New York sales tax rates, rules, and how to calculate

New York sales tax rates vary by location and product type. Learn how to calculate the right amount for your business transactions.

Written by Kari Brummond—Content Writer, Accountant, IRS Enrolled Agent. Read Kari's full bio

Published Friday 7 November 2025

Table of contents

Key takeaways

• Calculate New York sales tax by combining the 4% state rate with local taxes, which range from 3% to 4.875%, resulting in total rates between 7% and 8.875% depending on the customer's delivery location.

• Register for a Certificate of Authority through the New York State Department of Taxation and Finance before collecting any sales tax, then file returns at your assigned frequency (monthly, quarterly, or annually) even if you had no taxable sales.

• Apply sales tax based on where your customer receives the item, not where your business is located, and use the delivery address to determine the correct local tax rate for online sales.

• Recognize that clothing under $110 is exempt from the 4% state tax (though local taxes may still apply), and most professional services like consulting and legal work are not taxable in New York.

How much is sales tax in New York?

The combined New York sales tax rate ranges from 7% to 8.875%, depending on where you make the sale. The state rate is 4%, and local governments add their own taxes.

New York City has the highest rate at 8.875%, which includes:

- The 4% state tax

- A 4.5% city tax

- A 0.375% tax for the Metropolitan Commuter Transportation District (MCTD)

The MCTD tax actually applies to both the city and its surrounding counties, including Dutchess, Nassau, Orange, Putnam, Rockland, Suffolk, and Westchester.

If you sell a $100 item in Brooklyn, you’ll collect $8.88 in sales tax, making the total $108.88.

Check the New York Department of Taxation and Finance’s sales tax rate tables for current rates, or use a New York sales tax calculator for accurate estimates.

