How to make an invoice that's taken seriously

You’ve done the work; now it’s time to get paid. Let’s walk through the process of making an invoice.

Published Tuesday 24 August 2021

Before making an invoice

Before making and sending an invoice, check that your customer is expecting one. If your invoice comes out of nowhere, they may be slow to pay it, or even annoyed. It’s good etiquette to explain when you’ll be sending them. Ideally, you’ll set those expectations upfront, before starting work but if not, then at least tell them when an invoice is about to be sent.

What information goes on an invoice

You need to identify the buyer and seller, describe what’s being exchanged, and give the payment details. You may also be required to show if you collected GST on the sale.

How to make an invoice

Invoices are most commonly sent as a document (Microsoft Word or Google Docs), a spreadsheet, a PDF, or via specialised invoicing software. Whichever way you go, use a template and lock in details like your business name, bank details and payment terms so you don’t have to keep rewriting them on every invoice.

You can grab a free PDF invoice template from Xero. In the examples that follow we show the tax invoice but we’ll also send a non-tax invoice to use if you’re not registered for sales tax.

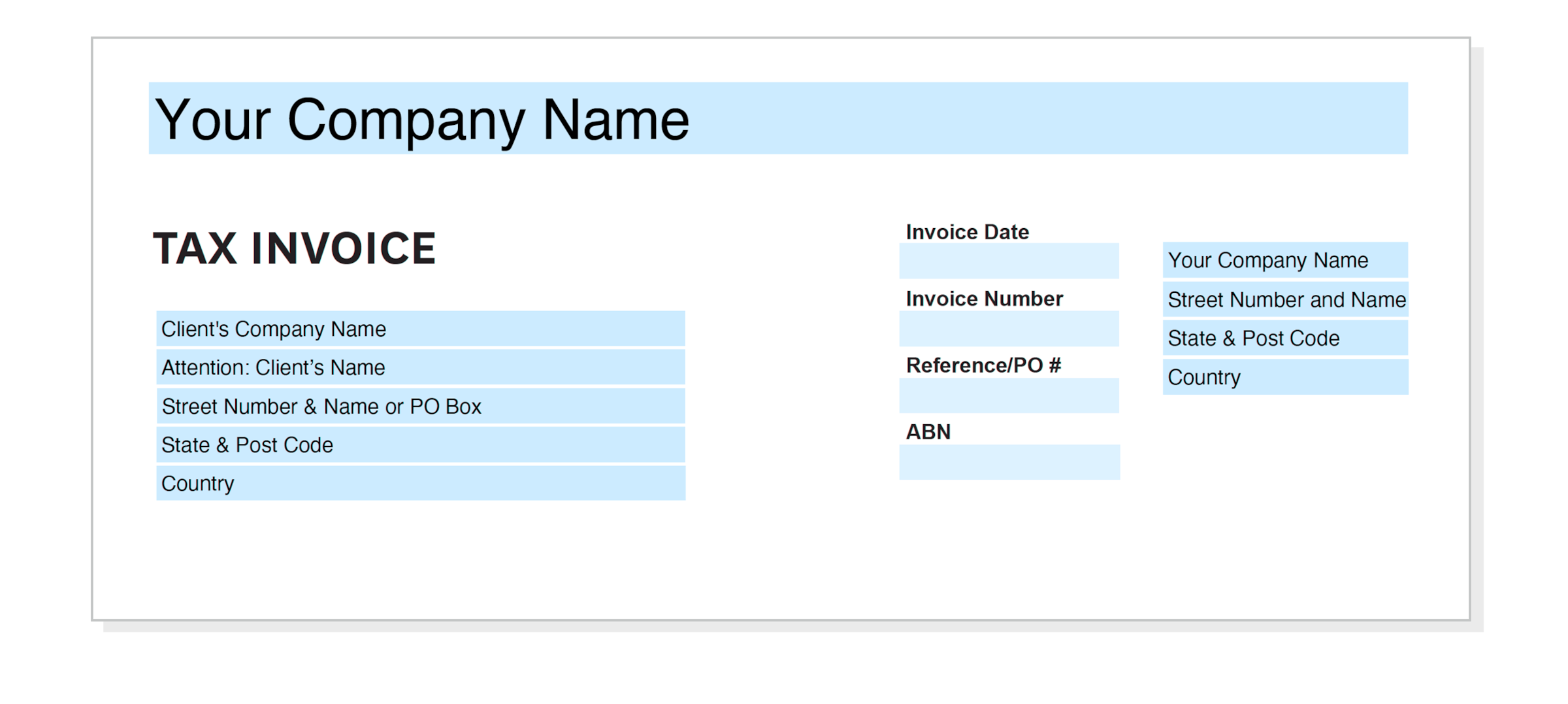

Anatomy of an invoice

There are three sections to keep in mind when making an invoice. Open your invoice template, save a copy for the job you want to bill, and work your way through them.

