Small business guide to Missouri sales tax: Key rates, rules and exemptions for filing

Learn how to collect the right Missouri sales tax, file on time, and stay compliant.

Written by Lena Hanna—Trusted CPA Guidance on Accounting and Tax. Read Lena's full bio

Published Wednesday 26 November 2025

Table of contents

Key takeaways

• Calculate your total Missouri sales tax rate by combining the 4.225% state rate with county, city, and special district taxes, which can exceed 10% in some areas, and verify rates quarterly using the Missouri Department of Revenue's official lookup tools.

• Register for a Missouri sales tax license with the Department of Revenue before collecting any sales tax, then file returns monthly, quarterly, or annually based on your collection volume to avoid penalties and license revocation.

• Apply Missouri use tax at 4.225% plus local rates when you purchase taxable items from out-of-state sellers who don't collect Missouri sales tax, including online purchases and business equipment.

• Utilize available exemptions such as the reduced 1.225% rate on groceries, complete exemptions on prescription drugs and medical equipment, and nonprofit exemptions to minimize your tax burden legally.

How much is sales tax in Missouri?

Missouri sales tax is a consumption tax with a base state rate of 4.225% that applies to most goods and services. Your actual rate depends on your business location due to additional local taxes.

Missouri sales tax includes several components. Here’s how it works:

- apply the 4.225% state rate statewide

- add county, city, and special district taxes as required

- check for combined rates that may exceed 10% in some areas

- review rate updates quarterly to stay current

In Andrew County, you pay a 2.2% county sales tax plus the 4.225% state rate, for a total of 6.425%. If your business is in Savannah, you also pay city surtaxes, bringing the total to 9.425%.

Sales tax rates update quarterly. Check the Missouri Department of Revenue rate tables for the latest rates.

