Gross pay vs net pay: Key differences and how to calculate each

Understanding gross pay versus net pay helps you manage payroll costs, employee expectations, and tax obligations accurately.

Written by Jotika Teli—Certified Public Accountant with 24 years of experience. Read Jotika's full bio

Published Monday 13 October 2025

Table of contents

Key takeaways

• Gross pay represents your total salary before any deductions, while net pay is the actual amount deposited into your bank account after taxes, National Insurance, and other deductions are removed.

• Use gross pay figures for employment contracts and salary negotiations, but base all personal financial decisions and budgeting on your net pay since this reflects your actual spending power.

• Calculate net pay by subtracting all mandatory deductions from gross pay, including income tax, National Insurance contributions, pension contributions, and any applicable student loan repayments.

• Implement payroll software to automate gross and net pay calculations, ensuring accuracy and HMRC compliance while reducing time-consuming manual calculations and potential errors.

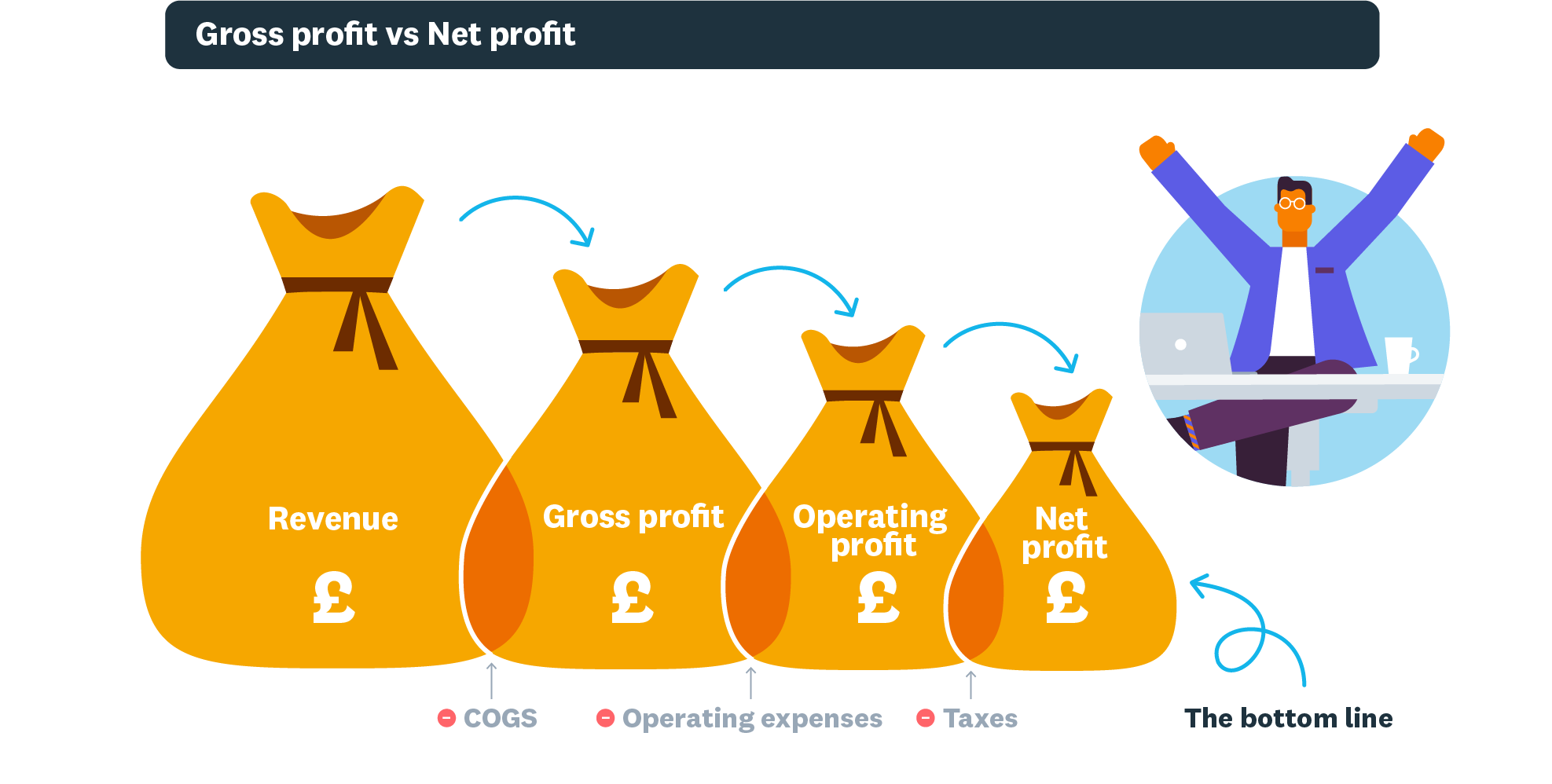

What is gross pay?

Gross pay is your total salary before any deductions are removed. This includes:

- Base salary: Your agreed annual or hourly wage

- Additional earnings: Overtime, bonuses, commissions, and allowances

- Pre-tax benefits: Company car allowances or other taxable benefits

When a job advertises £30k per annum, this refers to gross pay – not what you'll actually receive in your bank account.

What is net pay?

Net pay is the actual amount deposited into your bank account after all deductions are removed from your gross pay. Also called take-home pay, this is always lower than your gross salary.

Net pay = Gross pay minus all deductions, including:

- Income tax

- National Insurance contributions

- Pension contributions

- Student loan repayments

What deductions are taken from gross pay?