1. Identify the parties

- Include your business details (including tax number if you have one)

- Fill out the customer’s name and address

- Record the date you’re sending the invoice

- Create a unique invoice number (see below for more details)

- Add a job reference or purchase order (PO) number

- If adding tax, prominently label the invoice ‘Tax Invoice’

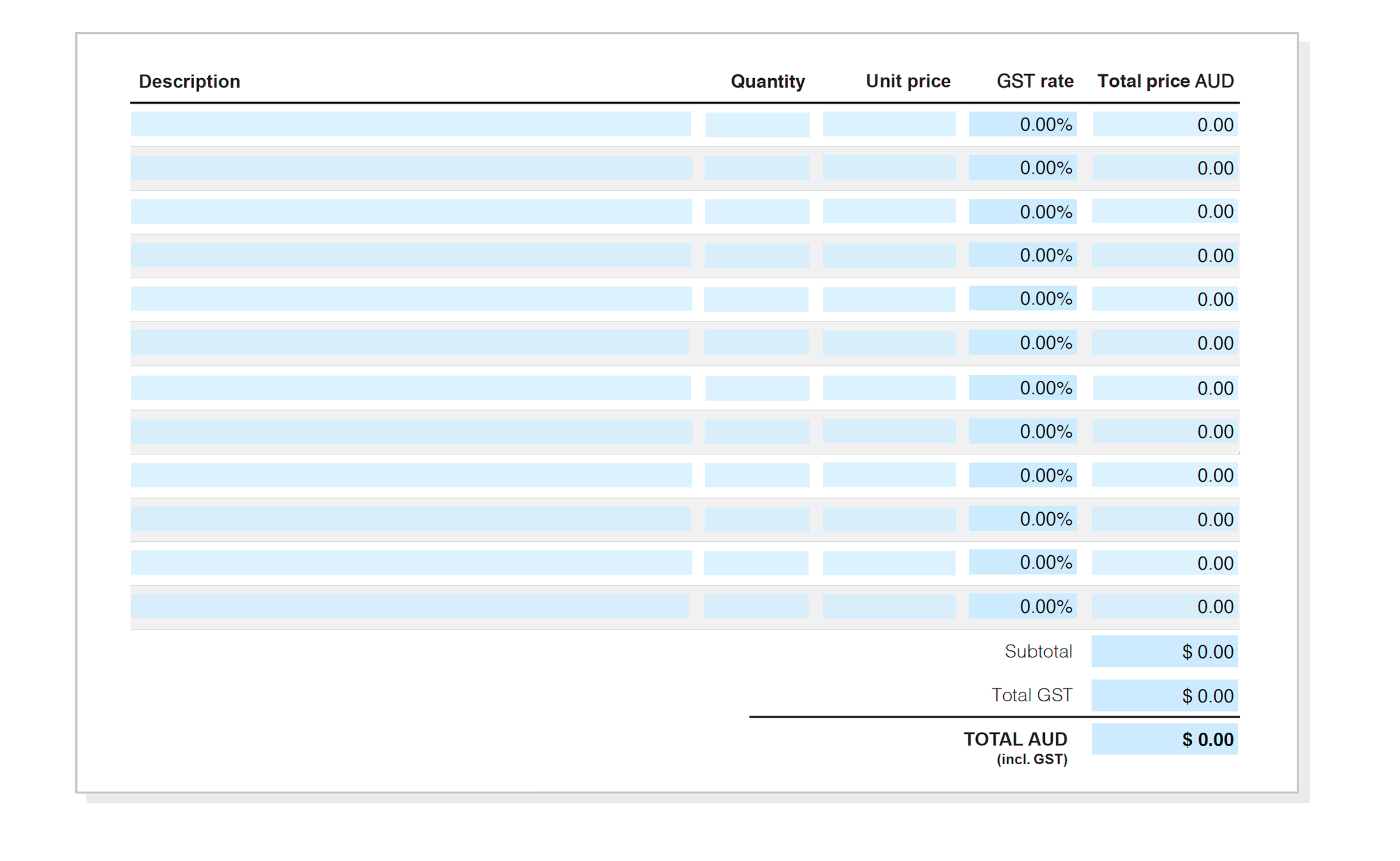

2. Describe what’s being exchanged

- Describe the goods or services provided using the same language as in your quote, if you provided one

- Display the quantities and costs of each item

- Add tax if you’re registered. Otherwise, leave the tax field blank or use our non-tax invoice template.

