United Kingdom Small Business Insights

This analysis focuses on core performance metrics of sales growth, jobs growth, wages growth, and time to be paid.

Small business performance little changed

Published: 31 October 2024

The September quarter Xero Small Business Insights (XSBI) data for the UK shows little growth in sales compared to a year ago, especially in the final two months of the quarter. This is despite the Bank of England cutting the official cash rate at its August meeting. Small businesses were paid increasingly late in the quarter. Labor market indicators were broadly unchanged, as small businesses continue to add jobs, albeit at a slow pace, and wage growth for small business employees remains a little below average.

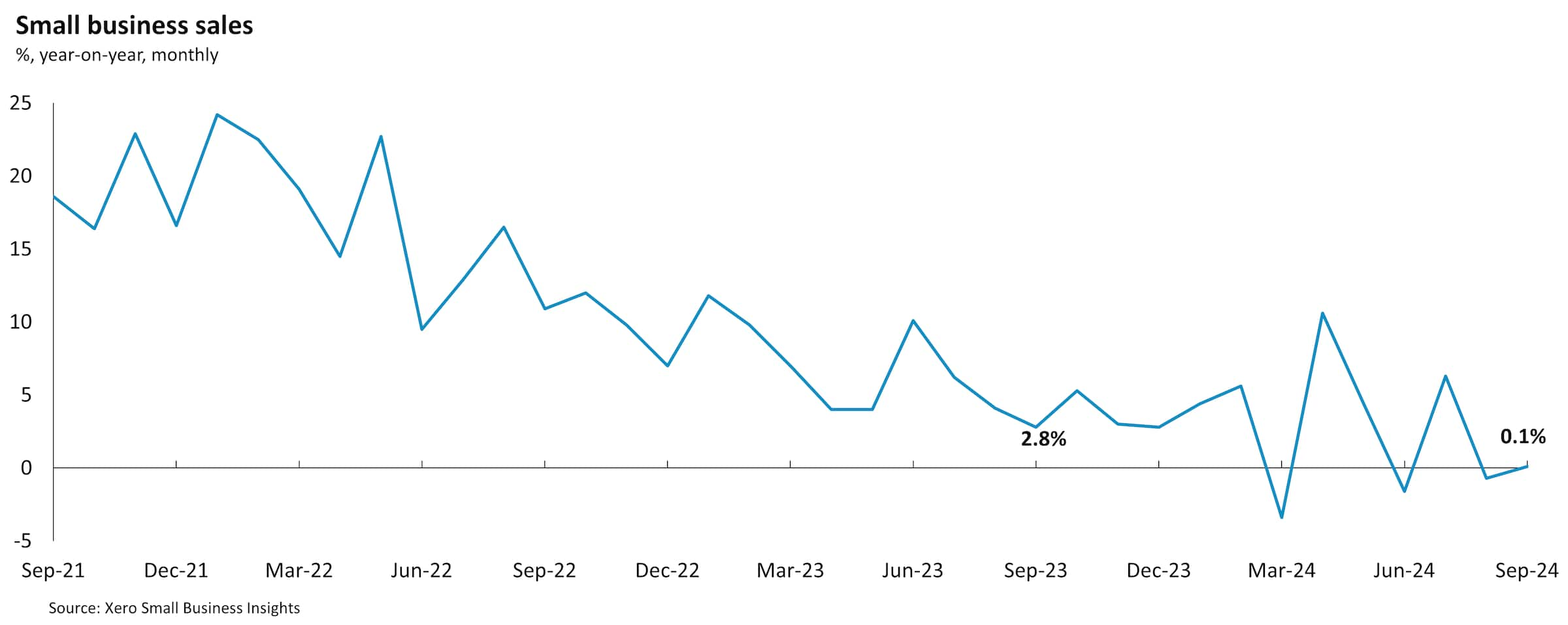

Sales growth in small businesses slowed to 1.9% year-on-year (y/y) in the September quarter, after a 4.5% y/y rise in the June quarter (revised up from the +1.7% y/y initially reported). Making a sale was particularly difficult in the final two months of the quarter, when sales fell 0.7% y/y in August and rose only 0.1% y/y in September. These results suggest small businesses are yet to feel the benefits of the Bank of England's decision on 1 August to cut the official cash rate by 0.25 percentage points to 5%.

