Making Tax Digital – Everything you need to know

Making Tax Digital for VAT and Income Tax requires businesses to use MTD-compatible software to keep digital records and submit returns online. MTD software can help businesses, accountants, and bookkeepers submit accurate returns, reduce errors, and simplify tax planning.

What is Making Tax Digital?

Making Tax Digital (MTD) is part of the government’s plan to modernise the UK tax system, making it easier for people to get their tax right. The legislation applies to two taxes – MTD for VAT, and MTD for Income Tax. It’s likely more taxes will be made digital in the future.

Simplify MTD with Xero

HMRC recognised and trusted by millions

Xero is designed to simplify compliance processes for accountants, bookkeepers, and businesses.

No need for multiple tools

Xero software provides an end-to-end solution. This means everything is covered in one place.

Make MTD hassle-free

New legislation doesn’t have to be cause for stress. With Xero, you can automate processes and speed up admin.

What is MTD for IT?

Making Tax Digital for Income Tax changes the way sole traders and landlords submit Income Tax returns. Those earning above £50,000 join the system first, in April 2026, followed by those earning over £30,000 in April 2027, and £20,000 in April 2028. Requirements include:

- Using MTD-compliant software for recordkeeping

- Submitting quarterly updates and a Final Declaration

When do I need to comply with MTD rules?

April 2022: MTD for VAT

All VAT-registered businesses are required to use MTD software to keep digital records and submit returns.

April 2026: Making Tax Digital for Income Tax

Sole traders and landlords earning above £50,000 need to follow MTD for IT rules.

April 2027: Making Tax Digital for Income Tax

Sole traders and landlords earning above £30,000 need to follow MTD for IT rules.

April 2028: Making Tax Digital for Income Tax

Sole traders and landlords earning above £20,000 need to follow MTD for IT rules.

TBC: MTD for IT for general partnerships

The deadline for general partnerships joining the MTD for IT system is yet to be announced.

TBC: MTD for Corporation Tax

The rollout of MTD for Corporation Tax is yet to be announced.

What’s changing under MTD for Income Tax?

Here are the key components of MTD for IT. MTD for IT.

Digital recordkeeping

Income and expenses records must be kept digitally, in MTD-compliant software.

Quarterly updates

Instead of a single annual return, you’ll need to send four quarterly updates on income and expenditure.

Final Declaration

Once you’ve submitted four quarterly updates, you’ll need to finalise your income with a Final Declaration.

How will MTD for Income Tax benefit me?

MTD for IT requires businesses to submit updates more regularly. But this gives you a clearer view of your tax liability throughout the year, making it easier to plan for your bill. Plus, MTD software can speed up recordkeeping and automate parts of the compliance process, and improve accuracy.

What does MTD for IT mean for me?

Accountants, bookkeepers, and businesses will need HMRC MTD software in place. It also pays to do your research on MTD requirements, and familiarise yourself with software ahead of the deadlines. Xero has a software solution for practices and businesses – making compliance easier.

MTD for accountants and bookkeepers

Clients are likely to call on you for help with understanding MTD legislation and getting compatible software in place. You can support your clients and team by:

- Reading up on the legislation and sharing updates with your team

- Familiarising yourself with MTD software ahead of the deadlines

- Automating bookkeeping and compliance processes to improve accuracy

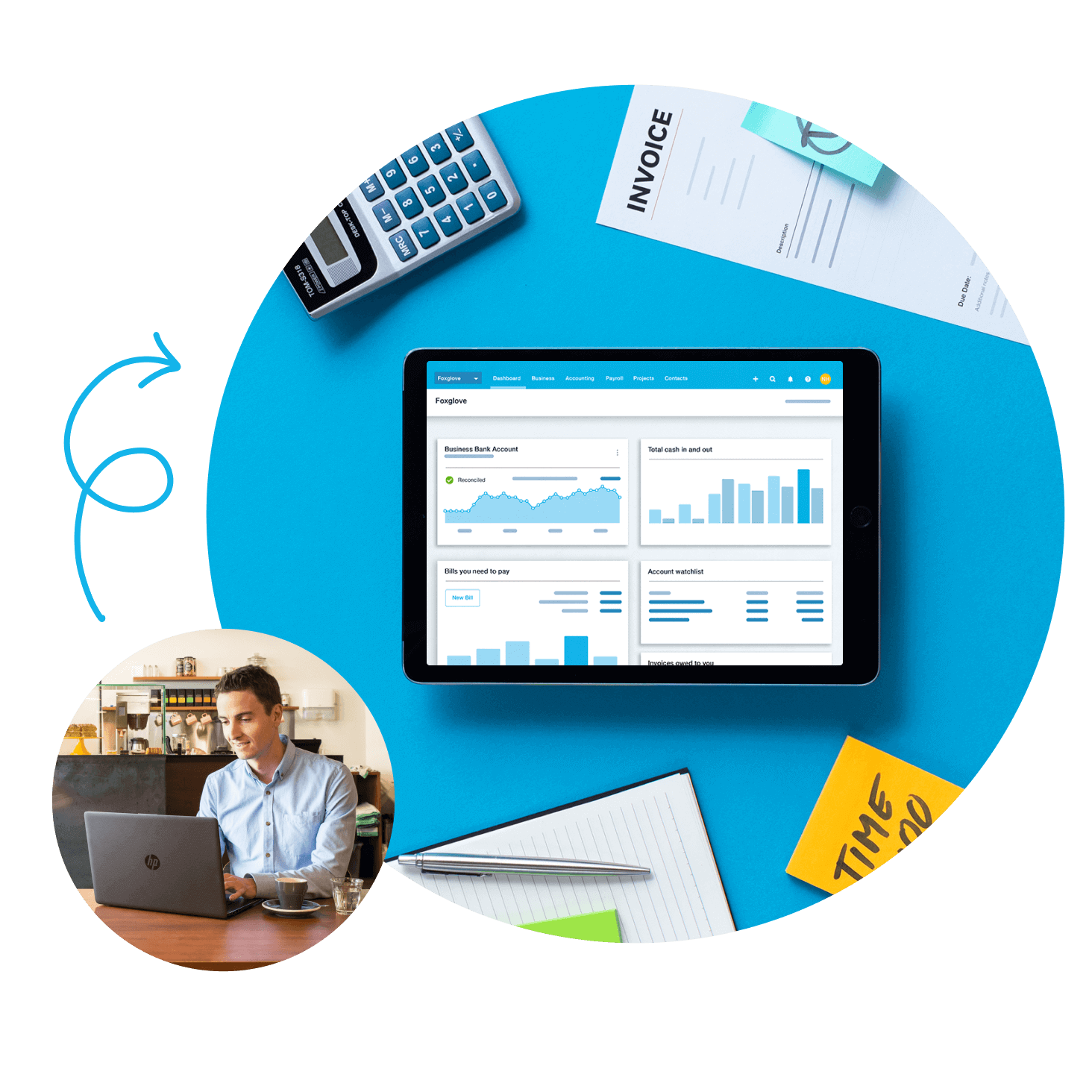

Make business easier with Xero MTD software

Making Tax Digital software isn’t just for compliance. Xero’s all-in-one platform simplifies business and practice tasks for you. Track cash flow, automate bookkeeping, invoice online, and file compliant returns for a range of taxes. Plus:

- Connect your bank account so transactions flow into Xero automatically

- See business finances at a glance with easy-to-read dashboards

- Add apps to bring all your financial data into one space

Getting Xero made the whole business more efficient. It made accessing the accounts so much easier.

Xero lets Sidonie from Papersmiths focus on other parts of her business

FAQs about Making Tax Digital

MTD compliance means following the Making Tax Digital rules. These include using MTD-compatible software to keep digital records and submit returns, and meeting the reporting deadlines for VAT and Income Tax. In most cases, both VAT and Income Tax returns need to be submitted quarterly. For MTD for Income Tax, you also need to send a Final Declaration once all quarterly updates are submitted.

MTD compliance means following the Making Tax Digital rules. These include using MTD-compatible software to keep digital records and submit returns, and meeting the reporting deadlines for VAT and Income Tax. In most cases, both VAT and Income Tax returns need to be submitted quarterly. For MTD for Income Tax, you also need to send a Final Declaration once all quarterly updates are submitted.

All VAT-registered businesses have been required to follow Making Tax Digital for VAT rules since April 2022. The upcoming MTD for IT deadlines are as follows. In April 2026, sole traders and landlords earning above £50,000 are required to follow MTD for IT rules. In April 2027, sole traders and landlords earning above £30,000 are required to follow MTD for IT rules. And, finally, in April 2028, sole traders and landlords earning above £20,000 are required to follow MTD for IT rules. MTD for general partnerships and Corporation Tax is yet to be confirmed.

All VAT-registered businesses have been required to follow Making Tax Digital for VAT rules since April 2022. The upcoming MTD for IT deadlines are as follows. In April 2026, sole traders and landlords earning above £50,000 are required to follow MTD for IT rules. In April 2027, sole traders and landlords earning above £30,000 are required to follow MTD for IT rules. And, finally, in April 2028, sole traders and landlords earning above £20,000 are required to follow MTD for IT rules. MTD for general partnerships and Corporation Tax is yet to be confirmed.

For mandated businesses, MTD for Income Tax is compulsory. Following the rules will help you avoid the penalties and fines that come with non-compliance. Using Making Tax Digital software can also improve efficiency and accuracy. Modern software providers offer automation features that can take care of repetitive admin for you. You also get a regular view of your tax liability, which makes planning for your bill easier.

Guide on Making Tax Digital penaltiesFor mandated businesses, MTD for Income Tax is compulsory. Following the rules will help you avoid the penalties and fines that come with non-compliance. Using Making Tax Digital software can also improve efficiency and accuracy. Modern software providers offer automation features that can take care of repetitive admin for you. You also get a regular view of your tax liability, which makes planning for your bill easier.

