Understanding gross pay versus net pay

Confusing gross and net pay can cause real issues for both employers and employees. Here’s everything you need to know.

Published Thursday 16 May 2024

It’s essential to understand the difference between gross pay and net pay. You’ll be able to more accurately manage your cash flow as a business owner, and help your employees understand what they’re actually being paid.

In this guide, we’ll explore net pay versus gross pay, how to calculate each, and how they affect your finances.

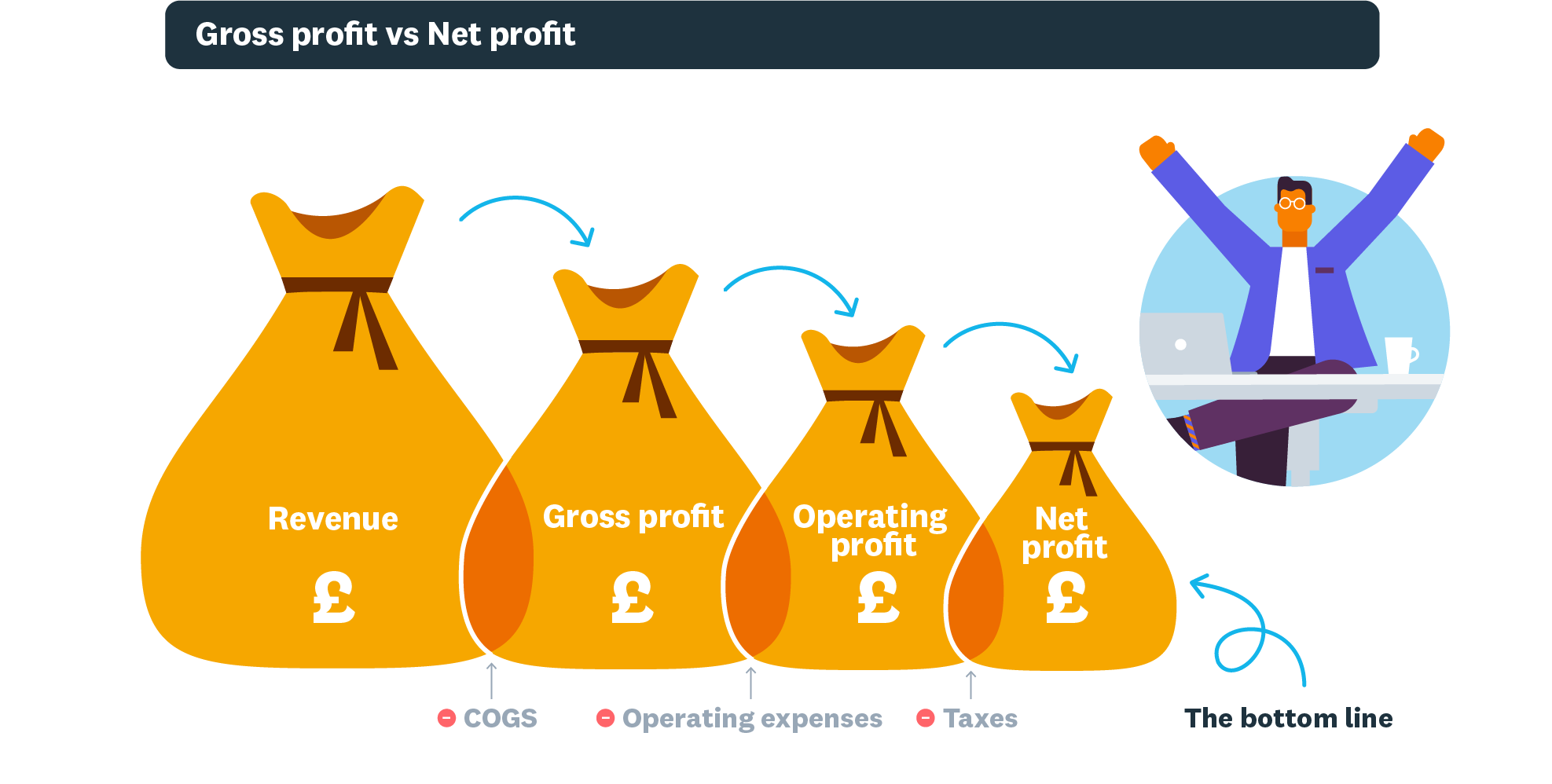

Breaking down the basics of gross pay vs net pay

What is gross pay?

Gross pay is the entire salary before any deductions are made, and therefore works similarly to gross profit. Alongside the main salary of an employee, it includes any overtime, bonuses and other earnings owed to them, all of which will be taxed.

Gross pay is discussed during salary negotiations and included in employment contracts. It’s key for both small business payroll as well as employees to understand. For instance, if a job is advertised at £30k per annum, this is the gross income and not the amount an employee takes home by the end of the year.

