What advisory model is best for our practice?

Choosing the right advisory model doesn’t have to be a struggle. In this article, Jen Senger, Senior Partner Consultant at Xero, outlines clear options for structuring your services to boost client understanding and profitability.

The whole industry is telling you to offer more client advisory–but what kind, and how should you structure it? In this article, we break down the different types of advisory services and explore how to package and price them in ways that clients understand and that create sustainable revenue for your firm.

What is definitely clear is that advisory is a good idea. 85% of firms now offer advisory services and most firms say it is their highest-margin offering according to our latest State of the Industry Report. A CPA.com advisory service benchmark report came to the same conclusion: Practices that offer advisory grow 17% faster than those that don’t.

But how should you actually bill clients? Or begin? Let’s explore your options.

The full list of client advisory service options

The best initial advisory offering is one that clients already ask for and that your team already feels comfortable delivering. It helps solve the two big challenges entrepreneurs face:

- Building a service customers will pay for

- Delivering meaningful results

If clients already ask for it, you know there’s demand. And if it’s already familiar to your firm, your accountants, bookkeepers, and fractional CFO team members will have greater confidence guiding clients through the material.

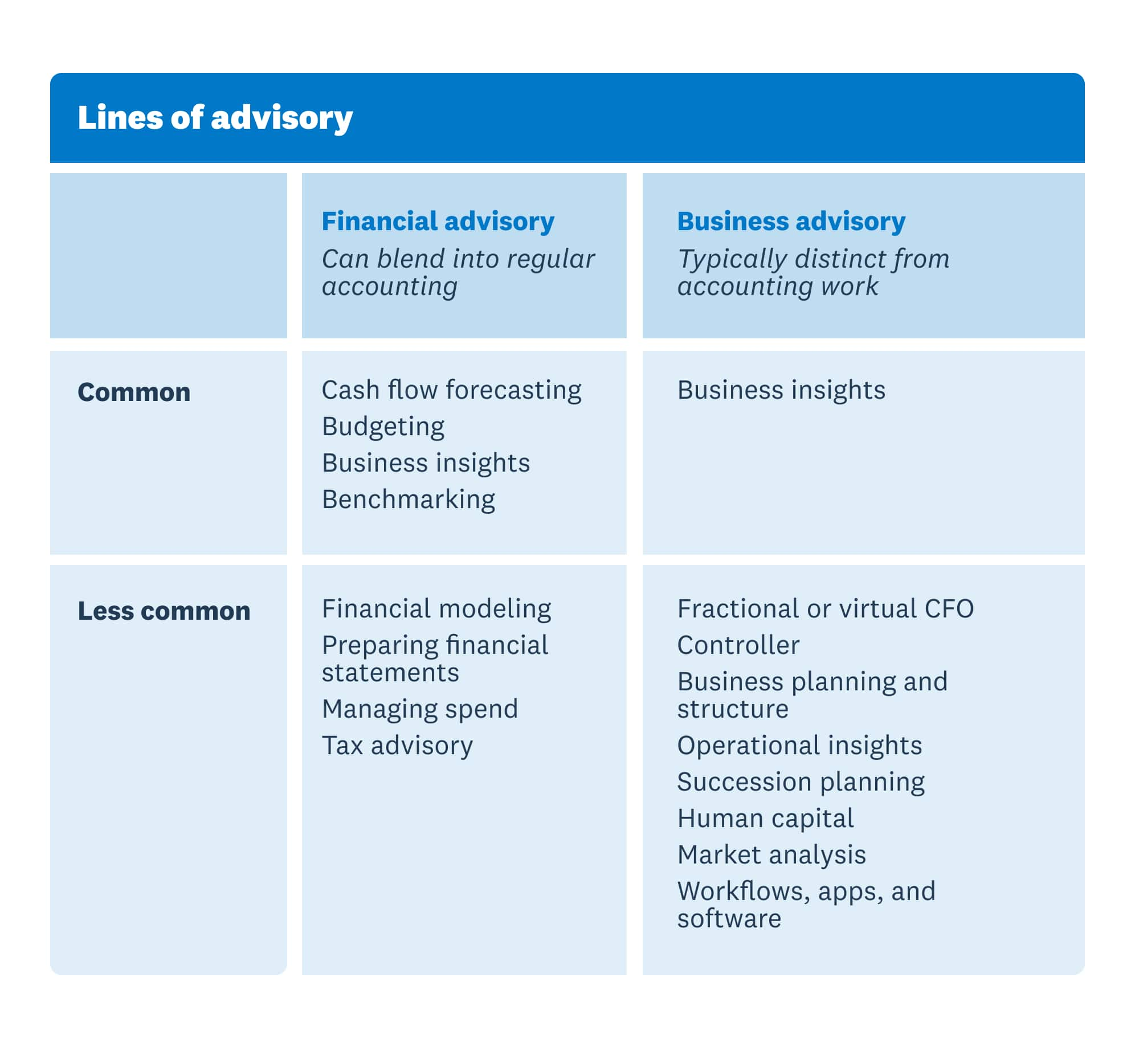

We have categorized our potential service lines into two groups: Financial Advisory and Business Advisory. Financial Advisory focuses on guidance related to your routine financial matters. These recommendations are typically straightforward and data-driven, relying on clear, round figures that tell a clear story.