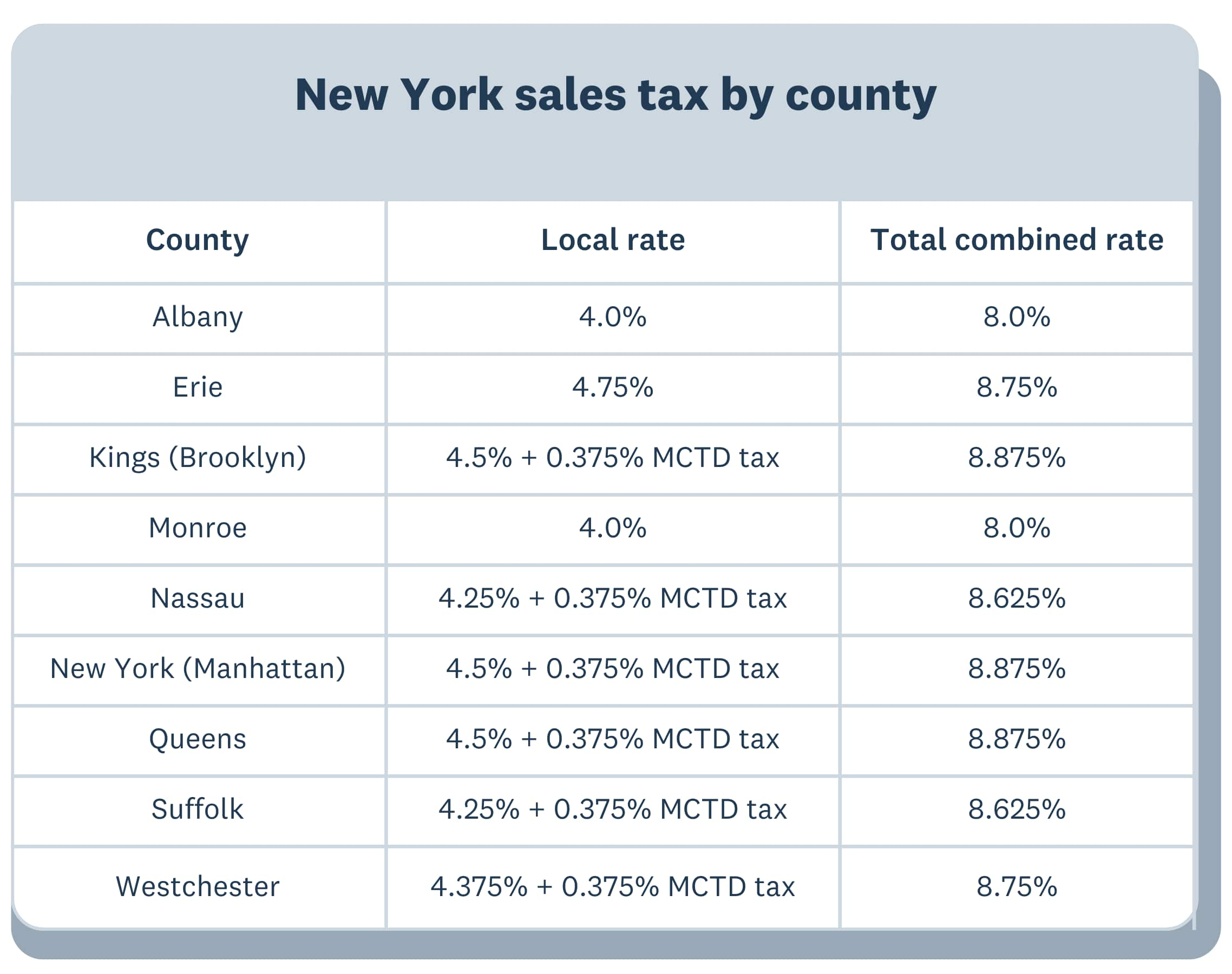

New York sales tax rate by county

New York county sales tax rates combine the 4% state rate with local taxes. Here are rates for major counties:

- New York County (Manhattan): 8.875%

- Kings County (Brooklyn): 8.875%

- Queens County: 8.875%

- Bronx County: 8.875%

- Nassau County: 8.25%

- Suffolk County: 8.625%

- Westchester County: 8.375%

Tax rates change often. Check the official rate tables for the latest rates in your area.

How to calculate New York sales tax

To calculate New York sales tax, combine the state, local, and Metropolitan Commuter Transportation District (MCTD) rates. See how to calculate sales tax for more details.

Purchase price × Total tax rate = Sales tax owed

Where total tax rate = State rate (4%) + Local rate + MCTD rate (if applicable)

If you sell a $200 item in Manhattan, you’ll collect $17.75 in sales tax.

- Total tax rate = 8.875% = (4% state rate + 4.5% county rate + 0.375% MCTD tax)

- $200 x 0.08875 = $17.75 in sales tax

The customer's total cost would then be $217.75.

You must charge sales tax based on where your customer receives the item, not where your business is located. For online sales, calculate the local tax rate for the delivery address. The 2018 Supreme Court decision in South Dakota v. Wayfair means you may need to collect New York sales tax even if your business is outside the state.

Need help calculating sales tax in New York?

Use Avalara’s New York state tax calculator to find location-specific rates and stay compliant with local and state rules.

How to register for New York sales tax

Register your business with the New York State Department of Taxation and Finance before collecting sales tax. You’ll need a Certificate of Authority to collect and remit sales tax.

You can register online through New York Business Express. After you register, the state tells you how often to file sales tax returns and what else you need to do to stay compliant.

Filing and paying New York sales tax

After you register, you must file sales tax returns and pay the tax you collect. New York assigns you a filing frequency—monthly, quarterly, or annually—based on your sales. File a return for every period, even if you had no sales.

File your return and pay online through your state account. Filing on time helps you avoid penalties and keeps your business in good standing.

