Grow without adding a single new client

Want to grow your firm and boost revenue without chasing new clients? Tyler Bartek, Partner Consultant at Xero, shares how firms are increasing profits by focusing on their existing client base—and how to use advisory services to make the most of the relationships you already have.

Every practice loves to win an exciting new client. But what about all the wonderful clients you already have?

According to our latest State of the Industry Report, a meaningful number of practices grew last year by increasing billings among existing customers. Specifically, 74% of firms said they grew revenue, yet just 56% said they added more clients. That could have only happened if some were billing more per client.

In this article, we explore the services those firms rely upon to grow without adding a single new client.

The mathematical advantage of upselling

Let’s return to the idea that everyone loves a new client. It’s true! But does that “new” factor feel justified when we run the numbers?

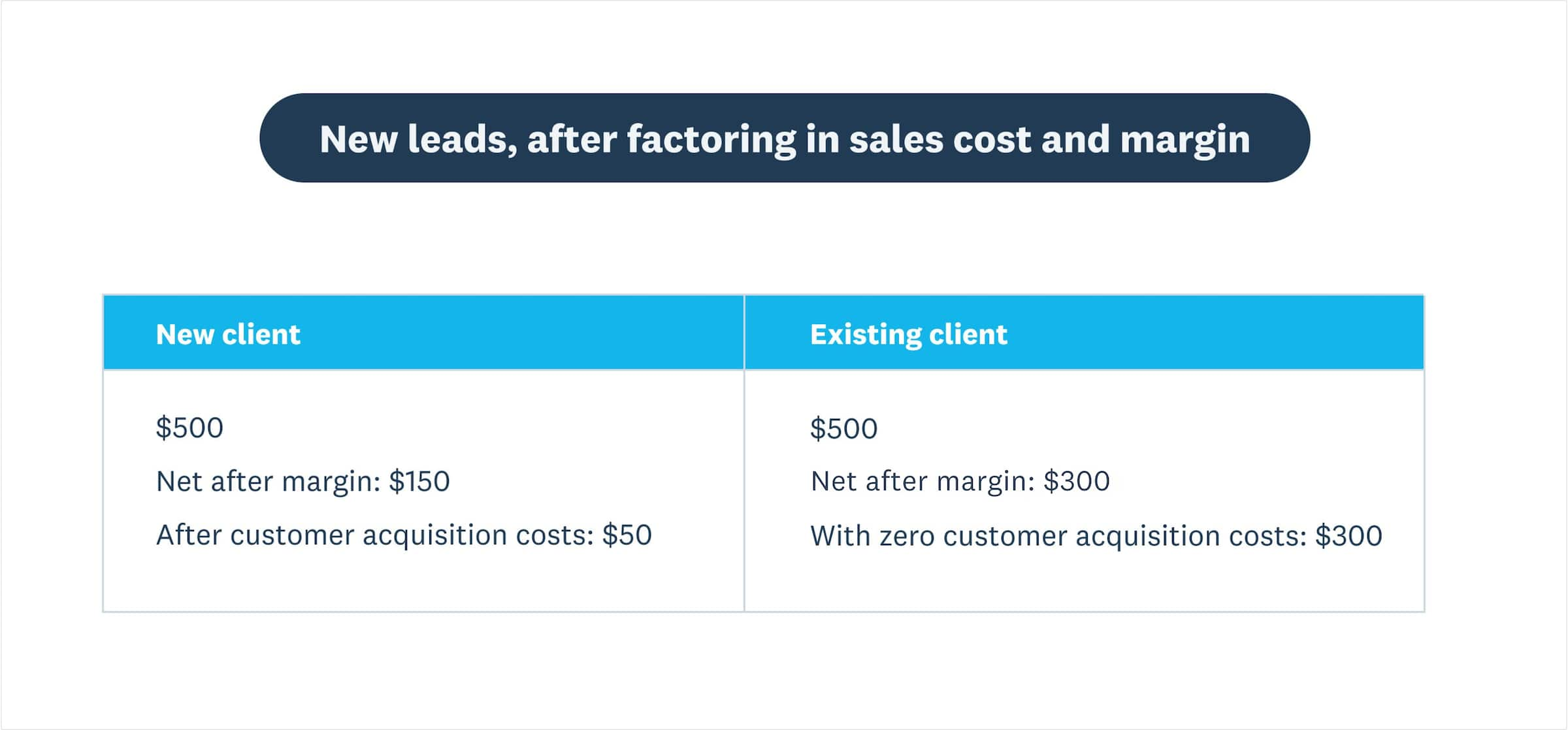

New customers come at a cost. If you haven’t built a pipeline of word-of-mouth referrals, you likely pay to acquire them, via ads or a referral fee to another firm. Plus, there are the hours to onboard the client and any additional support hours you don’t bill them for. There are the overhead costs of practice leaders checking in to make the client’s CEO feel welcome, and depending on the size of the account, a care package.