Business Advisory, on the other hand, involves stepping into the client’s world to provide guidance on more complex, strategic matters that may fall outside your daily operations. Often, the client holds more direct knowledge in these areas—for example, managing inventory in a restaurant. Your role is not necessarily to introduce new data, but to offer a different perspective. By analyzing and synthesizing the information they already possess, you can uncover new insights and help them reach conclusions they might not have considered on their own.

The table below outlines typical engagements under each advisory model. Some activities–like forecasting or strategic planning–may appear in both categories depending on the client context.

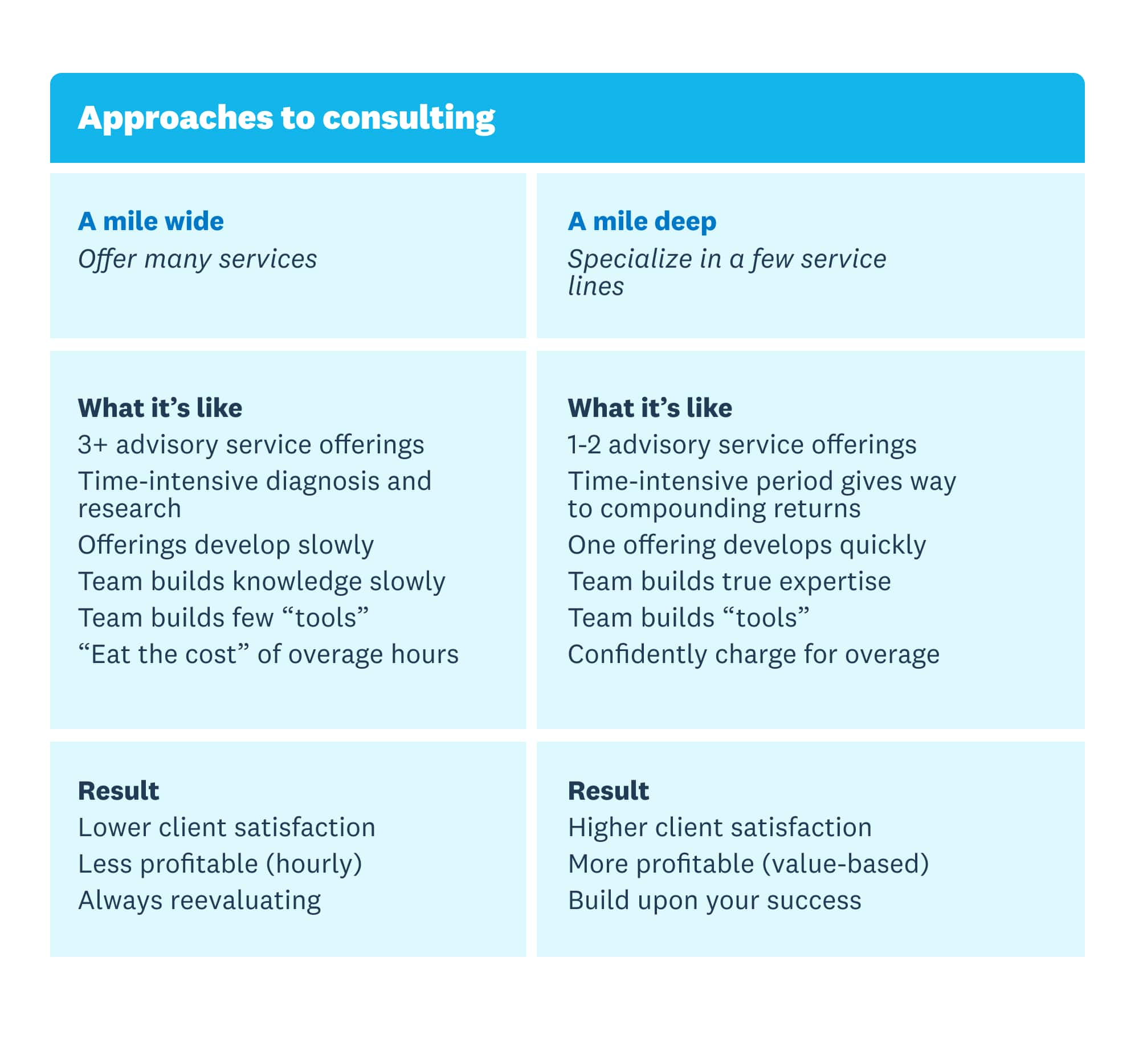

Start with one line of service

You may think, “We can offer all of these,” and could be right. But probably not all at once. Your job in the consulting world is to build knowledge and ownable intellectual property, according to author David C. Baker, in his book The Business of Expertise. You should see the same situation many times to understand the pattern well enough to match it and deliver insights with increasing ease.

Without that repetition, you're simply selling time to solve each problem for the first time. You’re not building a playbook—you’re starting from scratch with every client. Advising on layoffs, tariff-related supply shortages, and business acquisitions in the same quarter may be interesting, but it spreads your expertise thin. By contrast, guiding three companies through layoffs will teach you how that story tends to unfold—and how to help a client navigate it with both professionalism and compassion.

