC formFor detailed instructions on completing 1099s in Xero, please visit Xero Central.

Learn more about 1099 in XeroFor detailed instructions on completing 1099s in Xero, please visit Xero Central.

Learn more about 1099 in XeroTo pay vendors, create a bill or a spend money transaction, or submit a company expense claim as normal. Xero includes expenses paid via the Xero expenses feature in 1099 reports.

See how to pay 1099 contractor expensesTo pay vendors, create a bill or a spend money transaction, or submit a company expense claim as normal. Xero includes expenses paid via the Xero expenses feature in 1099 reports.

See how to pay 1099 contractor expenses

Get one month free

Purchase any Xero plan, and we will give you the first month free.