Making Tax Digital – Everything you need to know

Making Tax Digital for VAT and Income Tax requires businesses to use MTD-compatible software to keep digital records and submit returns online. MTD software can help sole traders, landlords, and business owners prepare accurate returns, reduce errors, and simplify tax bill planning.

What is Making Tax Digital?

Making Tax Digital (MTD) is part of the government’s plan to modernise the UK tax system, making it easier for people to get their tax right. The legislation applies to two taxes – MTD for VAT, and MTD for Income Tax. It’s likely more taxes will be made digital in the future.

Prepare your practice and clients for MTD

Learn how to support your clients with MTD regulations and set your practice up for success.

Making Tax Digital softwareLooking for more on MTD for VAT?

Simplify your VAT reporting and stay compliant with MTD for VAT regulations.

MTD for VAT fundamentals

Simplify MTD with Xero

HMRC recognised and trusted by millions

All Xero plans are designed to simplify compliance processes for accountants, bookkeepers, and businesses.

No need for multiple tools

Xero software provides an end-to-end solution. This means everything is covered in one place.

Make MTD hassle-free

New legislation doesn’t have to be cause for stress. With Xero, you can automate processes and speed up admin.

What is Making Tax Digital for Income Tax?

MTD for Income Tax changes the way sole traders and landlords submit Income Tax returns. Those earning above £50,000 need to comply in April 2026, followed by those earning £30,000 who are mandated from April 2027, then those earning £20,000 in 2028. To meet requirements, you must:

- Keep digital records of all business income and expenditure

- Submit quarterly updates using HMRC-recognised MTD for IT software

- Provide a Final Declaration by 31 January, following the tax year

When do I need to comply with MTD rules?

April 2022: MTD for VAT

All VAT-registered businesses are required to use MTD software to keep digital records and submit returns.

April 2026: Making Tax Digital for Income Tax

Sole traders and landlords earning above £50,000 need to follow MTD for IT rules.

April 2027: Making Tax Digital for Income Tax

Sole traders and landlords earning above £30,000 need to follow MTD for IT rules.

April 2028: Making Tax Digital for Income Tax

Sole traders and landlords earning above £20,000 need to follow MTD for IT rules.

What’s changing under MTD for Income Tax?

Here are the key components of MTD for IT.

Digital recordkeeping

Income and expenses records must be kept digitally, in MTD-compliant software.

Quarterly updates

Instead of a single annual return, you’ll need to send four quarterly updates on income and expenditure.

Final declaration

Once you’ve submitted four quarterly updates, you’ll need to finalise your income with a final declaration.

How will MTD for Income Tax benefit me?

MTD for IT will give sole traders and landlords a more regular view of their financial picture and tax liability throughout the year with more frequent quarterly submissions. Plus, using MTD software can speed up daily admin, improve accuracy and keep digital records, making filing easier.

- Time savings when using HMRC-recognised MTD software to keep digital records and prepare submissions

- Cash flow clarity, thanks to tax liability estimates in software and more regular submissions

- Improved accuracy through software automation, with bookkeeping records flowing into returns automatically

What does MTD for IT mean for me?

MTD for IT means sole traders and landlords need HMRC-recognised software, like Xero. You must keep digital records of income and expenditure, and submit quarterly updates and a Final Declaration to HMRC. Having up-to-date records is more vital than ever with an increased volume of submissions.

MTD for accountants and bookkeepers

Clients will look to you for advice and support as MTD rolls out. They’ll want to know about compatible software, and how to switch to MTD compliant processes. You can help clients, by doing the following:

- Familiarise yourself with MTD software ahead of the deadlines

- Stay up to date on MTD legislation and requirements

- Onboard your practice and clients onto MTD-compatible software ahead of the deadline

