Cash flow forecast: Simple steps for small businesses

Cash flow forecasting helps you predict future income and expenses, giving you the insights to make smarter business decisions.

Written by Kari Brummond—Content Writer, Accountant, IRS Enrolled Agent. Read Kari's full bio

Published Friday 7 November 2025

Table of contents

Key takeaways

• Create a cash flow forecast by recording your starting bank balance, listing expected income with specific dates, estimating all expenses including irregular costs like taxes, and calculating running balances to see your cash position at any point in time.

• Update your cash flow forecast monthly by removing completed months, adding new periods, and comparing actual results to previous predictions to maintain accuracy and improve future forecasting.

• Use cash flow forecasting to identify potential cash shortfalls weeks in advance, allowing you to secure loans, negotiate payment terms, or delay expenses before problems arise.

• Focus your analysis on three key areas: checking closing balances to ensure adequate cash reserves, monitoring net cash flow trends over time, and comparing forecasted versus actual results to refine your predictions.

What is cash flow forecasting?

Cash flow forecasting is a method of predicting future cash inflows and outflows to determine how much money your business will have at specific points in time. This financial planning tool helps you avoid cash shortages and make informed spending decisions.

Cash flow forecasting differs from – statements track past transactions while forecasts predict future cash positions.

Benefits of cash flow forecasting

Cash flow forecasting helps you avoid financial surprises by showing exactly when money will come in and go out of your business.

This visibility means you can:

- Pay bills on time without scrambling for funds

- Ensure regular owner payments instead of going without

- Plan for rising costs before they impact operations

Cash flow forecasting provides multiple operational and financial benefits:

- spot potential cash shortfalls weeks ahead so you can secure loans, negotiate payment terms or delay expenses

- decide if you can afford new equipment, staff or expansion without affecting your operations

- ensure you receive regular owner payments, even during tight periods

- identify rising expenses or falling revenue before they become a problem

- highlight issues like slow-paying customers, poor payment terms or seasonal changes

Key components of a cash flow forecast

A cash flow forecast tracks five key parts that show your business’s full cash picture:

- record your starting balance as the cash in your bank accounts

- add your expected cash inflows from sales, loans or asset sales

- subtract your planned cash outflows for expenses and payments

- calculate your net cash flow to see if your cash increased or decreased

- check your closing balance at the end of each period

A cash flow dashboard shows how cash balances will rise and fall in response to expected transactions.

How to create a cash flow forecast

Cash flow forecasting involves estimating when money will move in and out of your business, then tracking how these transactions affect your cash position.

The basic process:

- Choose your timeframe (weekly, monthly, or quarterly)

- List expected income with specific dates and amounts

- Record planned expenses including irregular costs like taxes or equipment

- Calculate running balances to see cash levels at any point

1. Estimate your income

Check your past sales data, upcoming invoices and new contracts to predict how much money will come in. Be realistic about when you expect customers to pay.

2. Estimate your expenses

List all your expected costs, including regular bills like rent and payroll, and less frequent payments like taxes or annual software subscriptions. Make sure you include variable costs that change with your sales volume.

3. Put it all together

Follow these four steps to create your cash flow forecast:

1. Set your starting point: Record your current bank balance and choose your forecast period (typically 3-12 months)

2. Project cash inflows: List all expected income with dates:

- Customer payments and sales receipts

- Grants, tax refunds, or loan proceeds

- Asset sales or other income sources

3. Estimate cash outflows: Include both regular and irregular expenses:

- Routine costs like rent, salaries, and supplies

- Periodic expenses like insurance, taxes, or equipment repairs

- Loan payments and other scheduled outgoings

4. Calculate running balances: Add income and subtract expenses chronologically to see your cash position at any point

Example of a cash flow forecast

The owner of Tiny Construction wants to know if they can afford a new $20,000 piece of equipment next month. They start with $45,000 in the bank. They expect $90,000 in sales payments and have $65,000 in expenses.

So the ‘money in’ part of the cash flow projection will look like this:

The "money out" part of the cash flow projection will look like this:

Their net cash flow is $25,000 ($90,000 – $65,000). Their closing balance will be $70,000 ($45,000 + $25,000), so they can comfortably afford the equipment.

Types of cash flow forecasts

You can create forecasts for different timeframes depending on what you need to know.

Short-term cash flow forecast

A short-term forecast usually covers the next 13 weeks. It helps you manage your daily cash, pay bills and staff on time, and spot cash gaps early. If your business has many transactions, you may need to check your cash position every day.

Long-term cash flow forecast

A long-term forecast looks further ahead, usually for the next 12 months or more. It helps you plan for things like getting a loan, growing your business or setting your annual budget.

How to analyse your cash flow forecast

Analyse your cash flow forecast to make better business decisions and improve your future predictions.

Focus on three key areas:

- check your closing balances to make sure you have enough cash at the end of each period

- look at your net cash flow trends to see if you are generating or using cash over time

- compare your forecast to actual results each month and adjust your estimates as needed

How often should you update your cash flow forecast?

Update your cash flow forecast every month to keep it accurate and useful for your business decisions.

Forecast accuracy decreases over time – predictions for next month are more reliable than those for next year. Most small businesses use three to 12 month forecasts for the best balance of accuracy and planning value.

