Tailored advisory for 10 business sectors

Provide advisory that resonates. In this article, Xero’s Casey Barlow, CPA and Sr. Enterprise Partner Consultant, shares actionable insights across 10 industries — from AI’s role in marketing to supply chain issues in manufacturing — to help you offer timely, relevant guidance to your clients.

Is your team reading up on your clients’ industries? Now is a good time. As much information as your team learns, it will always pale in comparison to the client's lived experience, and a lot can change in between meetings.

Plus, busy clients view the world through the narrow lens of their own specialty – they see that they need more product, customers, or vendors. They may not readily connect that these could be supply chain, cash flow, or business strategy questions that you can help with.

In this article, we look at 10 small business industries and what they are currently facing. We hope one of them sparks an idea for a client advisory project.

Overall, small businesses are tired but optimistic

Economic conditions are always changing and could change at any time. At the time of writing, businesses have endured five years of disruptions. Not long ago, New York restaurants were still just building outdoor open-air heated dining enclosures, most of which have now been dismantled. 50 million workers quit their jobs then sought new ones, and interest rates hit their highest level since the Great Inflation of the 1970s.

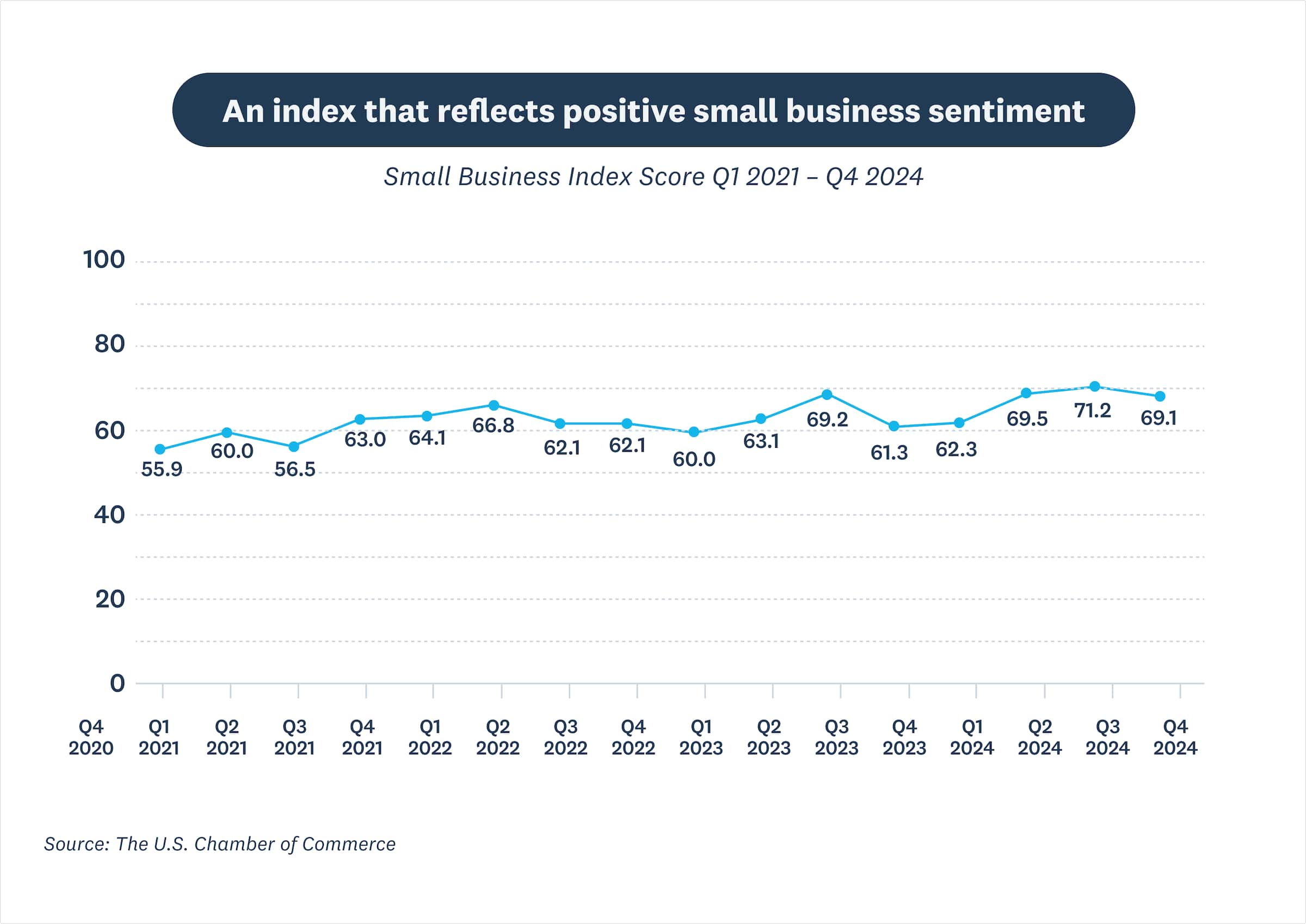

When we speak to small business owners, nothing occupies their mindshare like making more sales and their fears of inflation. According to the Small Business Institute, inflation is now their number one concern. At the same time, small businesses are feeling better about the future – last year, 61% were optimistic. This year, 69% are. Some 72% of owners say they expect their revenue to increase.

Source: The U.S. Chamber of Commerce

We can summarize their mindset thusly: They’ve made it through a lot. The pain isn’t over. And they’re ready for their hard work and perseverance to pay off. When you approach them with ideas, do not assume they are gloomy. Assume it’s about to get better and tell them how you can clear the path forward.

Let’s explore what’s happening in 10 specific industries along with ways you can offer guidance.

10 industry advisory trends and tips

Continue reading below or quick jump to any of the following industry advisory trends and tips:

- Marketing and creative agencies need new business

- Construction companies need workers

- Ecommerce needs sales as consumers aim to save

- Food and beverage companies are suffering high ingredient costs

- Healthcare companies are struggling with labor costs

- Hospitality companies must entice diners who are cutting back

- Manufacturing and transportation are having to pay tariffs

- Professional services are facing staffing issues

- Real estate is challenged by high rates

- Retail needs to grow more efficient

10 industry advisory trends and tips

Marketing and creative agencies need new business

Small agencies and creative studios have been struggling for years now. 10 million creatives lost their jobs during the pandemic. Meanwhile, the larger businesses who hire them tend to cut sales and marketing spend during hard times – and the cuts have been deep. Agencies say their top challenge is finding new business and 44% say, “It’s a struggle right now.”