Keep in mind that expertise doesn’t just live with individuals—it has to scale across your team. Most people retain very little of what they haven’t directly experienced, and without a shared focus, it’s hard for team members to learn from one another. Even concentrating your team around one advisory area is a challenge. Trying to stretch that focus across six or seven different services can dilute your firm’s collective learning and impact.

If you are like 60% of firms and have always offered some form of advisory, but it doesn’t perform like you hope, consider trimming your offerings. If a particular service line isn’t generating praise or repeat business, it may signal that you haven’t yet built sufficient depth in that area. True expertise shows up in the form of refined tools—pre-built Excel models, templates, and frameworks that make your process both efficient and impressive. You want clients to respond with, “Wow, we’ve never seen it presented like this before.” That kind of reaction is a strong indicator that you're delivering value beyond just time and effort.

Take, for instance, a firm that has intentionally focused its advisory services on human capital and profitability for creative agencies. That level of specialization is a strength—not a limitation. They’ve developed an “agency operating system” housed in a Google Sheets template, which they tailor during the initial engagement and then manage through a quarterly retainer model. When agencies encounter this offering, it stands out as far more compelling than a generic promise to “look into that.” In a focused advisory practice, your tools become a signature asset, and your clients become your most effective marketers.

Example tools to consider building:

- Market indices and data trackers

- Benchmark data

- Spreadsheet models (or better yet, data models in Syft Analytics!)

