Xero data reveals Aussie small business sales volatile in 2025, but ahead of other markets

Interest rate cuts yet to have sustainable impact on consumer spending

Melbourne — 31 July 2025 — Xero, the global small business platform, today released its latest Xero Small Business Insights (XSBI) update, revealing that small businesses are showing continued resilience despite a recent slowdown in sales growth and elevated global and economic uncertainty.

October 2024 - June 2025 at a glance:

- Sales growth averaged +3.0% y/y in the June quarter, down from +5.3% y/y in the March quarter and +4.5% y/y in the December 2024 quarter.

- Western Australia recorded the strongest sales (+4.6% y/y) in the June quarter, while the Australian Capital Territory (+1.0% y/y) recorded the weakest.

- Public administration was the best performing industry (7.9% y/y) in the June quarter, whereas education and training (-1.2% y/y) had the softest sales performance

Australian small business sales continue to outperform counterparts

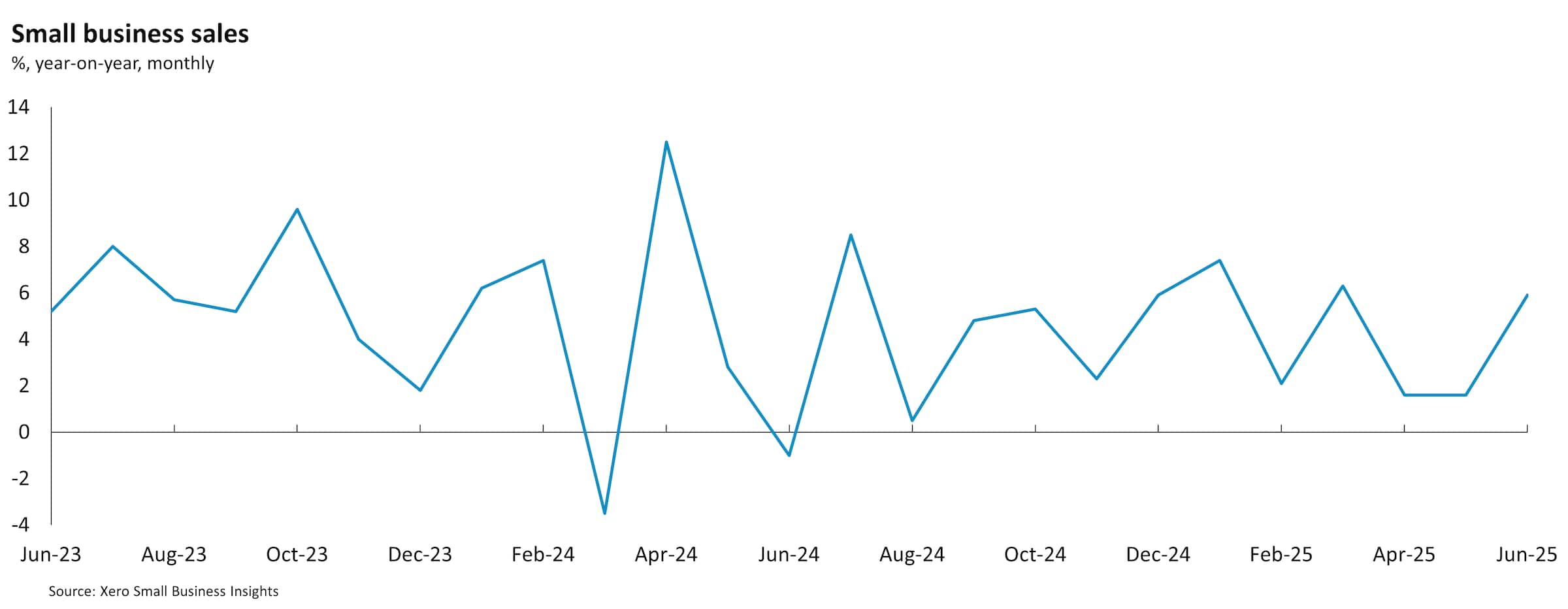

Following average sales growth of 4-5% year-on-year (y/y) in the second half of 2024 and in the first quarter of 2025, small business sales experienced a slowdown in the June 2025 quarter, growing 3.0% y/y. This result is the smallest quarterly growth in sales since 2020, and below the long-term average of this series (7.8% y/y). Despite the slowdown in sales, Australian small businesses continue to lead other markets tracked in this series, including New Zealand (-0.1% y/y) and the United Kingdom (+2.3% y/y), demonstrating their ongoing resilience despite challenging macroeconomic conditions.