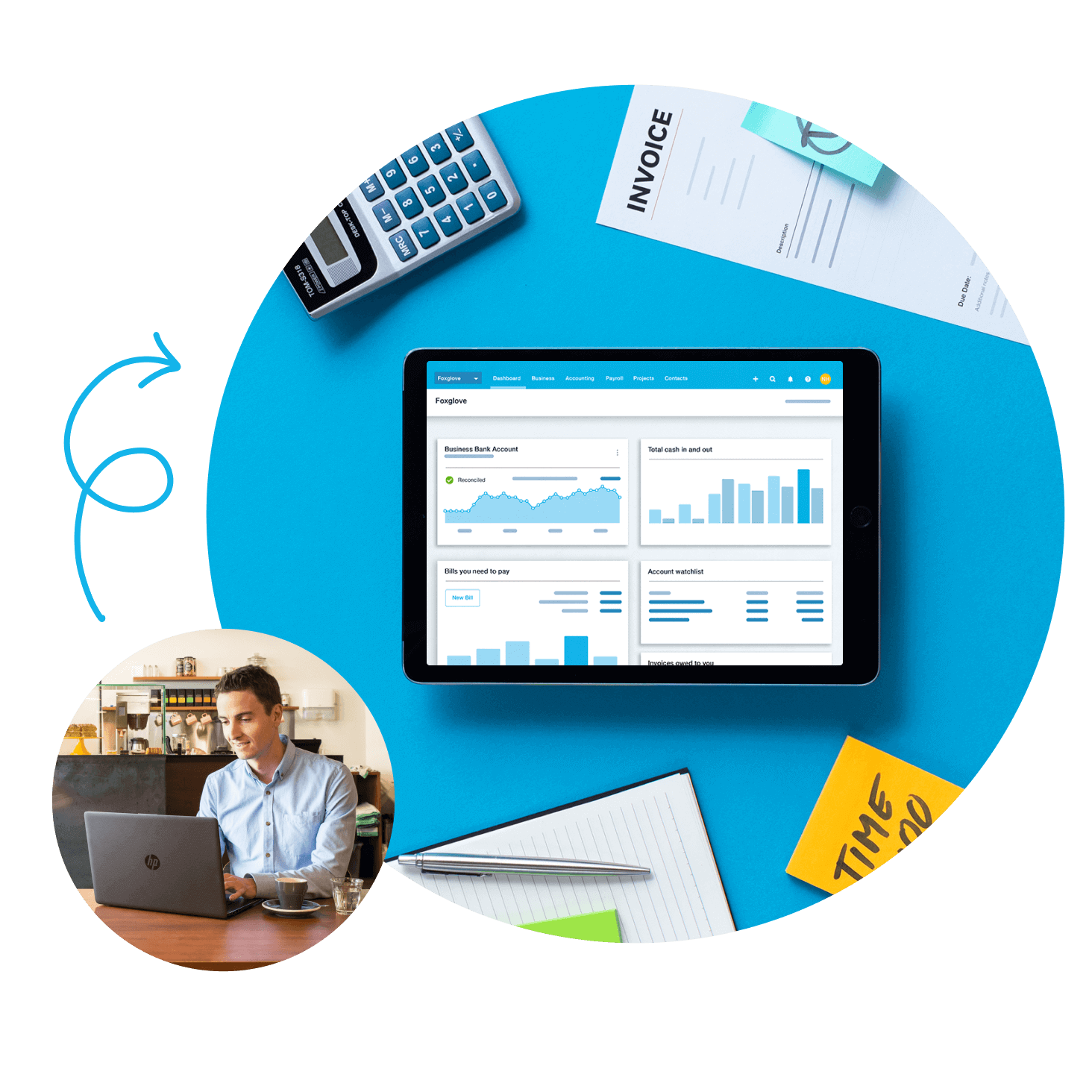

Make business easier with Xero MTD software

Making Tax Digital software isn’t just for compliance. Xero’s all-in-one platform simplifies business and practice tasks for you. Track cash flow, automate bookkeeping, invoice online, and file compliant returns for a range of taxes. Plus:

- Connect your bank account so transactions flow into Xero automatically

- See business finances at a glance with easy-to-read dashboards

- Add apps to bring all your financial data into one space

Getting Xero made the whole business more efficient. It made accessing the accounts so much easier.

Xero lets Sidonie from Papersmiths focus on other parts of her business

FAQs about Making Tax Digital

MTD compliance means following the Making Tax Digital rules. These include using MTD-compatible software to keep digital records and submit returns, and meeting the reporting deadlines for VAT and Income Tax. In most cases, both VAT and Income Tax returns need to be submitted quarterly. For MTD for Income Tax, you also need to send a final declaration once all quarterly updates are submitted.

MTD compliance means following the Making Tax Digital rules. These include using MTD-compatible software to keep digital records and submit returns, and meeting the reporting deadlines for VAT and Income Tax. In most cases, both VAT and Income Tax returns need to be submitted quarterly. For MTD for Income Tax, you also need to send a final declaration once all quarterly updates are submitted.

All VAT-registered businesses have been required to follow Making Tax Digital for VAT rules since April 2022. The upcoming MTD for IT deadlines are as follows. In April 2026, sole traders and landlords earning above £50,000 are required to follow MTD for IT rules. In April 2027, sole traders and landlords earning above £30,000 are required to follow MTD for IT rules. And, finally, in April 2028, sole traders and landlords earning above £20,000 are required to follow MTD for IT rules. MTD for general partnerships is yet to be confirmed.

