New Zealand Small Business Insights

This analysis focuses on core performance metrics of sales growth, jobs growth, wages growth, and time to be paid.

Another tough quarter for small businesses

Published: 31 October 2024

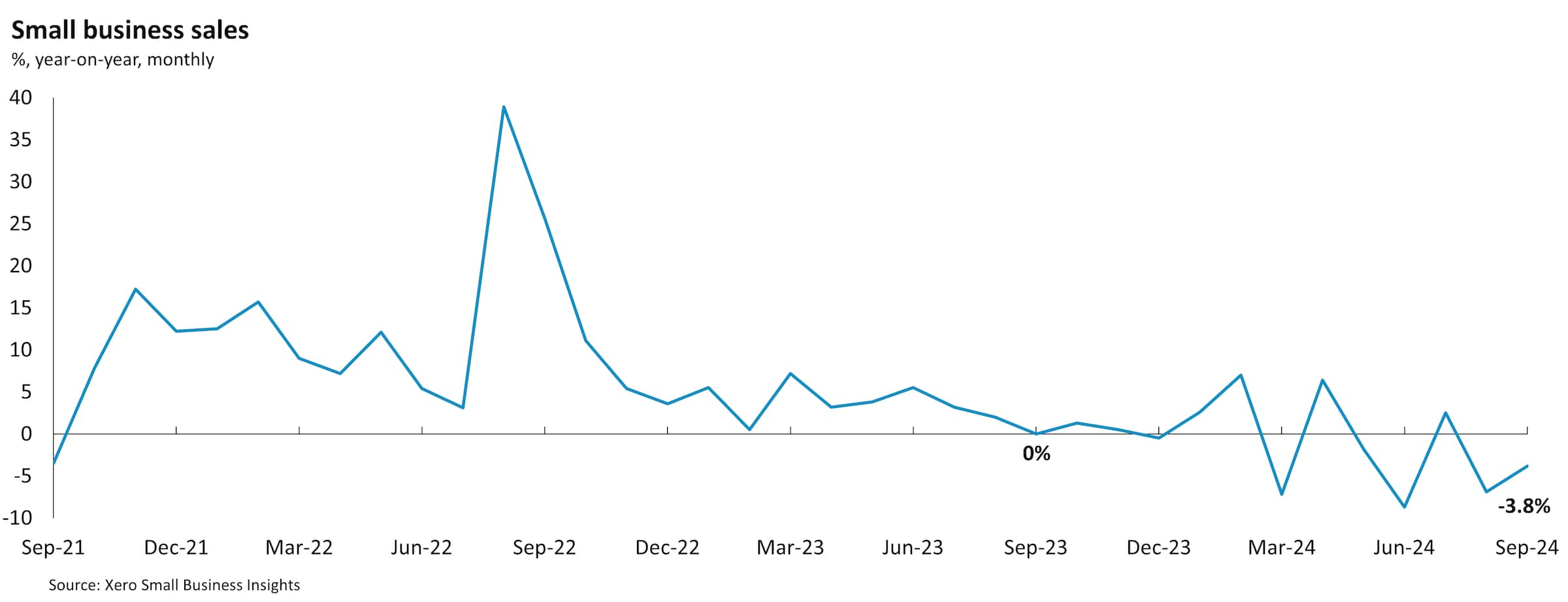

The September quarter Xero Small Business Insights (XSBI) data for New Zealand showed ongoing declines in sales which was reflected in smaller wage rises than in the June quarter. The tough sales conditions are also showing up in hiring patterns. The proportion of small businesses that are downsizing their workforces was at the highest rate since the initial pandemic lockdowns in early 2020. Both payment time measures improved slightly.

Sales in small businesses fell 2.7% year-on-year (y/y) in the September quarter, after declining 1.4% in the June quarter. Only two months in the past six have had higher sales than a year ago (April +6.4% y/y and July +2.5% y/y). These results suggest small businesses are yet to feel the benefit of the 0.25 percentage point cut in the official cash rate by the Reserve Bank of New Zealand in August or the income tax cuts that began on 31 July.

