Margin of safety formula: How to calculate your financial buffer

Learn how to use the margin of safety formula to protect profit, set sales targets, and make better pricing decisions.

Written by Shaun Quarton—Accounting & Finance Content Writer and Growth Marketer. Read Shaun's full bio

Published Friday 16 January 2026

Table of contents

Key takeaways

- Calculate your margin of safety by subtracting your break-even sales from current sales, then dividing by current sales to get a percentage that shows how far sales can drop before you start losing money.

- Aim for a margin of safety of 20% or higher to maintain a healthy financial buffer, as anything below 10% indicates high risk and limited flexibility to handle market changes or cost increases.

- Use your margin of safety percentage to make informed decisions about pricing strategies, cost control measures, and sales targets by understanding exactly how much room you have before reaching break-even.

- Monitor your margin of safety regularly through monthly or quarterly calculations, especially when experiencing significant business changes like price adjustments, new expenses, or shifting sales patterns.

What is the margin of safety?

Margin of safety is the percentage by which your current sales exceed your break-even point. It measures how far sales can drop before your business starts losing money.

This financial buffer protects against demand drops or cost increases. A wider margin provides better protection for your business.

The importance of the margin of safety for your small business

Margin of safety importance lies in measuring your business's financial risk tolerance. It shows exactly how much sales can drop before you start losing money.

Your margin of safety level determines your risk exposure:

- High margin of safety: low risk, as your business can absorb market shifts without disruption

- Low margin of safety: higher risk, because you are operating close to break-even with less flexibility

Consider how an external shock (like a jump in supplier prices) would affect your business. This increase in variable costs pushes up your break-even point, eating into your margin of safety and leaving your business exposed to further cost increases or falling sales.

Your margin of safety also supports smarter financial decisions across your business. See the section below on how the margin of safety supports your small business decisions.

What is the margin of safety formula?

The margin of safety formula calculates the percentage buffer between your current sales and break-even point:

(Current sales - break-even sales) ÷ current sales = Margin of safety

Here's what each component means:

- Current sales: Your business's total revenue from selling goods and services over a specific period

- Break-even sales: The exact revenue amount needed to cover all fixed and variable costs where your business makes zero profit or loss

Here's a quick margin of safety example. Let's say a business has current sales of $50,000 and needs $30,000 in sales to break even.

Margin of safety = ($50,000 – $30,000) / $50,000 = 0.4 (40%)

This means the business's sales could drop by 40% before it hits its break-even point. Any further sales drop would result in a loss.

The margin of safety calculation is set out in more detail below.

How to calculate margin of safety

Calculating your margin of safety involves three straightforward steps that give you a clear percentage showing your financial buffer. Here's how to work through each step:

1. Find your current sales

Step one requires identifying your current sales, either actual figures or forecasted amounts.

You can find current sales figures in your existing sales tools. Forecasting your sales takes some analysis and planning.

- Historical data: Analyze past sales trends and seasonal patterns from your POS system, eCommerce platform, or accounting software like Xero

- Market research: Study your target market, industry trends, and competitor performance

- Qualitative forecasting: Gather insights from your sales team or industry experts

- Quantitative forecasting: Use statistical methods to analyze historical and market data for accurate predictions

The best approach for you depends on your business type and the data available to you. For example, a craft business uses a point-of-sale (POS) system to track monthly sales. Last month, sales were $5,000. This figure is used in future steps of the margin of safety calculation.

2: Calculate your break-even sales revenue point

Step two calculates your break-even sales revenue, the exact dollar amount needed to cover all business costs.

Use this formula to find your break-even sales revenue:

Fixed costs ÷ ((Sales price – Variable cost) ÷ Sales price) = Break-even sales

The formula components include:

- Fixed costs: Expenses that remain constant regardless of sales volume (salaries, rent, insurance)

- Variable costs: Expenses that change with sales volume (raw materials, sales commissions, shipping)

Here's more info on variable costs and how they differ from fixed costs. Your accountant can also help you distinguish between them.

