What a gearing ratio is and how to calculate it for your small business

Learn how the gearing ratio guides smarter borrowing, reduces risk, and protects your cash flow.

Written by Shaun Quarton—Accounting & Finance Content Writer and Growth Marketer. Read Shaun's full bio

Published Friday 5 December 2025

Table of contents

Key takeaways

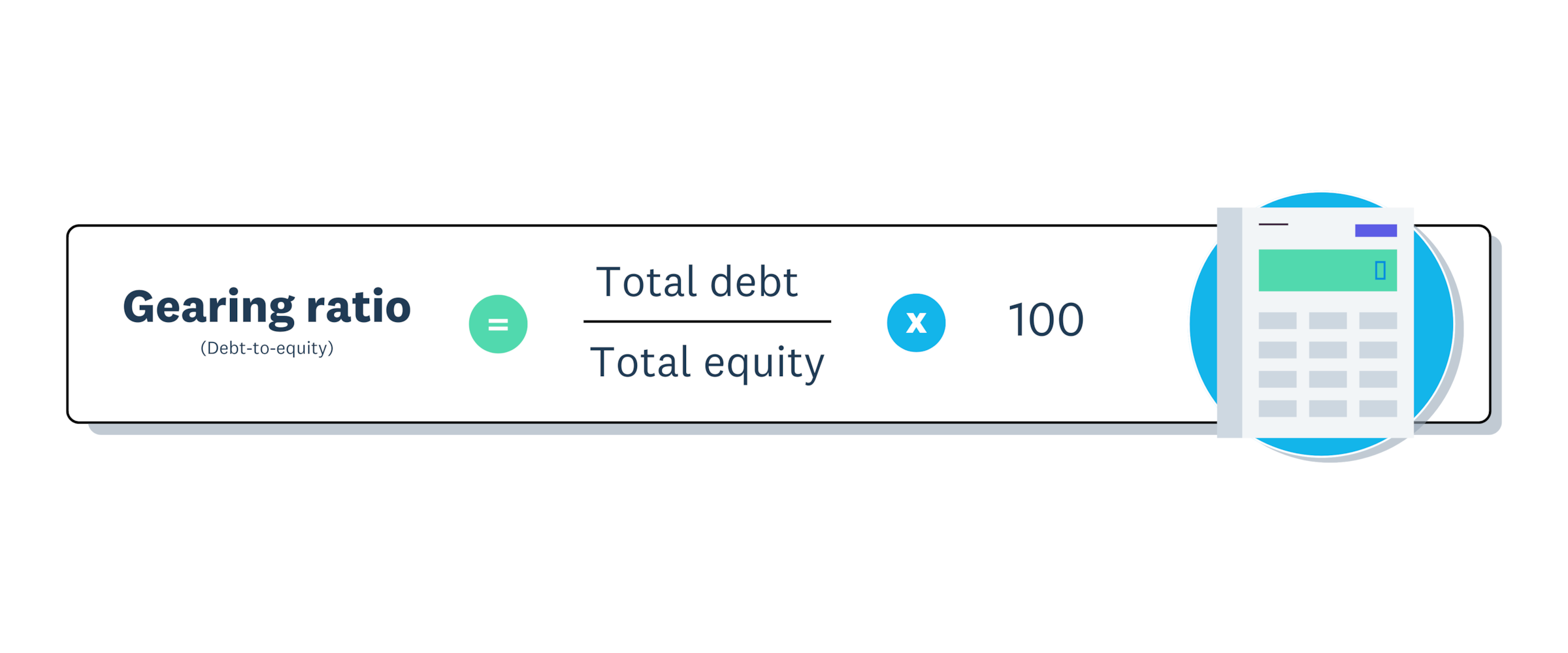

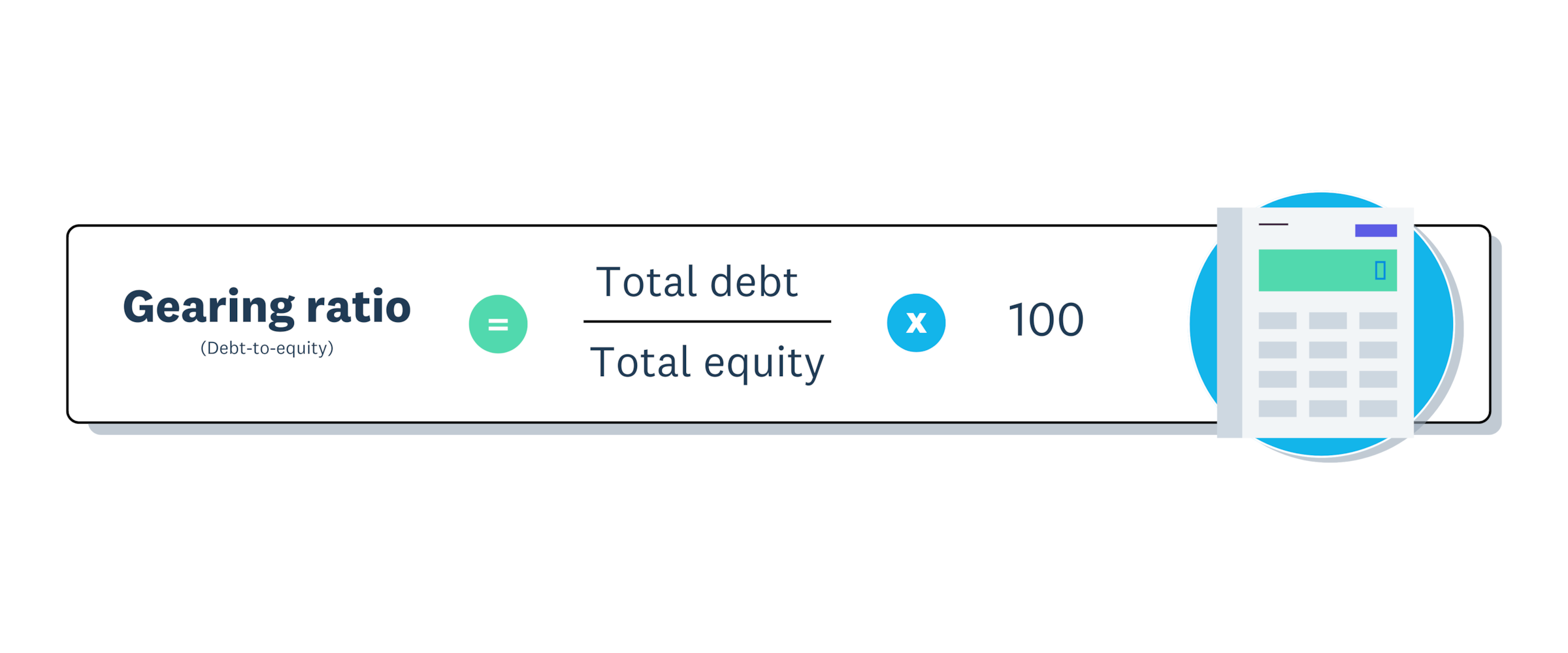

• Calculate your gearing ratio using the debt-to-equity formula (Total Debt ÷ Total Equity × 100) to assess your business's financial leverage and determine whether you're overly reliant on borrowed funds.

• Maintain a gearing ratio between 25% and 50% for optimal balance, as this range typically provides sufficient capital for growth while preserving financial stability and creditworthiness.

• Monitor your gearing ratio regularly to make informed borrowing decisions and identify early warning signs of financial strain before they impact your cash flow or ability to secure future funding.

• Improve a high gearing ratio by paying down existing debt (especially high-interest loans), reinvesting profits to build retained earnings, and selling underused assets to reduce your debt burden.

Gearing ratio definition

Gearing is the balance between debt and equity a company uses to fund its operations. In finance, this balance directly impacts your business's financial risk and growth potential.

