Profit margin formula: How to calculate and improve your margins

Profit margin shows how much money your business keeps from each sale. Learn the profit margin formula and how to calculate it.

Written by Jotika Teli—Certified Public Accountant with 24 years of experience. Read Jotika's full bio

Published Friday 7 November 2025

Table of contents

Key takeaways

• Calculate your profit margins using three key formulas: gross profit margin (revenue minus cost of goods sold divided by revenue), operating profit margin (operating income divided by revenue), and net profit margin (net income divided by revenue), then multiply each by 100 to get percentages.

• Track your profit margin trends over time to identify whether your business financial health is improving or declining, and compare your margins against industry benchmarks to assess competitive performance.

• Increase your profit margins by focusing on three strategic areas: reducing operational costs through expense reviews, improving efficiency through better customer service and staff training, and optimizing pricing with dynamic strategies that match market demand.

• Use profit margin data to make informed business decisions by directing resources toward high-margin products and services, adjusting prices for low-margin items, and investing in the most profitable areas for sustainable growth.

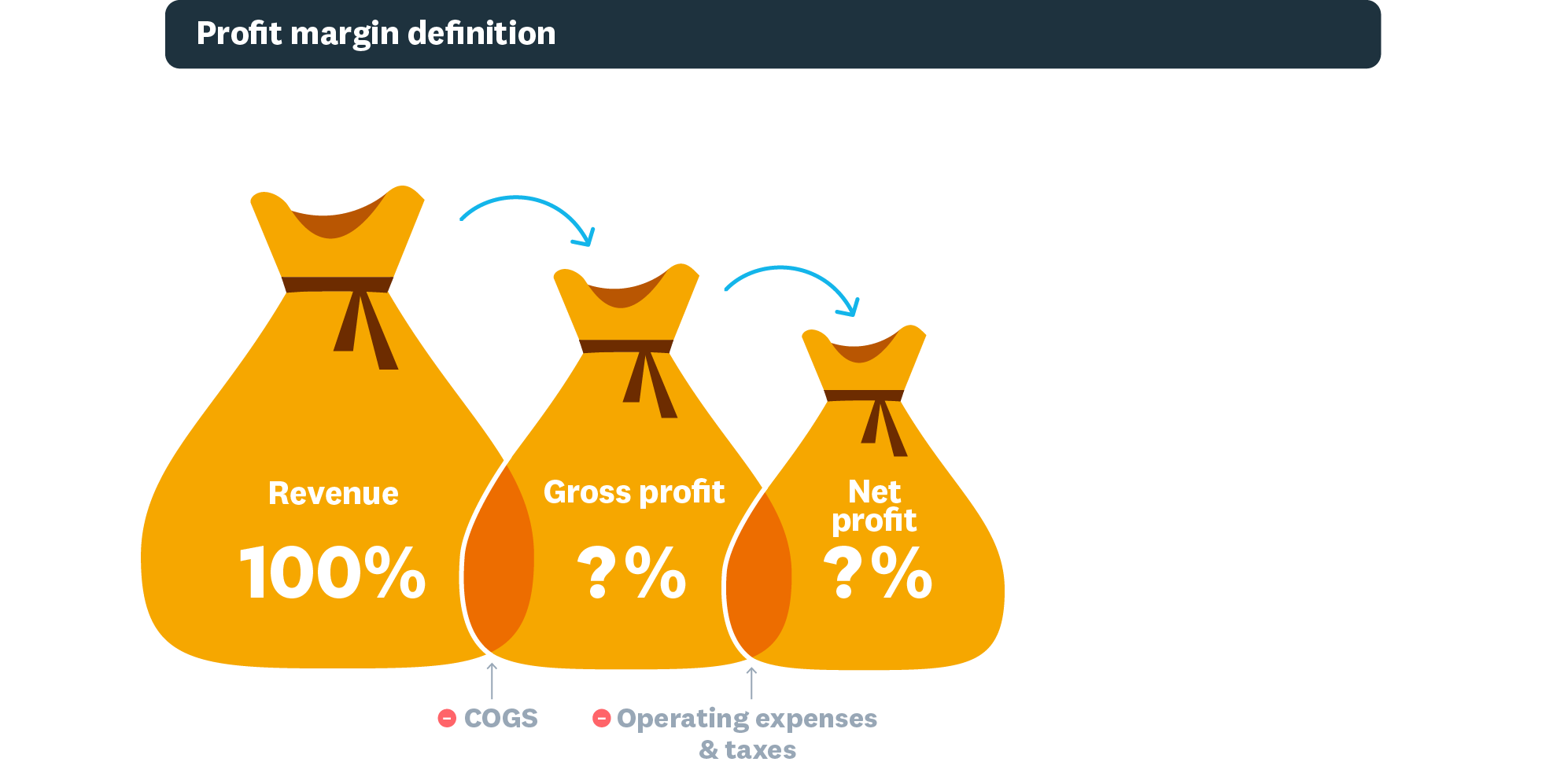

What is a profit margin?

