Pro forma invoice: What it is, how it works and when to use one

Learn how a pro forma invoice speeds up quotes, sets clear expectations, and helps you get paid faster.

Written by Jotika Teli—Certified Public Accountant with 24 years of experience. Read Jotika's full bio

Published Tuesday 18 November 2025

Table of contents

Key takeaways

• Use pro forma invoices to confirm pricing and transaction details with customers before finalizing sales, particularly for large purchases requiring financing approval, international shipments needing customs documentation, or procurement processes requiring formal cost estimates.

• Label documents clearly as "Pro forma invoice" and avoid recording them in your accounts receivable ledger since they do not represent completed sales or create legal payment obligations.

• Include essential elements such as buyer and seller details, product descriptions with quantities and prices, terms of sale, and a reference number for tracking, plus additional shipping information for international transactions.

• Wait to issue final sales invoices and record tax obligations only after receiving customer confirmation and completing the actual sale, as pro forma invoices are not tax documents for GST purposes.

What is a pro forma invoice?

A pro forma invoice is a preliminary document sent to buyers before completing a sale. It outlines products, services, and pricing without requesting payment.

Unlike regular invoices, pro forma invoices:

- Do not request payment or create legal payment obligations

- Do not have an invoice number or due date

- Are not recorded in your accounting books as accounts receivable

A pro forma invoice confirms the price and details before you complete a sale.

Three common reasons for issuing a pro forma invoice

Three common reasons for issuing a pro forma invoice

- Arrange financing before making large purchases

- Clear goods through customs for international shipments

- Get procurement approval with more definitive pricing information

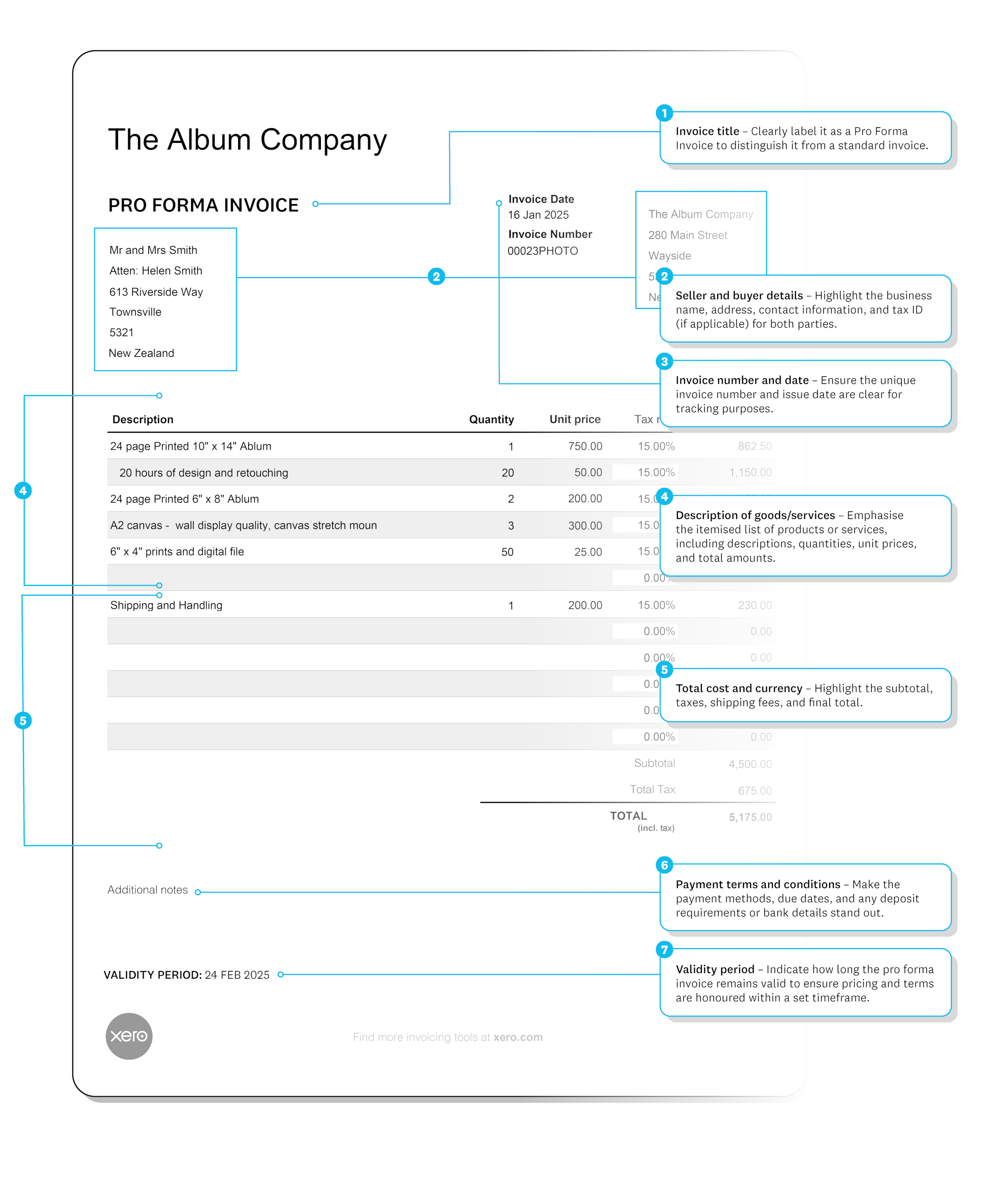

What should a pro forma invoice look like?

