Free pay stub template

Create a pay stub for your employees in no time with this easy-to-use pay stub generator. Then try Xero accounting software for free.

Download the pay stub template and check stub generator

Fill in the form to get a free pay stub template as an editable PDF. We’ll throw in a guide to help you use your new payroll stub generator.

Got your template? Try Xero for free.

Ready to take control of your business? Xero's got everything you need to succeed, from accounting and invoicing to reporting and payroll.

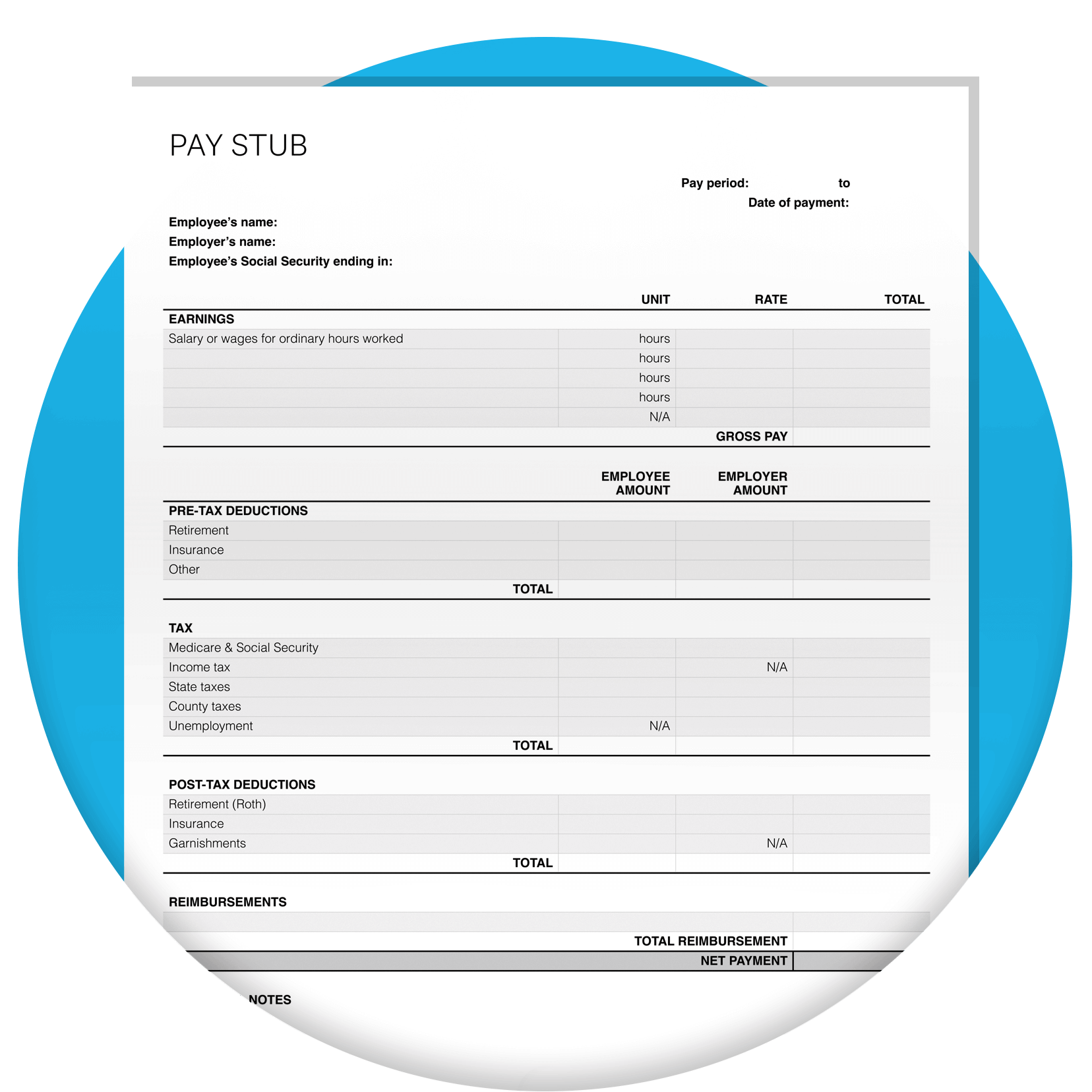

Features of this template

The paystub generator and paycheck stub maker let you enter all the information you need for employee payroll. There’s also a how-to guide with a pay stub example.

