Difference between cash and accrual accounting

Cash vs accrual accounting (comparison)

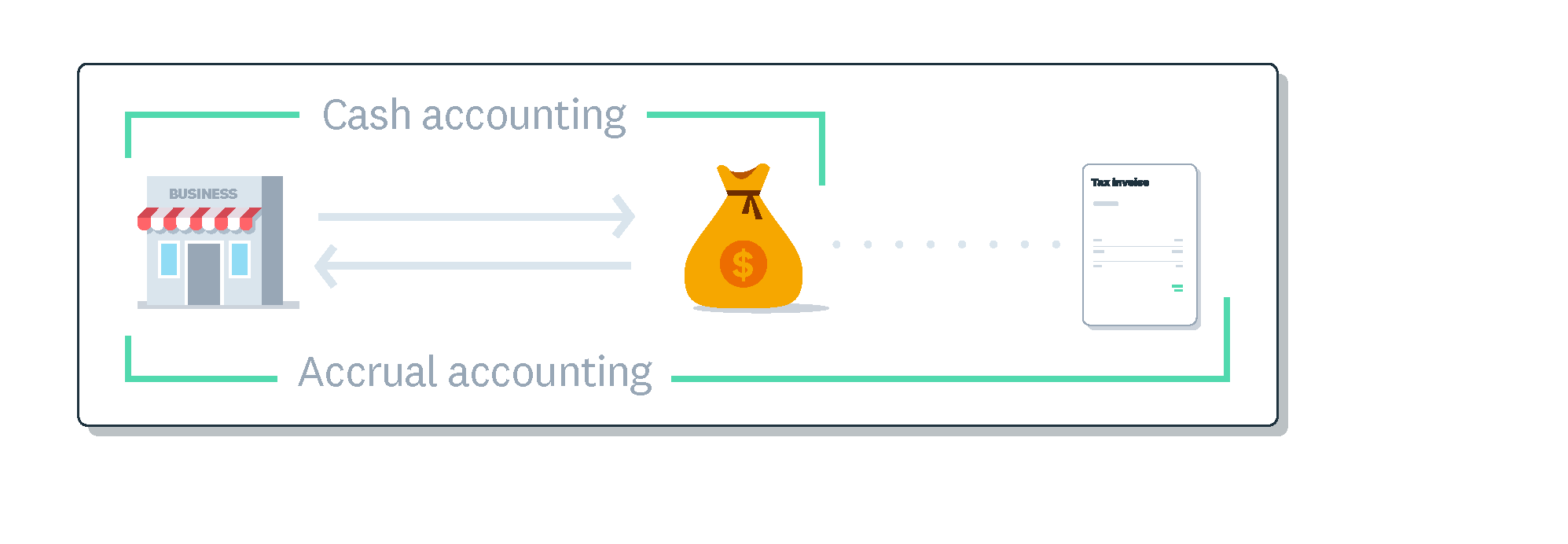

Accrual accounting recognizes income and expenses as soon as a sale or purchase is agreed, while cash accounting waits until money has changed hands.

This difference is most relevant when things are bought or sold via invoice. A business doing cash accounting won’t show these invoice-based transactions on the books until payment is made. A business doing accrual accounting will show that money is due to come or go.

Cash accounting focuses only on cash changing hands, not outstanding bills or invoices.

Cash accounting

- Business accounts are updated only when money changes hands

- Gives a shorter term view of finances

- A simpler method of accounting (preferred by some smaller businesses)

Accrual accounting

- Business accounts are updated to reflect pending income and expenses

- Gives a longer term view of finances

- May be required by some financiers or tax offices

See related terms

Handy resources

Advisor directory

You can search for experts in our advisor directory

Xero Small Business Guides

Discover resources to help you do better business

Financial reporting

Keep track of your performance with accounting reports

Disclaimer

This glossary is for small business owners. The definitions are written with their requirements in mind. More detailed definitions can be found in accounting textbooks or from an accounting professional. Xero does not provide accounting, tax, business or legal advice.