- Recorded trainings

- Newsletters

- Webinars

- Courses

Package your offerings to make buying easy

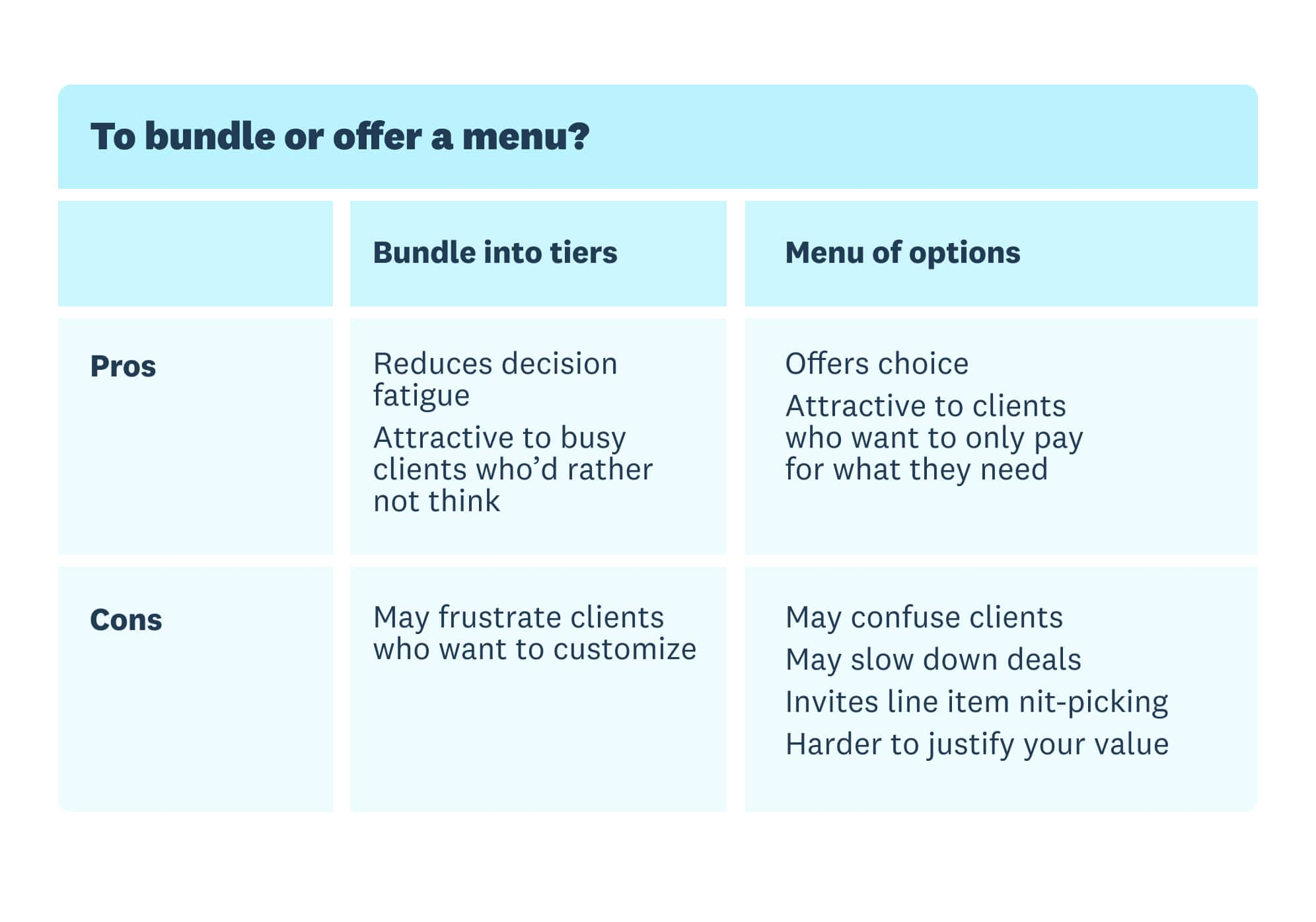

Accountants often have a strong inclination to price their advisory services with precision. They carefully analyze a cohort of clients to understand their financials, aiming to create pricing structures that offer flexibility—incorporating add-ons and variables to ensure fairness and provide clients with a sense of control. While this approach seeks to offer choice, it can sometimes complicate the buying decision.

Like those TV remotes, clients can experience decision fatigue when confronted with overly complicated pricing. While you may believe that offering a wide array of options provides flexibility, clients may not actually want that much choice. If your advisory services page or slide deck is filled with tables, rates, and exceptions, it could overwhelm them and reduce their interest.

Clients tend to prefer the simplicity of an Apple TV remote version of your pricing – just one or two clear options. They don’t want to learn your pricing model–they simply want to know if your services fit within their budget.

What makes your advisory services easy for clients to buy? Keep the options minimal, organized into familiar tiers, and priced in a straightforward way that makes payment simple. The "ideal" structure will naturally vary by industry and client, but simplicity and clarity should always be the goal.