Sales tax exemptions in New York

Some purchases in New York are exempt from sales tax, which can lower your business costs. Exemptions depend on:

- Item type: Specific goods like clothing under $110

- Buyer status: Nonprofits and government entities

- Transaction purpose: Resale or manufacturing use

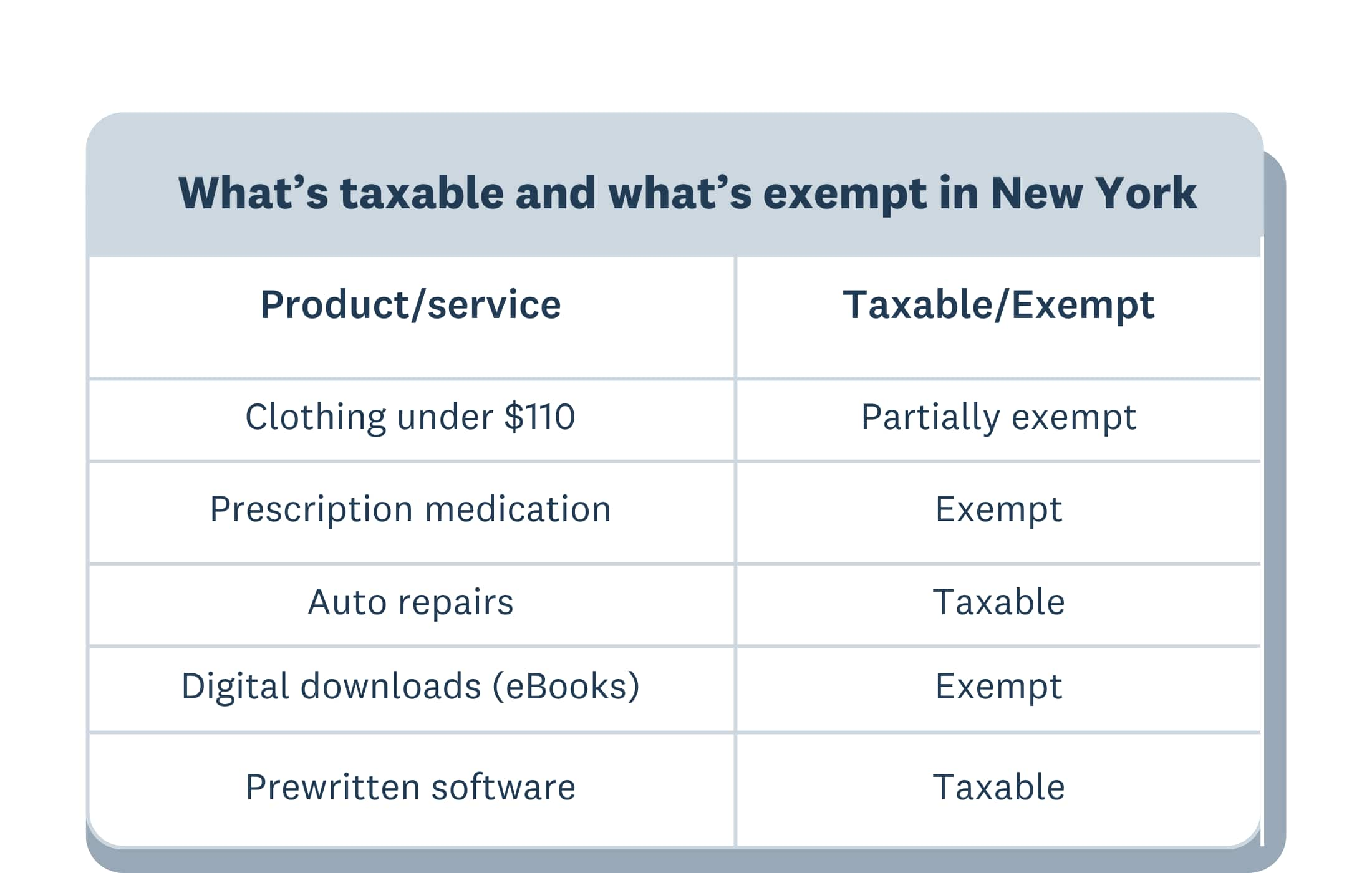

What's taxable and what's exempt:

Here are some examples of taxable and exempt items and services:

Common business exemptions

Common business exemptions that reduce your tax burden include:

- Clothing under $110: Exempt from 4% state tax (local taxes may still apply)

- Most services: Professional services like consulting and legal work aren't taxable (except installation, repair, or tangible property services)

- Nonprofit sales: 501(c)(3) organizations with proper documentation avoid all sales tax

Tax-exempt documents

If you are a tax-exempt organization, such as a nonprofit, you must collect and keep the right exemption certificates to qualify for tax-exempt sales:

- Form ST-119.1: This is the Exempt Organization Certificate for qualified nonprofits. This certifies that purchases are exempt from New York sales tax.

