Financial statements: What they are and how your small business can use them

Discover how financial statements sharpen cash flow, track profit, and guide decisions for your small business.

Written by Jotika Teli—Certified Public Accountant with 24 years of experience. Read Jotika's full bio

Published Wednesday 26 November 2025

Table of contents

Key takeaways

• Review all four financial statements together (balance sheet, income statement, cash flow statement, and statement of changes in equity) rather than focusing solely on profit, as a profitable business can still fail if it runs out of cash to pay bills and suppliers.

• Calculate key financial ratios like the current ratio, quick ratio, and debt-to-equity ratio using your balance sheet data to assess your business's liquidity and ability to cover short-term obligations and long-term financial stability.

• Compare your financial statements across multiple periods to identify trends in revenue growth, expense patterns, and cash flow cycles, enabling you to spot opportunities for improvement and make data-driven strategic decisions.

• Distinguish between revenue recorded on your income statement and actual cash in your bank account, as customers may not have paid their invoices yet, which can create dangerous cash flow gaps even when your business appears profitable on paper.

What is a financial statement?

Financial statements are written records that show your business's financial activities and performance over a specific time period. They help you track money coming in and going out, assess profitability, and make informed business decisions.

You can prepare financial statements for different periods, such as:

- Monthly periods: For regular business monitoring

- Quarterly periods: For seasonal analysis and investor updates

- Annual periods: For tax compliance and comprehensive reviews

Lenders and investors use these statements to evaluate your business's financial health and growth potential, and depending on the company type, regulators may enforce a strict lodgement deadline for these reports.

Types of financial statements

The four main types of financial statements work together to give you a complete picture of your business's financial health:

- Balance sheet: Shows what you own versus what you owe at a specific point in time

- Cash flow statement: Monitors money moving in and out of your business

- Statement of changes in equity: Records how much profit you're keeping in the business

Each statement gives you different insights into your finances, so you can make informed decisions.

Balance sheet

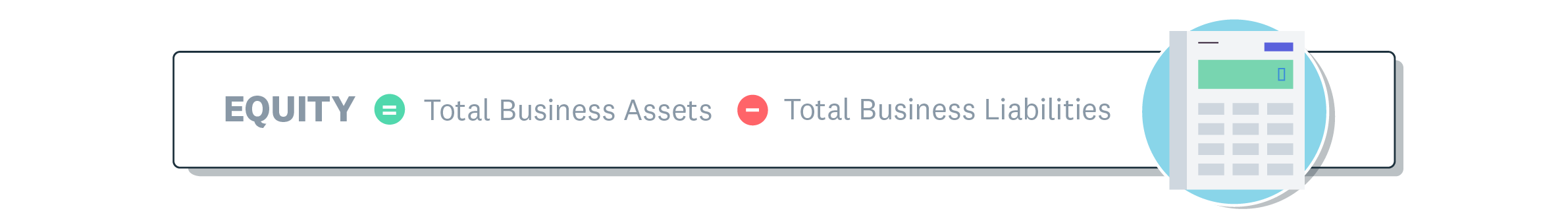

shows your business's financial position at a specific moment in time. It compares what you own against what you owe to calculate your business equity.

What you own (assets):

- Cash and bank accounts

- Inventory and stock

- Equipment and machinery

- Property and buildings

- Intellectual property and patents

What you owe (liabilities):

- Loans and mortgages

- Accounts payable

- Credit card debt

- Tax obligations

Your equity is the difference between assets and liabilities. This figure helps you understand your business's true value and financial stability.

To find the equity, use the formula:

Use this formula to evaluate your business's financial stability.

Income statement /Profit and loss statement

The income statement is a type of financial document that shows your business's revenues and expenses. Subtract expenses from revenues to show your business's profit and loss figure (also known as net income).

For example, in a certain period a manufacturing business might have:

- $150,000 in revenue

- $50,000 in operating expenses (like office hire and utilities)

- $70,000 in cost of sales (materials and labour costs)

In this situation, you would have $30,000 in net income.

Cash flow statement

Also called a statement of cash flows, the cash flow statement shows changes in the amount of cash passing in and out of your business over a period of time.