To demonstrate, let's say the craft business has:

- Fixed costs of $2,000

- Variable costs of $5 per unit

- A sales price of $25 per unit

Therefore:

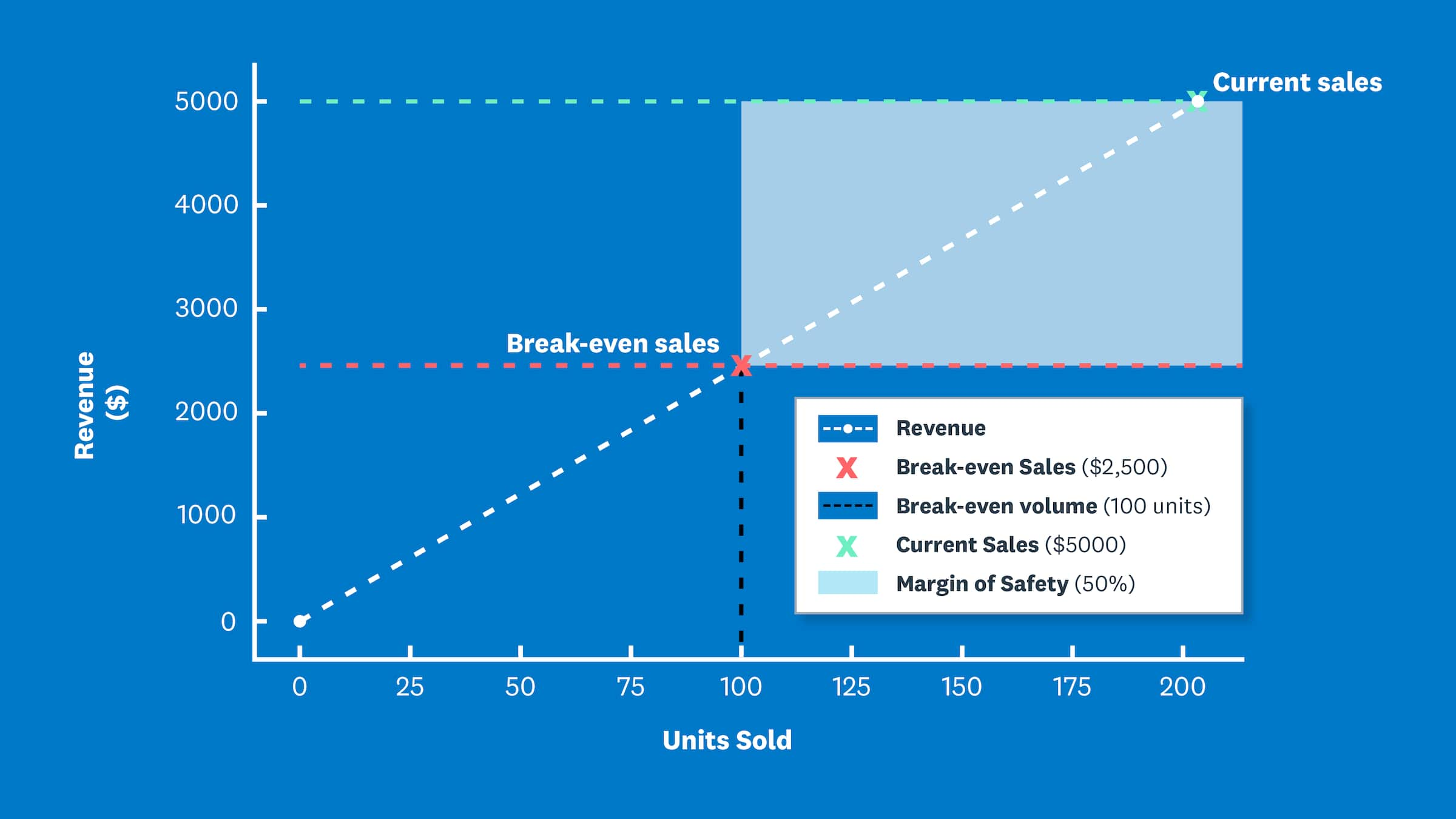

2,000 ÷ ((25 – 5) ÷ 25) = Break-even sales revenue = 2,000 ÷ (20 ÷ 25) = 2,000 ÷ 0.8 = $2,500

So with a sales price of $25, you need revenue of $2,500 (100 sales units) to break even.