All VAT-registered businesses have been required to follow Making Tax Digital for VAT rules since April 2022. The upcoming MTD for IT deadlines are as follows. In April 2026, sole traders and landlords earning above £50,000 are required to follow MTD for IT rules. In April 2027, sole traders and landlords earning above £30,000 are required to follow MTD for IT rules. And, finally, in April 2028, sole traders and landlords earning above £20,000 are required to follow MTD for IT rules. MTD for general partnerships is yet to be confirmed.

For mandated businesses, MTD for Income Tax is compulsory. Following the rules will help you avoid the penalties and fines that come with non-compliance. Using Making Tax Digital software can also improve efficiency and accuracy. Modern software providers offer automation features that can take care of repetitive admin for you. You also get a regular view of your tax liability, which makes planning for your bill easier.

For mandated businesses, MTD for Income Tax is compulsory. Following the rules will help you avoid the penalties and fines that come with non-compliance. Using Making Tax Digital software can also improve efficiency and accuracy. Modern software providers offer automation features that can take care of repetitive admin for you. You also get a regular view of your tax liability, which makes planning for your bill easier.

Xero software is HMRC-recognised and trusted by millions. You get all the tools to comply with MTD for VAT and MTD for Income Tax rules. Digital records for VAT and Income Tax flow into draft returns, ready for you to review and submit. Features like bank reconciliation predictions speed up admin, by suggesting matches for statement lines so you can reconcile your accounts faster. Plus, real-time tax estimates make it easier to plan for your bill and manage cash flow.

Xero software is HMRC-recognised and trusted by millions. You get all the tools to comply with MTD for VAT and MTD for Income Tax rules. Digital records for VAT and Income Tax flow into draft returns, ready for you to review and submit. Features like bank reconciliation predictions speed up admin, by suggesting matches for statement lines so you can reconcile your accounts faster. Plus, real-time tax estimates make it easier to plan for your bill and manage cash flow.

While it’s true that you can continue using bridging software and spreadsheets for MTD for VAT, when MTD for IT comes into place, it’s likely to be harder. This is because you need to submit cumulative quarterly updates. Full MTD software makes it easier to file compliant returns for both VAT and Income Tax.

See how to use Xero for spreadsheetsWhile it’s true that you can continue using bridging software and spreadsheets for MTD for VAT, when MTD for IT comes into place, it’s likely to be harder. This is because you need to submit cumulative quarterly updates. Full MTD software makes it easier to file compliant returns for both VAT and Income Tax.

See how to use Xero for spreadsheetsSince April 2022, Making Tax Digital for VAT has applied to all VAT-registered businesses. If you sign up for VAT, you’ll automatically be registered for MTD. To comply with digital VAT rules, you’ll need to use VAT compatible software to keep records and submit returns.

Learn more about MTD for VATSince April 2022, Making Tax Digital for VAT has applied to all VAT-registered businesses. If you sign up for VAT, you’ll automatically be registered for MTD. To comply with digital VAT rules, you’ll need to use VAT compatible software to keep records and submit returns.

Learn more about MTD for VATMTD for IT rules come into place over three phases, the first starting April 2026 for sole traders and landlords earning above £50,000. Those earning above £30,000 will need to comply from April 2027, and those earning above £20,000 will need to comply from April 2028. For each phase, mandated sole traders and landlords will need to use MTD-compatible software to keep records and submit quarterly updates. If you think you may be eligible for an exemption from MTD for IT, you will need to apply for an exemption directly to HMRC. Businesses with existing digital exemptions from MTD for VAT will still need to apply for an exemption for MTD for IT.

Learn more about MTD for ITMTD for IT rules come into place over three phases, the first starting April 2026 for sole traders and landlords earning above £50,000. Those earning above £30,000 will need to comply from April 2027, and those earning above £20,000 will need to comply from April 2028. For each phase, mandated sole traders and landlords will need to use MTD-compatible software to keep records and submit quarterly updates. If you think you may be eligible for an exemption from MTD for IT, you will need to apply for an exemption directly to HMRC. Businesses with existing digital exemptions from MTD for VAT will still need to apply for an exemption for MTD for IT.

Learn more about MTD for ITAll business and property income contributes to the MTD for IT thresholds. If you have multiple sources of business or property income, you need to add them all up. So, if you’re a freelancer who earns £35,000 from your business, and £20,000 per year from property, you’ll be above the 2026 threshold and will need to join MTD for IT.