The cash flow statement shows whether you can cover your short-term expenses, like bills and payroll. It typically records customer sales (operating activity), purchases and sales of assets like machinery (investment activity), and financial activity like money earned from stocks and bonds.

Statement of changes in equity

This statement is also called a statement of owner's equity, shareholder's equity, or retained earnings. It shows how much profit your business keeps after paying all costs and dividends.

You might retain earnings to repay debt, reinvest in your business, or keep as a reserve.

Why financial statements are important for small businesses

-calculation-2.1708626946541.png)

Understanding financial statements helps you make informed decisions by giving you clear insights into your company's financial health.

When you know how to read your statements, you can:

- assess your financial health by tracking profitability, cash flow, and equity

- attract investors and secure loans by providing financial proof to lenders

- comply with tax requirements by meeting reporting obligations and avoiding compliance issues

- track your business performance to identify trends and opportunities for growth

- manage your cash flow to cover expenses, payroll, and unexpected costs

- make informed decisions using accurate data to guide your strategy

How to use financial statements to analyse your business

Each financial statement serves a specific purpose in helping you analyse and improve your business performance. Here's how to use each one effectively:

Analyse financial performance with the income statement

Use your income statement to:

- Evaluate profitability: See whether your business is making or losing money by comparing total revenue against expenses

- Monitor expenses: Identify overspending in categories like cost of goods sold and operating expenses to find cost-cutting opportunities

- Track growth trends: Compare statements across multiple periods to spot patterns in revenue growth and profit margins

Use your income statement to calculate gross profit, operating income, and net income. These figures help you decide if you need to adjust prices or reduce costs.

Manage assets and plan for growth with the balance sheet

The balance sheet helps you:

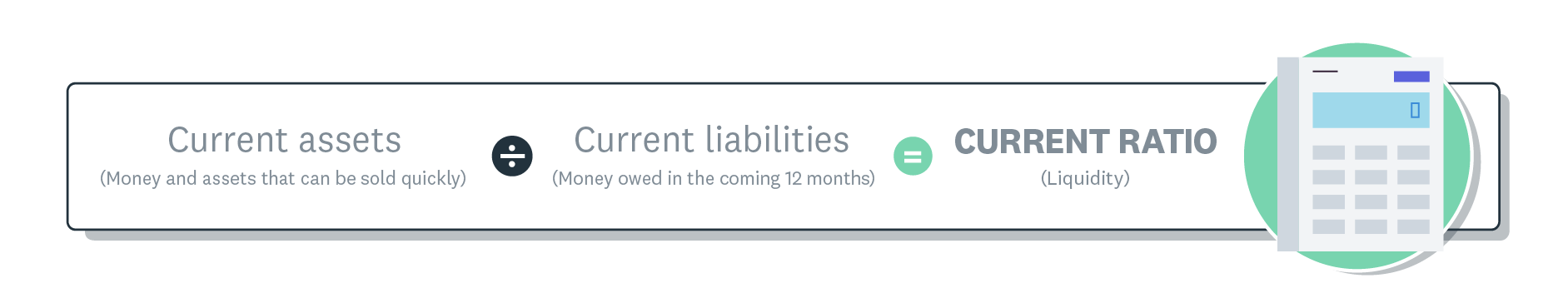

- Assess liquidity by comparing your business's current assets to its current liabilities. Use liquidity ratios like the current ratio and the quick ratio (see below) to decide whether you can cover your short-term obligations.

- Evaluate your business's solvency by examining its long-term liabilities and equity. A high debt-to-equity ratio may signal a risk to the business's financial stability, while a healthy equity base (a lower ratio) indicates strong financial health.

- Track asset management by examining how efficiently you're managing assets like inventory, property, and equipment. For example, analysis can reveal the total shrinkage of stock, which in one case study amounted to over 11% of the cost of goods sold, showing whether assets are contributing effectively to revenue.

Your balance sheet is an important input into liquidity and solvency ratios like the current ratio, quick ratio, and debt-to-equity ratio, which show you how much cash your business has to pay its bills.

Use the cash ratio to see if you have enough cash to cover payroll, expenses, and loan payments in the coming year.

The quick ratio measures whether you can cover your core costs over the next three months.