- Earnings, including money from normal hours and overtime

- Pre-tax deductions made for insurance, retirements or pensions

- Taxes

- Post-tax deductions (such as insurance)

- Reimbursements

Pay stub FAQs

Employees get pay stubs after each pay cycle that show what they earned, and where their money went. The pay stub shows their gross pay and take-home (net) pay, their taxes, and other deductions.

Employees get pay stubs after each pay cycle that show what they earned, and where their money went. The pay stub shows their gross pay and take-home (net) pay, their taxes, and other deductions.

Our free paycheck stub maker makes it easy to generate a pay stub. Just enter the wages paid along with deductions (like tax, health insurance premiums, or Canada Pension Plan (CPP) in a given period. You can also note reimbursements, such as repayments for travel expenses, in the check stub creator.

Accounting software like Xero can help support your pay runs.Our free paycheck stub maker makes it easy to generate a pay stub. Just enter the wages paid along with deductions (like tax, health insurance premiums, or Canada Pension Plan (CPP) in a given period. You can also note reimbursements, such as repayments for travel expenses, in the check stub creator.

Accounting software like Xero can help support your pay runs.Employers need pay statements to verify payments and maintain required tax documentation, while employees need pay stubs to check they’ve been paid properly. Pay stub documents also help verify income – by showing employee pay when applying for a loan or renting an apartment, for instance. You can also use pay stubs to track payments to contractors or independent contractors. Stay up to date with the Canada Revenue Agency.

CRA: Payroll news and updatesEmployers need pay statements to verify payments and maintain required tax documentation, while employees need pay stubs to check they’ve been paid properly. Pay stub documents also help verify income – by showing employee pay when applying for a loan or renting an apartment, for instance. You can also use pay stubs to track payments to contractors or independent contractors. Stay up to date with the Canada Revenue Agency.

CRA: Payroll news and updates

Components of a pay stub

A check stub generator lets you fill out the key components and generate an accurate, comprehensive pay stub.

General information

Includes the employer and employee data, such as their names and addresses, plus the pay period and pay dates

Gross wages

The pre-tax dollar amount of earnings, including hours, rate, and overtime (if applicable)

Tax deductions

Tax withholdings for each jurisdiction, including the amount and tax type

Employee benefit deductions

Details on the cost of health insurance, retirement contributions, or other items deducted from earnings

Voluntary deductions

Things like regular charitable donations or direct deposits to different accounts

Involuntary deductions

Items such as taxes owed, wage garnishments, or court-ordered child support

Employee's net pay

The final take-home pay after all deductions

Different types of pay stubs

Different types of pay stubs serve different needs. You can use a paycheck template to generate the type you need.

Basic pay stubs

A basic stub shows wages, benefit entitlements like paid time off (PTO), vacation, or employer contributions, plus taxes and any deductions

Contractor pay stubs

Shows independent contractor payments. Contractors are typically responsible for filing taxes on their own.

Electronic pay stubs

These are shared electronically (often by email). Electronic pay stubs avoid having to print paper copies so you can view them online.