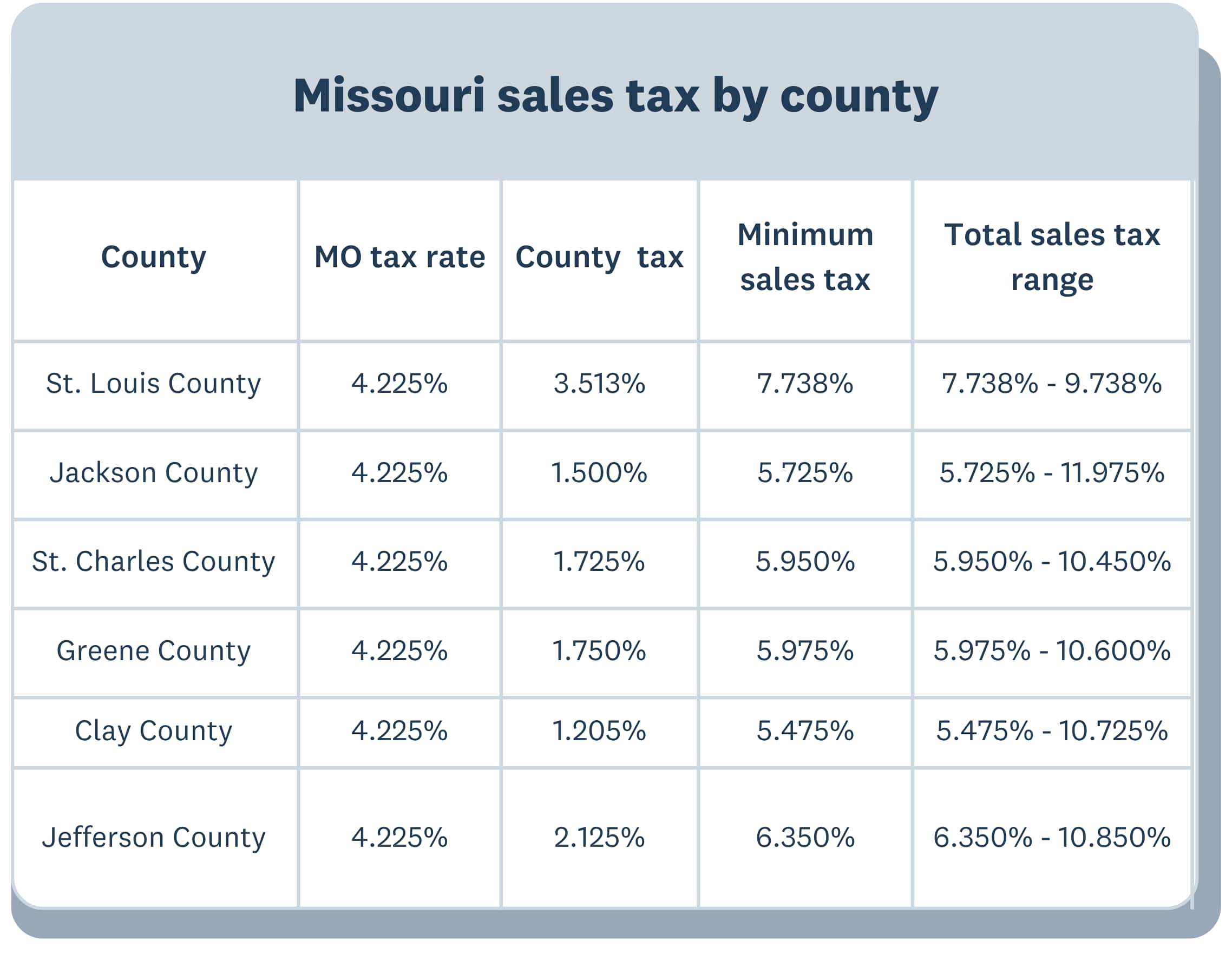

Missouri sales tax by county

Missouri county sales tax adds to the 4.225% state rate, creating different total rates across the state. Each county sets its own additional tax rate on top of the state minimum.

Local tax layers include:

- County taxes: Set by individual counties

- City taxes: Added within municipal boundaries

- Special district taxes: Community Improvement Districts (CID) and Neighborhood Improvement Districts (NID)

- Rate lookup: Use the Missouri Department of Revenue's official lookup tool for accurate rates

Below are sales tax rates for some of Missouri’s most populated counties. These rates include possible city and special district taxes.

Use a Missouri sales tax calculator and check the Missouri Department of Revenue for the latest information.

How to calculate Missouri sales tax

Calculate Missouri sales tax by multiplying the purchase price by the total tax rate for your business location.

Formula: Purchase Price × Total Tax Rate = Sales Tax Due

Total Tax Rate includes:

- State rate: 4.225% (applies everywhere)

- County rate: Varies by county

- City rate: Applies within city limits

- Special district rates: CID, NID, or other local districts

Use your full business address, not just your ZIP code, to get the correct tax rate.

You can use Avalara’s Missouri state tax calculator to find the right rate for your address.

Here's an example calculation:

If you sell in Savannah, Missouri, apply a total tax rate of 9.425%. This includes:

- The 4.225% state sales tax

- A 2.2% county tax

- A 0.5% special district tax

- A 2.5% city tax for Savannah, specifically

For a $100 item, multiply by 0.09425 to get $9.43 in sales tax. Your customer pays $109.43 in total.

Missouri sales tax registration and filing requirements

If you sell taxable goods or services in Missouri, register with the Department of Revenue for a sales tax license before you collect tax.

Your filing frequency depends on how much sales tax you collect. The state assigns you a monthly, quarterly, or annual schedule. If you file late, you may pay penalties and interest. The state can also revoke your sales tax license if you miss deadlines.

Use tax vs sales tax in Missouri

Missouri use tax is 4.225%. You pay it directly to the state when you buy taxable items without paying sales tax.

When use tax applies:

- Out-of-state purchases: Buying from sellers who don't collect Missouri sales tax

- Online purchases: From retailers without Missouri tax obligations

- Business equipment: Purchased without tax but used in Missouri

- Wholesale items: Bought for resale but used personally instead

The use tax rate is the same as sales tax: 4.225% plus any local rates.