All business and property income contributes to the MTD for IT thresholds. If you have multiple sources of business or property income, you need to add them all up. So, if you’re a freelancer who earns £35,000 from your business, and £20,000 per year from property, you’ll be above the 2026 threshold and will need to join MTD for IT.

All VAT-registered businesses need to follow MTD for VAT rules. When MTD for Income Tax comes into place from April 2026 for those earning above £50,000, sole traders and landlords will need to join the system too. MTD for both taxes means businesses need to get HMRC-recognised software, like Xero, in place for keeping digital records and filing returns. MTD software comes with all kinds of benefits, though – it can help you speed up admin, stay compliant, and prepare accurate returns quickly.

All VAT-registered businesses need to follow MTD for VAT rules. When MTD for Income Tax comes into place from April 2026 for those earning above £50,000, sole traders and landlords will need to join the system too. MTD for both taxes means businesses need to get HMRC-recognised software, like Xero, in place for keeping digital records and filing returns. MTD software comes with all kinds of benefits, though – it can help you speed up admin, stay compliant, and prepare accurate returns quickly.

Many accountants and bookkeepers will find themselves in an educator role, guiding clients on new rules and supporting them with software for MTD. Getting up to speed with software features and brushing up on MTD legislation is key to compliance.

Learn more about MTD for accountantsMany accountants and bookkeepers will find themselves in an educator role, guiding clients on new rules and supporting them with software for MTD. Getting up to speed with software features and brushing up on MTD legislation is key to compliance.

Learn more about MTD for accountantsYes, all Xero plans are Making Tax Digital (MTD) ready. Whether you're a VAT-registered business or a self-employed individual, Xero provides the tools to keep digital records and submit compliant returns directly to HMRC.

Explore Xero plansYes, all Xero plans are Making Tax Digital (MTD) ready. Whether you're a VAT-registered business or a self-employed individual, Xero provides the tools to keep digital records and submit compliant returns directly to HMRC.

Explore Xero plansXero’s Making Tax Digital software works for both MTD and non-MTD services. Once you’re signed up to MTD for VAT or MTD for IT, you can submit compliant returns using Xero software. Xero even gives you an estimation of your tax liability after each submission, making it easier to plan ahead.

See how to set up MTD for VAT in XeroXero’s Making Tax Digital software works for both MTD and non-MTD services. Once you’re signed up to MTD for VAT or MTD for IT, you can submit compliant returns using Xero software. Xero even gives you an estimation of your tax liability after each submission, making it easier to plan ahead.

See how to set up MTD for VAT in XeroNo. If your business is VAT-registered, you need to follow MTD for VAT rules. If you’re a sole trader or landlord and you earn above the £50,000, £30,000, or £20,000 threshold, you need to follow MTD for IT rules when the relevant phase comes into place. Some individuals, including the elderly, people with disabilities, or those living in remote locations, can claim digital exemptions.

Learn more about how to request a digital exemptionNo. If your business is VAT-registered, you need to follow MTD for VAT rules. If you’re a sole trader or landlord and you earn above the £50,000, £30,000, or £20,000 threshold, you need to follow MTD for IT rules when the relevant phase comes into place. Some individuals, including the elderly, people with disabilities, or those living in remote locations, can claim digital exemptions.

Learn more about how to request a digital exemptionYes, the systems are separate. When you register for VAT, you’ll automatically be signed up for MTD for VAT. For MTD for IT, you can sign up using HMRC’s online service, or through your accountant or bookkeeper. Some sole traders will need to follow MTD for VAT and MTD for IT rules, whereas others will only need to sign up for MTD for IT.

Sign up for MTD for IT on the HMRC websiteYes, the systems are separate. When you register for VAT, you’ll automatically be signed up for MTD for VAT. For MTD for IT, you can sign up using HMRC’s online service, or through your accountant or bookkeeper. Some sole traders will need to follow MTD for VAT and MTD for IT rules, whereas others will only need to sign up for MTD for IT.

Sign up for MTD for IT on the HMRC website

Use Xero for MTD

Access all Xero features free for 30 days, then decide which plan best suits your business.

Explore more MTD news and resources

Get started in a few steps. Any Xero plan that supports VAT is compatible with Making Tax Digital.

Making Tax Digital for IT resources

Explore our MTD webinars, guides, articles, and FAQs for everything you need to know about MTD for IT.

Making Tax Digital software

Learn more about why you need Making Tax Digital software that’s 100% HMRC compliant.

Making Tax Digital for VAT resources

Explore our MTD webinars, guides, articles, and FAQs for everything you need to know about MTD for VAT.