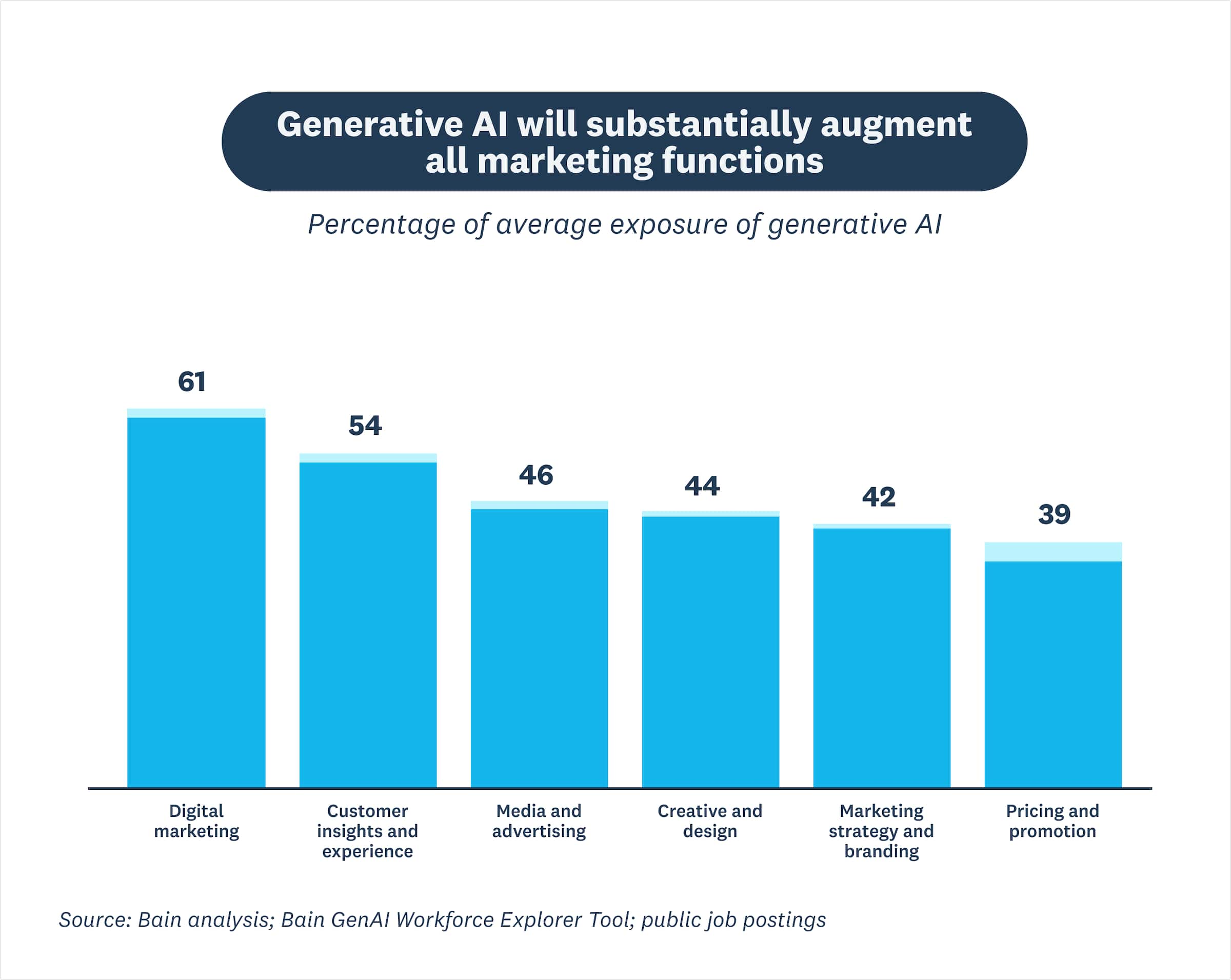

Meanwhile, AI threatens or offers to transform their workflows, depending on who you ask. Agencies seem divided on thinking machines – in a poll, half welcome AI, half disdain it. Few are undecided.

Source: Bain & Company

Help them:

- Model labor costs – when to hire full-time versus contract?

- Track project time and costs and run project based financials to see what projects are most profitable and which ones are not generating a positive bottom line.

- Generate operational insights – can you help them experiment with AI?

- Begin tax planning – are pass-throughs making their estimated tax payments?

Construction companies need workers

Construction companies face a decades-long worker shortage and need another 454k workers just to meet demand. This has not stopped them from growing, and the industry did well revenue-wise last year. But the worker shortage limits their growth and has prevented them from saving for the present supply shortages that are driving up the cost of raw materials. The cost of building materials are up 34% since 2020 says the National Association of Home Builders.

Meanwhile, construction companies have suffered from high interest rates, persistent inflation, and cash flow crunches as big clients delay their payments.

Help them:

- Analyze the market – some commercial work is booming, such as multifamily and industrials, particularly data centers and other infrastructure to power AI services.

- Generate operational insights – how can drones and satellites reduce the cost of surveys, studies, insurance, and security?

- Generate business insights – consumers are willing to pay 10% more for net-zero projects.

Ecommerce needs sales as consumers aim to save

The Black Friday-Cyber Monday season (BFCM for short) was far better for ecommerce companies than it was for traditional retailers this year. While retail sales were up just 3.4%, ecommerce sales were up 14.6% according to Mastercard. That’s good news after a few hard years. But the trifecta of interest rates, inflation, and tariffs are raising prices on consumers who are now delaying purchases and cutting costs. Two-thirds of retail executives expect consumers to trade down, buy less per trip, and focus on necessities.

