How to get a California business license

Starting a business in California? Learn what licenses you need, how much they cost, and how to get started.

.1742870730063.png)

Written by Lena Hanna—Trusted CPA Guidance on Accounting and Tax. Read Lena's full bio

Published Wednesday 14 May 2025

Table of contents

Key takeaways

- California has many different types of business licenses. There’s no statewide business license in California, so most businesses get licenses from their local city or county authority. The requirements that apply to you therefore depend on where you are and your industry.

- Costs and renewal requirements vary – some areas charge annual fees, while others set fees based on your business’s revenue or number of employees.

- Business registration in California involves several steps. You need to register your business, identify permits you need, and make sure you're following state and local regulations.

- To prevent delays or penalties, avoid mistakes like missing deadlines, failing to check zoning laws, or submitting incomplete applications.

Why do I need a license to operate my California business?

Many Californian cities and counties impose fines and penalties – sometimes quite large ones – for unlicensed businesses. In some cases, authorities can even shut down your business until it complies with regulations.

Operating without a license can make it harder to get one later – some authorities frown on past violations when reviewing new applications. So make sure you have all licenses and permits you need before you open your door for business.

Types of business licenses in California

Registering for the right licenses is critical to ensure legal compliance and to avoid potential fines or disruptions to your operations. While some licenses are necessary for all businesses, others depend on your industry, location, and business activities.

There are many types of business licenses, but here are three more common ones to note:

General business licenses

A general business license is required for most businesses to operate legally within a city or county. Your local government (where your business is located) issues this license. Here’s more on getting a business license.

Seller’s permits

You’ll need one of these if you’re selling goods or services in retail or wholesale, or you’re conducting taxable sales. The California Department of Tax and Fee Administration (CDTFA) issues this permit.

Professional and industry-specific licenses

You’ll need certain state business permits to operate in professions with strict industry standards and consumer protection laws, such as transportation, cosmetology, law, healthcare, or construction. State agencies like the California Department of Consumer Affairs (DCA) and the Contractors State License Board (CSLB) issue these licenses.

You’ll have to renew most of these licenses annually or every two years. Some cities offer multi-year licenses or prorated fees if you register by a certain date.

Here’s more info from California’s government on registering for the right licenses. There are a few industries that require Federal licenses as well. The U.S. Small Business Administration provides more details on these specific industries not covered under state government regulations.

