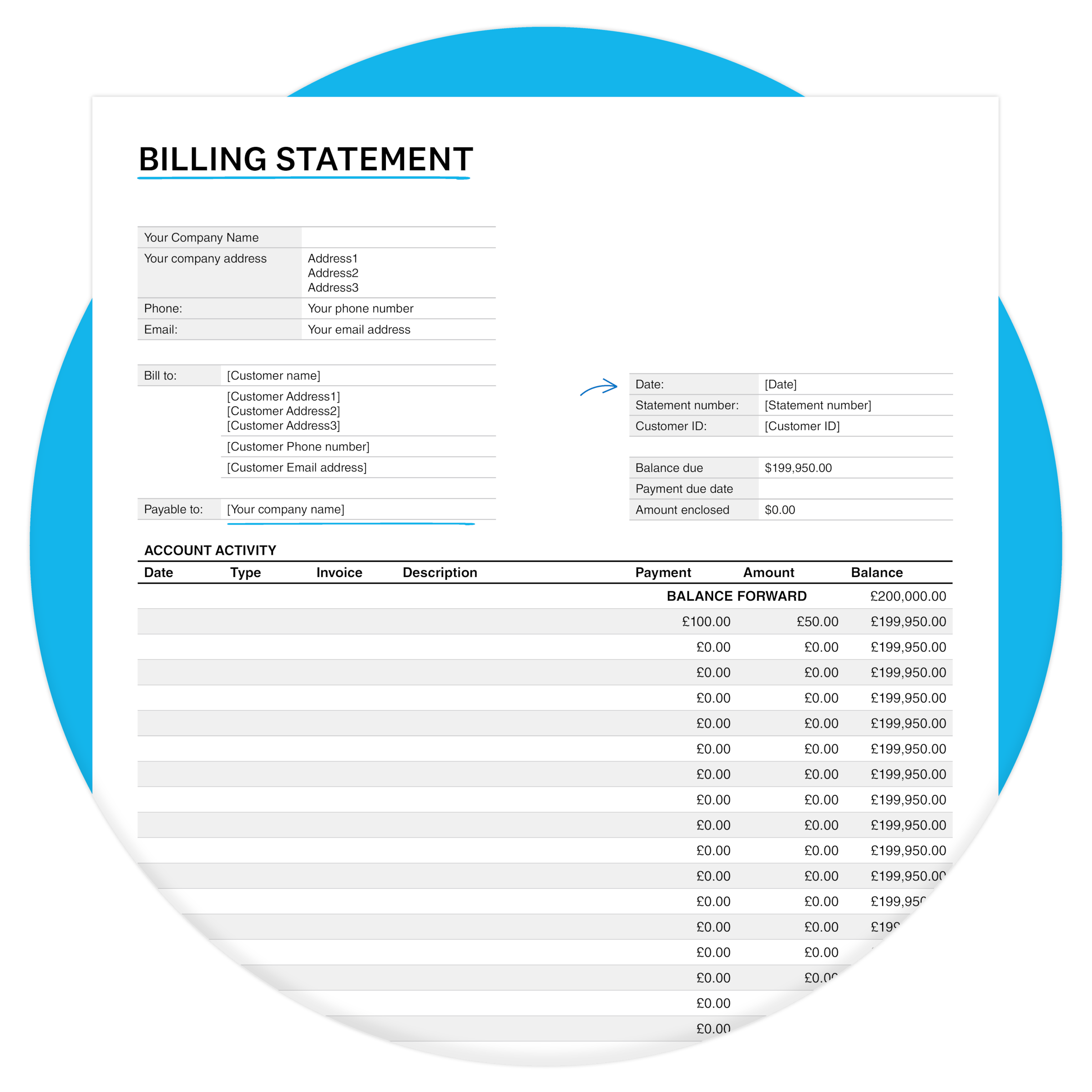

Free billing statement template

Xero’s free billing statement template helps you streamline your billing process and stay organized. Track payments, manage outstanding balances, and keep accurate financial records – you’ll always know which bills are paid and which are outstanding.

Clear and professional

A clean, clear layout makes all charges and payments easy to read and follow.

Tailored to your business

Add your business name and contact details for a polished, professional look.

Effortless record-keeping

Keep track of all transactions and balances in one convenient document.

Download the free billing template

Fill in the form to get a free billing template as an editable PDF.

Got your template? Try Xero for free.

Ready to take control of your business? Xero's got everything you need to succeed, from accounting and invoicing to reporting and payroll.

Why accurate billing statements matter

Accurate billing statements make it easier to manage cash flow, help your tax compliance, and offer insights that lead to smarter decision-making.

- Easier budgeting – track expenses and payments for a clear overview of cash flow at all times

- Clear and detailed records – organized statements help you review charges and resolve disputes efficiently

- Reliable financial reporting – accurate billing helps streamline your bookkeeping and make confident forecasts

- Legal compliance – organized billing statements make it easier to meet tax and regulatory rules

- Data for decisions – reliable revenue records lead to stronger financial strategies

Benefits of our free billing statement template

Our free billing statement template keeps all your payment details in one convenient place. It’s a digital bill list that helps you track transactions, manage outstanding balances, and ensure timely payments. That means no more digging through emails for payment confirmations, and less time spent chasing customers.