- Total the costs, showing how much is going to tax and the grand total

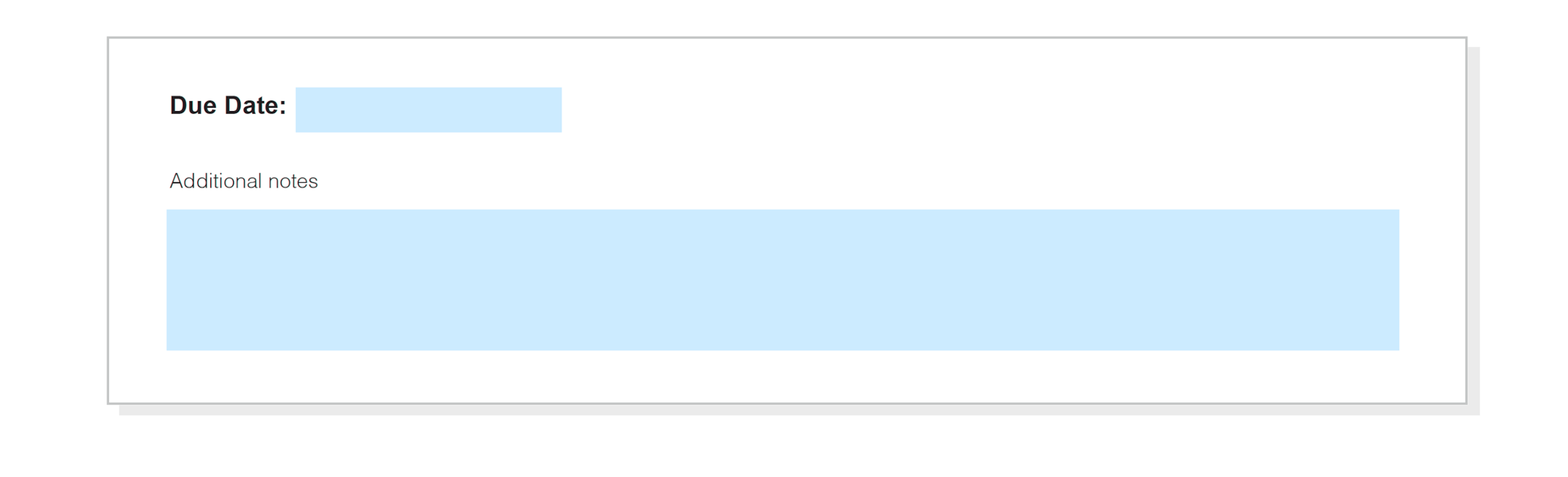

3. Give the payment details

- Add the due date

- Add details of any on-time discounts or late fees

- Explain how they can pay, eg, internet banking, credit card, Stripe or GoCardless, cash, cheque

- Include your bank account number or a link so customers can pay online

- Give a contact phone number or email so they can reach you with any queries

How to create an invoice number

You need to have a unique invoice number on every bill you send. This is to help you, the customer (and potentially tax auditors) to track down specific invoices.

An invoice number can be any string of numbers and letters. You can use different approaches to create an invoice number, such as:

- numbering your invoices sequentially, for example, INV00001, INV00002

- starting with a unique customer code, for example, XER00001

- including the date at the start of your invoice number, for example, 2023-01-001

- combining the customer code and date, for example, XER-2023-01-001

How much detail to include when making an invoice

Always provide a description of the goods or services supplied so the customer knows what they’re paying for. You want your invoices to be concise, but with enough detail that your customer doesn’t have to ask questions. Limit your invoice to a single page if possible.

If you need to provide a detailed record of the work done or a breakdown of the items used on the job, you can provide a summary on the invoice and add the details in an attachment.

Recap of tips for making invoices

- Include a unique invoice number

- Identify the customer and the supplier

- List all the products and services, with prices, and show the taxes charged if applicable

- Say when payment is due and tell them how to pay

- Provide your contact details for any questions

For business-to-business invoices, check you’ve used the legal name of the business. This may be different from the trading name that you’re familiar with. Ask if they need you to include a purchase order number on the invoice. And check where to send your invoice, too. It may not be the person who placed the order with you. It may need to go to an accounts payable department.

Using software to make your invoices

Online software can speed up invoice creation and help you collect payments.

Making invoices: Software includes dozens of templates to choose from. You can drag in your logo easily. Some software allows you to convert approved quotes into an invoice with the click of a button.

Tracking invoices: Online software tells you when your invoice has been opened by the customer and it can also match them with payment into your bank account to tell you when it’s paid.

Getting payments: Because it knows which invoices are unpaid, online software can automatically send reminder emails to customers. And it allows you to include a ‘Pay now’ button for instant payment by card or e-wallet.

Get the client, do the work, and invoice as soon as possible. Make the invoice so clear you get paid for it, no questions asked. The invoice should be your brand equity. The client should be in no doubt about the value-add you bring.

Lisa Martin, Xero gold partner, Go Fi8ure

Disclaimer

Xero does not provide accounting, tax, business or legal advice. This guide has been provided for information purposes only. You should consult your own professional advisors for advice directly relating to your business or before taking action in relation to any of the content provided.

How to invoice

Looking for help on making and sending invoices and getting them paid? Check out these tips on the art of invoicing.

- What is an invoice?

What exactly is an invoice? What does it do and what are the core building blocks that make one? Let’s take a look.

- How to make an invoice

You’ve done the work; now it’s time to get paid. Let’s walk through the process of making an invoice.

- How to send an invoice

How you send invoices can have a big impact on how quickly you’re paid. Let’s look at some of the basics.

- The invoicing process

Sending a bill is just one part of the invoicing process. Find out what else it takes to get paid.

Download the guide to invoicing

Learn how to create and send invoices that get opened, understood, and paid. Fill out the form to receive our invoicing guide as a PDF.

Now that you have your guide

Managing finances can feel overwhelming. With Xero’s powerful tools, small businesses can stay organised and confident.