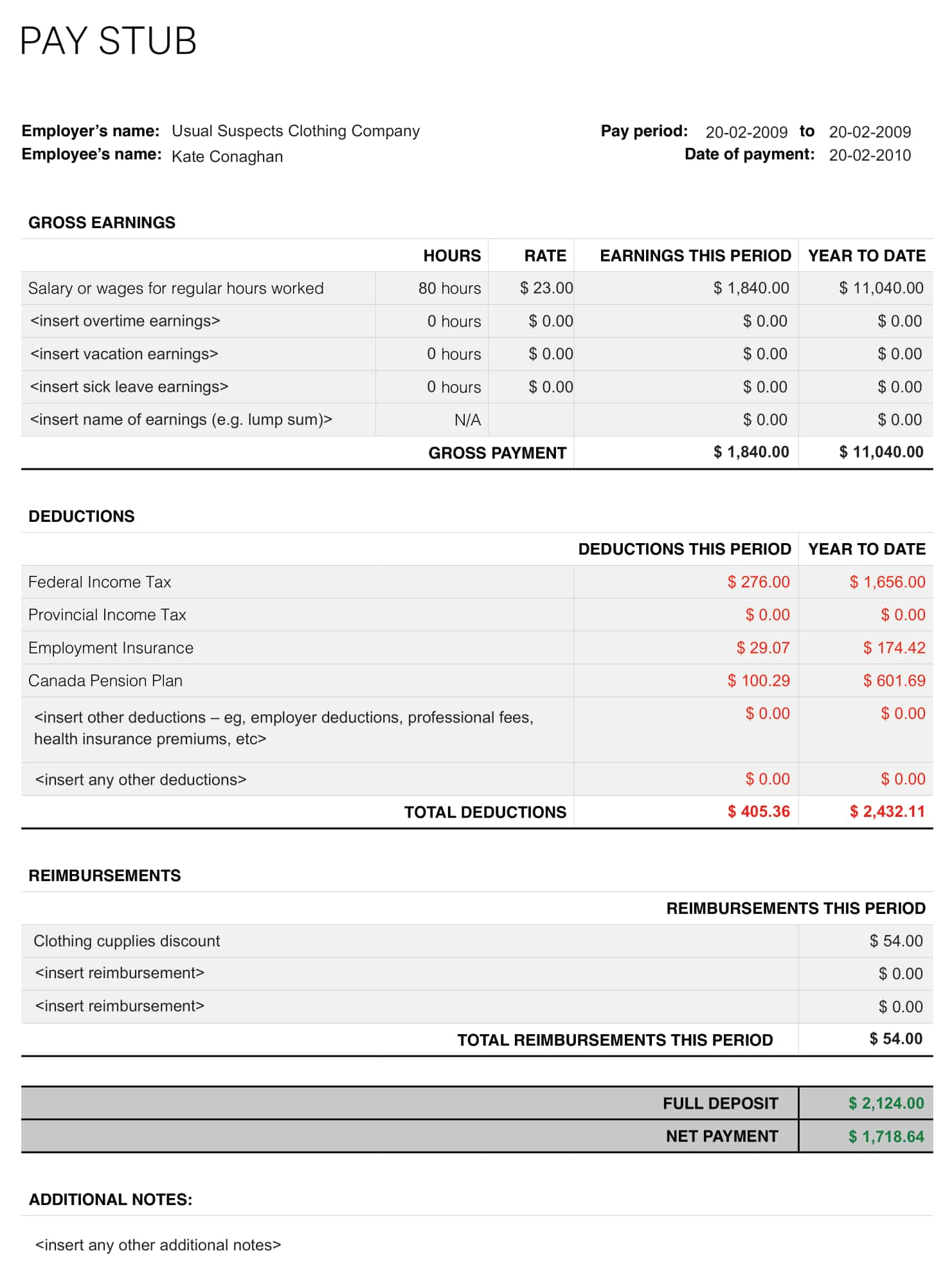

Example of a pay stub layout

See what a pay stub looks like and what’s included.

The sample payroll check stub below shows what our online paystub generator can produce.