Profit margin is the percentage of revenue remaining after subtracting all business expenses from total revenue. This metric shows how much profit your business generates for every dollar of sales.

A strong profit margin shows your business is financially healthy and helps you understand your performance:

- Generate enough revenue to cover all expenses

- Identify which areas of your business are most profitable

- Pinpoint where reducing expenses will have the greatest impact

Profit margins vs net profit

Net profit is the dollar amount left after paying all expenses. Profit margin converts this into a percentage of total revenue.

For example: If you earn $100,000 and have $20,000 left after expenses, your net profit is $20,000 and your profit margin is 20%.

Profit margin formula

The profit margin formula is a simple way to measure your business's profitability. It shows you how much profit you make for every dollar of revenue.

The basic formula is:

Profit Margin = (Net Income / Revenue) x 100

To use this formula, you divide your net income by your revenue and then multiply the result by 100 to get a percentage. This percentage tells you how many cents of profit the business has generated for each dollar of sale.

Types of profit margins

The three main profit margin types measure different aspects of your business profitability:

Gross profit margin measures profitability after direct costs:

- What it shows: Revenue remaining after paying for goods and services sold

- Formula: (Revenue - Cost of Goods Sold) ÷ Revenue × 100

- Use it for: Setting pricing and identifying production efficiencies

Operating profit margin measures core business profitability, as seen in financial reports where a company like Hewlett Packard Enterprise reported a 23.6% operating profit margin for its Intelligent Edge business segment.

- What it shows: Profit from regular operations before taxes and interest

- Formula: Operating Income ÷ Revenue × 100

- Use it for: Evaluating operational efficiency and attracting investors

Net profit margin measures overall business profitability:

- What it shows: Final profit after all expenses, taxes, and costs

- Formula: Net Income ÷ Revenue × 100

- Use it for: Assessing total financial health and business sustainability

Here's more info about net profit margin

How to calculate profit margins

The basic profit margin formula is:

Profit Margin = (Profit ÷ Revenue) × 100

This calculation converts your profit into a percentage, making it easier to compare performance across different time periods or benchmark against competitors.

Gross profit margin calculation

Let's say your business makes $20,000 by cleaning offices. It costs you $8,000 to provide those services, so your gross profit is $12,000.

Therefore:

$12,000 / $20,000 x 100 = 60% gross profit margin

Try our gross profit margin calculator.

Net profit margin calculation

You also pay $4,000 in taxes, so your net profit is $8,000.

Therefore:

$8,000 / $20,000 x 100 = 40% net profit margin

Try our net profit margin calculator.

Operating profit margin calculation

You spend another $3,000 on operating expenses, so your operating profit is $5,000.

Therefore:

$5,000 / $20,000 x 100 = 25% operating profit margin

Why do profit margins matter?

Profit margins show your business's financial health by comparing your income to your expenses. They help you make decisions about pricing, controlling costs, and budgeting. When you need funding, banks and investors will review your margins before making a decision.

What is a good profit margin?

A good profit margin varies by industry and business model. Here are typical ranges:

By industry:

- Retail: 2-6% net margin

- Restaurants: 3-9% net margin

- Software/Tech: 15-25% net margin

- Professional services: 10-20% net margin

By margin type:

- Gross margin: Typically 20-80% depending on industry

- Operating margin: Usually 5-20% for healthy businesses

- Net margin: Generally 5-15% indicates good performance

Benefits of high profit margins for growth

High profit margins typically mean a business:

- Is financially healthy, making it easier to attract investment

- Has room to reinvest in its own growth

- Has more space to innovate – for example, by changing pricing strategies to find a competitive edge

Review your business's performance to find trends and opportunities. Benchmark your business against competitors to see if you're in a strong position.

Do high profit margins guarantee growth?