If the retailer does not charge sales tax, report and pay the use tax by filing a Missouri use tax return.

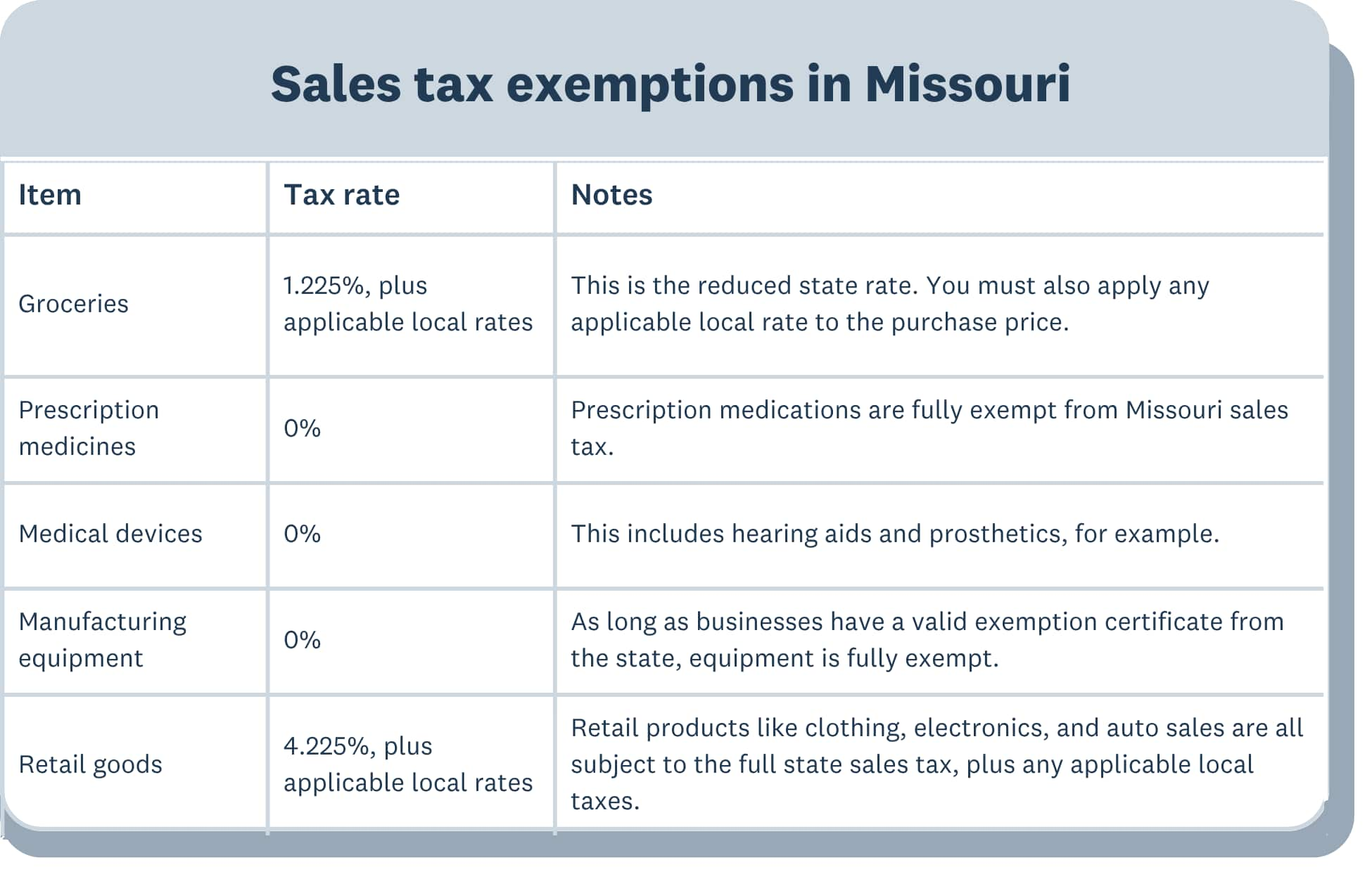

Sales tax exemptions in Missouri

Missouri sales tax exemptions let you pay less or no tax on certain items.

