What is solvency vs liquidity?

Both solvency and liquidity cover key aspects of your business’s financial health.

Published Wednesday 12 March 2025

What does solvency mean in business?

Solvency refers to how well a business can meet its long-term financial commitments. A ‘solvent’ business must maintain a positive net equity, meaning its total assets are worth more than its total liabilities.

What factors affect your solvency?

To keep your business solvent, you must:

- Stay profitable: Your profits must be consistent enough to keep your balance sheet in good shape. This means your total assets need to continue to exceed your total liabilities.

- Manage your debts: You might negotiate lower repayments on any loans. When it comes to collateral loans (which use your assets as security), ask your lender exactly what happens if you can’t pay on time.

- Use your assets wisely: Your assets – things you own, like inventory – must generate enough financial returns to cover your debts. Optimise how you use each asset; for instance, track your inventory to avoid waste.

What is solvency vs profitability?

While solvency relates to your ability to pay debts over time, profitability is about how much money you make in relation to your costs. In broad terms, if you earn more money than it costs you to produce the goods or services you sell, your business is profitable.

In generating a good profit, a business boosts its chances of staying solvent. But a business that fails to manage its debts or assets could become insolvent. For example, if you take out new loans without paying others off, your total liabilities could start to exceed your assets, resulting in insolvency if not addressed.

How does solvency affect your business growth?

Stay solvent and you’ll more easily:

- Borrow money from banks and lenders who’ll feel more confident that you can pay them back

- Attract potential investors to bring more resources and expertise to your business

- Get better deals with suppliers by using your cash reserves to buy in bulk, and therefore lower your cost per unit

- Keep your business running smoothly and make plans for the future

What does liquidity mean in business?

Liquidity measures a business’s ability to pay its bills and make loan repayments in the coming months. It’s commonly expressed as a ratio, like the cash ratio or quick ratio.

Liquidity compares current liabilities (amounts owed within the coming year) against current assets. Current assets include cash, inventory, payments due, and any assets that can be sold quickly.

Other liquidity ratios

Although the current ratio is the most common way for small businesses to measure liquidity, there are two other ratios:

- Quick ratio (or acid test ratio): It only uses assets that can be changed into cash within three months. Cash, cash equivalents, short-term investments and receivables divided by current liabilities (debts due to be paid within three months). Or alternatively, current assets minus inventory and prepaid expenses divided by current liabilities (debts due to be paid within three months).

- Cash ratio: Cash and cash equivalents divided by current liabilities.

Learn more in our guide on liquidity ratios.

How liquid are your assets?

Some assets are highly liquid – that is, they can be quickly converted to cash.

Cash – physical currency and funds in savings accounts that can be withdrawn immediately – is your most liquid asset.

Accounts receivable is the balance of invoices owed to you as part of your regular operations. These are treated as liquid assets because they can be converted to cash relatively quickly. The longer you give your customer to pay you, the less liquid this asset is.

Other assets are less liquid. Physical assets – resources your business owns, like buildings or equipment – aren’t that liquid as it can take months to sell them before you get any cash.

Liquidity vs other financial concepts

You might hear about liquidity in relation to other terms, like cash flow. Here’s roughly how they compare; if liquidity shows how easily your business can cover its upcoming costs:

- Cash flow refers to the general availability of cash

- Working capital shows how much money you have left after covering these upcoming costs

- Free cash flow is the amount of cash left after making capital investments

How does liquidity affect business growth?

When it comes to expanding your business, liquidity can help you:

- Seize opportunities – with cash ready to launch a new product, or take on more staff

- Prepare for unexpected challenges – if your liquidity is high, you’ll have cash ready to, say, pay for a rain-damaged roof

- Maintain stability – since you won’t need to adapt your operations to find cheaper suppliers, different lenders, and so on

The main differences between solvency and liquidity

Table of the difference between solvency and liquidity

Solvency takes a long-term view of your financial health, while liquidity focuses on the short term. This table outlines other differences.

Keep a steady eye on both your business’s liquidity and solvency to stay on top of its financial picture.

How to measure solvency and liquidity in your business

To calculate solvency ratio, first look at the ratios that measure solvency and liquidity.