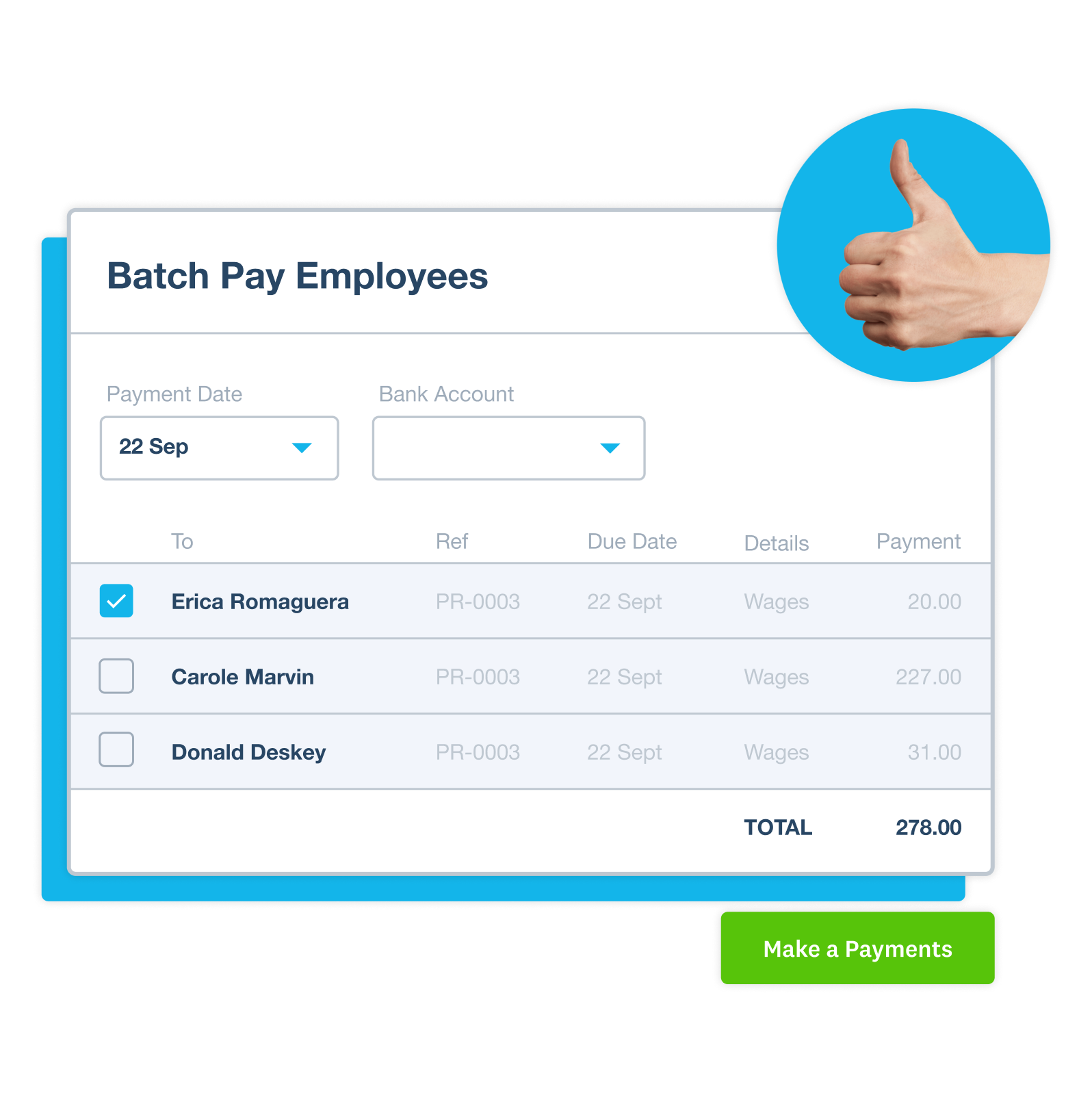

Make payday a better day

Connect your payroll app to Xero accounting software to streamline your payday. This saves you from manually filling out a pay stub template, saving time and reducing the chance for human error.

- Pay stubs are created automatically each payday

- Taxes are calculated automatically

- Salary and wages flow straight into your general ledger

- Payday expenses show up in your cash flow forecasts

Other tools to help you run your business

Besides our automated pay stub generator, we have other resources to help you manage your small business finances

Income statement template

Easily create an income statement for your business.

Margin calculator

Calculate your gross profit margin with this simple calculator to check you’re hitting your targets.

Invoice template

An invoice template creates a professional look, does the math, and makes it easy for customers to follow

Disclaimer

Xero does not provide accounting, tax, business or legal advice. This template has been provided for information purposes only. You should consult your own professional advisors for advice directly relating to your business.