All those costs eat into your sales and reduce the net value of those leads. The more a lead costs you to acquire, the less it is actually worth to your practice.

You can measure your overall sales efficiency by going into your own books – see the equation below. Also consider that not every lead becomes a paying customer. What percentage of first introduction calls convert to a sale for your firm? Factor that in too.

Whereas expansion revenue happens more like this: You host a tax webinar to attract new clients, but Tara, your existing client, shows up. Afterwards, she asks for additional help with financial planning. She already trusts Jonathan on her account, and he already knows everything about her business. The onboarding is really just a catch-up call.

That’s a whole lot more efficient. You cut out the advertising middle-person.

Let’s run those numbers: If your cost to acquire a new client is conservatively $100, then a new client with a $500 project is really worth $400. Whereas if an existing client asks you to do $500 in additional work, that “lead” is worth 20% more to you.

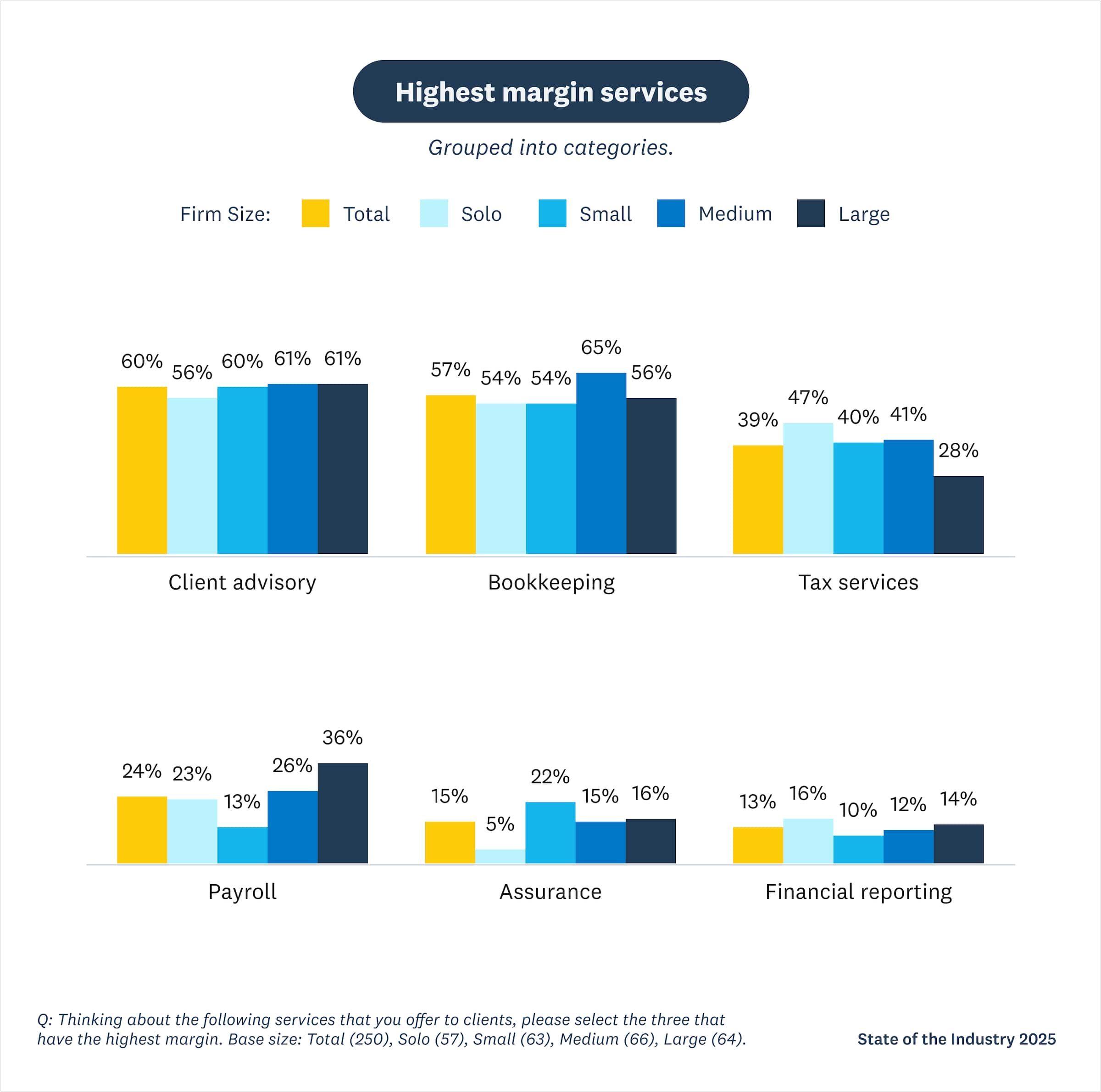

And it gets better. Let’s assume that $500 inbound lead is a simple tax return. Tax accounting margins are middle-of-the-road according to our latest State of the Industry Report. They’re better than keep-the-lights-on type of work such as payroll or reporting, but less rewarding than bookkeeping or – this year’s highest-margin service – client advisory.

Let’s say your margin on tax work is 30% and your margin on advisory is 60%. Now the upsell gap is even greater. That $500 project is worth six times more to your firm if it comes in through an existing client.

These are hypothetical numbers and not benchmarks – you will have to run this analysis for your own practice.

This is all to say, there is a reason in this year’s State of the Industry Report that more respondents grew revenue than added new clients. It is also why advisory is so popular. Practices are as likely to offer it as they are to offer bookkeeping.

And yet, the story is not over. When we asked practices why they offer advisory, the top answers had nothing to do with money.

Client advisory is high margin, but there’s more to it

Advisory occupies that wonderful cross-section between what is high value to the client and what is high value to your firm. Accountants tell us advisory takes the same effort as other services, or less, but is of course far higher margin.

85% of practices now say they offer advisory and the larger the firm, the more likely they are to do so. 94% of enterprise practices offer advisory. This is quite a shift from one decade ago when practices would debate whether to offer advisory. Today, the debate is about, “Which kind?”

