Get back to what you love with Xero accounting software

Spend less time in the books

Try accounting software for everyday businesses. With features and tools to save you time. Explore all features.

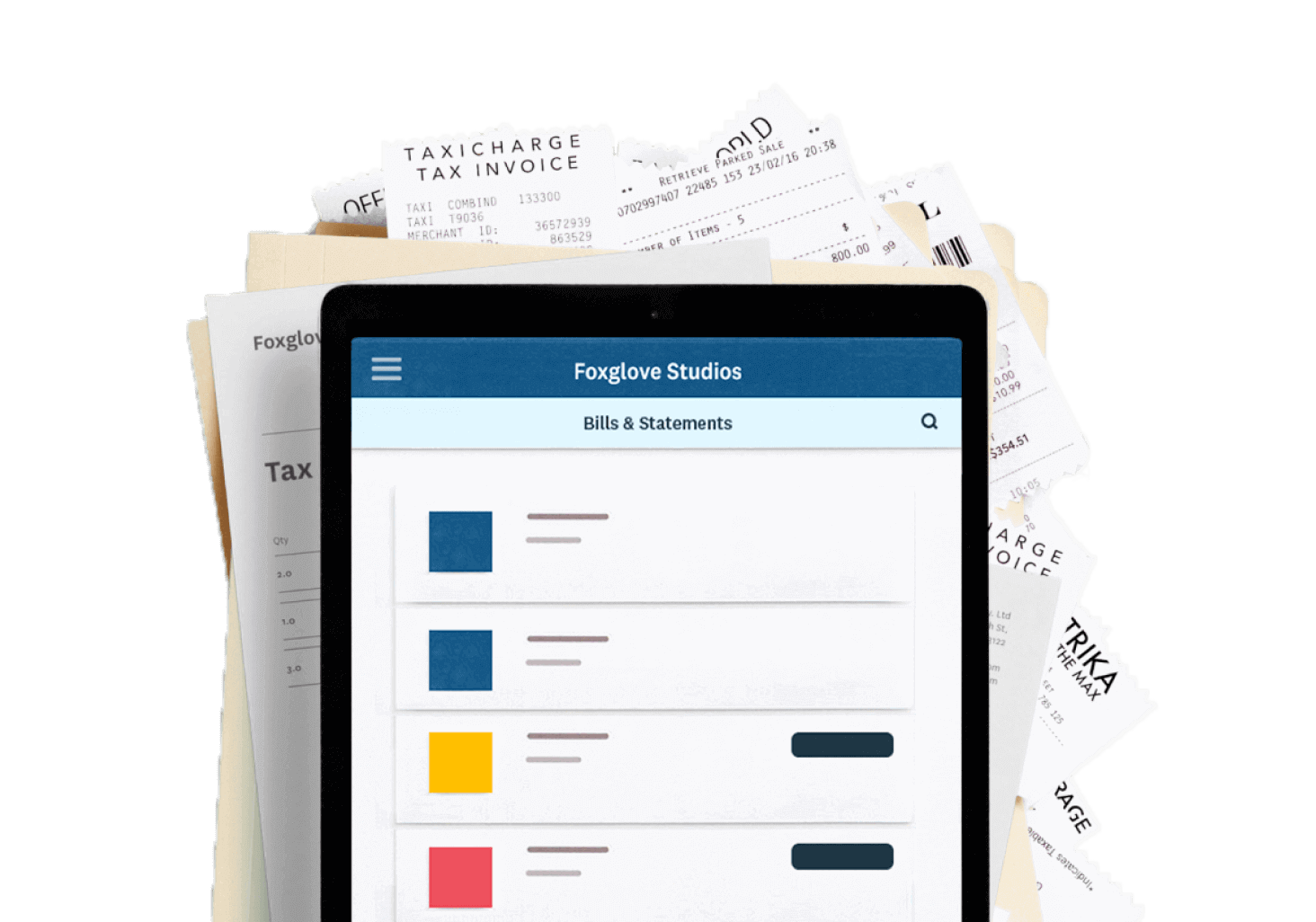

All in one, paperless record keeping

Centralize your finances with safe and secure cloud accounting software.

Automated features to save you time

From reconciling bank transactions to sending invoice reminders, Xero works for you.

Smart data and insights

Make confident business decisions with trend analysis and simple, customizable reporting.

Get set up faster

Get the most out of Xero with access to our team of onboarding specialists during your first 90 days.

Expert advisors help you thrive

An accountant or bookkeeper can be useful set of hands to help with the accounting heavy lifting.

Capture data automatically

Pull bills and receipts into Xero automatically with Hubdoc.

We’re backing small business

Introducing the Xero Beautiful Business Fund. A chance to win a better future for your small business.

Try Xero for free

30-day free trialAccess Xero features for 30 days, then decide which plan best suits your business.

30-day free trial

$0

USD

- Access Xero features

- Set up with your data or a demo

- No credit card required

- 24/7 online support

- Cancel any time

How Xero works for your business type

Manage your finances, control cash flow and integrate with apps. See how Xero can help businesses in your industry. See all business types

Construction and trades

Send quotes and invoices, track expenses, and manage jobs from your phone with Xero’s construction accounting software.

Real estate

Track performance and view client records on the go. Manage taxes with easy accounting software for real estate agents.

Retail

View cash flow on the go and reduce manual admin. Run your retail business efficiently with Xero accounting software.

Plans to suit your business

All pricing plans cover the accounting essentials, with room to grow.

Early

$15

USD per month

Good for sole traders, new businesses, and the self-employed.

Growing

$42

USD per month

Good for growing small businesses.

Established

$78

USD per month

Good for established businesses.

Products for accountants and bookkeepers

Keep your practice a step ahead with Xero accounting software.

Explore the Partner Program