What is net pay?

Net pay is the amount of money that an employee actually receives in their bank account. It’s different from gross pay as it’s had everything deducted including taxes, National Insurance, pension contributions and student loan repayments. Net pay will therefore be a lower figure than gross pay.

‘Take-home pay’ is another way to say ‘net pay’. Employees must understand this is the real amount that’ll hit their bank balance rather than the gross pay which is their annual income pre-deductions.

Gross pay versus net pay: Where each matters

Financial management

The difference between gross pay versus net pay will hugely affect budgeting and financial management for both employers and employees.

As an employer, you’ll need to carefully decide how much to pay an employee to ensure you can afford their gross salary plus any company benefits you decide to offer in your employment package. You’ll also usually use the gross pay figure to determine how much you contribute towards an employee’s pension.

Employees, on the other hand, should base their financial planning on the net pay, not the gross pay, as this is what they’ll receive.

For example, if they’re on a £30k per annum salary and on the standard 1257L tax code – with no other sources of income and they’re not above the state retirement age – their net salary after tax for the 2024/2025 tax year will be £25,122. This is before any amounts that may be relevant to their circumstance have been deducted such as student loan repayments.

You can use HMRC’s income tax calculator for more information on estimating net pay from gross pay. Ensuring employees understand their gross income is important as this figure will determine which tax bracket they fall into and will affect their pension contributions.

The importance of both in financial statements

Though gross pay is of more interest to employers and net pay to employees, it’s important that everyone understands net pay versus gross pay, and both figures should be clearly detailed in all relevant financial statements and practices.

One area where it’s vital to get these figures right is when hiring new staff or offering a current staff member a pay rise. Employers should fully describe the compensation package in writing, with the gross income stated when offering a role – and ask the employee to confirm they’re happy with the terms before they accept and start their new position.

When issuing payslips: state the gross pay followed by a clear list of each deduction and finish with the net pay. This tells employees how much to expect in payment, plus provides transparency over what deductions have been made and why.

Calculating gross and net pay in the UK

How to calculate gross pay

To effectively forecast your cash flow in each financial period as an employer, you’ll need to know your employees’ gross pay for each payment period. There are two ways to calculate this, depending on whether you have salaried employees or hourly workers.

For salaried employees, take their annual gross income and divide this by the amount of pay periods. For example, to calculate the monthly gross pay of a £30k annual income, simply divide by 12 to get £2,500 per month.

The final stage is to add any additional income they may have generated, such as commission. For instance, if they earned £100 extra as a sales bonus in January, their monthly gross salary for that month would increase to £2,600.

For hourly employees, you’ll need to multiply their hourly salary by the number of hours they’ve worked.

For example, if they’re on the London Living Wage of £13.15 and their shift is eight hours, their gross pay would be £105.20. As before for salaried employees, next you’d need to account for any additional earnings they’ve secured in the role such as overtime payments and bonuses. For instance, say they worked two additional hours and you offer them a £50 bonus for good sales, their gross income would be:

£105.20 (base salary) + £50 (bonus) + £26.30 (2 x additional hours @ £13.15) = £181.50

How to calculate net pay from gross

To calculate net pay from gross, you’ll need to take the gross pay amount and subtract the relevant deductions. You can use this formula:

Gross pay - Deductions = Net pay

For the 2024/2025 tax year, taking a £30k per annum salaried employee on the standard 1257L tax code, this would be:

£30,000 (gross pay) - £4,878 (£3,484 Income Tax + £1,394 National Insurance) = £25,122 (net pay per annum)

In addition to these taxes, there may be other deductibles depending on an employee’s situation, such as pension contributions and student loan repayments, that you need to account for to get the true net salary.

If you don’t have the resources in-house to take care of payroll, you could always outsource to a payroll professional. Or you could utilise accountancy tools, like Xero’s payroll software, to automate these calculations for you, streamlining the payroll process.

How Xero simplifies gross and net pay calculations

Xero’s accounting software can help you get your gross versus net pay straight by calculating it for you.

Xero can assist with:

- Faster Payments: Streamlined online invoicing with reminders and online payments. Get paid quicker, and reduce late fees.

- Smarter Spending: Track expenses, categorise easily, and identify savings areas. Budget effectively, and forecast accurately.

- Clear Visibility: Real-time dashboards, cash flow forecasting. See your cash position anytime, and proactively manage flow.

- Effortless Bookkeeping: User-friendly interface, automated features. Save time, eliminate manual entry, and work on the go.

Find more cash flow tips in our cash flow resource hub.

Disclaimer

Xero does not provide accounting, tax, business or legal advice. This guide has been provided for information purposes only. You should consult your own professional advisors for advice directly relating to your business or before taking action in relation to any of the content provided.

Start using Xero for free

Access Xero features for 30 days, then decide which plan best suits your business.