Our free billing statement template keeps all your payment details in one convenient place. It’s a digital bill list that helps you track transactions, manage outstanding balances, and ensure timely payments. That means no more digging through emails for payment confirmations, and less time spent chasing customers.

Our billing statement template organizes key details – like charges, payments, and outstanding balances – into a structured bill sheet to reduce errors. The streamlined bill form helps you keep accurate financial records, and gives you clear evidence to help resolve disputes painlessly.

Our billing statement template organizes key details – like charges, payments, and outstanding balances – into a structured bill sheet to reduce errors. The streamlined bill form helps you keep accurate financial records, and gives you clear evidence to help resolve disputes painlessly.

Send professional billing statements that impress your clients, complete with your own company contact details. Recording transactions this way simplifies budgeting, keeps your financials accurate, and helps you stay ready for audits. To streamline your payments process and maintain a consistent, professional look, try Xero’s free invoice template.

Download our free invoice template.Send professional billing statements that impress your clients, complete with your own company contact details. Recording transactions this way simplifies budgeting, keeps your financials accurate, and helps you stay ready for audits. To streamline your payments process and maintain a consistent, professional look, try Xero’s free invoice template.

Download our free invoice template.

What are the different types of billing statements?

Tracks customer accounts by summarizing all transactions – such as invoices, payments, and outstanding balances – in one clear, organized document. It’s a useful overview of all account activity that helps small businesses who want to keep accurate and transparent financial records.

Tracks customer accounts by summarizing all transactions – such as invoices, payments, and outstanding balances – in one clear, organized document. It’s a useful overview of all account activity that helps small businesses who want to keep accurate and transparent financial records.

Breaks down charges in detail by listing individual products or services, their quantities, unit prices, and descriptions. It’s especially useful when billing for multiple items or time-based work. Customers appreciate the transparency and it helps prevent confusion or disputes over the final bill.

Breaks down charges in detail by listing individual products or services, their quantities, unit prices, and descriptions. It’s especially useful when billing for multiple items or time-based work. Customers appreciate the transparency and it helps prevent confusion or disputes over the final bill.

Consolidates multiple charges over a set period – ideal for subscription-based businesses or long-term contracts. This format works well for service providers who want to simplify their billing. By grouping recurring charges into one statement, it’s easier for customers to follow and reduces admin time on your end.

Consolidates multiple charges over a set period – ideal for subscription-based businesses or long-term contracts. This format works well for service providers who want to simplify their billing. By grouping recurring charges into one statement, it’s easier for customers to follow and reduces admin time on your end.

Notifies customers of overdue payments. It outlines the outstanding balance, any late fees, and explains the payment terms as agreed. These statements encourage customers to resolve things promptly to avoid further late fees and are a professional way for small businesses or freelancers to chase up unpaid invoices without straining their customer relationships.

Notifies customers of overdue payments. It outlines the outstanding balance, any late fees, and explains the payment terms as agreed. These statements encourage customers to resolve things promptly to avoid further late fees and are a professional way for small businesses or freelancers to chase up unpaid invoices without straining their customer relationships.

Make the most of your free billing statement template

Take control of your billing process. Save time, reduce errors, and stay organized.

Download and customize

Personalize the free billing form with your business name and contact details.

Record transactions

Input charges, payments, and balances to keep your finances accurate.

Send and track

Share statements with customers and follow up on outstanding payments to boost your cash flow.

FAQs on billing statements

An invoice is a one-time request for payment for a specific product or service. You issue it once you’ve provided goods or services – like your monthly mobile phone bill, which covers the cost for that billing cycle. A billing statement, however, is a summary of multiple transactions over a specific period. For example, your mobile provider might send yearly statements that include all monthly invoices, payments made, and any outstanding balance.

An invoice is a one-time request for payment for a specific product or service. You issue it once you’ve provided goods or services – like your monthly mobile phone bill, which covers the cost for that billing cycle. A billing statement, however, is a summary of multiple transactions over a specific period. For example, your mobile provider might send yearly statements that include all monthly invoices, payments made, and any outstanding balance.

To resolve a dispute, start by checking the billing statement against your invoices, payment records, and any agreements you made with the customer. Share these documents so you’re both clear what a charge is for and to reveal any misunderstandings – often, this will resolve the issue. And if it doesn’t, work together towards a fair solution. Handle disputes professionally so they don’t escalate – this means responding promptly and clearly, and respecting the customer.

Here’s more guidance from the Federal Trade CommissionTo resolve a dispute, start by checking the billing statement against your invoices, payment records, and any agreements you made with the customer. Share these documents so you’re both clear what a charge is for and to reveal any misunderstandings – often, this will resolve the issue. And if it doesn’t, work together towards a fair solution. Handle disputes professionally so they don’t escalate – this means responding promptly and clearly, and respecting the customer.