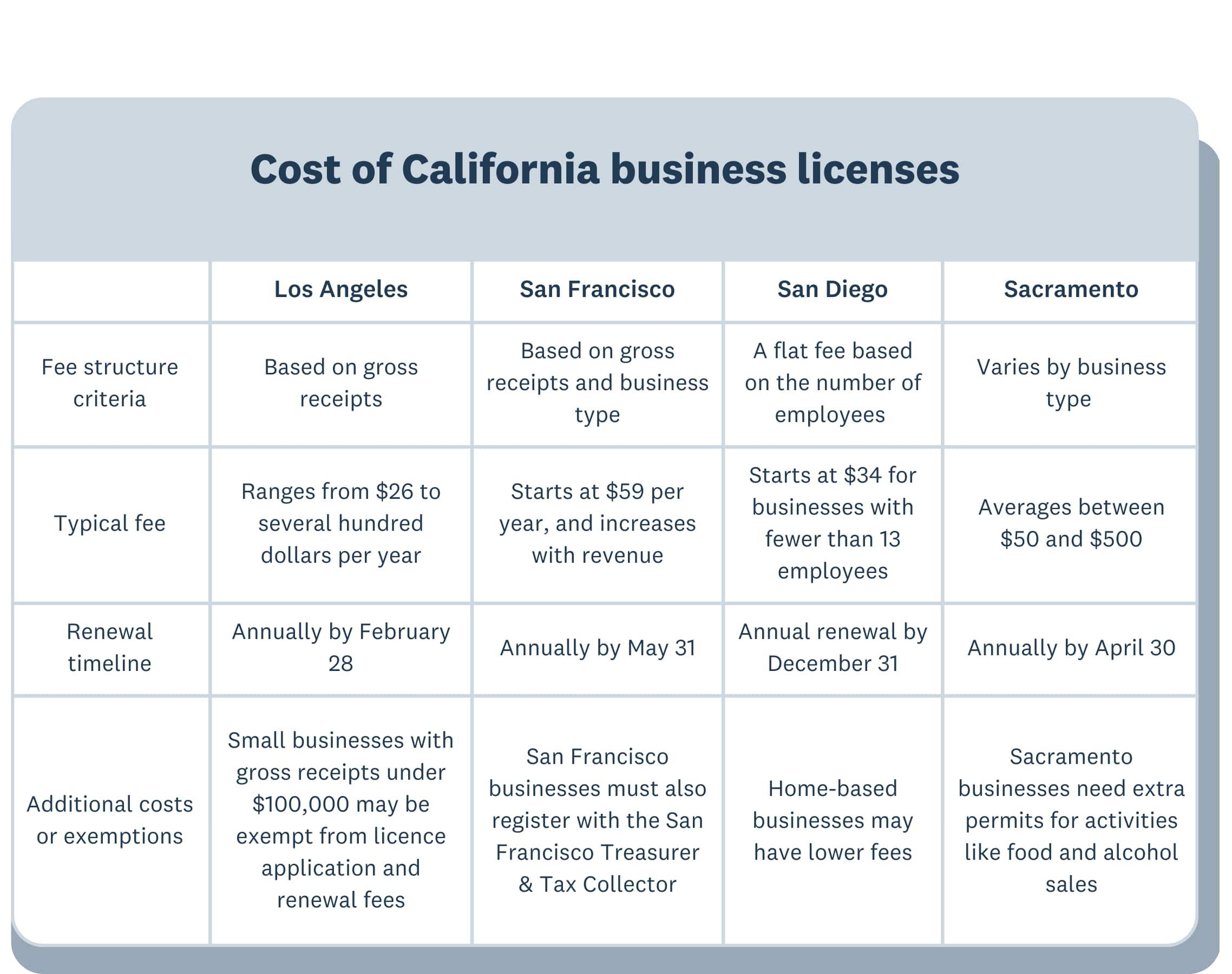

What California business licenses cost

California regulates business licensing mainly at the local level, so the costs and processes vary depending on the city or county where your business operates.

Here are examples from major cities:

Here’s where to find more information for your area:

Los Angeles: Los Angeles County Treasurer and Tax Collector

San Francisco: City and County of San Francisco Treasurer and Tax Collector

San Diego: San Diego County Business Licenses

Sacramento: the Sacramento County Department of Finance

How to get a business license in California

Although the business licensing process is pretty straightforward on paper, it takes time – so start early! Use the steps below to guide you through the business licensing process.

1. Choose your business structure and name

The first step is to choose a structure for your business The structure you choose affects California tax registration, your personal liability for your business’s finances, and operational requirements.

Here are some common business structures:

- Sole proprietorship: the simplest structure – the owner is personally liable for business debts, whether running a physical storefront or an online service

- Partnership: recognizes shared ownership between two or more people, with different structures like general or limited partnerships

- Limited liability company (LLC): an LLC has liability protection while maintaining flexible management and tax options

2. Register your business and get an EIN

Next, There are two steps here:

1. If you’re an LLC, corporation, or a partnership, register your business with the California Secretary of State.

2. Unless you’re a sole proprietor and elect to use your Social Security number for your business), apply to get an employer identification number (EIN) from the IRS either online with the IRS or by email or fax. The IRS website sets out the process.

3. Apply for the general business license

Complete the application for licensing that your local government requires and pay any necessary fees. In some Californian jurisdictions you may not need a business license, so check your local regulations.