The industry and regional sales data highlights that this softness in sales is not uniform. Those industries that have some public-sector links are doing better and those that are more sensitive to interest rates are finding current conditions more challenging. In the September quarter there was continuing solid sales performance in education and training (+5.7% y/y) and health care (+6.1% y/y) but sales declined in retail trade (-3.6% y/y), hospitality (-0.2% y/y) and information media and telecommunications (-0.2% y/y). The Northeast of England continued to be the best performing region, with sales growing 4.5% y/y in the September quarter. This region has had the strongest sales performance for the past year. Scotland, which was the best performing region in 2023, had the slowest sales growth in the September quarter (+1.6% y/y).

The Northeast of England continued to be the best performing region, with sales growing 4.5% y/y in the September quarter. This region has had the strongest sales performance for the past year.

XSBI UK July - September 2024 data

Small businesses paid increasingly late

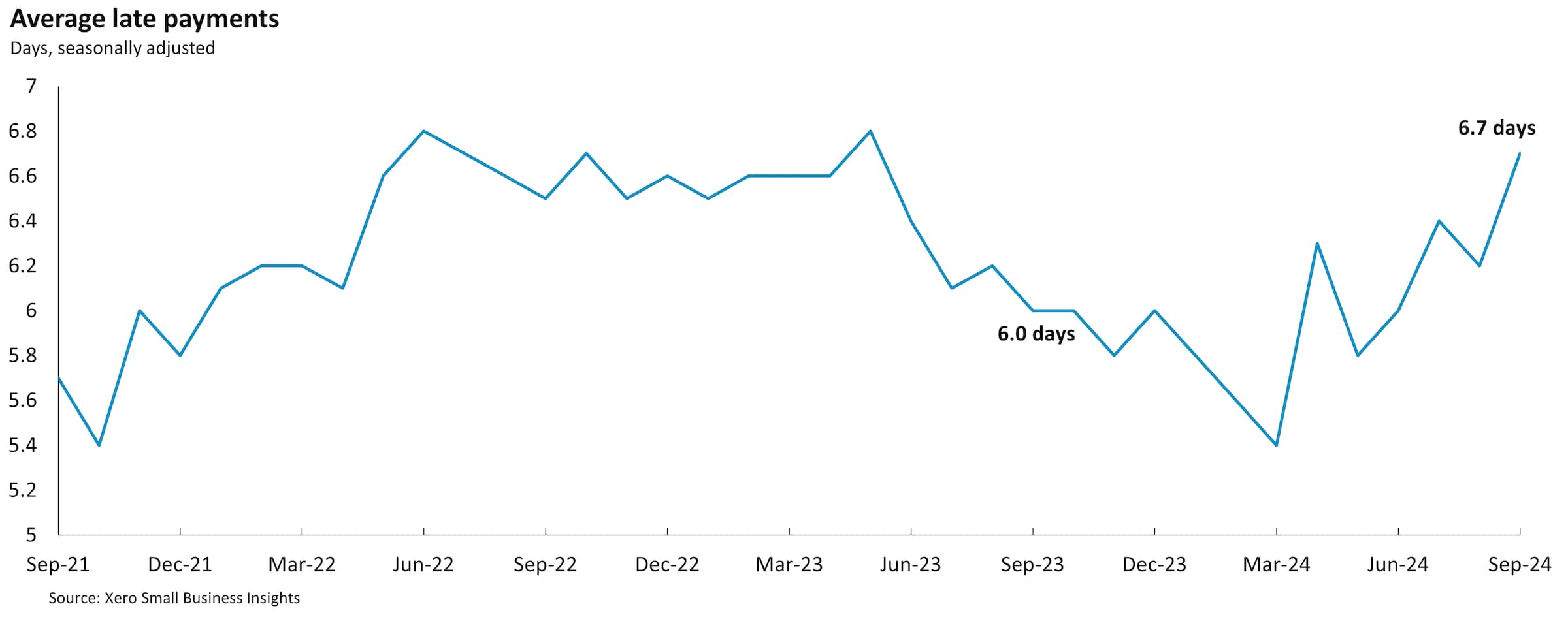

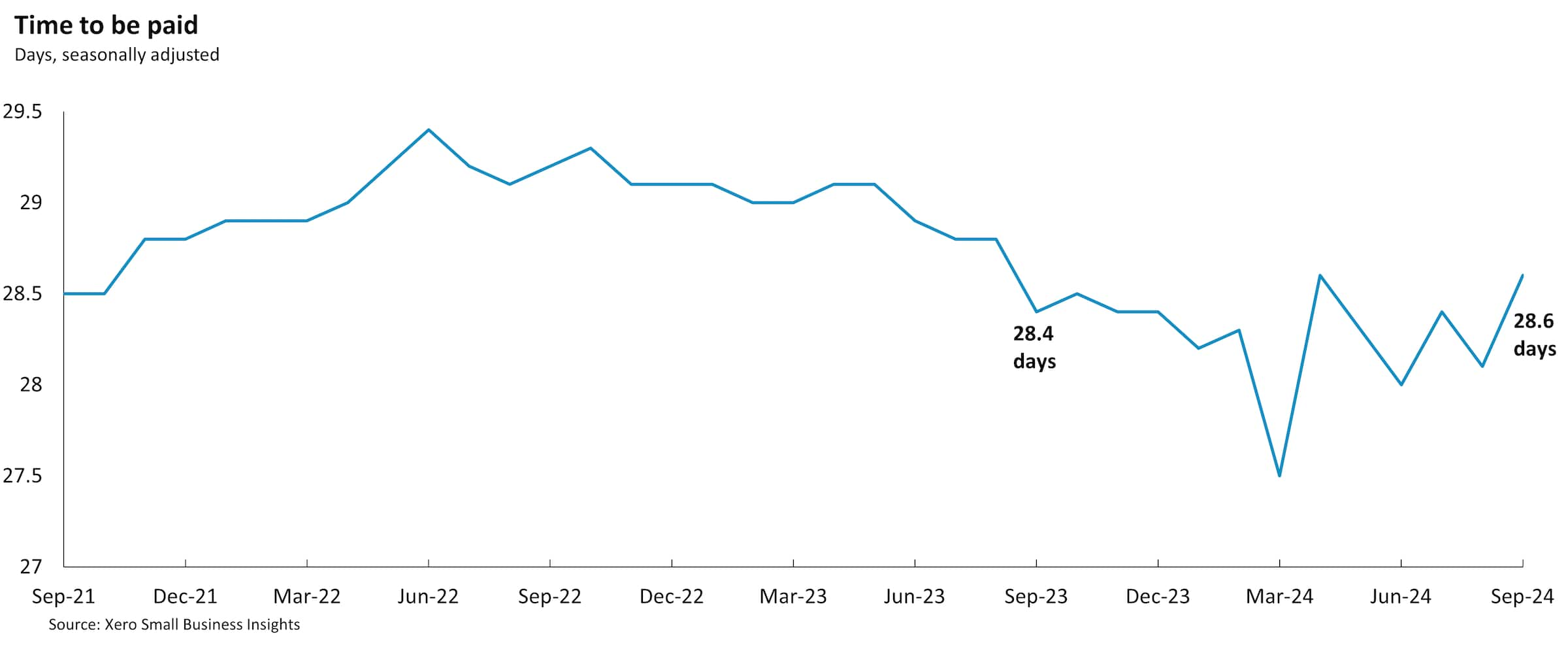

Small businesses were paid an average of 6.4 days late in the September quarter, 0.4 days longer than in the June quarter. The longest month in the quarter was 6.7 days, recorded in September, which was the highest late payment time since May 2023. The average time small businesses waited between issuing an invoice and getting paid was 28.4 days in the September quarter, similar to the 28.3 day wait in the June quarter.