All industries, except other services (+1.3% y/y), experienced lower sales in the September quarter¹. The largest falls were in construction (-5.1% y/y), agriculture (-4.1% y/y) and retail trade (-4.0% y/y). All regions had a decline in sales in the quarter, ranging from a 6.0% y/y fall in Taranaki to a 0.9% fall in Northland.

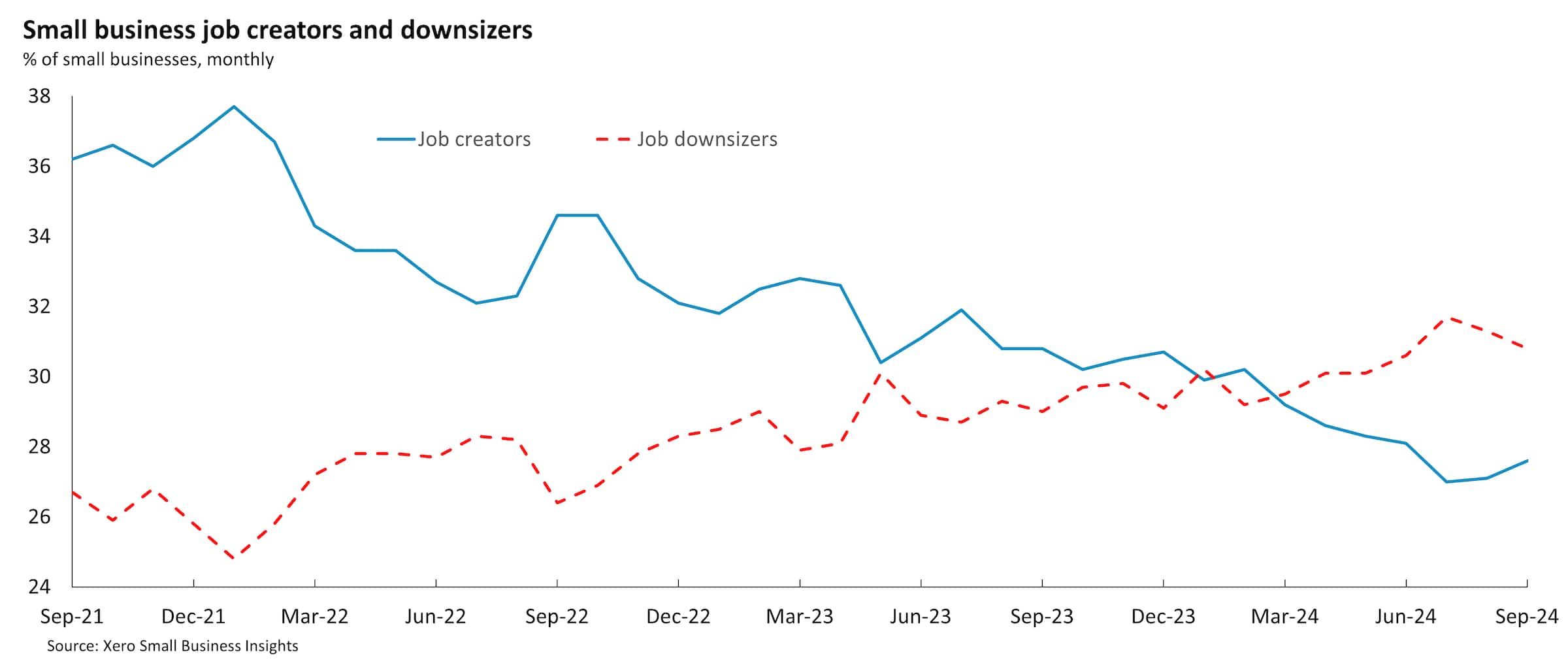

In the September quarter 31.3% of firms downsized their workforce in the past year and fewer, only 27.2%, increased their workforces.