Help them:

- Review cost structures – how can they reduce platform and payment fees?

- Identify high-performing channels – what channels help with margins?

- Model channel sales scenarios – where can they find more demand?

Food and beverage companies are suffering high ingredient costs

You don’t have to be on TikTok to have heard the cost of eggs and all manner of everyday goods are out of control. Food prices are 20% higher than they were four years ago. This puts food and beverage manufacturers in the unenviable position of raising prices on already price-conscious consumers. Few food companies can absorb these costs alone – just like consumers, they are suffering from high inflation as well as higher costs to procure grains, sugars, and oils. Meanwhile, tariffs can drive up the cost of manufacturing, production, distribution, and bottling.

Batch producers are having the hardest time right now. Batch processing relies on consistent prices and leaves them paying to store goods they may earn little on. Large food and beverage companies may be able to rely on the futures markets to stabilize these costs, but small businesses rarely have that acumen or those resources.

Help them:

- Manage their spend – how can they save on packaging, warehousing, and transportation?

- Monitor their food and beverage costs in relation to their sales. What is their gross margin and how can they increase the margin? This is the number one area they can improve their bottom line.

- Analyze the market to understand the cost of future raw goods. Buying goods in bulk now vs. later to reduce inflation risk.

- Use the 4-4-5 reporting method. The 4-4-5 calendar in restaurant financial reporting divides a year into quarters, with each quarter having two 4-week periods and one 5-week period. This structure helps with comparing similar weeks across months, aligns holidays, and ensures consistent reporting and comparisons year over year.

Healthcare companies are struggling with labor costs

Small healthcare companies such as clinics, dentists, and doctor’s offices have been dealing with labor disruption since the pandemic. Meanwhile, billing and the payer system remain their top operational pains. They do not always have the resources to navigate Medicare and insurers’ systems, where small errors affect their cash flow, keep them navigating support phone trees, and cut into their margins.

One of their top opportunities is using more of their financial data to better understand their staffing, profitability, and business strategy. If they can project their cash flow and understand their true labor costs, they can better allocate people and fill their calendars.

Help them:

- Create models for metrics such as bed occupancy rate, case acceptance rate.

- Give insight on their Patient retention rate, Patient attrition rate.

- Model whether to take insurance or accept Medicare patients.

- Lastly, closely monitor their unpaid invoiced revenue, what amount per month is going to collections.

Hospitality companies must entice diners who are cutting back

Hospitality companies face a triple threat: Labor costs are rising (driven by inflation), goods and supplies are growing more expensive, and sober culture is eating into the section of their menus that tends to drive the highest margins – wine and liquor. Hospitality margins are often already thin, so companies have little choice but to pass these costs along to consumers. Fast casual prices are up 42% year-over-year, reports Food and Wine, and 78% of Americans now think of fast-food meals as a luxury. Consumers are eating out less and businesses are cutting back on travel spending.

Help them:

- Budget better for off-seasons.

- Generate business insights – help them activate spaces in the off-time with events and popups.

- Model their staffing needs to better plan for seasonal hiring.

Manufacturing and transportation are having to pay tariffs

Manufacturers are deeply affected when new tariffs affect the U.S.’s largest local trading partners, which account for 40% of all U.S. imports. Unless their supply chain does not cross any borders, many small manufacturers and distributors must pay the increased cost of goods until they can figure out how to near-shore operations – which is difficult for smaller businesses with less capital.

Unlike larger enterprises with strong ERP systems and supply chain software to automatically reroute to new suppliers, small business owners are caught between running operations and trying to adapt.

They are particularly worried about an overall economic slowdown. In March, the investment bank Goldman Sachs downgraded its forecast for U.S. GDP this year from a respectable 2.4% to just 1.7%. Small business owners in this industry are deeply worried: “I’m very concerned. It’s just another tax. We’re getting taxed to death,” Dennis Percy, general manager of Fred’s Energy, whose trucks pick up energy in Canada and deliver it to customers in Northern Vermont, told The Boston Globe.