Labor market indicators show little change

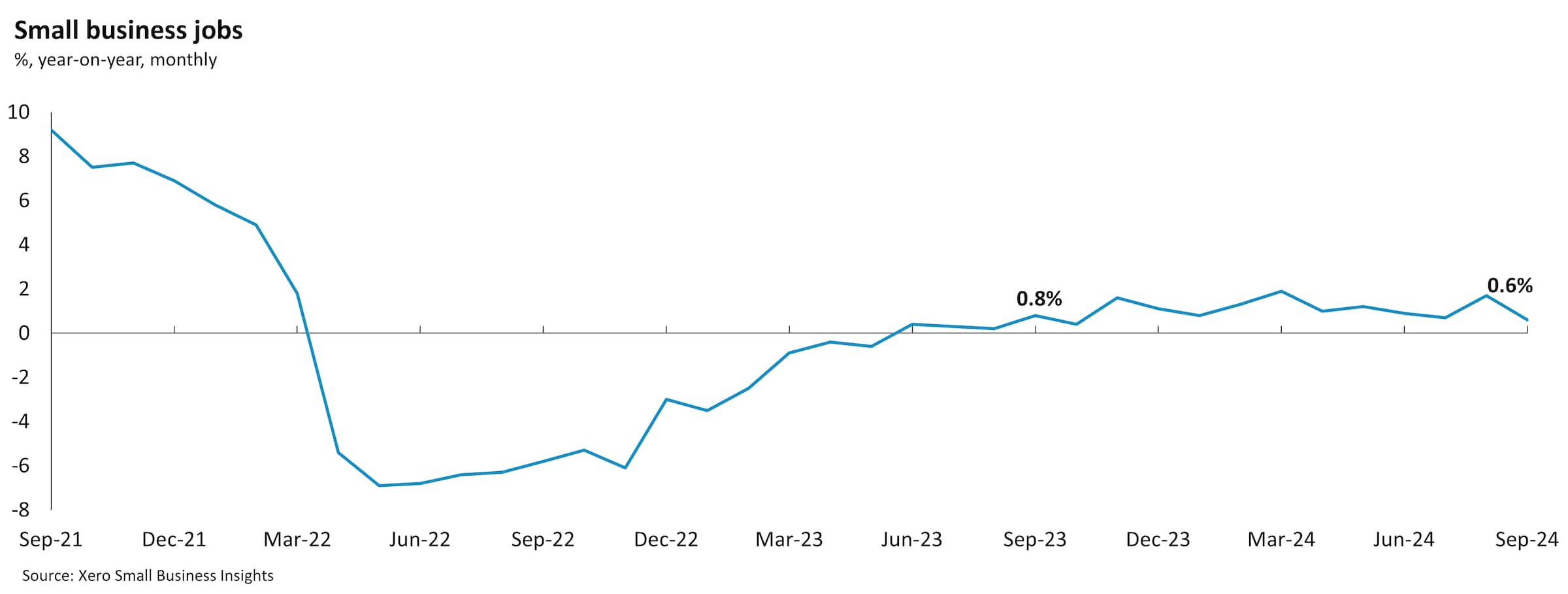

There was little change in the two labor market indicators in the latest quarter. Jobs grew only 1.0% y/y in the September quarter, the same result as the June quarter. Jobs have been growing around a similar pace for the past year, which is below the pre-pandemic average of 3% y/y for this series.

As with sales, there is considerable variation in jobs performance across industries and regions. Health care was the strongest performer in terms of jobs growth (+4.0% y/y) in the September quarter. In contrast, hospitality is employing 0.4% fewer people than it was in September 2023. By far the softest industry for jobs was administrative services, where jobs fell 3.6% y/y in the quarter and have been lower than a year ago for the previous two-and-a-half years. The Northeast of England has been in the top two job growing regions so far in 2024, recording a 5.7% rise in the September quarter. The West Midlands had 0.6% fewer jobs in the September quarter than a year ago - the third successive quarterly decline in jobs for that region.