- Form ST-121: This is the Exempt Use Certificate, which applies when businesses purchase items for a tax-exempt use, like manufacturing equipment or buying items for resale.

Request the right form from your customer to confirm and document the exempt sale.

Online sales tax rules for New York businesses

If you sell online in New York, you must collect sales tax from your customers, no matter where your business is based. Most states with sales tax have similar rules. Always collect tax based on your customer’s delivery address.

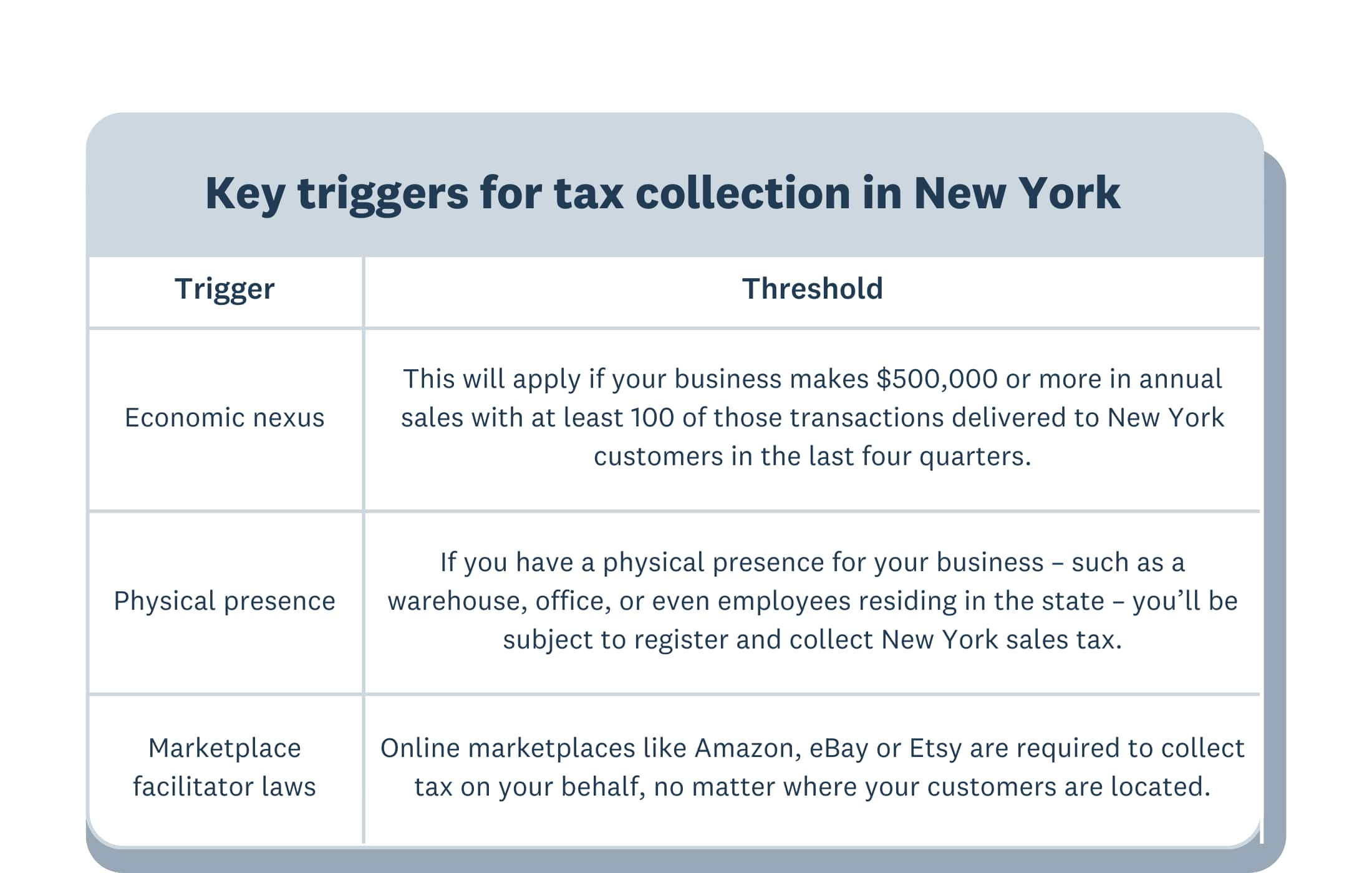

Key triggers for tax collection

You must register and collect sales tax in New York when you meet certain triggers:

What your online business must do to comply

To stay compliant with New York sales tax, follow these steps:

- Register for your Certificate of Authority: Apply through the New York State Department of Taxation and Finance before making any taxable sales. This certificate authorizes legal tax collection.

- Collect the correct tax rate per shipping address. In New York, online sales are destination-based, so you must charge sales tax based on where the product is delivered and not where your business is located. This includes the state rate and any local taxes.

- File sales tax returns at the proper filing frequency. After you register for your certificate, you'll be assigned a filing frequency based on your expected sales volume – monthly, quarterly or yearly. You'll need to file promptly each time, even if you don't have any taxable sales for the period.

- Keep records of everything for at least three years. New York requires businesses to keep records of all taxable and exempt sales, returns, and collected taxes in case of an audit.

Rules for shipping and digital products

In New York, shipping charges are taxable unless you list them separately on the invoice. Itemize shipping fees to avoid charging tax on them.

Most digital items, such as eBooks, downloaded music, and online courses, are exempt from New York sales tax. Prewritten software is taxable, whether you download it or access it in the cloud.

Custom software and services may be exempt, depending on how you deliver and use them. If you sell software as a service or subscriptions, review the rules or ask a tax professional.

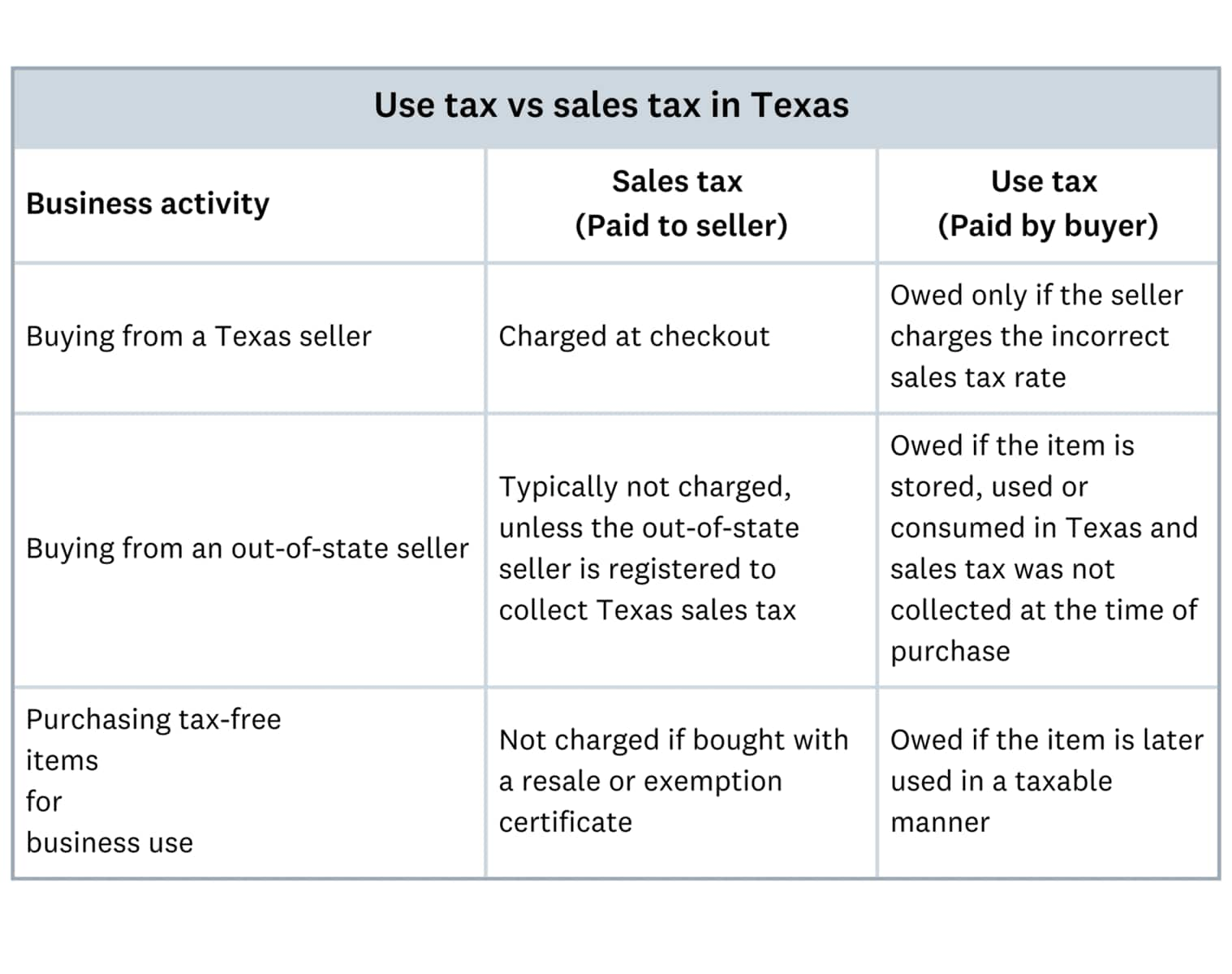

Use tax vs. sales tax in New York

Use tax versus sales tax in New York serve different collection purposes:

- Sales tax: You collect from customers at the time of purchase

- Use tax: Customers pay when no sales tax was collected (like out-of-state purchases)

When each applies:

If you buy from an out-of-state seller who does not collect sales tax, you must pay use tax. Report this on your tax return to stay compliant.

Streamline your New York sales tax with Xero

Managing New York sales tax rates, calculations, and filings takes time. Xero helps you track sales and expenses so you have clear records when you file.

Connect Xero with sales tax automation apps to apply the right rates and prepare your returns. You can focus on growing your business, knowing your compliance is covered.

