Investor information

See Xero’s financial results, interim and annual reports, key dates, market announcements and more.

Latest market announcements

Latest financial information

Investor Day 2024

Results announcements

Key upcoming dates:

- 15 May 2025 - FY25 Full Year Results to 31 March 2025

- 21 August 2025 - Xero Annual Meeting

- 13 November 2025 - FY26 Half Year Results to 30 September 2025

- 14 May 2026 - FY26 Full Year Results to 31 March 2026

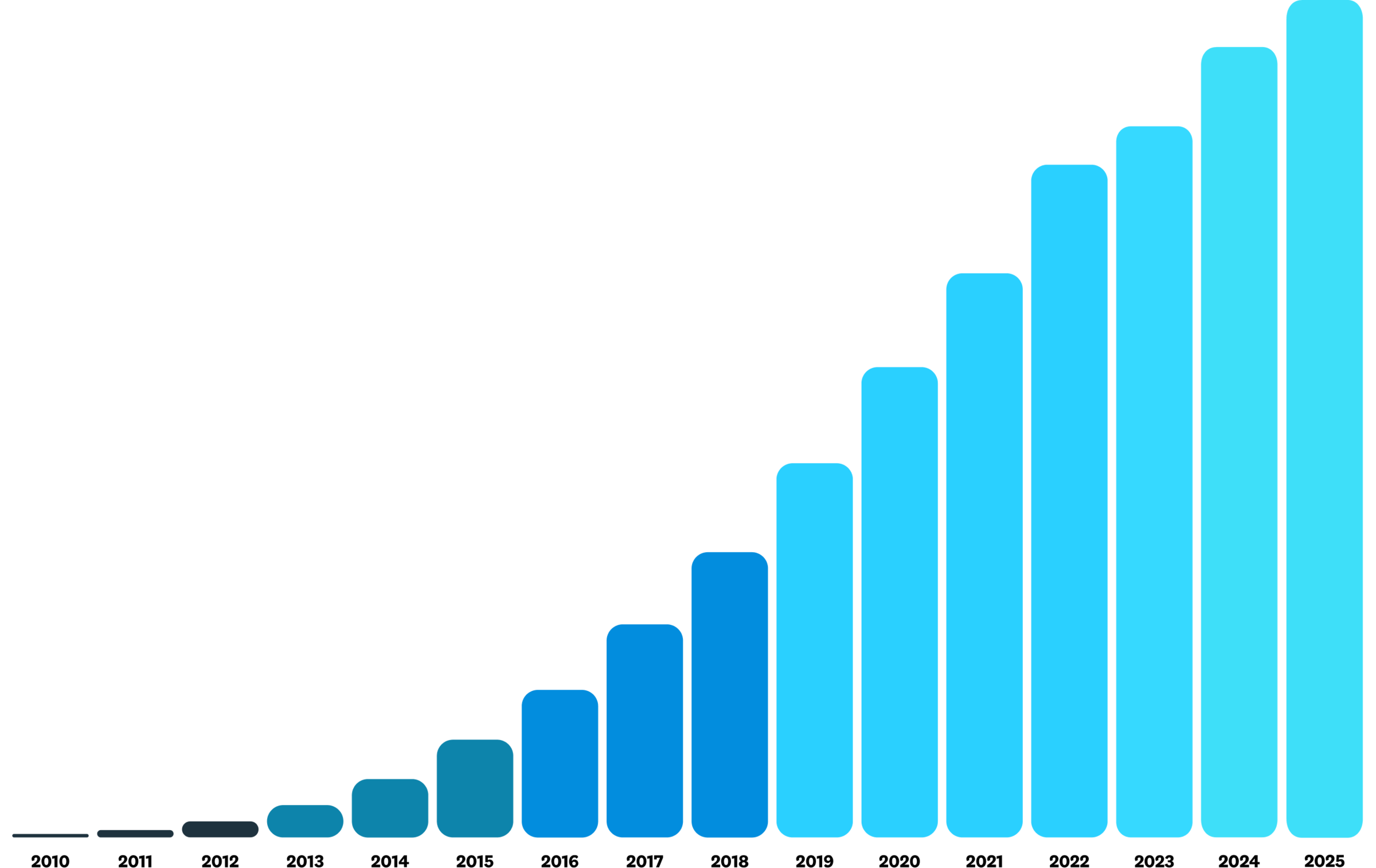

Building momentum

Since our start in 2006, we’ve grown from a handful of small businesses in New Zealand to 4.4 million subscribers globally.

See our latest market announcements

Got questions?

Here’s who to contact if you need more information.

MUFG Pension & Market Services

Contact MUFG Pension & Market Services to manage your shareholding.

MUFG Pension & Market Services