A common mistake: pricing entry-level advisory out of reach

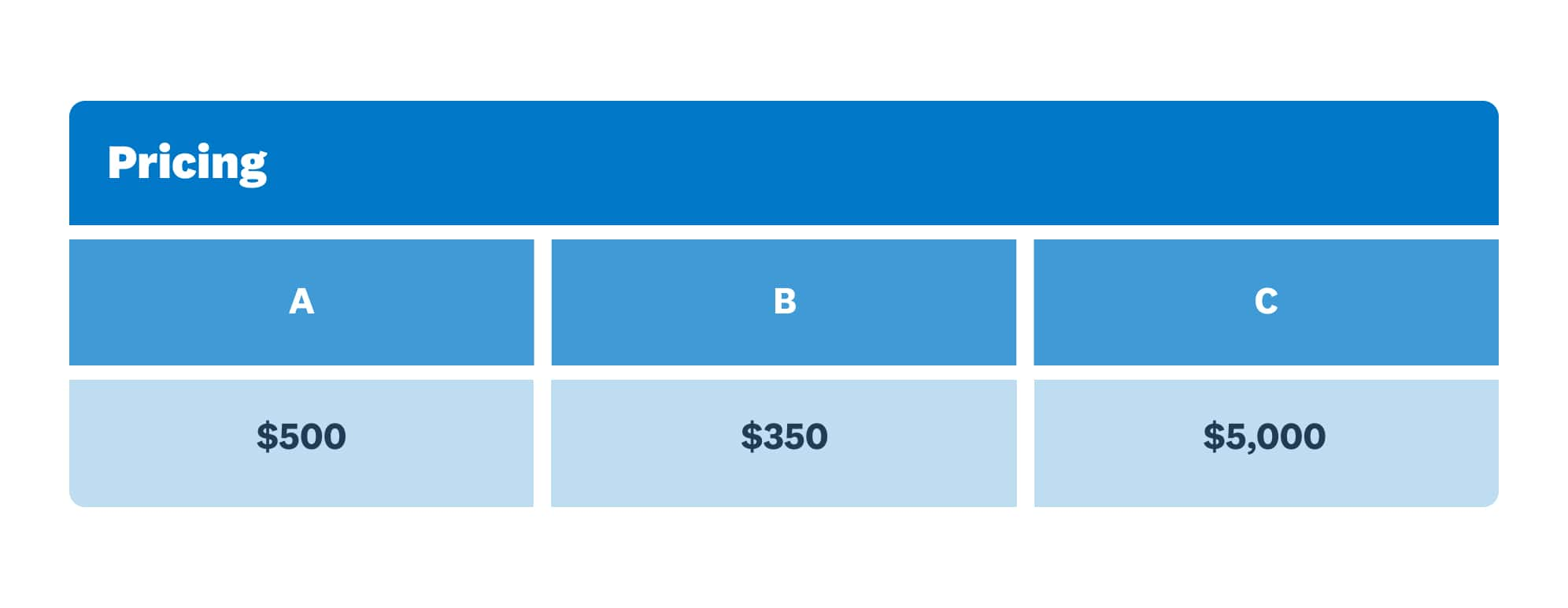

Firms that are enthusiastic about the value advisory services can bring to their clients may sometimes price their offerings too aggressively at first. For example, a website might feature $500 for simple tax preparation, $350 per month for bookkeeping, and $5,000 per month for CFO services. While these prices reflect the expertise provided, they can lead to sticker shock for clients—especially when many are still unfamiliar with the specifics of the advisory services on offer.

Given that clients are seeking guidance, they may not fully understand what they are receiving in return. Their main question is likely, “What’s in it for me?” To them, it all looks like the table below.

To lower the barrier to entry, consider offering a starter-level advisory session—perhaps just 2–3 hours—that puts the client face-to-face with one of your fractional CFOs. Use this time to explore their goals, share relevant examples from similar clients, and begin mapping out what’s possible. Importantly, this should be a paid engagement – we do not suggest offering this for free. Even a short, well-structured session can deliver meaningful value, and clients are more likely to take it seriously when there’s a cost attached.

Equally important: revisit your services page to frame each offering in terms of client outcomes. Assume your client is intelligent but not yet familiar with advisory services. Speak directly to their perspective—answering the question they’re really asking: “What’s in it for me?”

Select pricing that encourages recurring revenue

Consulting research shows that the single biggest factor in ensuring an advisory engagement goes well isn’t something you can control: The client must decide what they need and how to measure it.

You can support this process through a structured onboarding consultation where goals, objectives, and key metrics are established together. But for your recommendations to stick, the client needs to be committed. It’s not uncommon for advisors to deliver accurate information, valuable advice–only to see it go unused because the client never fully engaged with it.

Price to keep clients involved

Design your pricing to keep clients actively engaged for as long as they need your help. This has three major advantages:

- It increases the client’s accountability and follow-through.

- It gives you more time and insight to offer better, more tailored advice.

- It supports your firm’s ability to invest in stronger tools, applications, and advisory infrastructure.

Clients who have already paid are much more likely to act on your advice–they feel motivated to extract value from their investment. Some firms take this further by bundling advisory and compliance services together into a single monthly subscription. While this approach has both advantages and tradeoffs, it creates a dynamic where clients who may have ignored advice early in the year often re-engage later, determined to make the most of what they’ve already paid for.

By contrast, project-based or hourly billing models offer an easy out. If a client loses momentum, they simply stop booking meetings or paying invoices. A well-structured subscription keeps the relationship, and the results, moving forward.

Price in a way that reflects how you deliver

The most effective pricing models mirror the way your team actually delivers value—not just how they track time. While hourly billing may feel intuitive, especially if your team already tracks time, it rewards effort rather than outcomes. That can create a ceiling on profitability and shift the focus away from results.

Subscription or value-based pricing, by contrast, encourages deeper client relationships and more strategic thinking. It allows your team to work toward impact, not just hours logged. Yes, it may require more careful management to ensure that time invested aligns with revenue—but the payoff is a more scalable, client-aligned model.

If your firm tracks time but bills by subscription, you’ll need systems in place to monitor delivery costs and ensure margins stay healthy. Still, this approach supports a more modern advisory experience–where clients pay for guidance, not just access to your calendar.