- Debt is borrowed money, such as loans and lines of credit, that you must repay with interest

- Equity is the owner's investment in the business, including retained earnings and share capital

A gearing ratio is a financial metric that compares a business's debt to its equity. It shows how reliant your business is on borrowed funds relative to its overall value, giving you insight into financial health.

Lenders, investors, and stakeholders use gearing ratios to assess financial stability. Banks, for example, calculate a capital adequacy ratio as the amount of capital relative to its ‘risk-weighted assets’ to determine the level of risk associated with lending to a business.

- Higher ratio: Greater reliance on debt, increased financial risk but potential for higher returns

- Lower ratio: Stronger equity position, reduced risk but potentially limited growth opportunities

Why does your gearing ratio matter?

Your gearing ratio matters because it's a key indicator of your business's financial health. Tracking it effectively helps you make smarter financial decisions and plan for sustainable growth.

Your gearing ratio matters because it helps you:

- make borrowing decisions by showing whether you can take on more debt without straining your cash flow or increasing financial risk

- attract investors and lenders by signalling financial stability, which can make your business more appealing to potential funders

- plan strategy by aligning your debt-to-equity mix with your growth goals, whether you want rapid expansion or steady, low-risk growth

- keep cash flow stable, as a lower ratio frees more cash for reinvestment while a higher ratio sends more to debt repayments

- manage risk by helping you spot financial pressures early so you can act

Types of gearing ratios

Four main gearing ratios help small businesses measure financial leverage and risk. Each examines different aspects of your financial stability:

- debt-to-equity ratio – compares total debt to total equity, showing how much of the business is funded by creditors versus owners

- debt-to-capital ratio – measures the share of total capital (debt plus equity) funded by debt; higher ratios mean greater reliance on borrowing

- equity ratio – shows how much of your total assets are financed by equity; higher ratios indicate stronger financial stability and lower risk

- times interest earned (TIE) ratio – shows how easily you can cover interest payments with pre-tax earnings; higher ratios reassure lenders you can meet your debt obligations

How to calculate the gearing ratio

Calculating your gearing ratio involves these steps:

1. Calculate total debt

Include all financial liabilities such as loans, bonds and credit lines

2. Determine total equity

Add retained earnings and share capital to calculate the owner's total investment

3. Apply the formula

Use one of these common formulas:

- Debt-to-equity formula: Gearing ratio = (Total Debt / Total Equity) × 100

- Debt-to-capital formula: Gearing ratio = (Total Debt / (Total Debt + Total Equity)) × 100

4. Interpret the Result

- A higher percentage indicates a higher reliance on debt

- A lower percentage shows a stronger equity position.

Example gearing ratio calculations

This example shows how to calculate gearing ratios using both common formulas:

- Total debt: $50,000

- Total equity: $100,000

Using the debt-to-equity formula:

Gearing ratio = (Total debt / Total equity) × 100

Gearing ratio = ($50,000 / $100,000) × 100 Gearing ratio = 50%

Using the debt-to-capital formula:

Gearing Ratio = (Total Debt / (Total Debt + Total Equity)) × 100

Gearing Ratio = ($50,000 / ($50,000 + $100,000)) × 100 Gearing Ratio = ($50,000 / $150,000) × 100 Gearing Ratio = 33.3%

Gearing ratio analysis

Gearing ratio analysis helps assess your business's financial health by revealing the balance between debt and equity. Use these benchmarks to interpret your results:

- Low gearing (below 30%): Strong equity position with lower risk exposure and greater stability

- Moderate gearing (around 50%): Balanced financial approach suitable for most small businesses

- High gearing (above 70%): Heavy reliance on debt with increased financial risk

Typical gearing ratios vary significantly by industry, growth stage, and risk tolerance. Many small and medium-sized businesses (SMBs) keep a 30% to 50% mix of debt and equity, using borrowed funds to support growth while relying on equity for stability. Striking the right balance is key to managing financial risk and sustainable growth.