Guide on Making Tax Digital penaltiesXero software is HMRC-recognised for MTD for Income Tax, and has all the tools you need to comply with the rules. You can keep digital records and submit compliant returns to HMRC. Plus, additional features can save you time and improve accuracy. For example, bank reconciliation predictions suggest matches for statement lines, so you can reconcile your accounts faster. Real-time tax estimates make it easier to plan for your bill. Plus, automatic updates in line with legislation help you stay on the right side of compliance.

Xero software is HMRC-recognised for MTD for Income Tax, and has all the tools you need to comply with the rules. You can keep digital records and submit compliant returns to HMRC. Plus, additional features can save you time and improve accuracy. For example, bank reconciliation predictions suggest matches for statement lines, so you can reconcile your accounts faster. Real-time tax estimates make it easier to plan for your bill. Plus, automatic updates in line with legislation help you stay on the right side of compliance.

Xero accounting software is HMRC-recognised and trusted by millions. You get all the tools to submit compliant returns for MTD for VAT and Income Tax, plus features that simplify and speed up admin tasks. Accountants, bookkeepers, and businesses get a clearer financial picture with Xero. Making it easier to run a healthier practice and business.

Xero accounting software is HMRC-recognised and trusted by millions. You get all the tools to submit compliant returns for MTD for VAT and Income Tax, plus features that simplify and speed up admin tasks. Accountants, bookkeepers, and businesses get a clearer financial picture with Xero. Making it easier to run a healthier practice and business.

Since April 2022, Making Tax Digital for VAT has applied to all VAT-registered businesses. If you sign up for VAT, you’ll automatically be registered for MTD. To comply with digital VAT rules, you’ll need to use VAT compatible software to keep records and submit returns.

Learn more about MTD for VATSince April 2022, Making Tax Digital for VAT has applied to all VAT-registered businesses. If you sign up for VAT, you’ll automatically be registered for MTD. To comply with digital VAT rules, you’ll need to use VAT compatible software to keep records and submit returns.

Learn more about MTD for VATCurrently, all VAT-registered businesses need to follow MTD rules. When MTD for Income Tax comes into place, sole traders and landlords will need to join the system too. Those earning above £50,000 will join MTD for IT first in April 2026. Then, sole traders and landlords earning above £30,000 will join in April 2027. For those earning above £20,000, MTD for IT rules come into place from April 2028.

Currently, all VAT-registered businesses need to follow MTD rules. When MTD for Income Tax comes into place, sole traders and landlords will need to join the system too. Those earning above £50,000 will join MTD for IT first in April 2026. Then, sole traders and landlords earning above £30,000 will join in April 2027. For those earning above £20,000, MTD for IT rules come into place from April 2028.

Many accountants and bookkeepers will find themselves in an educator role, guiding clients on new rules and supporting them with software for MTD. Getting up to speed with software features and brushing up on MTD legislation is key to compliance.

Learn more about MTD for accountantsMany accountants and bookkeepers will find themselves in an educator role, guiding clients on new rules and supporting them with software for MTD. Getting up to speed with software features and brushing up on MTD legislation is key to compliance.

Learn more about MTD for accountantsXero’s Making Tax Digital software works for both MTD and non-MTD services. Once you’re signed up to MTD for VAT or MTD for IT, you can submit compliant returns using Xero software. Xero even gives you an estimation of your tax liability after each submission, making it easier to plan ahead.

See how to set up MTD for VAT in XeroXero’s Making Tax Digital software works for both MTD and non-MTD services. Once you’re signed up to MTD for VAT or MTD for IT, you can submit compliant returns using Xero software. Xero even gives you an estimation of your tax liability after each submission, making it easier to plan ahead.

See how to set up MTD for VAT in XeroYou’ll need to use bridging software that connects spreadsheets to HMRC, in order to submit MTD compliant returns. Though, with the increased reporting requirements, using spreadsheets for MTD for IT could prove tricky. Xero provides bridging software that lets you upload VAT amounts, then send MTD VAT standard rate returns from Xero.

See how to use Xero for spreadsheetsYou’ll need to use bridging software that connects spreadsheets to HMRC, in order to submit MTD compliant returns. Though, with the increased reporting requirements, using spreadsheets for MTD for IT could prove tricky. Xero provides bridging software that lets you upload VAT amounts, then send MTD VAT standard rate returns from Xero.

See how to use Xero for spreadsheets

Set up for MTD with Xero

Get started in a few steps. Any Xero plan that supports VAT is compatible with Making Tax Digital.

Check you're signed up for MTD for VAT

If you’re VAT registered, you’ll automatically be signed up for MTD for VAT.

Connect Xero to HMRC

HMRC will email to confirm you’re signed up to MTD for VAT. You can then connect HMRC digital tax with Xero.

Use the correct VAT filing

Use the MTD VAT return, and submit it to HMRC directly from Xero.

Use Xero for MTD

Access all Xero features free for 30 days, then decide which plan best suits your business.

Explore more MTD news and resources

Making Tax Digital for VAT

All VAT supporting Xero plans cover MTD at no extra cost. Find out more about how Xero and MTD works.

Making Tax Digital software

Learn more about why you need Making Tax Digital software that’s 100% HMRC compliant.

Making Tax Digital resources

Explore our MTD webinars, guides, articles, and FAQs for everything you need to know about MTD for VAT.