Learn more about your break-even point.

3: Apply the margin of safety formula

Step three applies the margin of safety formula to calculate your financial buffer percentage:

(Current sales – Break-even sales) ÷ Current sales = Margin of safety

The result shows the exact percentage your sales can drop before your business starts losing money.

Let's apply the formula to the craft business example, where current sales are $5,000 and the break-even point for sales revenue is $2,500:

($5,000 – $2,500) ÷ $5,000 = Margin of safety = 2,500 ÷ 5,000 = 0.5 = 50%

The craft business has a 50% margin of safety, meaning sales could fall by half before they reach the break-even point.

What is a good margin of safety percentage?

While there's no single magic number, a higher margin of safety is always better because it means your business has a larger cushion to absorb unexpected challenges.

Many businesses aim for a margin of safety of 20% or more. A percentage in this range generally indicates a healthy buffer between your sales and your break-even point. However, what's considered 'good' can vary by industry and business model.

A margin of safety below 10% means you have very little room for sales to fall before you start making a loss. If your margin is low, it might be time to look at your pricing, costs, or sales strategy.

How the margin of safety supports your business decisions

Margin of safety supports critical business decisions across four key areas:

- Performance targets: Calculate clear break-even points to set achievable sales targets that maintain profitability

- Pricing strategy: Monitor shrinking margins to adjust pricing so each sale covers costs adequately

- Cost control: Identify when low margins signal the need to reduce expenses and protect your financial buffer

- Product evaluation: Assess how new product costs impact your margin of safety before launching

Other metrics work with the margin of safety in your accounting analysis

Margin of safety works best when combined with other financial metrics to provide comprehensive business insights.

CVP analysis, a topic significant enough to be included in courses that grant professional education credits, paired with margin of safety gives you a complete view of profitability and risk. Together, these metrics guide planning decisions more effectively than using margin of safety alone.

Master your margin of safety with Xero

Manual margin of safety calculations waste time tracking figures, updating spreadsheets, and piecing together reports.

Xero automates your margin of safety calculations by providing instant access to financial data. You get faster calculations and confident decision-making without manual spreadsheet work.

Get one month free and streamline your financial analysis today.

FAQs on margin of safety

Still have questions about your margin of safety? Here are answers to some common queries.

How often should I calculate my margin of safety?

It's a good practice to calculate your margin of safety regularly, such as monthly or quarterly. You should also recalculate it anytime there's a significant change in your business, like a price increase, a new major expense, or a shift in sales trends.

What if my margin of safety is negative?

A negative margin of safety means your current sales are below your break-even point, and your business is operating at a loss. This is a critical signal to take immediate action, such as finding ways to increase sales or reduce costs.

Can my margin of safety be too high?

While a high margin of safety is a sign of financial health, an extremely high margin could suggest you're being too conservative. It might indicate missed opportunities for growth, such as reinvesting profits into marketing, product development, or expanding your team.

How does seasonality affect my margin of safety?

For seasonal businesses, the margin of safety will naturally fluctuate. It will be higher during peak seasons and lower during off-seasons. Calculating it for different periods helps you understand your financial risk throughout the year and plan accordingly for slower months.

Disclaimer

Xero does not provide accounting, tax, business or legal advice. This guide has been provided for information purposes only. You should consult your own professional advisors for advice directly relating to your business or before taking action in relation to any of the content provided.

Get one month free

Sign up to any Xero plan, and we will give you the first month free.