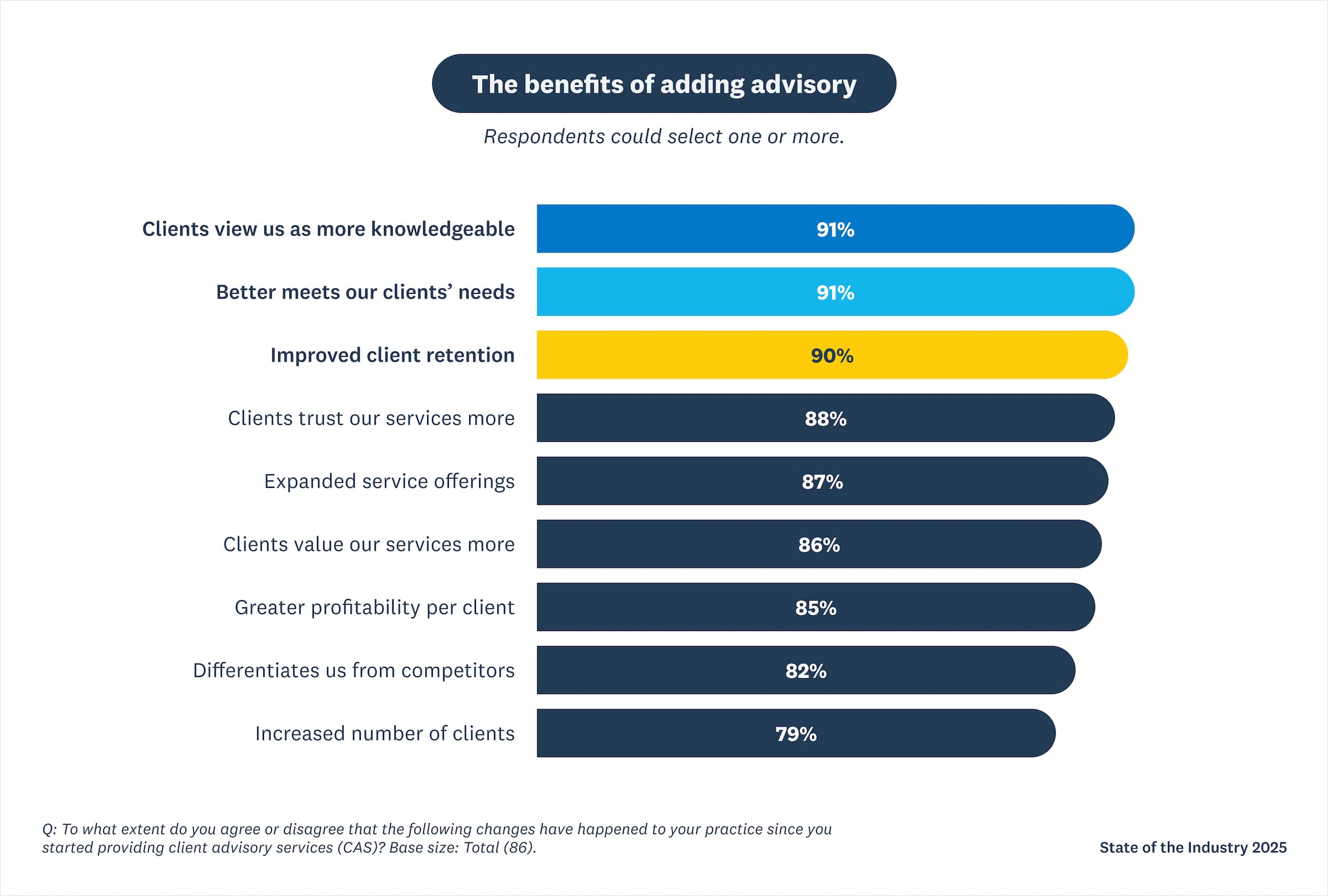

When we asked practices why they offer advisory, the least likely answer was, “It increased the number of clients we served.” That was reason eight out of eight. Practices were slightly more likely to say advisory increased their profitability per client, but that too, is near the bottom – reason six of eight.

No, the top reason for offering advisory is because clients are asking for it. The top four reasons combined are about how advisory makes accounting professionals seem more knowledgeable, meets the client’s needs, helps keep them as customers, and makes the practice more trusted.

If we extrapolate on this data, it seems clear why more clients would be asking for advisory: The number one challenge firms say they faced last year was “economic uncertainty” such as interest rates and inflation. Accounting practices are businesses themselves, and they are feeling what their clients are feeling. And it’s been quite a year, or five.

Let’s review. Interest rates rose from essentially nothing at the start of 2022 to north of 5%. That means borrowing grew expensive. Meanwhile, inflation hit 9.1% in 2022. Bankruptcies leapt in industries like transportation and restaurants. All this “disruption” has long-term consequences that sometimes take years to be felt. A small business that hit a slowdown may have taken out a loan; and while it is not counted in the U.S. Small Business Administration’s business “death rate” index (morbid, but that’s the term they use), it is weighed down by fees and in financial trouble.

What we are likely seeing right now is businesses struggling at the start of an economically difficult decade. From unavailable materials to the soaring cost of food, individuals and businesses are feeling the pain and are looking for a trusted advisor.

And advisory is mutually beneficial. Advisory work may be what helps accounting practices get through their own phase of disruption, just around the corner.

The AI factor in advisory

There’s no discussing advisory without mentioning the role of AI and automation. It may or may not surprise you, but accountants feel overwhelmingly positive about AI. 80% think it will have a positive effect on their firm according to our latest State of the Industry Report. 32% of practices are planning to use AI and other machine learning technologies to automate routine tasks such as data entry, compliance work, bank reconciliation, invoicing (the whole process, from reminders to reconciliation), and planning.