The three advisory billing models

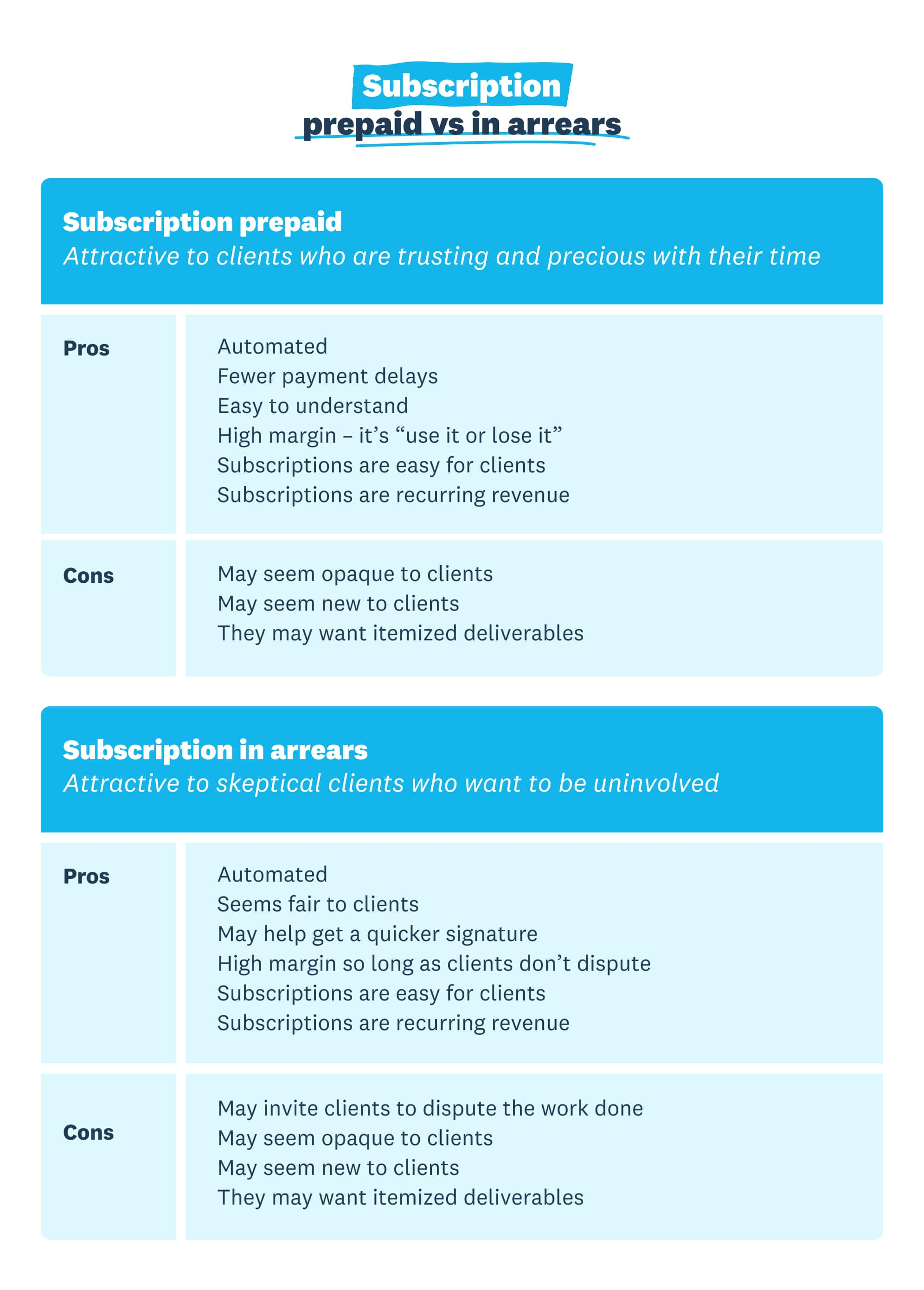

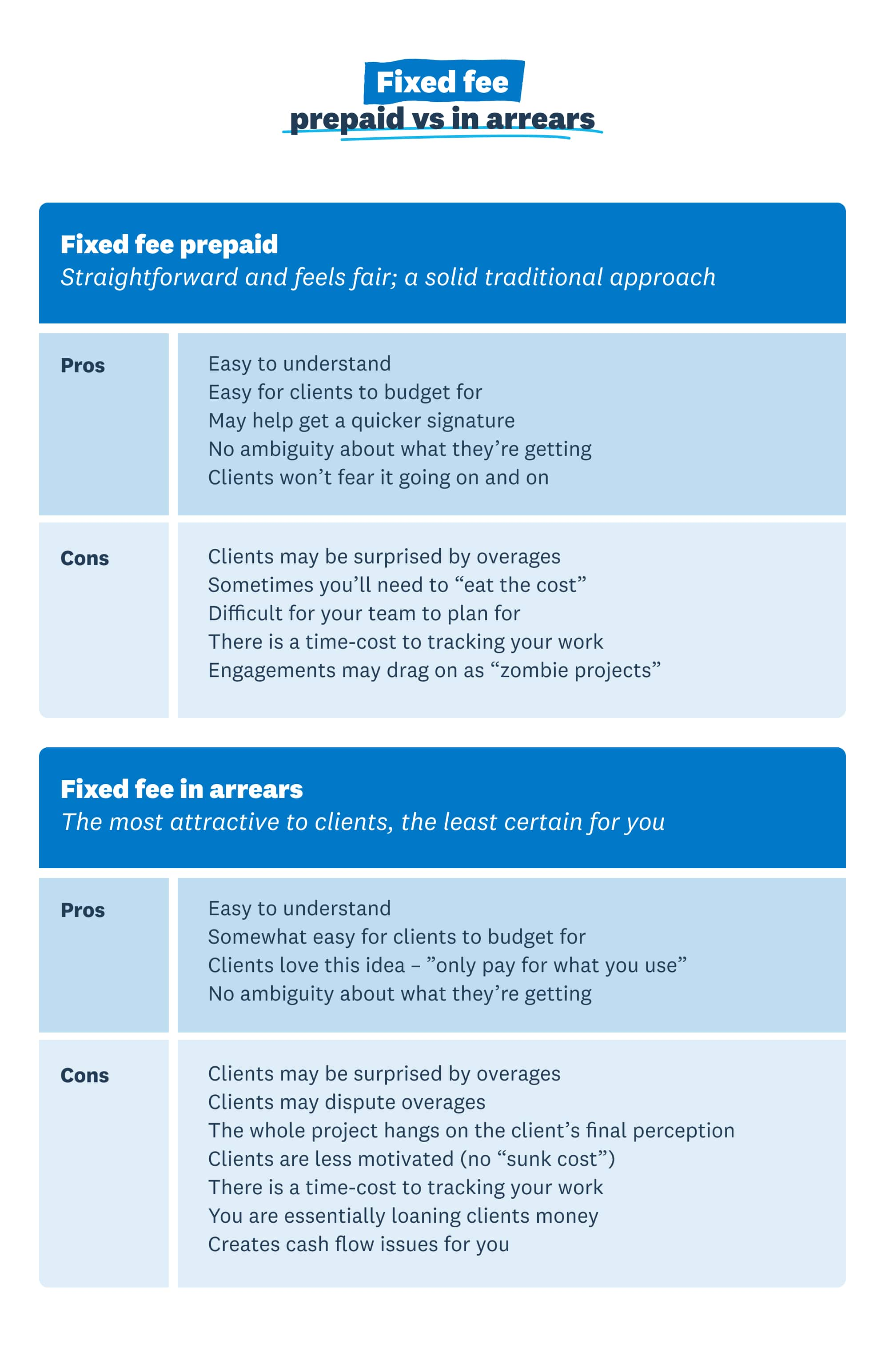

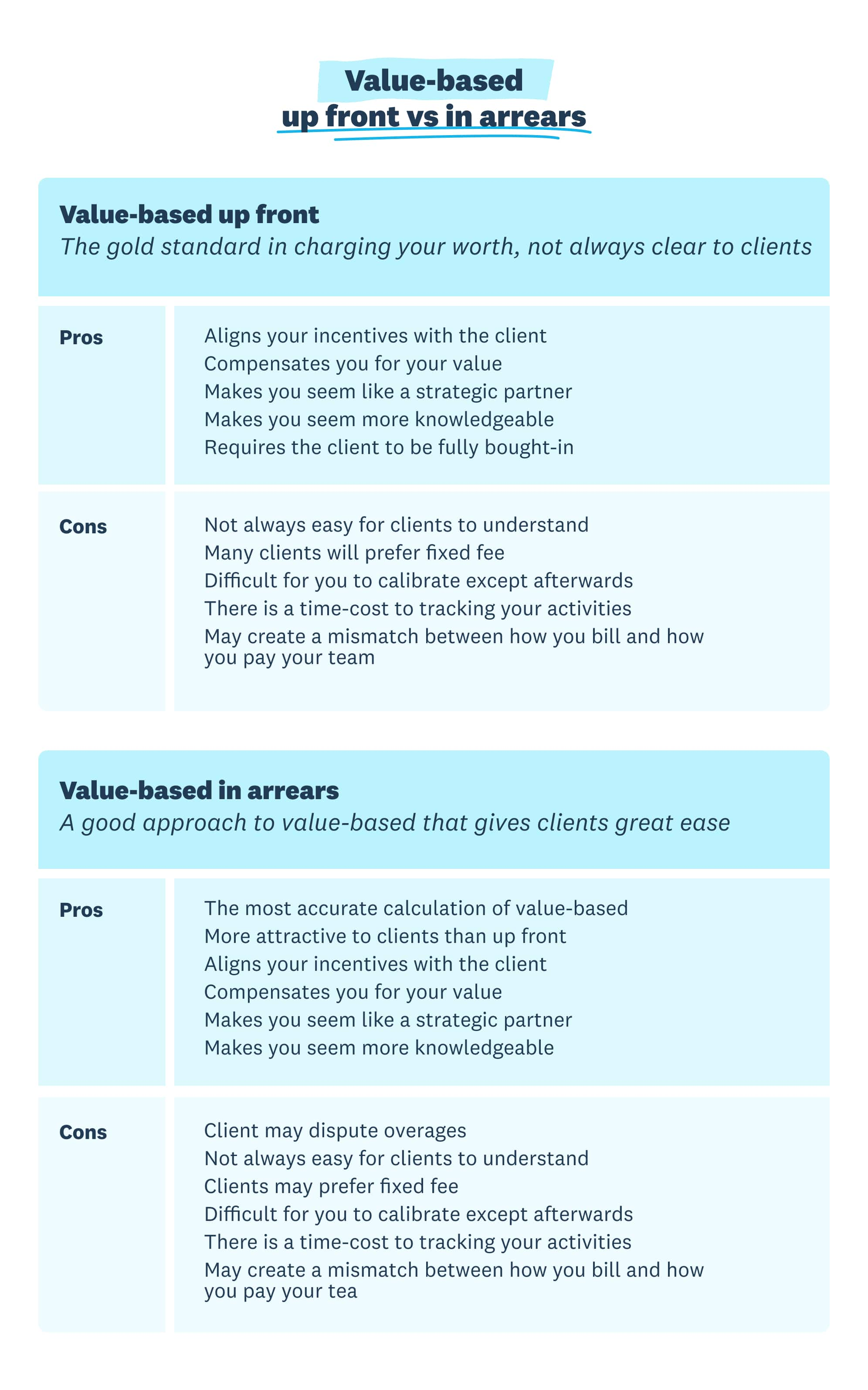

Advisory services can be billed in one of three primary ways: subscription, fixed fee, or hourly. Each can be invoiced up front or in arrears, depending on your workflow and client expectations. Below, we outline the strengths and tradeoffs of each approach.

There’s no universally perfect model– only the one that fits your firm’s services and your clients’ buying preferences. You’ll know you’ve chosen the right one when the model feels natural to deliver and easy for clients to understand and say yes to.

In addition to these models, you might also charge for the components of your advisory work.

According to CPA.com, practices are fairly evenly divided on whether they bill up front or in arrears. One-third (32%) charge for an initial advisory assessment, 79% charge for new client onboarding, 55% charge for technology setup, and 66% manage the billing for those software licenses such as an accounting platform and bill the client via a separate fee.