XSBI NZ July - September 2024 data

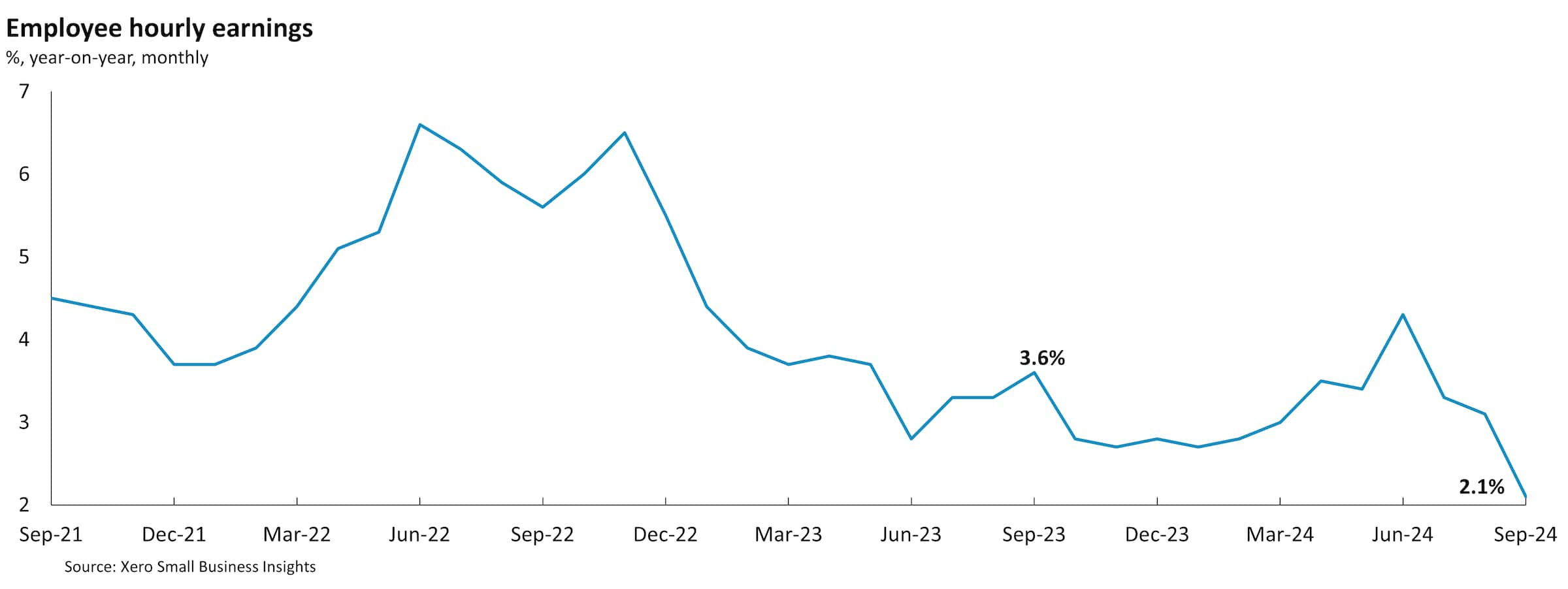

Smaller rises in wages over the quarter

The persistently weak sales results mean small businesses are likely finding it increasingly difficult to pay wage increases. Wages rose 2.8% y/y in the September quarter, after a 3.7% y/y rise in the June quarter. The latest quarterly result is the same as the March 2024 and December 2023 quarterly results and is below the pre-pandemic average of 3.9% y/y growth for this series.

Jobs growth coming from a smaller number of businesses

Jobs rose 6.6% y/y in the September quarter, the same as in the June quarter. This result is surprisingly strong given the weak sales outcomes. The XSBI job downsizer and job creator data shows that this jobs growth is concentrated in an increasingly small proportion of small businesses. The job downsizer data measures the proportion of firms who downsized their workforce over the past year and the job creator data shows the proportion of firms who grew their workforce over the past year. In the September quarter 31.3% of firms downsized their workforce in the past year and fewer, only 27.2%, increased their workforces. These results were 30.3% and 28.3% respectively in the June quarter. The job downsizer result is the highest proportion of firms reducing their workforces since early 2020, during the initial pandemic-related lockdowns.