The presumption is that advisory will free up accountants and bookkeepers to do even more advising.

It may already be freeing them up to grow their practice and expand into new industries. Recall in our prior chart that 87% of practices said advisory helped them expand into serving new types of clients and industries. And while you're perfecting the art of upselling to your existing clients, you might find that these services can also help lower the overhead when you're ready to acquire new clients as well.

For example, practices tell us that advising some industries helps them generate insights that are useful to other businesses. If your practice completes a complex, cross-border tax planning project for a food and beverage company, it has generated reusable intellectual property. Practice leaders can then email other food and beverage companies asking if they suffer the same issue. They can also move up or down the supply chain – might the food company’s manufacturer or distributor also need insight?

Like creativity, advisory is a gift that keeps on giving. The more you use it, the more you have – and opportunities it creates.

Advisory: The new way to grow with old clients

We are of course not advising your firm to stop seeking out new clients. This guide is not tax or business strategy advice. But we are suggesting that according to this year’s report, the reason more firms grew their revenue over their client list is largely because they grew more efficient and offered advisory. Advisory helps retain those clients, and most important of all, it’s what clients are asking for.

If you want your firm to grow, advisory is something you can launch as a limited test. It starts with calculating your sales efficiency and asking, could we raise our revenues without adding a single new client?

Save this for later—get it by email

Learn how to grow your firm without adding a single new client. Fill in this form to be sent a download of this article to your inbox!

Become a Xero partner

Join the Xero community of accountants and bookkeepers. Collaborate with your peers, support your clients and boost your practice.