Whether you bundle all those components into one simple subscription or offer it as a menu is up to you, of course, and what the client will readily agree to.

Launching your new advisory model

When rolling out advisory services, start with focus. It’s usually best to offer just one type of advisory at first–something narrow and repeatable. However, it’s perfectly reasonable to experiment with different pricing models in that lane. For example, a firm offering tax advisory might try hourly, fixed fee, and subscription pricing. That’s actually not a bad test. They’re learning how clients respond, while honing their expertise in a focused area.

Once there’s a proven fit, the firm can standardize around the pricing model that works best–for both client and team–and then consider expanding into a second advisory line.

As your practice grows, revisit your advisory offerings to keep them simple and purposeful. Over time, it’s easy to accumulate exceptions, one-off projects, and too many service lines. Periodically step back and ask:

- Which services are most profitable?

- Which ones do your team enjoy delivering?

- Which ones are easiest to sell and for clients to understand?

Return to your original rubric: What’s easy for your team to offer, and easy for clients to buy?

From there, lean into experimentation. Talk with peer firms about what they’re trying and what’s working. Talk often with your clients about what’s valuable. The best advisory model is the one that’s simple enough to scale, fuels your firm’s growth, and makes a real difference to the clients you serve.

Save this for later—get it by email

Learn how you can structure services to optimize advisory delivery. Fill in this form to be sent a download of this article to your inbox!

Become a Xero partner

Join the Xero community of accountants and bookkeepers. Collaborate with your peers, support your clients and boost your practice.