How to calculate net profit margin

Net profit margin (calculation)

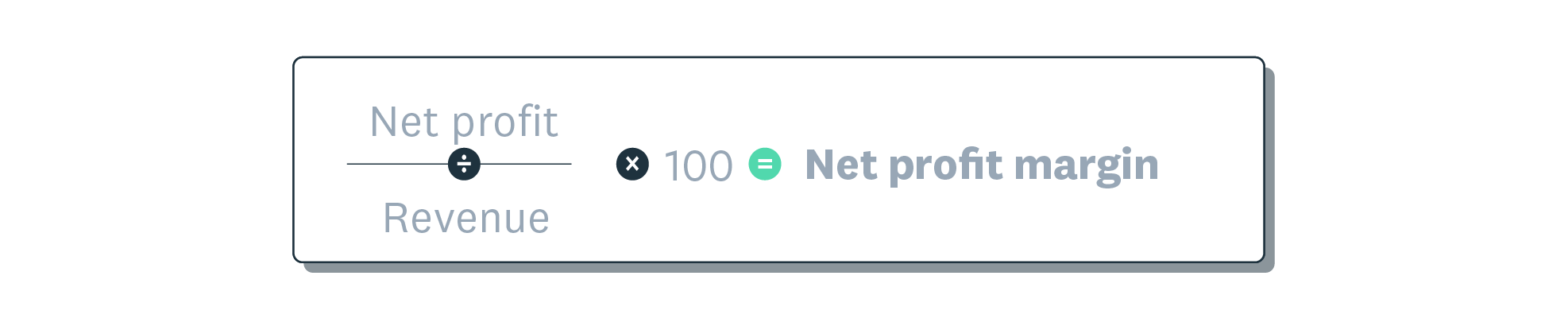

Net profit margin is net profit divided by revenue, times 100. It tells you what portion of total income is profit.