FAQs on New York sales tax

Here are common questions small business owners might have about sales tax in New York.

Is New York State sales tax 8%?

The combined sales tax rate in New York is not the same everywhere. The state rate is 4%, and local areas add their own taxes. In New York City, the total rate is 8.875%, which includes the 4% state tax, 4.5% city tax, and 0.375% MCTD surcharge.

What items are not taxed in New York?

Many essential items are exempt from sales tax in New York, such as most groceries, prescription drugs, and medical equipment. Clothing and footwear under $110 are also exempt from the 4% state tax, but local taxes may still apply.

Do I need to charge New York sales tax if I sell services instead of physical products?

Most services are exempt from New York sales tax. Only certain services, such as repairs, installations, and data processing, are taxable. Consulting, legal, and accounting services are not taxed.

Can I deduct sales tax on business purchases in New York?

Sales tax is not usually deductible for businesses unless the purchase is for resale or exempt use. For individuals, the IRS limits the deduction for state and local taxes, including sales tax, to $10,000. Use Form ST-120, the Resale Certificate, to avoid paying tax on qualifying purchases, or Form ST-121, the Exempt Use Certificate, if you are a qualified nonprofit.

Is sales tax in NY the same for in-store and online purchases?

Yes, sales tax rates are the same for in-store and online purchases. The rate depends on where the customer receives the item:

- Physical stores: Charge tax based on your store's location

- Online sales: Charge tax based on the customer's delivery address

What records should I keep to stay compliant with state and local rules?

Keep detailed records of all taxable and exempt sales, collected taxes, exemption forms, and filed returns. Store these records for at least three years.

Disclaimer

Xero does not provide accounting, tax, business or legal advice. This guide has been provided for information purposes only. You should consult your own professional advisors for advice directly relating to your business or before taking action in relation to any of the content provided.

Get one month free

Sign up to any Xero plan, and we will give you the first month free.