Read more reactions from business owners facing high tariffs.

Help them:

- Plan for scenarios and adopt supply chain software.

- Raise capital to purchase supplies.

- Find tax credits for producing goods in the U.S.

Professional services are facing staffing issues

Professional services businesses (such as accounting firms!) are broadly facing a skilled labor shortage. The U.S. expects it needs an additional one million science, technology, education, and math (STEM, for short) professionals by 2033. And all services businesses in general are reporting their own versions of difficulty hiring, training, and retaining staff. AI implementation in this industry can really help with automation of administrative tasks that take up a lot of non billable time which can alleviate the already over encumbered staff due to talent shortages.

Help them:

- Forecast cash flow and closet monitor past due accounts with Accounts Receivable Aging reports.

- Improve morale and increase worker retention.

- Implement AI-powered engagement, project, task management software. The idea is to have AI supplement not replace their administrative work such as engagement letters, client communications and workflow management.

Real estate is challenged by high rates

This is just one hyper-local example, but residential real estate has been in limbo since soaring inflation and interest rates, which have eaten into consumer savings and caused homebuyers to pause shopping. At the same time, potential sellers who feel they cannot refinance at lower rates are deciding not to sell. Home sales and inventory are low and demand is “seriously suppressed” according to JPMorgan Chase.

That said, the real estate “ground truth” varies by market and some markets are doing just fine, especially in the sunbelt region. Some areas of commercial real estate are also seeing a comeback, notably multifamily and industrials, the latter of which is driven by new construction of data centers to power AI services.

The administration's oft-stated plans to cut back on immigrant labor and reduce immigration also threatens to further accentuate the construction talent shortage, which will further delay resupply.

Help them:

- With operational insights on how to better leverage capital. I.e Tenant turnover, ROI, Payback period, average rent price per property to anime a few specifics.

- Use apps and software to find more new business and market properties and manage current investments and their profitability.

- Manage their spend and build a safety buffer for unforeseen market fluctuations and high tenant turnover.

Retail needs to grow more efficient

Retailers have faced several years of stagnant growth ranging from 1.5% to 3%, reports Deloitte. During Black Friday-Cyber Monday (BFCM), retail sales were up just 3.4%. Retailers suffer similar labor shortages as the hospitality industry – many people left that line of work during the pandemic and did not return. At the same time, retailers face softening consumer demand as people spend less in anticipation of hard times. Nearly 6 in 10 retail executives say they expect consumers to care more about prices than brand loyalty in the year ahead.

In response, many retailers are looking for ways to grow more efficient. Those that launched AI chatbots for their ecommerce sites saw 15% higher conversion rates over BFCM. Many say they expect AI tools to soon help them with projections, inventory, and forecasting demand.

Help them:

- Understand which parts of their marketing spend are wasted. It’s time to be very deliberate on what and who they are marketing to.

- Conduct a market analysis to help them prepare. Less product offerings can be better. What products are doing well and what products should be deprecated. You’ll see this in many restaurant establishments. They stick to a few high selling profitable items with variations rather than a Cheesecake Factory type menu! The same can be said for retail, less is more!

- Explore AI use cases that can increase sales or decrease expenses.

Business owners could use your advice

This article offers just a brief glimpse into all that’s happening in each of these worlds. The more research your team conducts and advisory projects you complete, the greater your knowledge of that space and the higher quality of advice you’ll be able to give. Sometimes, your clients aren’t waiting to call you – they’re waiting for you to call them. They simply need to know that these are topics you can help with.

Look for ways this year to continuously pass along financial and accounting insights to your small business customers via social media, a newsletter, or on calls. At the very least, it is a nice gesture, and at the most, it is a conversation starter and genuine help in a difficult time.

Save this for later—get it by email

Uncover actionable insights for 10 business sectors. Fill in this form to be sent a download of this article to your inbox!

Become a Xero partner

Join the Xero community of accountants and bookkeepers. Collaborate with your peers, support your clients and boost your practice.