4. Apply for any extra permits you need

The licenses and permits you need depend on your business type and location. Some common additional permits are:

- Seller’s permits for selling taxable goods or services and to collect and remit sales tax

- Health permits for handling food and beverages, or for personal care services (such as tattoo parlors)

- Alcohol licenses for selling alcoholic beverages, including bars, restaurants, and liquor stores

- Building and fire safety permits if you’re operating in a commercial space or construction

- Environmental permits for activities that could affect the environment (like waste disposal)

Use the CalGold tool to find out which business license requirements in California apply to you.

Renew your licences to stay compliant

You’ll need to renew your business license as often as your local jurisdiction requires. So stay up to date with local, state, and industry regulations so your business stays compliant.

Common mistakes to avoid when applying for a California business license

Small errors can delay the licenses you need. Here are several common mistakes to avoid:

- Submitting incomplete applications: Check you’ve completed all forms correctly, paid the fees,and included all the required documents and attachments.

- Ignoring zoning laws: Businesses in some industries need zoning approval before opening – so check with your local city or county zoning office before buying business property, signing a lease, or starting operations.. You might save yourself big fines or relocation costs!

- Not checking state vs local requirements: A general business license from your city or county may not be enough, so check the legal business requirements for your industry and location to make sure you don’t need state-issued licenses for your business type, such as a landscaping business or car rental service.

- Forgetting to renew your license: Don’t forget to renew! Most business licenses are valid only for a year, so keep track of renewal deadlines and pay the fees on time.

How long does it take to get a business license in California?

The license and permit application process varies. Most take 2–4 weeks to process, although industry-specific licenses can take longer due to background checks, professional exams, or state board approvals. So a general business license might take only a few days, while a contractor’s license could take months.

Are there business activities for which you don’t need a license in California?

Smaller businesses – like If you’re a freelancer, independent contractor, or running a hobby-based operation, you may not need a license, especially if:

- Your revenue is minimal

- You don’t have a physical storefront

- You’re an online business without a local presence

These are just guidelines as requirements vary by city and county, so check with local authorities to confirm.

I plan to operate in multiple cities in California. Do I need a separate license for each location?

Probably – in most cases, you’ll need a separate business license for each Californian city where you run a business, since the requirements in each city can vary. But some cities and counties offer reciprocity agreements that let businesses operate in multiple areas under a single license, so check with each location where you plan to do business to ensure full compliance.

Do I need a license for my home-based business in California?

It’s likely. If you’re starting a home-based business, you’ll probably require a general business license. And check your local requirements in case you also need:

- A home occupation permit

- To comply with local zoning restrictions for things like foot traffic, signage, or on-site inventory storage

- Approval to have clients or employees on your home business property

What documents do I need to apply for a business license in California?

The documents you need vary by your business type and location, but in general, make sure you have Proof of registration of your business, your organization’s documents, Employer identification number (EIN, zoning and local business approvals, and sales tax permits.

Before you apply for any licenses or permits, check with your local city and county offices to confirm any documentation you need for your industry or location.

What tax benefits or incentives can I get for my business licensed in California?

Quite a lot. Your business will be eligible for tax deductions on business expenses like rent, utilities, equipment, and advertising. The business could also benefit from state and federal tax incentives for activities like hiring employees, investing in sustainable practices, or operating in specific zones.

A business license can also boost your eligibility for small business grants and loans. Ask your tax professional for advice.

Manage your California business with Xero

Once you’ve secured your California business license, it’s time to focus on running your business. Xero’s easy-to-use accounting software helps you send invoices, track expenses, and manage your finances with ease. Get one month free and see how Xero can streamline your admin.

Disclaimer

Xero does not provide accounting, tax, business or legal advice. This guide has been provided for information purposes only. You should consult your own professional advisors for advice directly relating to your business or before taking action in relation to any of the content provided.

Get one month free

Sign up to any Xero plan, and we will give you the first month free.