While healthy margins support growth, they do not always increase as your business grows. Sustainable growth helps you maintain strong profit margins, even as your business expands. Consider your profit margins when making strategic business decisions.

Factors affecting profit margins

Profit margins can change due to market conditions or business strategy decisions. For example, some companies report lower gross margins compared to the previous year. Industries like retail and hospitality have higher overheads, so their profit margins are usually tighter than those of business consultancies.

Economic changes can affect profit margins. Inflation and high interest rates can increase your costs. If you have business loans, higher interest rates may reduce your profit margins.

Your location affects the rent and taxes your business pays. Include these costs when you assess your profit margins and set your pricing strategies.

How to increase your profit margins

Increasing profit margins requires focusing on three key areas: reducing costs, improving efficiency, and optimizing pricing.

1. Control your costs

Reduce operational expenses by reviewing subscriptions and removing items you no longer need. Manage labor costs to keep spending under control.

2. Make your operations more efficient

Increase your operational efficiency by delivering great customer service. Encourage your team to innovate. Invest in staff training so everyone performs at their best.

3. Adjust your pricing

Having a strong pricing strategy that suits your industry and consumer base helps maximize your revenue and, therefore, boost your margins. Think about:

- Dynamic pricing where you adjust prices to fit demand and seasonal changes

- Premium packages and bundles can increase revenue.

Learn from high-profit-margin businesses

Some industries have higher profit margins. Strong value propositions, efficient operations, and customer loyalty help increase margins.

Industries with high profit margins

Sectors like luxury goods, software, and technology often have high profit margins. Some business models, such as online businesses, also achieve healthy profit margins. For example, tech-focused segments with growing Hybrid Cloud revenue can see significant margin growth. One report showed an increase from 1.0 percent to 5.4 percent year over year.

Tips for maintaining high profit margins

You can raise your profit margins even if you are not in a high-profit sector or cannot change your business model. Many high-profit businesses use these strategies.

- Communicate a strong value proposition to your customers

- Streamline your operations to use resources efficiently and reduce unnecessary costs

- Build customer loyalty with strong products, excellent service, and marketing such as loyalty programs

Analyze your profit margins for better business decisions

Use profit margin data to make strategic business decisions:

- Optimize pricing: Identify high-margin products to focus on and low-margin items that need price adjustments

- Allocate resources: Direct investment toward products and services with the highest profit margins

- Guide expansion: Invest in the most profitable areas of your business for sustainable growth

What profit margin trends reveal

Profit margin trends show how your profit margins change over time. They can indicate your business's financial health and operational efficiency.

A steady increase in profit margins shows your business's financial health is improving. A decline may mean the opposite. For example, one of Hewlett Packard Enterprise's business segments saw its operating profit margin fall to 5.9 percent, compared to 11.0 percent in the previous year, even as revenue increased.

No single number defines a 'good' profit margin. Compare your profit margin trends with competitors to see how your business is performing in the market.

Track your profit margins with confidence

Understanding and tracking your profit margins is key to making smart business decisions and driving growth. With a clear view of your profitability, you can price your products effectively, control costs, and invest in the right areas.

With Xero, you get real-time insights into your financial health. It's easy to monitor your margins and stay on top of your numbers. See how your business is performing and take control of your finances.

Get one month free to see how Xero can help you run your business with confidence.

FAQs on profit margin formulas

Here are common questions small business owners might have about profit margins.

How do you calculate the profit margin?

To calculate profit margin, divide your net income (revenue minus expenses) by your revenue. Then multiply the result by 100. This gives you a percentage that shows your profitability.

What does a 30% profit margin mean?

A 30 percent profit margin means you keep 30 cents as profit for every dollar of revenue after paying all expenses. The remaining 70 cents covers your business costs.

How do I calculate a 20% profit margin?

To get a 20 percent profit margin, your net profit must be 20 percent of your total revenue. For example, if your business generates $100,000 in revenue, you need a net profit of $20,000 to achieve a 20 percent profit margin ($20,000 / $100,000 × 100 = 20 percent).

What is an ideal profit margin for small businesses?

An ideal profit margin varies by industry. As a general benchmark, 10 percent is healthy, 20 percent is high, and 5 percent is low. Compare your margin to other businesses in your industry for a more accurate sense of performance.

Disclaimer

Xero does not provide accounting, tax, business or legal advice. This guide has been provided for information purposes only. You should consult your own professional advisors for advice directly relating to your business or before taking action in relation to any of the content provided.