Australian small businesses experience modest bounceback after October’s easing of restrictions

Xero Small Business Index rose five points in October as the post-lockdown recovery begins in NSW, the ACT and Victoria

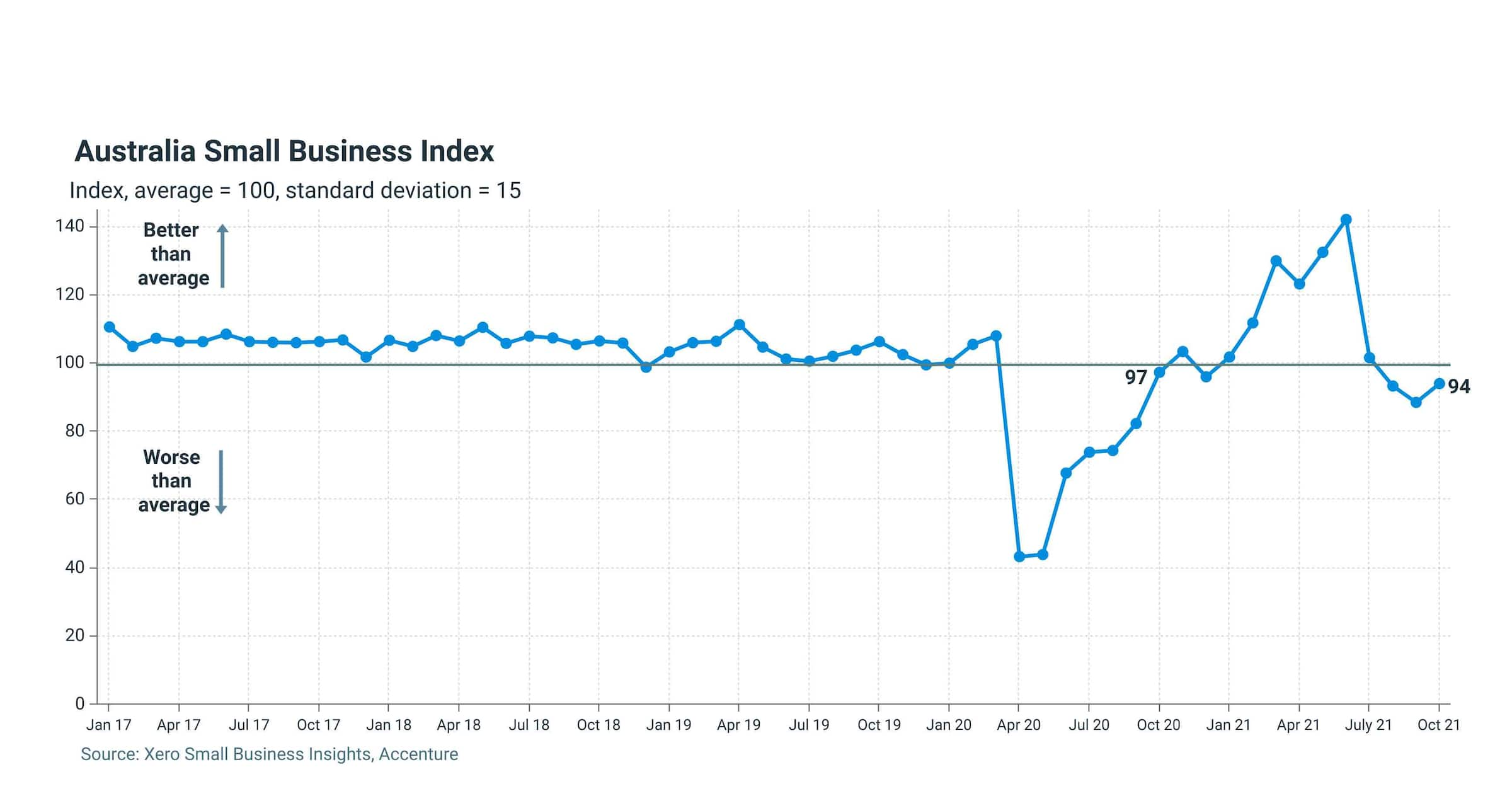

Melbourne — 25 November, 2021 —Xero, the global small business platform, today released its latest data on the health of Australia’s small business economy during October from the Xero Small Business Index. Based on aggregated and anonymised transactions from hundreds of thousands of small businesses, the Index is produced in partnership with Accenture and is part of the Xero Small Business Insights program.

The Index rose five points in October to 94, a change largely attributed to the easing of lockdown restrictions in NSW, the ACT and Victoria during the month. While the Index only showed a modest increase, keeping the overall small business performance below average for the third consecutive month, it provides an early indication of what can be expected after a full month of eased restrictions.

Sales growth slows

Nationally, the Index showed a sales growth of 4.4 percent year-on-year (y/y), after adjusting for base effects, which was a slowdown from +8.2 percent y/y in September. While every state experienced slower sales growth in October, Victoria continued to record the weakest results as sales rose just 0.6 percent y/y, despite lockdown restrictions easing from 21 October. Sales growth in NSW was 4.8 percent, while Tasmania weakened considerably delivering +1.9 percent y/y sales growth, down from +10.4 percent y/y in September.