This finding, that jobs growth is concentrated in certain small businesses, is supported by the industry data which shows a wide range of results. Hospitality jobs are only 2.3% higher than a year ago compared to professional services (+8.7% y/y) and other services (+9.4% y/y). There was less of a range across regions, with Hawke's Bay (+8.9% y/y) and Otago (+8.0% y/y) leading the way and Auckland (+5.0% y/y) recording the smallest rise.

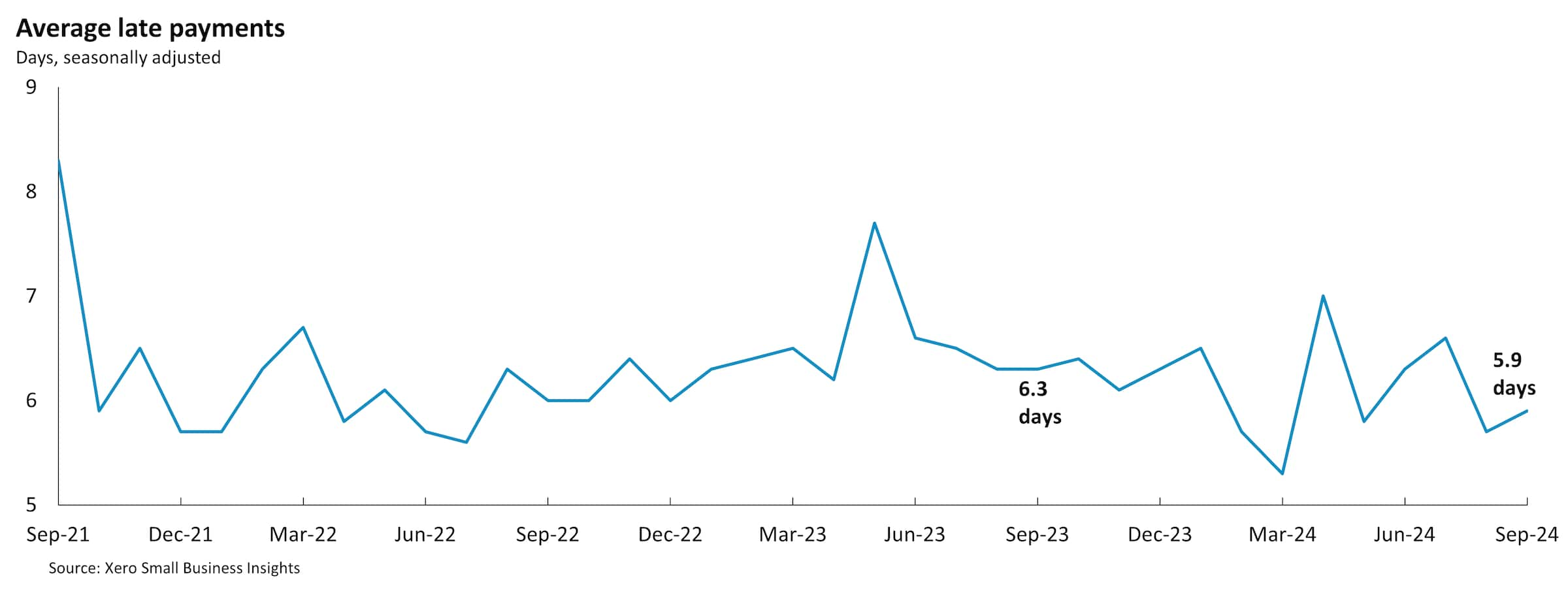

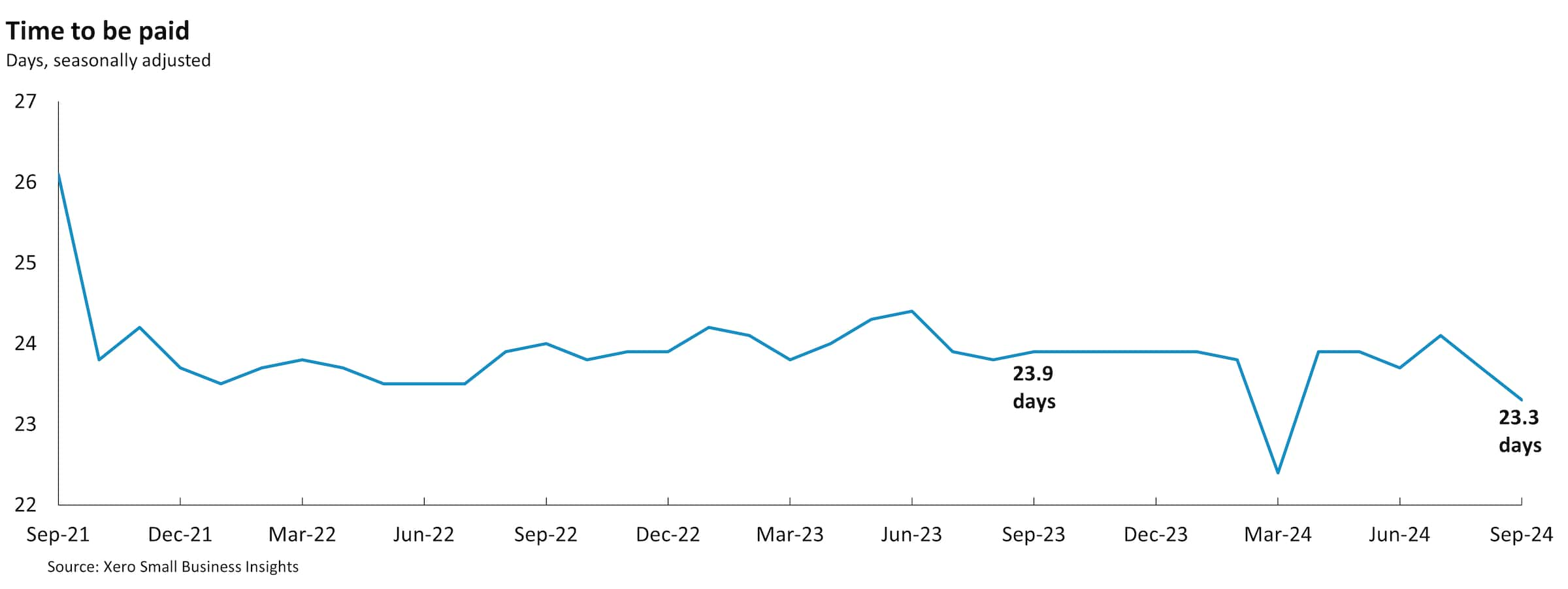

Small improvement in payment times

Both measures of payment times improved slightly during the September quarter. Payments to small businesses were made, on average, 6.1 days late in the September quarter compared to 6.4 days in the June quarter. The average time small businesses waited between issuing an invoice and getting paid was 23.7 days in the September quarter, similar to the 23.8 day wait in the June quarter.

Looking ahead

Overall, the latest XSBI results are an early indication that the New Zealand economy remained weak in the September quarter, following the decline in GDP in the June quarter (official September quarter GDP data is not released until December). This is broadly in line with the Reserve Bank of New Zealand's view that: "economic growth is weak, in part because of low productivity growth, but mostly due to weak consumer spending and business investment. High-frequency indicators point to continued subdued growth in the near term."

Since the end of the September quarter the RBNZ has cut the official cash rate a further 0.5 percentage points to 4.75%. Small businesses will be hoping that this additional cut in interest rates encourages consumers to spend a little more in their local businesses heading into the important end of year festive season and summer holiday period.

For more information on the XSBI metrics, see our methodology page.

¹ Other services includes a range of personal services such as hair, beauty, weight management, funerals and religious services

Disclaimer

This report was prepared using Xero Small Business Insights data and publicly available data for the purpose of informing and developing policies to support small businesses.

This report includes and is in parts based on assumptions or estimates. It contains general information only and should not be taken as taxation, financial, investment or legal advice. Xero recommends that readers always obtain specific and detailed professional advice about any business decision.

The insights in this report were created from the data that was available as at the date it was extracted. Data used was anonymised and aggregated to ensure individual businesses can not be identified.

Contact us about Xero Small Business Insights

Arming small business owners with simple but powerful insights. If you have any questions, reach out to us.