Current ratio: Formula, examples, and why it matters

Learn how the current ratio helps your small business cover bills and plan cash with confidence.

Written by Jotika Teli—Certified Public Accountant with 24 years of experience. Read Jotika's full bio

Published Wednesday 17 December 2025

Table of contents

Key takeaways

- Calculate your current ratio by dividing current assets by current liabilities to determine if your business can cover short-term debts, with a ratio above 1.0 indicating you have sufficient assets to meet obligations.

- Monitor your current ratio regularly on a monthly basis to identify trends and potential cash flow concerns, while comparing it against industry benchmarks since acceptable ratios vary significantly between sectors.

- Recognize that the current ratio provides only a snapshot in time and treats all current assets as equally liquid, so combine it with cash flow forecasts and other liquidity ratios like the quick ratio for a complete financial picture.

- Improve your current ratio by speeding up invoice collections and converting excess inventory to cash while negotiating extended payment terms with suppliers and paying down short-term debt.

What is the current ratio?

Current ratio is a financial metric that measures your business's ability to pay short-term debts by comparing current assets to current liabilities. This liquidity ratio shows whether you can cover upcoming bills and loan repayments. You might also see it called the working capital ratio.

Why the current ratio matters for businesses

Current ratio importance helps your business in three critical areas:

Managing short-term obligations

A strong current ratio reflects your ability to pay suppliers, rent, and employee salaries without borrowing additional money.

If current assets are lower than liabilities, it can be harder to cover bills as they fall due. You may need to find extra funding to stay on top of payments, so it pays to watch this ratio closely.

Building investor and lender confidence

Lenders and investors look at your current ratio to gauge your business's financial stability and whether it can service a loan or is worth investing in. For example, businesses with a high current ratio typically manage their liquidity well and are therefore a lower risk for investors.

Planning for growth

A healthy ratio shows you have an opportunity to invest in growth. With strong liquidity, for instance, you can confidently open a new store or invest in new technology. A strong ratio also suggests you have a safety margin to handle unexpected downturns.

A solid current ratio helps your business to stay agile and take advantage of opportunities for growth while protecting your financial stability.

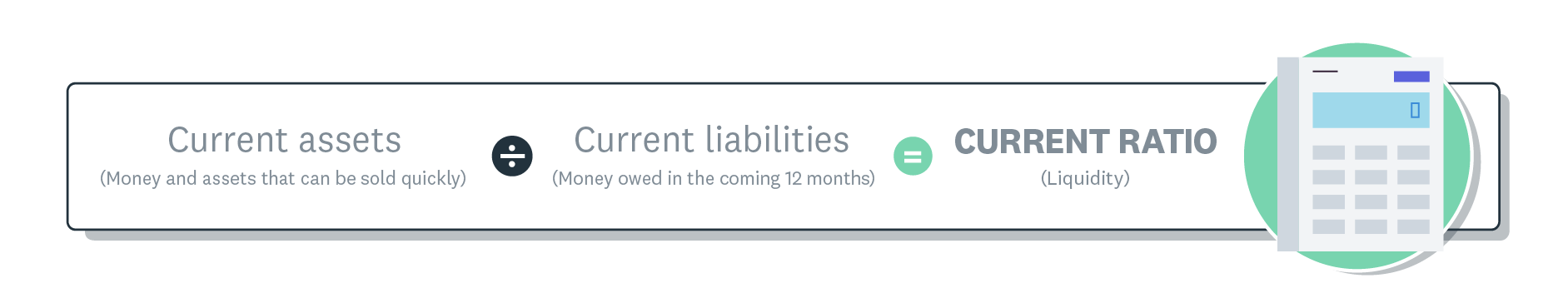

Current ratio formula

Here's the current ratio formula:

Current ratio = current assets ÷ current liabilities

You'll find your current assets and liabilities on your balance sheet. Here's more about balance sheets from the U.S. Small Business Administration (SBA).

Components of the current ratio

Current assets are resources you can convert to cash within one year. Current assets include:

- Cash and cash equivalents: Money in checking accounts and short-term investments

- Accounts receivable: Money customers owe you

- Inventory: Products ready for sale or raw materials

- Prepaid expenses: Insurance, rent, or supplies paid in advance

Current liabilities are debts you must pay within the same period. Current liabilities include:

- Accounts payable: Money you owe suppliers

- Short-term loans: Debt due within 12 months

- Accrued expenses: Wages, taxes, or utilities you owe

- Current portion of long-term debt: Next year's payments on long-term loans

Example of a current ratio calculation

A small construction business wants to determine its current ratio to see if it can cover upcoming loan repayments and material costs.

