Cash flow management for small businesses

Maintaining a healthy flow of cash in and out of your business is more important now than ever. Browse resources from Xero experts to see how to better manage your cash flow and get paid faster.

Canada Small Business Insights

The latest Xero Small Business Insights data showed that small businesses were increasingly being paid late and that sales are barely growing during the March quarter. However, the June quarter Bank of Canada Survey of Consumer Expectations showed some signs of improving consumer confidence.

Check out the full report here

Using Xero to manage your business finances

Xero can help you run your business efficiently, get paid promptly, and view up-to-date figures.

Send professional invoices

Send personalized online invoices from the desktop or app as soon as a job is done.

Sending invoicesGive customers more ways to pay

Add a ‘Pay now’ button to online invoices so you get paid faster and speed less time chasing late payments.

Accepting online paymentsTrack your bills and pay them on time

Learn about Xero features that help you track your bills and pay them on time to avoid late payment fees.

Tracking bills on the dashboard

Using Xero to manage cash flow

Xero helps you track, manage, forecast and improve cash flow so you have enough money on hand to cover debts and unlock business potential.

Money coming in and out

Forecast the cash flow of your business from month to month.

Use our free calculator herePlan for the future

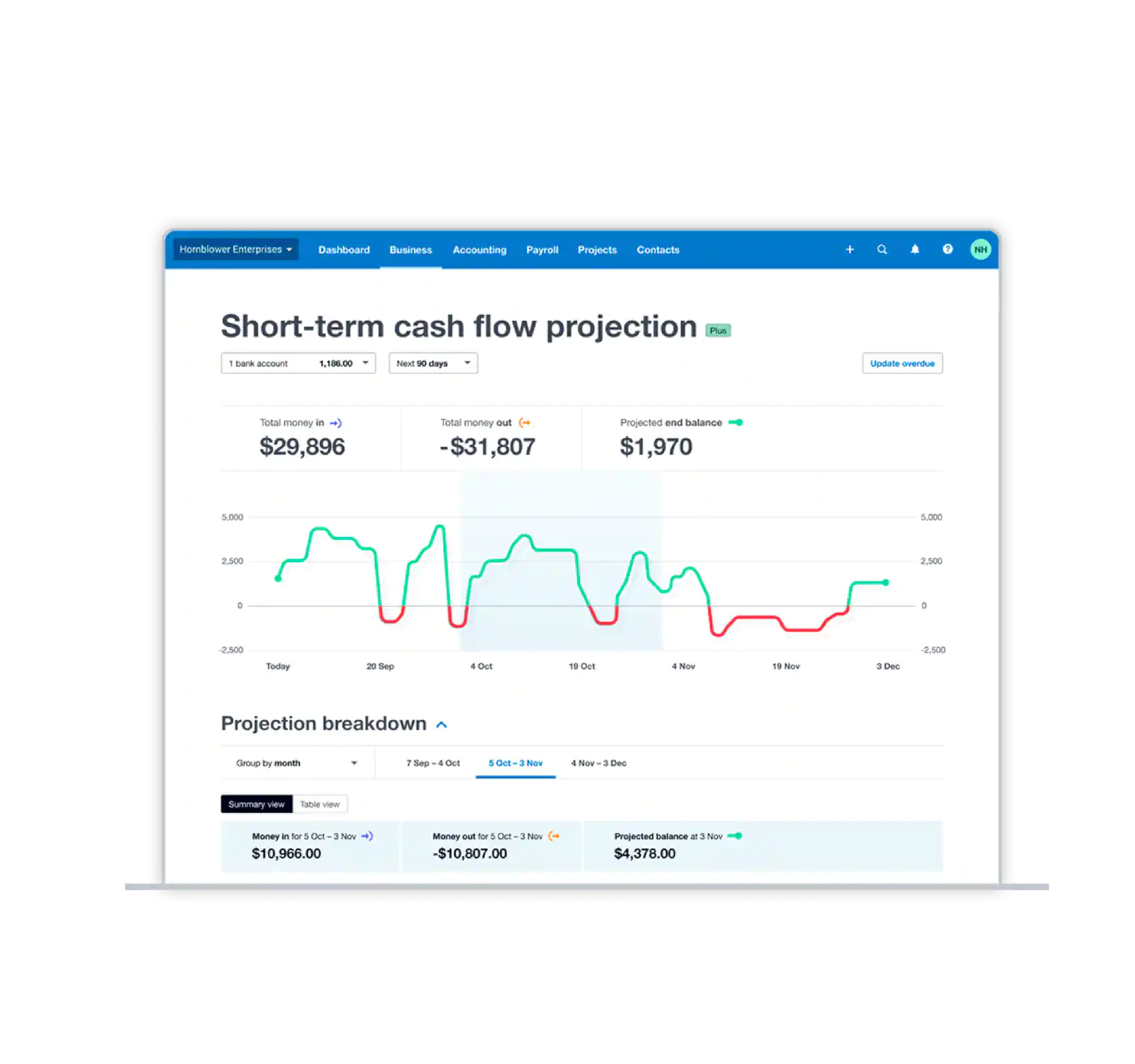

Get cash flow forecasts for the next 30 days with Xero Analytics, and the next 90 days with Analytics Plus.

Get business insights and forecastsStay in control with cash flow forecasting

Measure business health with cash flow figures that help you spot opportunities and mitigate risk.

Get a snapshot of your short-term cash flowView a snapshot of your business financials

Know your numbers with a snapshot of your business financials so you can see what’s working and what’s not.

Get a business snapshot

Guides to help you manage business finances

Our expert guides explore how to maintain healthy cash flow and stay on top of your finances.

How to invoice

Looking for help on making and sending invoices and getting them paid? Check out these tips on the art of invoicing.

How to create a small business budget

Businesses need budgets. So how do you go about setting a business budget? What are the main things you need to put in?

How to finance your business

Need finance for your business? Learn about the types of finance, approaching lenders and investors and more.

Small business bookkeeping for beginners

Bookkeeping lets you know how your small business is doing. So what does it involve and how do you make it less boring?

The best inventory management software for small business

Inventory management software can remove the guesswork and give you greater control of your business.

How to do market research

Good research can improve your service or product, and make you a better marketer. Here’s a guide to get you started.

Guides to managing cash flow

Our expert guides explore how to maintain a healthy cash flow so you can pay your suppliers, employees, lenders and owners on time.

5 rules for managing small business cash flow

Cash flow management is vital for a growing business. Here are five rules to help you keep cash flow under control.

How financial statements boost your small business

Understanding financial statements helps you make smarter business decisions. Find out how to read financial statements and use them effectively.

How to manage petty cash

Petty cash is cash that businesses keep on hand for small purchases. Learn how to manage a petty cash fund.

Online help: Track & predict cash flow in Xero

Find step-by- step instructions for tracking and predicting cash flow in these Xero Central help articles.

Track short-term cash flow and financial metrics

View predicted transactions on the short-term cash flow dashboard in Analytics Plus, and track financial metrics with a business snapshot.

Track your cash flowMake projections based on cash predictions using Analytics Plus Track financial metrics with a business snapshot

Managing when times are tough

Planning, managing and surviving through difficult times

Find out how to plan ahead, prepare and get through the tough times.

Get a free business continuity plan templateManaging debtFind an accountant or bookkeeper for help and advice

Glossary of terms

These definitions are for small business owners. Detailed definitions can be found in accounting textbooks or from accounting professionals.

Plans to suit your business

All pricing plans cover the accounting essentials, with room to grow.