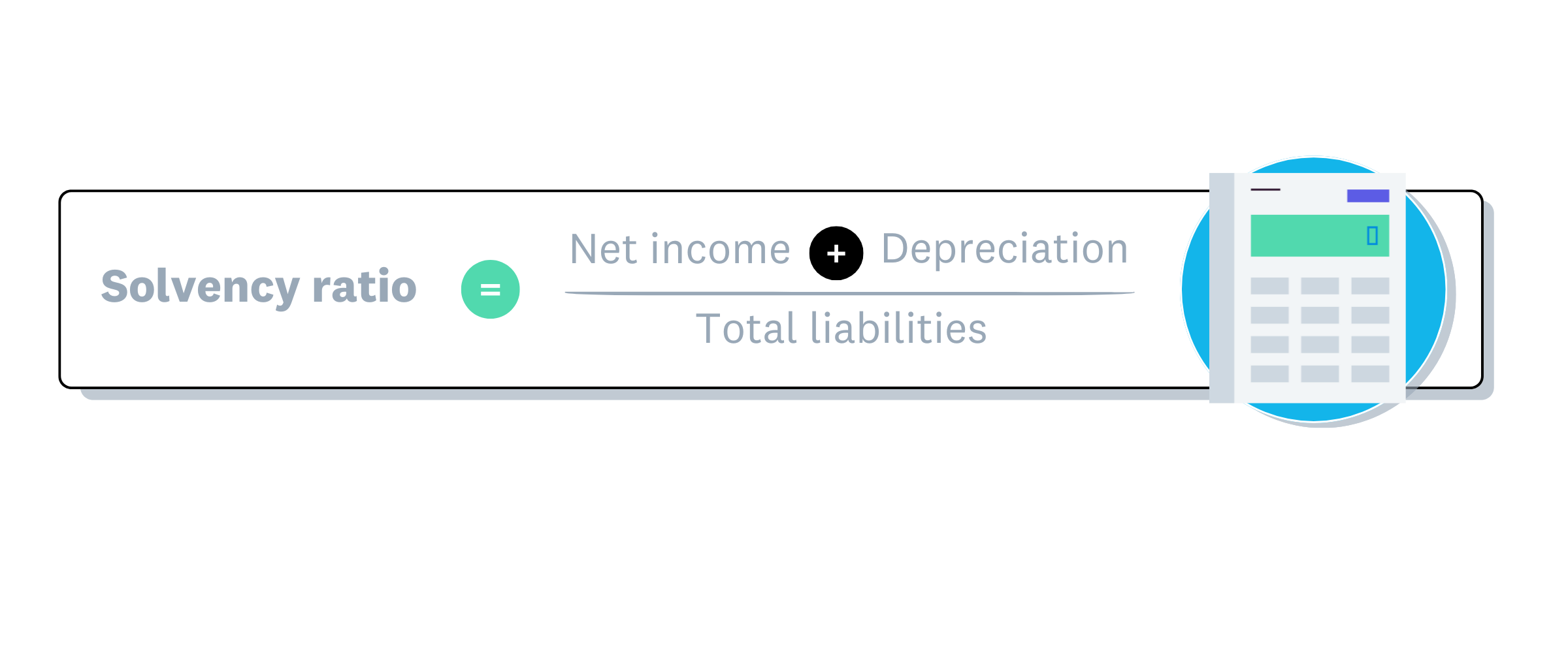

Solvency ratio formula

Solvency ratio formula

A solvency ratio calculation example

Martha owns a cafe that has:

- A net income of £50,000

- Asset depreciation* of £10,000

- Total liabilities of £300,000

To work out her solvency, she divides 60,000 (50,000 + 10,000) by 300,000, which equals 20%. A ratio of 20% or above is considered healthy, so Martha’s business has a good chance of paying its debts over the years.

*Depreciation is the decrease of the value of your assets over time from normal wear and tear, which is entered on your balance sheet as a deduction from the assets value.

Liquidity ratio formula

There are several liquidity ratios, like the cash ratio, quick ratio, and the working capital ratio, which is a useful long-term measure of liquidity.

Here’s the formula for the working capital ratio:

A liquidity ratio calculation example

Sadiq runs a sports shop that has:

- Current assets of £120,000

- Current liabilities of £80,000

To work out his liquidity (using the current ratio), he must divide 120,000 by 80,000 to equal 1.5. Since this is above 1.0, his liquidity is good and it’s likely he can meet his short-term financial commitments.

Why solvency and liquidity matter for your small business

A solvent business is financially stable. It can manage risk (such as clients not paying), use its resources to grow, and keep the shareholders happy. A business with poor liquidity will struggle to pay its staff and suppliers. This might be because their customers pay them late, which slows their cash flow.

A business with poor solvency will have trouble paying its debts. And an ‘insolvent’ business is in financial distress and may face bankruptcy. See government info on insolvency.

A business with liquidity has enough cash to pay its suppliers and team. This liquidity also protects it against financial difficulties, like periods of low productivity due to illness, changes in market conditions, and unexpected costs.

By watching your solvency and liquidity, you’ll make better decisions for both your daily operations and your long-term financial planning.

Tips to improve your financial solvency and liquidity

Here are a few ideas to help your business stay (or become) solvent and liquid.

For your solvency

- Attract new investors to your business.

- Look for ways to renegotiate, refinance, or consolidate bank loans (here’s a guide to managing debt).

- Consider restructuring your business, possibly by making some staff redundant.

For your liquidity

- Regularly measure your cash flow and plan your payments in line with it (here’s how to track your cash flow).

- Benchmark your liquidity against industry standards to see how you stack up.

- Make it easier for customers to pay their invoices.

- Consider maintaining a cash reserve for unexpected expenses.

FAQs on solvency and liquidity

What does it mean to provide liquidity?

To provide liquidity is to make sure your business has enough cash to pay its bills and obligations in the short term. For example, you might provide your business with liquidity by finding ways to improve its cash flow – such as by offering a discount to get paid sooner.

Can my business have good solvency but poor liquidity?

Definitely. Your business might struggle with liquidity if its cash flow is weak (there’s not much cash in the bank), yet it’s solvent because it has valuable fixed assets, like land and buildings. It can therefore pay its long-term debts.

Is solvency good or bad?

Solvency is good! The financial solvency definition is being able to meet your long-term financial obligations.

What is a good solvency ratio for my small business?

It depends on your industry. In general, a ratio of 20% or more indicates you can meet your long-term financial obligations.

What is employee liquidity?

This relates to how easily your employees can access their salary or otherwise manage their money – for example, whether they have the freedom to receive their salary in advance, or how freely they can convert their stocks and shares to cash.

High employee liquidity helps boost morale in your workplace.

Use Xero to track your solvency and liquidity

With Xero accounting software, you know exactly what’s happening with your numbers. Maybe you want to scrutinise your daily spending with real-time information, or you need an overview of your long-term solvency based on financial reports. Either way, let Xero give you the full financial picture.

Start using Xero for free

Access Xero features for 30 days, then decide which plan best suits your business.