How to calculate net profit margin

Example of a net profit margin calculation

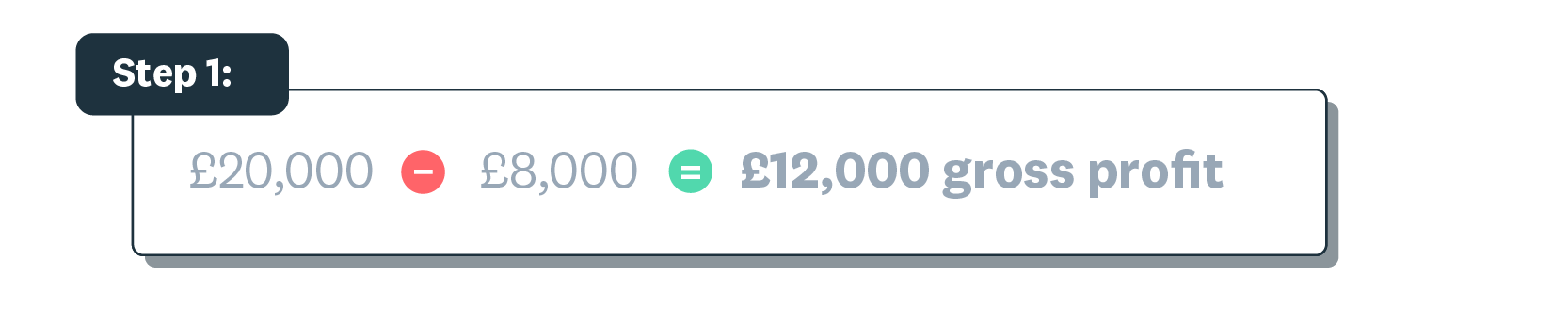

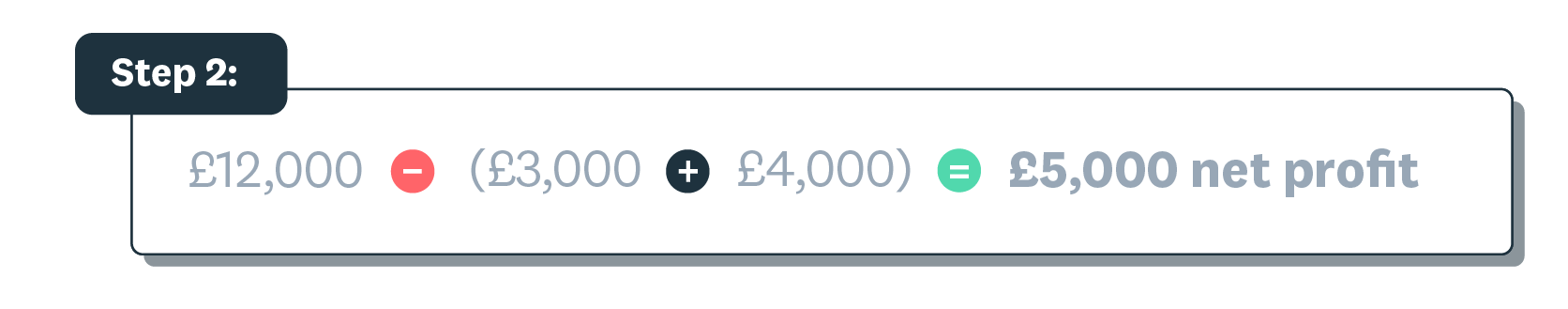

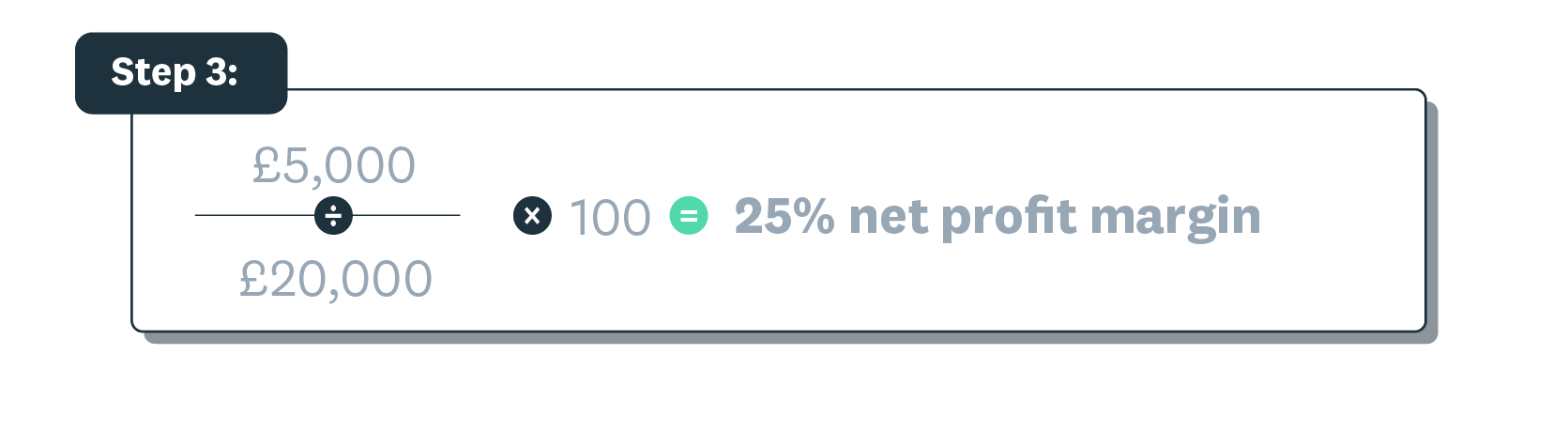

Let’s say your business makes £20,000 by cleaning offices. It costs you £8000 to provide those services. And you spent another £7000 on operating expenses and taxes. Here’s how to work out your net profit margin.

Your net profit margin shows what percentage of your revenue is actual profit after all expenses are deducted. This number shows how efficient your business is at turning income into profit.

See related terms

Handy resources

Advisor directory

You can search for experts in our advisor directory

Profit & Loss template

Download Xero’s profit and loss statement template to show how much money your business is making

Financial reporting

Keep track of your performance with accounting reports

Disclaimer

This glossary is for small business owners. The definitions are written with their requirements in mind. More detailed definitions can be found in accounting textbooks or from an accounting professional. Xero does not provide accounting, tax, business or legal advice.