The business has $250,000 in current assets and $175,000 in current liabilities. The current ratio calculation is therefore:

$250,000 ÷ $175,000 = 1.43

The current ratio is above 1, which means the business can cover its upcoming debts. For every $1 of liabilities, the business has $1.43 available.

This gives the business a couple of options. It could invest in other areas with its remaining cash, or it could hang on to the cash in case its assets lose value or it needs to take on debt.

How to interpret current ratio results

Current ratio interpretation helps you assess your financial health:

- Calculate your ratio: Divide current assets by current liabilities

- Interpret your results:

- Track regularly: Measure monthly at consistent intervals to avoid seasonal fluctuations

- Look for patterns: Compare month-to-month for trends signaling cash flow concerns

- Combine with other metrics: Use alongside cash flow forecasts and profitability ratios

Current ratio vs quick ratio and cash ratio

Along with the current ratio, other liquidity ratios help provide a complete financial picture:

- What it measures: Assets convertible to cash within 90 days vs current liabilities

- Why it matters: More conservative view excluding slow-moving inventory

Cash ratio:

- What it measures: Only cash and cash equivalents vs current liabilities

- Why it matters: Most stringent test of immediate liquidity

Use all three ratios together to understand your short-term cash position. Learn more about these metrics in Xero's guide to liquidity ratios.

Common pitfalls when using the current ratio

It only gives a snapshot in time

Like most liquidity ratios, the current ratio shows a momentary view of your finances. It doesn't reflect daily changes in cash flow or future income.

It treats all current assets as equally liquid

The current ratio doesn't distinguish between types of assets. Cash is immediately available, but inventory or accounts receivable may take time to convert to cash.

It ignores the timing of payments

The ratio assumes liabilities are paid evenly over time, while in reality many businesses have uneven or seasonal payment patterns. If your income and expenses vary by season or billing cycle, the ratio might not reflect true liquidity.

Current ratio compared with working capital and cash flow

Each metric can be used alongside the current ratio to provide different insights into your financial health and liquidity position:

- Working capital: Current assets minus current liabilities (dollar amount); shows actual money left after covering short-term debts

- Cash flow: Net money moving in and out over a specific period; shows whether you can pay suppliers, employees, and lenders on time

- Free cash flow: Operating cash flow minus capital expenditures; shows cash available after investing in equipment and property

Monitor your current ratio in real time with Xero

Xero takes care of the complex calculations for you, so you have a clear view of the cash available in your business.

Check your latest cash flow at a glance, track expenditure, and monitor financial performance indicators over time. Then create forecasts and projections using Xero's reporting features to make informed financial decisions. Get one month free.

FAQs on current ratio

Here are answers to common questions about calculating and interpreting current ratios.

How does the current ratio help me judge my business's ability to pay its short-term debts?

Current ratio measures your ability to pay short-term debts using current assets. A ratio above 1.0 means you can cover obligations, while below 1.0 may indicate potential cash flow challenges.

Why does the current ratio change over time, and how should businesses interpret these changes?

Your current ratio can change due to seasonality, industry trends, and your business strategies. So you should interpret these changes within your context: a dip in your ratio may not mean you have cash flow problems if you're planning for future growth or dealing with a setback.

How does the current ratio vary across different industries?

An acceptable current ratio can vary between industries quite a lot. A manufacturing company can have a higher ratio because of inventory levels, while a service-based business could have lower current assets. Get familiar with the benchmarks in your industry so you have a baseline for judging your financial stability and carrying out business liquidity management.

How does the current ratio affect investor decisions and credit evaluations?

Lenders and credit rating agencies typically use the current ratio formula to decide whether a company can meet its short-term financial obligations. A business with a high ratio is seen as a less risky bet, boosting the business's chances of getting favorable credit terms. But if your ratio is low, you might have trouble borrowing funds or lenders might charge you higher interest rates to offset their risk.

How can I improve my business's current ratio?

Improve your current ratio with these strategies:

Increase current assets:

- Speed up collections: Follow up on overdue invoices faster

- Liquidate excess inventory: Convert slow-moving stock to cash

- Optimize cash management: Keep appropriate cash reserves

Reduce current liabilities:

- Negotiate payment terms: Extend supplier payment periods

- Pay down short-term debt: Reduce immediate obligations

- Restructure debt: Convert short-term to long-term financing

Disclaimer

Xero does not provide accounting, tax, business or legal advice. This guide has been provided for information purposes only. You should consult your own professional advisors for advice directly relating to your business or before taking action in relation to any of the content provided.

Get one month free

Sign up to any Xero plan, and we will give you the first month free.