A pro forma invoice gives detailed transaction information in a familiar invoice format, but makes it clear it's not a payment request.

Essential elements include

- clear labelling as "Pro forma invoice"

- buyer and seller details (names, addresses, contact information)

- product or service descriptions with quantities and prices

- terms of sale and payment conditions

- reference number for easy tracking (not an official invoice number)

- Clear labeling as "Pro forma invoice"

- Buyer and seller details (names, addresses, contact information)

- Product or service descriptions with quantities and prices

- Terms of sale and payment conditions

- Reference number for easy tracking (not an official invoice number)

For international shipments, also include

- product weights and dimensions

- shipping costs and methods

- country of origin details

- Product weights and dimensions

- Shipping costs and methods

- Country of origin details

How is a pro forma invoice different from other invoices (and quotes)?

Pro forma invoices serve a different purpose from other business documents, though they're often confused with similar paperwork.

Key differences

enough information to determine the following seven details

- Commercial invoice:A commercial invoice is a special sort of sales invoice exchanged between importers and exporters. It includes extra information about the responsibilities of the buyer and seller, and may also identify tariffs that apply to the shipment. A pro forma invoice is also used in shipping, as the details on it can help estimate customs duties and fees, but that's where the similarities end. As a form of sales invoice, a commercial invoice indicates a sale is final while a pro forma invoice doesn't. Quotes and pro forma invoices both help you agree on prices. However, you usually send a pro forma invoice after you agree to the deal, to support tasks with customs, lenders or procurement.

A pro forma invoice isn't a tax invoice

Pro forma invoices are not tax documents for GST purposes because you have not made a sale yet.

Important GST considerations:

- Wait to record tax liability until you issue the final sales invoice

- Include estimated GST amounts for planning, but make sure the final tax invoice shows the exact GST amount

- Record tax obligations only on actual sales invoices if you are GST-registered

- Provide a tax invoice within 28 days if a customer requests one, unless the sale is for $82.50 (including GST) or less.

When to send a pro forma invoice

Send pro forma invoices primarily when customers request them, typically after agreeing on terms but before finalising the sale.

Common timing scenarios

- Send after both parties accept a quote

- Use for import or export transactions that need customs documentation

- Provide during procurement processes that require formal cost documentation

Important timing considerations

- Confirm the sale is not final at this stage

- Get explicit approval before shipping products or processing payment

- Issue the final sales invoice only after you receive customer confirmation

How to create a pro forma invoice

To create a pro forma invoice, use your standard invoice template and make a few changes to avoid accounting issues.

Step-by-step process

- Use your standard invoice template and complete all required fields

- Label clearly as "Pro forma invoice" to avoid payment confusion

- Don't record in your accounts receivable ledger (no sale has occurred)

- Check your accounting software for pro forma invoice features to avoid accidentally creating a sales invoice

If you issue a sales invoice by mistake instead of a pro forma invoice, you may record unearned income and create tax and reporting issues. New rules for disclosing material accounting policies may also affect you.

Managing pro forma invoices with the right tools

You need to track your pro forma invoices, convert them to final sales invoices when the deal is confirmed, and keep them separate from your official accounting records. The right tools help you do this easily.

With Xero, you can create a pro forma invoice from a quote, send it to your customer, and convert it to a tax invoice when you are ready to bill. This saves you time, reduces errors, and keeps your records accurate. Try Xero for free.

Frequently asked questions about pro forma invoices

Is a pro forma invoice legally binding?

Pro forma invoices are not legally binding like an invoice. You create a pro forma invoice before you deliver your products and services. It's a good-faith agreement.

Can a pro forma invoice be canceled?

Pro forma invoices are not legal documents nor are they official invoices used for accounting purposes. If the sale isn't complete, there's no need for you to edit or cancel the invoice.

Can you turn pro forma invoices into commercial invoices?

No, you cannot turn pro forma invoices into commercial invoices. Although they contain similar information, a commercial invoice also includes terms from the Uniform Commercial Code (UCC) with details of the rules and regulations of the sale to the import broker, freight forwarder, marine insurance company, and the buyer's and seller's banks.

How can a pro forma invoice help you?

Certain types of customers, such as importers, may require a pro forma invoice. Being able to produce them will therefore help you do business with them.

Is it OK to pay a pro forma invoice?

You should not pay a pro forma invoice because it is not a binding agreement and the price may still change. Wait until you receive an official sales invoice.

What are the advantages of pro forma invoices?

The three main advantages of the pro forma invoice are that:

- they ensure both the buyer and seller are on the same page

- they can assist businesses to provide necessary information to get through customs

- you can easily make changes to the products, services and costs listed without having to edit your business accounts

Disclaimer

Xero does not provide accounting, tax, business or legal advice. This guide has been provided for information purposes only. You should consult your own professional advisors for advice directly relating to your business or before taking action in relation to any of the content provided.

Related content

What is an invoice?

Get the lowdown on invoices.

How to send an invoice

Find out when and how to send an invoice.

How to make an invoice

Let’s walk through the process of making an invoice.

Disclaimer

Xero does not provide accounting, tax, business or legal advice. This guide has been provided for information purposes only. You should consult your own professional advisors for advice directly relating to your business or before taking action in relation to any of the content provided.

Start using Xero for free

Access Xero features for 30 days, then decide which plan best suits your business.