Looking at sales throughout 2025, performance was volatile month-to-month. After a strong start to the year in January (+7.4% y/y), momentum slowed in February (+2.1% y/y), but experienced a sharp jump in March (+6.3% y/y). Sales were much softer in April and May (+1.6% y/y), before rising again (+5.9% y/y) in June. The strong rebound in March and June, the months immediately following The Reserve Bank of Australia’s (RBA) decision to cut the official interest rate, suggests consumer confidence improved and had a short-term positive impact on spending in these months.

“Despite slower growth than in previous quarters, it’s encouraging to see Australian small business sales continuing to rise. Yet, with growth still below the long-term average, it’s clear many businesses are operating in a challenging environment,” said Louise Southall, Xero Economist. “Easing inflation may pave the way for further rate cuts, which could help lift consumer spending and ease the pressure of loan repayments for small business owners. However, uncertainty remains, particularly as global trade tensions, including US tariffs and their flow-on effects in China, continue to pose potential risks.”

Western Australia remains a top performer, yet Victorian sales cool

All states and territories recorded a slowdown in sales growth in the June quarter compared to the two previous quarters. Western Australia remained the strongest performer, with sales growing +4.6% y/y. However, this was a marked slowdown from the March and December quarters, where sales grew +7.5% y/y and +7.4% y/y respectively, suggesting even the strongest performing states are feeling the effects of current economic uncertainty.

While Queensland (+4.2% y/y) and South Australia (+3.4% y/y) also recorded strong results in the June quarter, Victoria experienced cooling sales performance (+1.8% y/y). Sales growth in Tasmania (+1.4% y/y) and the Australian Capital Territory (+1.0% y/y) was also modest, well below the national average of +3.0% y/y.

Industries benefiting from government spending remain on top

At an industry level, small businesses in the public administration sector experienced strong sales, recording +7.9% y/y growth in the June quarter following double digit growth in the previous two quarters. Health care and social assistance was also particularly resilient, averaging +7-8% y/y for the past three quarters. The continued strength within these industries is likely tied to ongoing government investment, particularly due to increased demand for services like the National Disability Insurance Scheme (NDIS) and aged care.

In contrast, education (-1.2% y/y) recorded a fall in sales in the June quarter, likely due to the ongoing decline in international students attending tertiary education in Australia. Hospitality sales were also soft (+1.5% y/y) compared to the average +2.0% y/y growth seen in the two previous quarters, suggesting ongoing caution around discretionary spending. Agriculture (+1.9% y/y), manufacturing (+2.1% y/y), and transport (+2.2% y/y), industries typically exposed to global supply‑chain disruptions and trade volatility, all recorded sales growth below the national average.

Angad Soin, Managing Director ANZ & Global Chief Strategy Officer, Xero said: “Following months of economic uncertainty, it’s reassuring to see the underlying resilience of our small business sector. However, as most small business owners know, it’s important to consistently stay on top of cash flow and be ready to adapt to changing customer behavior. This will be key in the months ahead and can be as simple as offering flexible payment options or automating invoicing to help get paid faster. This can make a big difference in staying ahead. We know offering more ways to pay helps small businesses get paid faster.”

To find out more about how Xero Small Business Insights is constructed, see the methodology.

ENDS

Media Contact

Xero Australia | Jess Brophy | Director of Communications, ANZ | +61 431 268 549 | jess.brophy@xero.com

About Xero

Xero is a global small business platform that helps customers supercharge their business by bringing together the most important small business tools, including accounting, payroll and payments — on one platform. Xero’s powerful platform helps customers automate routine tasks, get timely insights, and connects them with their data, their apps, and their accountant or bookkeeper so they can focus on what really matters. Trusted by millions of small businesses and accountants and bookkeepers globally, Xero makes life better for people in small business, their advisors, and communities around the world. For further information, please visit xero.com.

Disclaimer

This media release includes and is in parts based on assumptions or estimates. It contains general information only and should not be taken as taxation, financial, investment or legal advice. Xero recommends that readers always obtain specific and detailed professional advice about any business decision. The insights in this release were created from the data that was available as at the date it was extracted. Data used was anonymised and aggregated to ensure individual businesses can not be identified.

Related media and inquiries

For all media inquiries, please contact the Xero media team.

- Media release

New Xero research reveals over half of Australians fear making a mistake on their tax return

73% of Australians report feeling worried or stressed at EOFY, with small business owners echoing this sentiment

- Media release

Xero and Sumday partner to support climate reporting demands with free carbon accounting tools

Small businesses can easily track their carbon footprint with 12 months free access

- Media release

Xero now offers Tap to Pay on iPhone for Australian small businesses with a Stripe account to accept contactless payments

An easy, secure and private way to accept contactless payments with an iPhone and the Xero Accounting iOS app

Get one month free

Sign up to any Xero plan, and we will give you the first month free.