High vs low gearing: what's the difference?

High and low gearing represent different funding strategies. The key differences are:

High gearing means relying more on debt than equity:

- Benefits: Accelerates growth when sales are strong, provides capital for expansion

- Risks: Highly geared businesses are vulnerable to revenue drops and interest rate increases, a risk highlighted by projections that the speculative-grade corporate default rate could rise to 7% in the US.

- Best for: Businesses with stable cash flow or high-growth industries requiring rapid expansion

Low gearing means using more equity and less debt:

- Benefits: Minimises financial risk, protects credit rating, ensures long-term stability

- Drawbacks: Slower growth compared to debt-funded expansion

- Best for: Businesses prioritising security over rapid growth, especially in unstable markets

Finding the right balance is key to managing financial risk so your business is ready to seize growth opportunities.

What is a good gearing ratio?

There's no single 'good' gearing ratio, as the ideal number depends on your industry, business size, and goals. However, some general guidelines can help you understand where you stand.

- A low gearing ratio is anything below 25%. This suggests lower financial risk but could mean you're missing out on opportunities to grow using borrowed funds.

- An optimal gearing ratio is often between 25% and 50%. For many small businesses, this range represents a healthy balance between funding growth with debt and maintaining financial stability.

- A high gearing ratio is anything above 50%. This indicates a greater reliance on debt, which increases financial risk but can also fuel faster expansion.

Capital-intensive industries like construction or manufacturing might comfortably operate with higher ratios, while service-based businesses may prefer to keep theirs low. It's always a good idea to discuss your ratio with an accountant to see what makes sense for your business.

How to improve your gearing ratio

If your gearing ratio is higher than you'd like, there are several practical steps you can take to lower it and reduce financial risk.

- pay down debt – focus on repaying existing loans, especially those with high interest rates, to reduce your total debt and improve your ratio

- increase equity – reinvest some profits back into the business to build retained earnings and strengthen your equity position

- boost profitability – increase revenue or reduce operating costs so higher profits add to retained earnings and equity over time

- manage your assets – sell underused assets and use the cash to pay down debt

Debt-to-equity ratio vs gearing ratio

Debt-to-equity and gearing ratios measure financial leverage but serve different purposes. While often used interchangeably, they have distinct applications:

- debt-to-equity ratio – compares long-term debt to shareholders' equity

- gearing ratio – uses different formulas to show how much debt your business has compared to its overall funding

Both ratios are essential for evaluating financial risk. The debt-to-equity ratio is useful for quick financial assessments, while the gearing ratio offers deeper insights for long-term planning.

When to use the debt-to-equity ratio vs the gearing ratio

When deciding which metric to use, consider your business's needs:

- debt-to-equity ratio – best for quick financial checks and standard comparisons, when you need a snapshot of how much debt your business has relative to equity

- gearing ratio – better for deeper analysis and long-term planning, when you want a more complete view of your overall debt levels

FAQs on gearing ratios

Here are answers to some common questions about gearing ratios.

Is a 50% gearing ratio good?

A gearing ratio of 50% is often considered optimal for many small businesses. It suggests a balanced approach, where the business is using debt to fund growth without taking on excessive financial risk. However, whether it's 'good' depends on your industry and specific business situation.

What is the difference between gearing ratio and debt-to-equity ratio?

The debt-to-equity ratio specifically compares a company's total debt to its shareholder equity. The gearing ratio is a broader term that can include several different formulas, such as debt-to-equity or debt-to-capital, to measure a company's financial leverage.

Why do lenders look at gearing ratios?

Lenders use gearing ratios to assess the financial risk of a business before approving a loan. A high ratio indicates that a business has a lot of debt compared to its equity, which can make it a riskier borrower, especially in an environment where global debt has reached a record high of more than 355 per cent of world GDP. A lower, more balanced ratio signals financial stability and a greater ability to handle debt repayments.

Start using Xero for free

Access Xero features for 30 days, then decide which plan best suits your business.