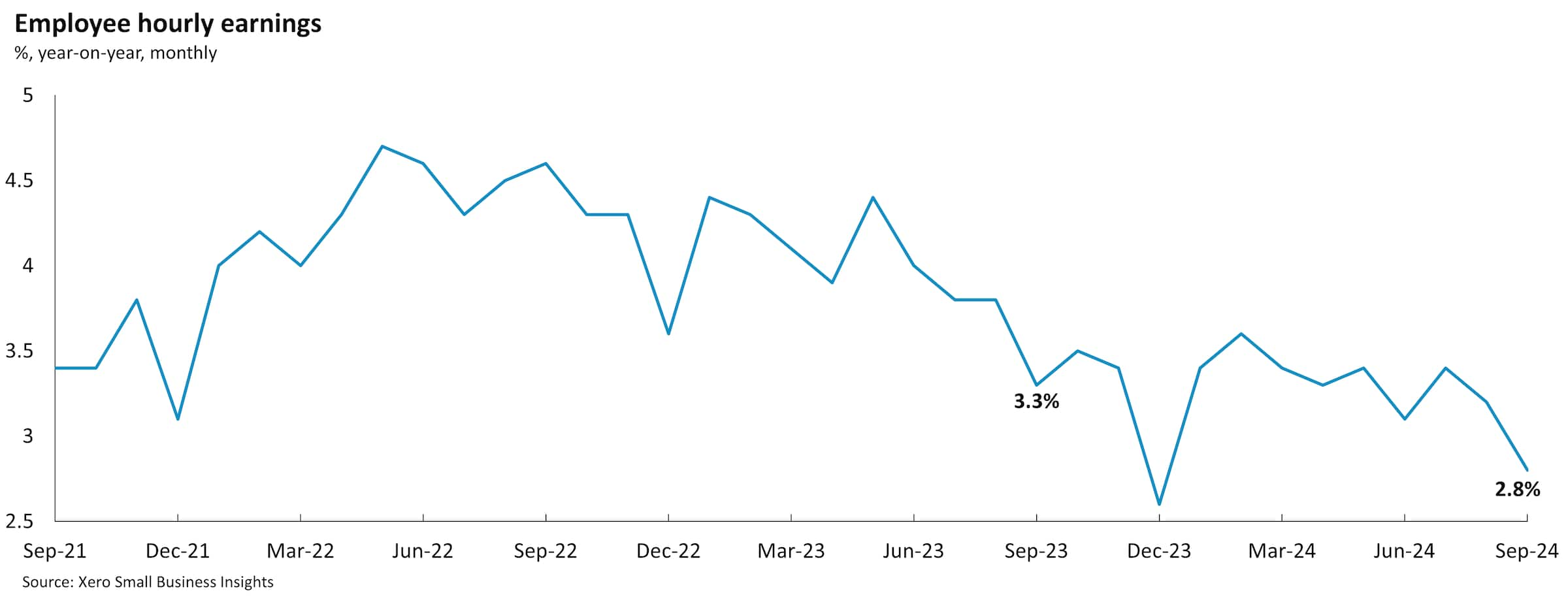

Wages grew 3.1% y/y in the latest quarter, down from a 3.3% y/y rise in the June quarter. The monthly September result of 2.8% y/y is the smallest rise since December 2023. Over the past year wages have been broadly growing in line with the long-term average of around 3.4% y/y.

Looking ahead

Overall, the latest XSBI results are an early indication that the UK economy may have lost some of the GDP growth momentum seen in the first half of the year. This is broadly consistent with the latest monthly GDP results, published by the Office of National Statistics, and the Bank of England's expectation that growth is likely to slow a little in the second half of 2024.

The August decision by the Bank of England to start cutting the official cash rate should, in theory, start to ease the pressure on both household budgets and small businesses. However, the August and September XSBI sales results suggest small businesses are yet to see a boost after the start of the rate cutting cycle. How quickly lower interest rates flow through the economy is always uncertain. There are two more Monetary Policy Committee meetings between now and the end of the year (November 5 and December 19) and small businesses will be eagerly watching to see if the August rate cut is closely followed by more, or if the Bank wants to keep waiting, as it did in September, until it is more confident that inflation is sustainably around 2%. The case for another rate cut this year was given a boost with the September CPI result which showed only a 1.7% y/y rise in the CPI (+2.6% y/y in CPIH). The CPI result was the first time inflation has been below the Bank of England's target since April 2021. While this inflation news doesn't mean prices are now falling, it does mean they are not rising by as much as they previously were, which should ease the mounting pressure on the cost base of small businesses.

For more information on the XSBI metrics, see our methodology page.

Disclaimer

This report was prepared using Xero Small Business Insights data and publicly available data for the purpose of informing and developing policies to support small businesses.

This report includes and is in parts based on assumptions or estimates. It contains general information only and should not be taken as taxation, financial, investment or legal advice. Xero recommends that readers always obtain specific and detailed professional advice about any business decision.

The insights in this report were created from the data that was available as at the date it was extracted. Data used was anonymised and aggregated to ensure individual businesses can not be identified.

Contact us about Xero Small Business Insights

Arming small business owners with simple but powerful insights. If you have any questions, reach out to us.