Monthly refresh process:

- remove the completed month from your forecast

- add a new month to the end

- update all remaining projections with new information

- compare actual results to previous predictions to improve accuracy

Cash flow forecasting tools and software

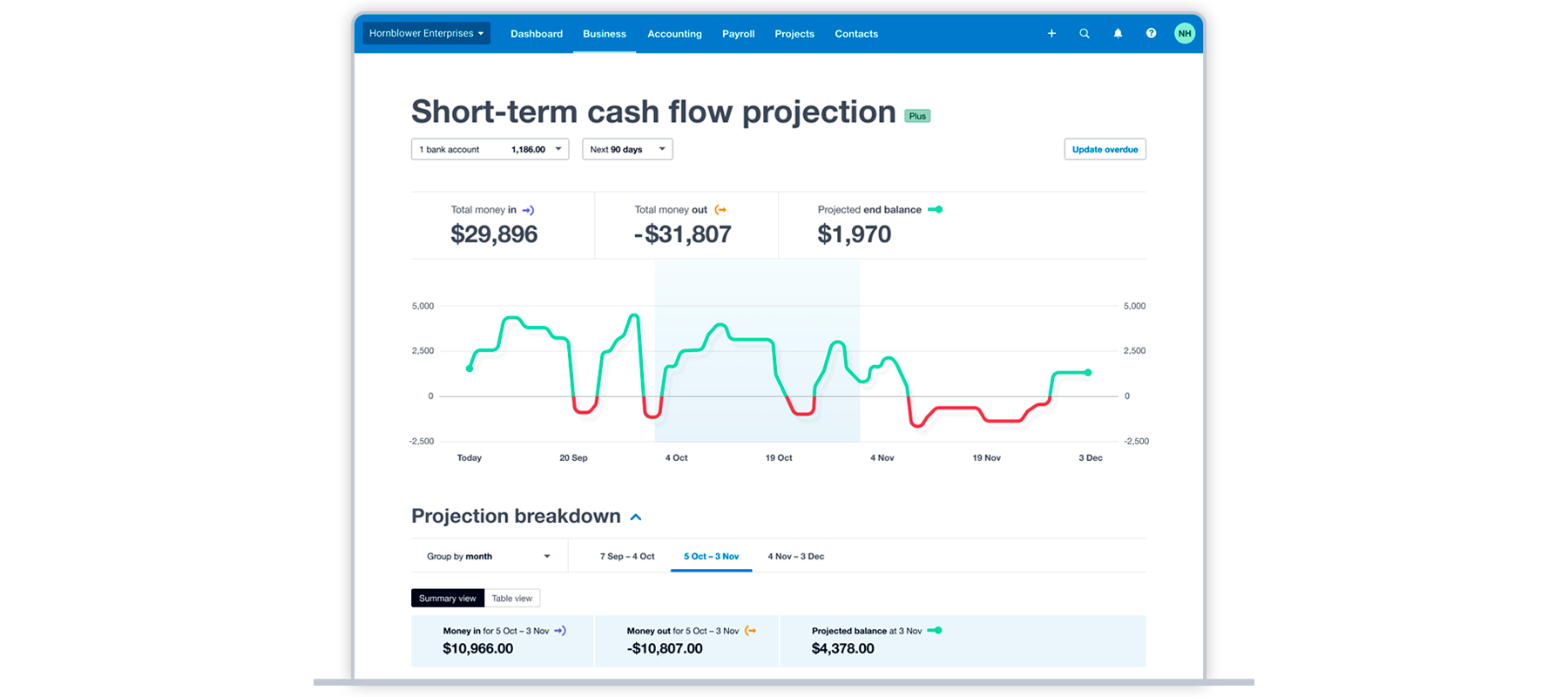

You can start with a spreadsheet, but it can be time-consuming and prone to errors. Xero accounting software automates much of the work for you.

A cash flow dashboard shows how cash balances will rise and fall in response to expected transactions.

Xero accounting software tracks your invoices and bills, so you can create a short-term cash flow projection in just a few clicks. This gives you an up-to-date view of your finances without manual data entry.

For more detailed, long-term forecasting, you can connect Xero accounting software to specialised forecasting apps in the Xero App Store, such as Spotlight, Fathom and Calxa.

Take control of your business finances

A cash flow forecast gives you confidence in managing your finances. When you plan ahead, you can make better decisions, avoid surprises and keep your business running smoothly. Using accounting software makes the process simple, so you have more time to focus on your business.

Ready to see your future cash flow? Try all features of Xero accounting software free for 30 days to find the plan that suits your business. Try Xero for free.

FAQs on cash flow forecasting

Here are answers to some common questions about cash flow forecasting.

What is a 3-way cash flow forecast?

A three-way forecast connects your cash flow forecast with your profit and loss statement and your balance sheet. Because all three reports are linked, any change in one automatically updates the others. It provides a complete financial picture and is often required by lenders.

What's the difference between a cash flow forecast and a budget?

A cash flow forecast tracks the actual cash moving in and out of your bank account. A budget is a plan for your income and expenses, but it doesn't always align with when cash is actually received or paid. For example, you might budget for a sale in May, but if the customer doesn't pay until June, your cash flow forecast will reflect that delay.

Can I forecast cash flow with no historical data?

Yes, you can. If you're a new business, you'll need to rely on market research and your business plan. Estimate your likely sales, the cost of those sales, and your overhead expenses. It's a good idea to be conservative with your income estimates and generous with your expense estimates to create a buffer.

Disclaimer

Xero does not provide accounting, tax, business or legal advice. This guide has been provided for information purposes only. You should consult your own professional advisors for advice directly relating to your business or before taking action in relation to any of the content provided.

Start using Xero for free

Access Xero features for 30 days, then decide which plan best suits your business.