Common exemptions include:

- Food items:Groceries taxed at reduced 1.225% rate

- Prescription drugs: Completely exempt

- Medical equipment: Exempt when prescribed

- Agricultural supplies: Seeds, fertilizer, and farming equipment

- Manufacturing equipment: Machinery used in production

- Nonprofit purchases: Qualifying organizations with exemption certificates

For more information, review the sales and use tax exemptions guide from the Missouri Department of Revenue.

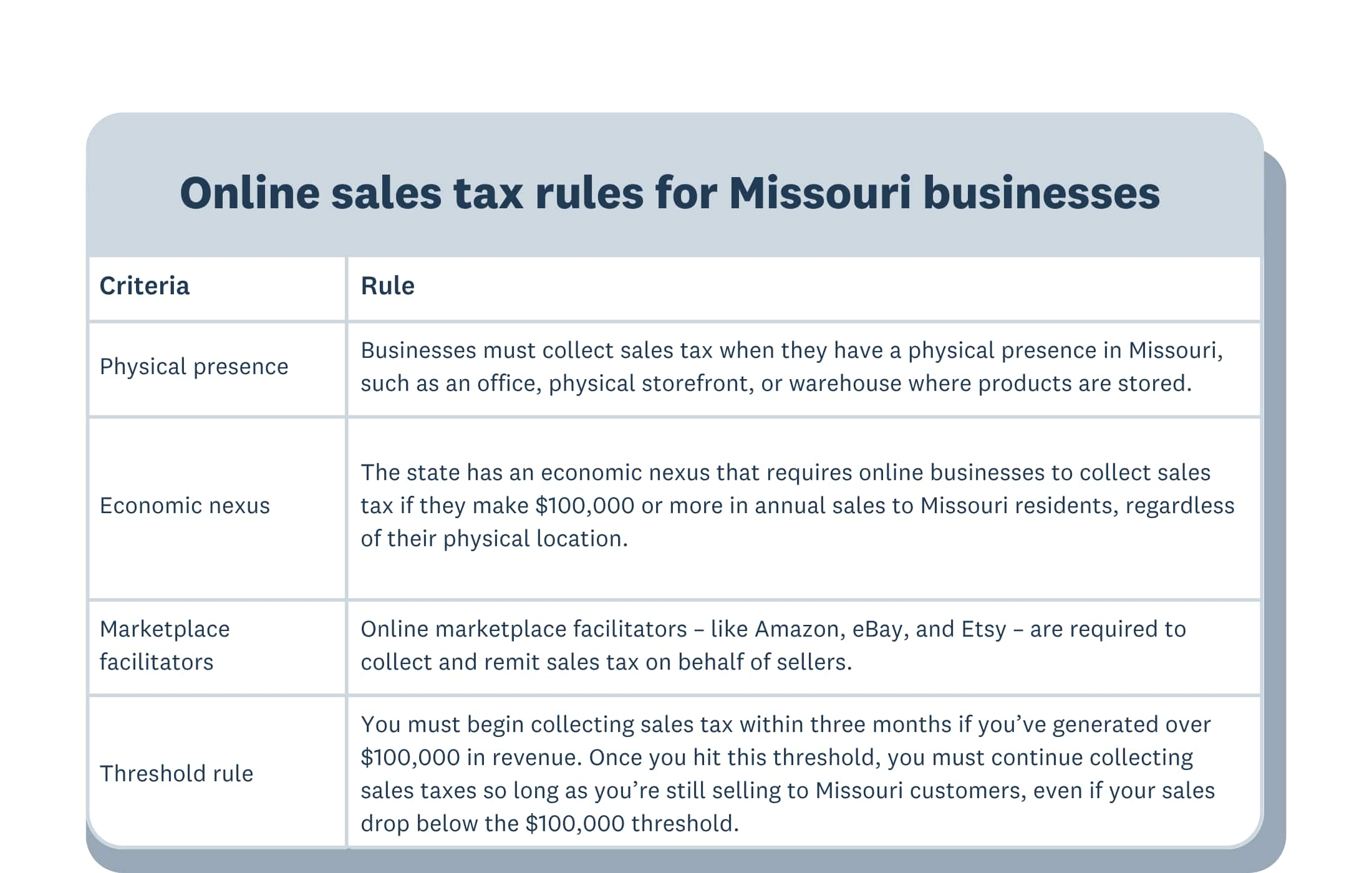

Online sales tax rules for Missouri businesses

Missouri requires out-of-state businesses to collect and remit sales tax if they meet certain sales thresholds. Senate Bill 153, effective January 1, 2023, established these rules. Nationwide, remote sales tax collections reached about $30 billion in 2021.

Compliance steps for online sellers

- Register for a sales tax license through the Missouri Department of Revenue.

- Collect and remit the full rate, including the state rate and applicable local rates.

- File returns based on your designated frequency, such as monthly, quarterly or annually.

- Keep accurate sales records for tax filing and audit purposes.

Manage your Missouri sales tax with confidence

You can manage Missouri sales tax easily with accounting software. Automate calculations, save time, and reduce errors.

Xero accounting software helps you manage sales tax, so you can focus on your business. Get one month free.

FAQs on Missouri sales tax

Here are common questions and answers small business owners might have about sales tax in Missouri.

Do businesses in Missouri need a sales tax permit?

Yes, you need a Missouri sales tax license before you collect sales tax. Register with the Department of Revenue if you sell taxable goods or services.

Registration requirements:

- Who must register: Businesses selling tangible goods or taxable services

- When to register: Before making your first taxable sale

- How to register: Online through the Missouri Department of Revenue portal

- Cost: Registration is typically free

How often do businesses need to file sales tax returns in Missouri?

How often you file Missouri sales tax returns depends on your monthly state sales tax collections. Local taxes do not count toward these thresholds.

Filing schedules:

- Monthly filing: Collect more than $500 in state sales tax per month