The current ratio includes your inventory value. Use it to help you decide how to manage your expenses and cash.

Manage your cash flow with the cash flow statement

Strong cash flow means you can meet your financial obligations. Use your cash flow statement to check your cash position and take action if needed.

In particular, use the cash flow statement to:

- Analyse cash flow from operations by determining if the core business activities generate enough cash to sustain operations. Consistently negative cash flow can indicate a problem, even if profits are healthy.

- Judge the quality of investments by tracking how much cash you're using for capital expenditures like equipment or expanding your operations. This shows whether the business is reinvesting to stimulate future growth.

- Monitor financing activities by reviewing cash flow from loans, equity financing, or dividends to see how external financing affects the company's cash position.

Here's more advice on managing your finances and cash flow. For support in your area, check your local accounting standards.

Analyse growth with the retained earnings statement

This statement is useful for demonstrating your business':

- Growth potential: If your business' retained earnings grow from one financial period to the next, it suggests your business can comfortably retain profits and reinvest in itself without borrowing, perhaps by purchasing new equipment or paying off debts.

- Financial health: A decline in retained earnings suggests a business is using profits to cover losses or debts – a warning sign of financial problems.

Financial statement templates for your business

Financial statement templates save you time because you can use them to create your balance sheet, income statement, and cash flow statement.

Benefits of using templates:

- keep your formatting consistent across all statements

- save time by using templates instead of creating statements from scratch

- reduce errors with pre-built formulas

- present your financial reports professionally to lenders and investors

Get started with Xero's free financial statement templates.

Ways to use your financial statements

Use these tips to better understand how to effectively use your financial statements.

Consider the big picture – not just profit

Review all your financial statements together to understand your business's financial position. Focusing only on profit can hide cash flow problems.

Why this matters: A profitable business can still fail if it runs out of cash to pay bills, staff, or suppliers, especially with a high reliance on trade sales, which can delay cash flow even when revenue is high. Review your income statement, balance sheet, and cash flow statement as a set to spot potential issues early.

Pay attention to your cash flow

If you overlook your cash flow statement, you could run short of cash even if your business is profitable. Check your cash flow statement to track your liquidity and make sure you have enough cash to cover short-term costs.

Know the difference between revenue and cash

Revenue from sales is not the same as cash on hand. You may have recorded revenue, but the money might not be in your bank account yet.

Track your sales and cash inflows separately so you know how much you can spend. Keep accounts receivable separate to avoid confusion.

Analyse trends by comparing your financial statements

Compare your financial statements over time to spot trends in revenue, expenses, and liabilities. For example, you might find that weekend trading generates 36 per cent of total sales, so you can invest more in those periods and address areas that are not performing well.

Get across your financial ratios

Financial ratios help you measure your business's liquidity, profitability, and financial health.

Use key financial ratios, such as the current ratio and quick ratio, to evaluate your company's financial position and make better decisions.

FAQs on financial statements

Here are answers to some common questions about financial statements.

What's the difference between the income statement and cash flow statement?

The income statement shows profitability – whether you're making money on paper by comparing revenue to expenses. The cash flow statement shows liquidity – the actual cash moving in and out of your business.

Key difference: You can be profitable but still have cash flow problems if customers haven't paid their invoices yet, or if you've spent cash on inventory that hasn't sold.

Does my small business need all four types of financial statements?

Each of the four financial statements helps you understand your business's financial health. The balance sheet, income statement, and cash flow statement are the most useful for improving your financial literacy. Use the retained earnings statement if you plan to reinvest your profits.

How often should I prepare financial statements?

That depends on your business needs. It's good to prepare financial statements regularly (monthly, quarterly, or annually) so you can react faster when an opportunity or problem arises.

Can I automate my financial statements?

Yes – Xero accounting software automates the creation of financial statements, saving you time, reducing errors, and making tax compliance easier.

Disclaimer

Xero does not provide accounting, tax, business or legal advice. This guide has been provided for information purposes only. You should consult your own professional advisors for advice directly relating to your business or before taking action in relation to any of the content provided.

Start using Xero for free

Access Xero features for 30 days, then decide which plan best suits your business.