Small business accounting to set you free

Accounting software made for small businesses and sole traders.

Join over 4.4 million subscribers using Xero

Awards and recognition for our work

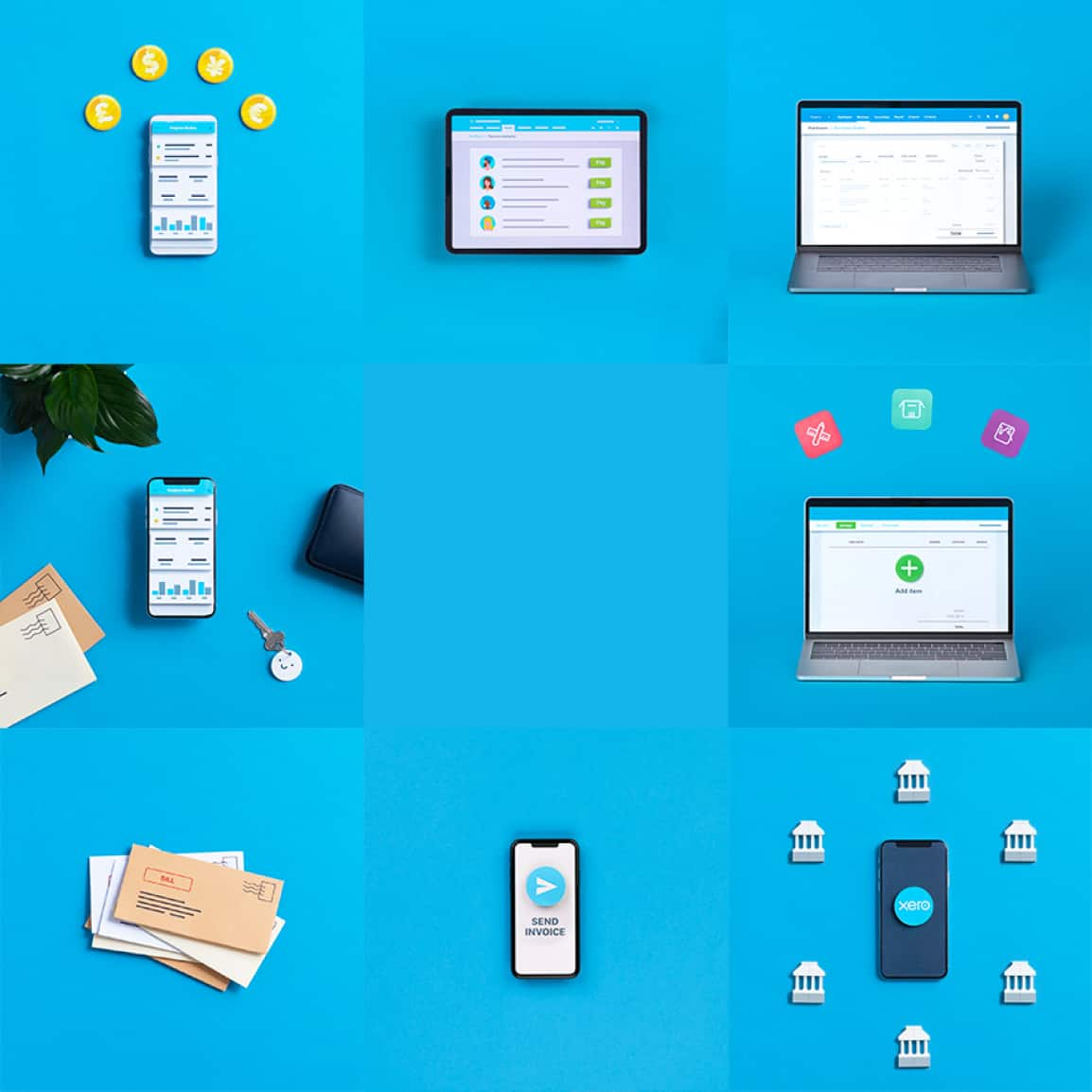

Accounting software with more oomph

Explore Xero accounting software and its powerful tools for small businesses, accountants, and bookkeepers.

Plans to suit your business

All pricing plans cover the accounting essentials, with room to grow.

Time to take your business further

Manage your finances, control cash flow and integrate with apps. See how Xero can help your business type or industry. See all business types.

Self-employed

Manage your finances and send invoices easily with accounting software for sole traders and freelancers.

Construction and trades

Send quotes and invoices, track expenses, and manage jobs from your phone with Xero’s construction accounting software.

Retail

View cash flow on the go and reduce manual admin. Run your retail business efficiently with Xero accounting software.

Set customisation to cruise control

Connect Xero to apps, integrations, and financial services to make it easier to run your small business.

Accountants and bookkeepers, it’s go time

Keep your practice one step ahead with Xero accounting software.

Get paid up to twice as fast†

With online invoice payments through Stripe and GoCardless, you can accept payments by card or direct debit.

Discover Xero innovations

Discover this year’s updates designed to help you save time, featuring powerful new tools and features you might’ve missed.

Try Xero for free

30-day free trialAccess Xero features for 30 days, then decide which plan best suits your business.

30-day free trial

$0

NZD

- Access Xero features

- Set up with your data or a demo

- No credit card required

- 24/7 online support

- Cancel any time