Joseph Lyons, Managing Director Australia and Asia, Xero said: “The latest Xero Small Business Index data highlights how it’s likely it will take a while for small businesses impacted by lockdowns to get back on their feet. As we lead into the festive season and summer holidays, it’s really important that Australians continue their support of small businesses, shopping locally wherever they can. With density limits easing and borders reopening, it’ll also be great to see holidaymakers exploring their own backyard and supporting local tourism operators while doing so.”

Jobs growth edges positive

At a national level, small business jobs rose a modest 0.1 percent y/y, adjusting for base effects in October. This slight rebound came off the back of a decline of 1.0 percent y/y in September.

The national average continues to mask significant state differences. While the jobs situation improved in the lockdown states as they gradually reopened throughout the month, growth still remained negative, with the ACT experiencing -2.8 percent y/y, -2.3 percent y/y in Victoria and -1.2 percent y/y in NSW.

Tasmania also recorded negative jobs growth for the first time this year, down 0.2 percent y/y as ongoing border closures with the mainland start to bite into the tourism sector. Meanwhile, Western Australia (+5.1% y/y) and Queensland (+3.2% y/y) continue to record solid jobs growth.

“We were still witnessing a two-speed economy in October, despite restrictions lifting in NSW, the ACT and Victoria. On the jobs front, Western Australia and Queensland continue to be our strongest performers. We will be keeping an eye on November’s results to see how quickly others can catch up,” added Lyons.

While still experiencing negative impacts from COVID-19, arts & recreation (-8.3% y/y) and hospitality (-7.7% y/y) showed a slight improvement in jobs growth in October. Healthcare (+4.8% y/y) and professional services (+3.5% y/y) continue to be the most job resilient sectors.

"It will take time for those heavily impacted small businesses to rebuild jobs, as they still deal with ongoing restrictions such as patron limits. The summer holiday period is a great opportunity for people to show their support for local hospitality and arts and recreation small businesses," said Louise Southall, Xero Economist.

Time to be paid down slightly

The time small businesses had to wait to be paid by customers increased slightly by 0.2 days to 23.3 days in October. The late payments measure, which tracks the average number of days late that invoices are paid, was down 0.1 days to 6.6 days, 3.3 days below the April 2020 peak.

Wages growth inches up

Wages rose 2.7 percent y/y, up from 2.6 percent y/y in September and 2.5 percent y/y in August, now sitting slightly below the pre-pandemic average. The construction industry experienced the strongest wage growth, up 3.4 percent y/y.

To download the full October results, including industry and regional breakdowns, go to the website here.

The impacts of the first full month out of lockdown for all Australian states, excluding the Northern Territory, will be assessed in the next update, to be released in December.

To find out more about how the Xero Small Business Index is constructed, see the background information and methodology.

ENDS

Media Contact

Xero Australia | Jessica Brophy | +61 431 268 549 | jess.brophy@xero.com

About Xero

Xero is a cloud-based accounting software platform for small businesses with over 3 million subscribers globally. Through Xero, small business owners and their advisors have access to real-time financial data any time, anywhere and on any device. Xero offers an ecosystem of over 1,000 third-party apps and 300 plus connections to banks and other financial partners. In 2021, Xero was included in the Dow Jones Sustainability Index (DJSI), powered by the S&P Global Corporate Sustainability Assessment. In 2020 and 2021, Xero was included in the Bloomberg Gender-Equality Index and in 2020, Xero was recognized by IDC MarketScape as a leader in its worldwide SaaS and cloud-enabled small business finance and accounting applications vendor assessment.

About Accenture

Accenture is a leading global professional services company, providing a broad range of services and solutions in strategy, consulting, digital, technology and operations. Combining unmatched experience and specialized skills across more than 40 industries and all business functions — underpinned by the world’s largest delivery network — Accenture works at the intersection of business and technology to help clients improve their performance and create sustainable value for their stakeholders.

Note to editors:

All growth rates quoted in this release are annualized two-year growth to adjust for the base effects due to the low pandemic-impacted results in 2020.

The Xero Small Business Index is unweighted and comprised of the following four metrics:

- Sales - captures a core measure of small business health and a measure of the overall economic activity in the small business economy.

- Time to be paid - captures how long businesses are waiting to be paid, providing insight on the financial health of their customers and small business cash flow.

- Jobs - captures if small businesses are growing and how small business is impacting on the broader economy and community.

- Wages - captures how benefits from small business performance are translating to employees-benefits flowing to the broader small business economy.

These four metrics were selected because they encompass the operating state of the small business (sales and time to be paid) and the contribution small businesses make to the community (jobs and wages).

Related media and inquiries

For all media inquiries, please contact the Xero media team.

- Media release

Australian small business jobs decline in September for the first time in 2021, Xero data reveals

Xero Small Business Index falls seven points as the journey out of lockdowns for the small business economy begins

- Media release

Australian small business jobs growth posts its lowest result since October 2020

Xero Small Business Index falls nine points in August as lockdowns impact four states

- Media release

New Xero data reveals how lockdown restrictions in July impacted Australian small businesses

Xero Small Business Index falls 41 points in July as lockdown return in Greater Sydney, Victoria and South Australia

Start using Xero for free

Access Xero features for 30 days, then decide which plan best suits your business.