- Quarterly filing: Collect $500 or less in state sales tax per month

- Annual filing: Collect less than $200 in state sales tax per quarter

Check your filing schedule with the Department of Revenue, as due dates vary.

Is labor subject to sales tax in Missouri?

Repair labor is usually not taxable, even if you list it separately on the invoice. Labor for making or producing goods is taxable, even if you itemize it.

Do nonprofit organizations have to pay Missouri sales tax?

Not all nonprofit organizations are exempt from Missouri sales tax. Civic, service, social, and fraternal organizations can get an exemption letter from the Department of Revenue. This exempts them from sales tax on purchases for their exempt activities.

Is there a sales tax on real estate transactions in Missouri?

No, you do not pay sales tax on real estate transactions. Other taxes, such as capital gains tax, may apply.

Does Missouri charge sales tax on vehicle purchases?

Yes, you pay state and local sales tax when you buy a vehicle. You can subtract any trade-in allowance.

How does Missouri's sales tax apply to shipping and delivery charges?

If you charge for delivery to a location your customer chooses, do not tax the delivery fee. If you bundle shipping and delivery with the purchase price, charge sales tax on the total.

Are digital goods and software subject to sales tax?

Most digital goods, such as music and subscription services delivered online, are not taxable. Prepackaged software sold on a CD or USB is taxable.

Does Missouri offer sales tax holidays?

Yes, Missouri has a Back-to-School tax holiday during the first weekend in August. The Show-Me-Green tax holiday runs from April 19 to April 25.

What happens if a business doesn't collect or remit sales tax?

If you do not collect or file state sales tax, you are still responsible for the tax, plus penalties and interest. The penalty is 5% of the amount due each month, up to 25%. The state can also revoke your sales tax license until you comply.

Disclaimer

Xero does not provide accounting, tax, business or legal advice. This guide has been provided for information purposes only. You should consult your own professional advisors for advice directly relating to your business or before taking action in relation to any of the content provided.

Get one month free

Sign up to any Xero plan, and we will give you the first month free.