You subtract several deductions from gross pay to calculate net pay. While these can vary, most UK employees will see the following on their payslip.

Income Tax

This is a tax you pay on your earnings. The amount you pay depends on how much you earn and what tax code you're on. Most people have a personal allowance, which is an amount of income you can earn before you start paying tax.

National Insurance (NI)

National Insurance contributions build your entitlement to certain state benefits, such as the State Pension and Maternity Allowance. The amount you pay depends on your employment status and how much you earn.

Pension contributions

If you're enrolled in a workplace pension, a percentage of your pay will be automatically contributed. Your employer usually contributes as well. You save for retirement directly from your salary.

Other deductions

You might have other deductions, such as student loan repayments, trade union payments or charitable donations through a payroll giving scheme.

Calculating gross and net pay in the UK

Understand the importance of calculating both gross and net pay and how to do it yourself with these step-by-step calculations and examples.

How to calculate gross pay

Calculating gross pay helps you forecast payroll costs accurately and avoid cash flow surprises.

For salaried employees:Annual salary ÷ Number of pay periods = Gross pay per period

For hourly employees:Hourly rate × Hours worked = Base gross pay

Step-by-step calculation:

- Base monthly pay: £30,000 ÷ 12 = £2,500

- Add extras: Commission, bonuses, overtime

- Total gross pay: £2,500 + £100 bonus = £2,600

For hourly employees, you'll need to multiply their hourly salary by the number of hours they've worked.

For example, if they're on the London Living Wage of £13.15 and their shift is 8 hours, their gross pay would be £105.20. As before for salaried employees, next you'd need to account for any additional earnings they've secured in the role such as overtime payments and bonuses. For instance, say they worked two additional hours and you offer them a £50 bonus for good sales, their gross income would be:

£105.20 (base salary) + £50 (bonus) + £26.30 (2 additional hours at £13.15) = £181.50

How to calculate net pay from gross

Net pay formula:Gross pay - All deductions = Net pay

UK example (2024/2025 tax year):

- Starting amount: £30,000 gross

- Income tax: -£3,484

- National Insurance: -£1,394

- Final amount: £25,122 net

Additional deductions may include: Pension contributions, student loans, or salary sacrifice schemes.

If you don't have the resources in-house to take care of payroll, you could always outsource to a payroll professional. Or you could utilise accountancy tools, like Xero's payroll software, to automate these calculations for you, streamlining the payroll process.

Gross pay vs net pay: Where each matters

Use gross pay for: Employment contracts, salary negotiations, and pension calculations.

Use net pay for: Personal budgeting, mortgage applications, and financial planning.

For employers: Budget for the full gross salary plus employer costs like National Insurance contributions and pension matching.

For employees: Base all personal financial decisions on net pay – this is your actual spending power.

Example calculation:

- Gross pay: £30,000

- Deductions: £4,878 (income tax + National Insurance)

- Net pay: £25,122

This shows how £30k gross becomes £25k net – a difference of nearly £5,000 that affects your actual spending power.

You can use HMRC's income tax calculator for more information on estimating net pay from gross pay. Employees need to know their gross income, as it determines their tax bracket and pension contributions.

The importance of both in financial statements

Employers focus on gross pay, while employees look at net pay. Make sure both figures appear clearly in financial statements.

You need accurate figures when hiring new staff or offering a pay rise. State the gross income in the written compensation package. Ask the employee to confirm they accept the terms before starting.

On payslips, list gross pay, each deduction, and net pay. This shows employees what they will receive and why deductions were made.

Getting gross and net pay right for your business

As a business owner, running payroll accurately is essential. It keeps you compliant with HMRC regulations and ensures your employees feel valued and trust that they're being paid correctly. Manually calculating deductions for each employee can be time-consuming and leaves room for error.

Payroll software automates complex calculations, saves you time, and ensures your figures are correct. You can focus on running your business, not your books.

How Xero simplifies gross and net pay calculations

Xero's payroll software automates gross and net pay calculations, reducing errors and saving time on every pay run.

Key payroll benefits:

- Automatic calculations: Tax, National Insurance, and pension deductions calculated correctly

- Payslip generation: Clear breakdown of gross pay, deductions, and net pay

- HMRC compliance: auto-enrolment and Real Time Information (RTI) submissions handled automatically

- Employee self-service: Staff can access payslips and P60s online

Find more cash flow tips in our cash flow resource hub.

FAQs on gross pay vs net pay

Below you’ll find answers to common questions about gross and net pay.

Which is higher, gross pay or net pay?

Your gross pay is always higher than or equal to your net pay. Gross pay is your full earnings before deductions. Net pay is your take-home pay after tax and National Insurance are subtracted.

Is it better to negotiate gross or net salary?

Negotiate your gross salary, as this is the standard figure in contracts and for pay rises. Your net pay can change, but your gross salary stays the same.

Why is my take-home pay less than the advertised salary?

The advertised salary is usually your gross pay. Your take-home pay is lower because deductions like income tax, National Insurance and pensions are subtracted before you receive it.

Do all employees pay the same deductions from gross pay?

No, deductions vary for each person. Most people pay income tax and National Insurance, but the amount depends on your earnings, tax code, student loans and pension contributions.

Disclaimer

Xero does not provide accounting, tax, business or legal advice. This guide has been provided for information purposes only. You should consult your own professional advisors for advice directly relating to your business or before taking action in relation to any of the content provided.

Start using Xero for free

Access Xero features for 30 days, then decide which plan best suits your business.