Here’s more guidance from the Federal Trade CommissionIt depends. Most billing cycles are monthly or quarterly – but the right schedule depends on your business model. You may need to update certain customers – those with overdue balances or ongoing services, say – more often. You might send quarterly billing statements alongside a monthly bill sheet to both update customers and to gently prompt them to pay. So be consistent – set a schedule and communicate billing dates and payment terms clearly. Tools like Xero can automate this process for you.

Accept payments with XeroIt depends. Most billing cycles are monthly or quarterly – but the right schedule depends on your business model. You may need to update certain customers – those with overdue balances or ongoing services, say – more often. You might send quarterly billing statements alongside a monthly bill sheet to both update customers and to gently prompt them to pay. So be consistent – set a schedule and communicate billing dates and payment terms clearly. Tools like Xero can automate this process for you.

Accept payments with Xero

Upgrade your billing statements with Xero

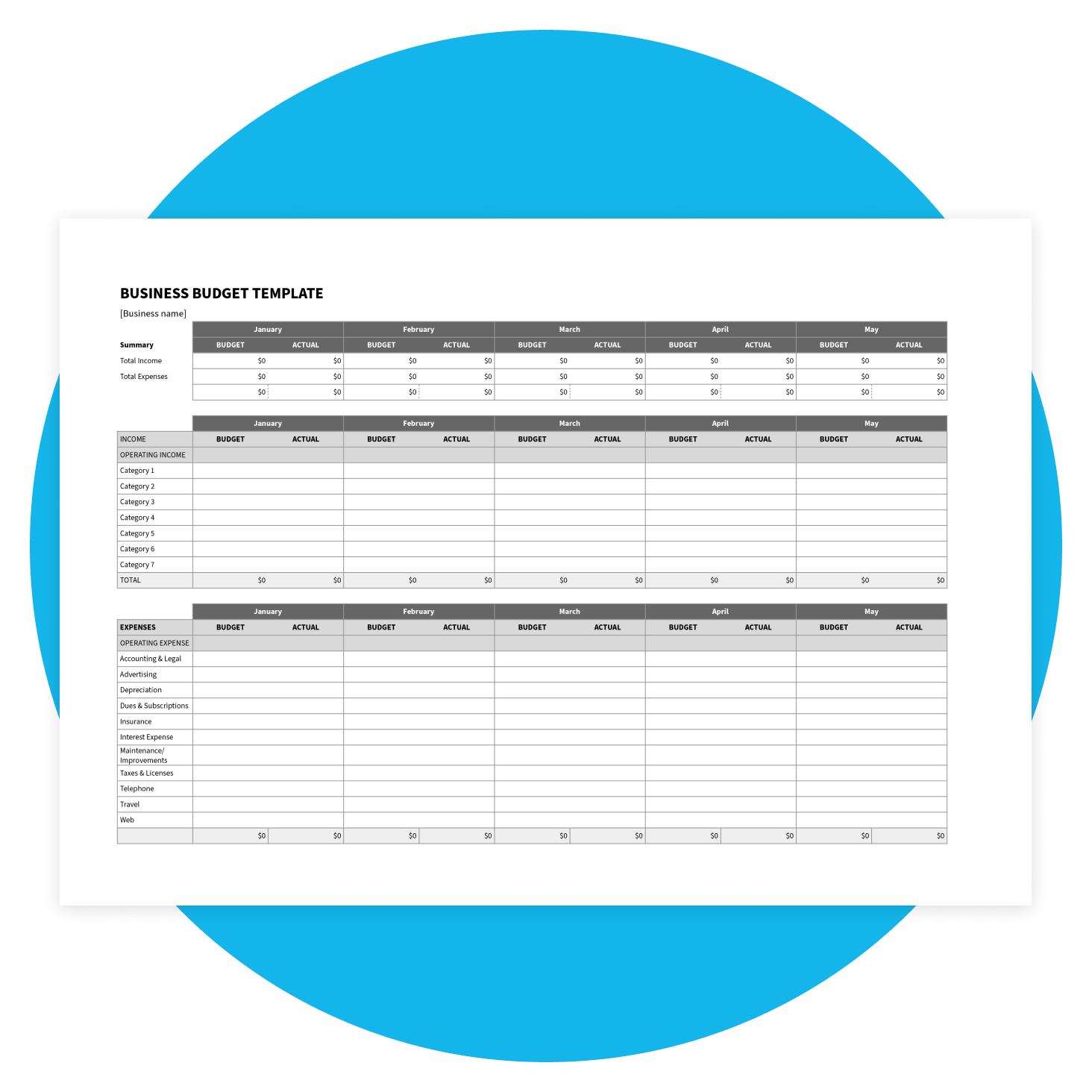

A preview of Xero's billing statement template

- Track and organize transactions for a clear view of your cash flow.

- Create professional, tailored billing statements that match your branding.

- Reduce the manual work load and save time.

Disclaimer

Xero does not provide accounting, tax, business or legal advice. This template has been provided for information purposes only. You should consult your own professional advisors for advice directly relating to your business.